Traditional financial institutions by now have come to understand much about how neobanks and other fintechs work, but the evolution of financial services continues. New types of financial entities keep expanding the concepts of banking and payments in new directions on new rails built for “Web 3.0.” Backers of Web 3.0, also called Web3, believe it should be the next iteration of the internet.

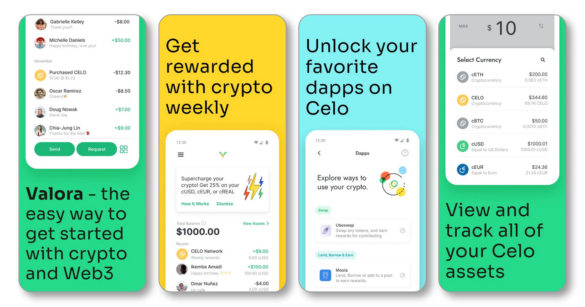

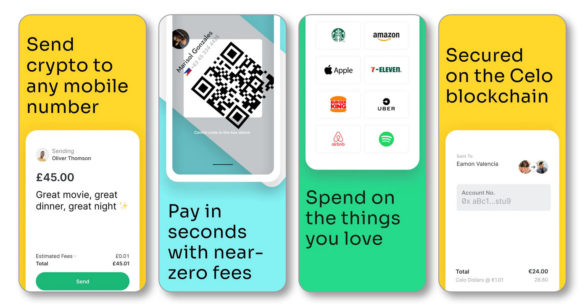

A good case in point about the new players is Valora, a cryptocurrency wallet that debuted in February 2021. Broadly, Valora represents a way for people to send crypto payments to anyone with a mobile phone number, making it in effect a crypto P2P service.

People can also hold crypto balances in the wallet and at present they can earn promotional weekly “Supercharge” rewards on their balances, too.

Asked what her “elevator pitch” about Valora would be, CEO Jackie Bona says the company’s proposition comes down to: “If you can send a text message, you can crypto.”

What Sets Valora Apart:

The cryptocurrency wallet is built on blockchain technology and runs on mobile devices.

Being set up specifically for mobile devices makes Valora services available over much of the world — no computer needed.

This wallet also provides users with a gateway to a growing marketplace of “dapps.” These are apps designed to operate in the world of decentralized finance, hence the “d” in “dapps.” More about that later.

Before its launch, Valora began as a project of cLabs, which developed the Celo blockchain that Valora runs on.

Celo, pronounced “Sell-Oh,” means “purpose” in Esperanto, an invented language dating back to the late 1800s that has appeal to the desire to overcome barriers through a universal tongue. That ties in with the overall worldview of the Celo blockchain community, which is heavy on financial inclusion goals and aspirations to do well for underprivileged users. For example, Valora has worked with a large charity provider of universal basic income grants and has advised wallet holders how to use their Supercharge rewards to assist Ukrainians impacted by the war with Russia.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Creating an Entrée to Cryptocurrency Payments for Everyone

Bona was a partner at cLabs working on Valora prior to taking the top post when it separated from its parent. Previously she worked in marketing and product management roles at Google, Twitter and Spotify.

Drilling down from her elevator description, in an interview with The Financial Brand, Bona explains that Valora has a twofold aim in how it offers cryptocurrency payments.

First comes the technology side of it. Bona says that many crypto wallets require a deeper understanding of how cryptocurrencies and related instruments work than many people have.

For example, to send cryptocurrency to another person, typically you would need to use a 42-character public key, says Bona, “which is impossible to remember and really easy to mess up.” Errors can actually misroute transactions and may not be recoverable, Bona adds.

Dig Deeper: Explainer: What Is Web 3.0? (And Why Should Banks Care?)

“Most people don’t know how to transact that way,” she continues, “but everybody has a phone number. So Celo enables Valora to tie your phone number to that blockchain public key, and that’s a key feature.”

Another technical factor in Valora is the ability to transact in a growing number of cryptocurrencies through “tokens” built on the Celo blockchain or from other blockchains designed to function on other platforms.

“There are stablecoins that Valora runs on that are native to the Celo blockchain,” says Bona, “but we understand there is demand for other popular cryptocurrencies.” Valora, therefore, built in the ability to move other currencies.

Read More: What Biden’s Crypto Executive Order Will Mean for Banking and CBDCs

The second Valora goal is improving the functionality of money and the cost of that functionality.

“It’s 2022 and almost everything is on demand” on the internet, says Bona, except money. “You’re not able to send money freely and that’s a problem.” Bona points out that some transactions, such as sending money overseas, can take a long time and can run into stiff fees.

She says this can be a problem in both developed and emerging economies. Building Valora around crypto makes things possible that would not be as likely to happen on traditional payment rails. Central to this goal is low fees for transactions on Valora.

“Even in the crypto wallet space it can be expensive to move money because of transaction fees,” says Bona. One factor is “gas fees.” These are charges that may be assessed in the crypto world for the energy costs required to create certain digital currencies, which require enormous amounts of computing power.

Read More: How Banks Will Mint Their Own Stablecoins

Taking Wallets Beyond Transactions

Does Valora have long-term plans to become a “crypto-neobank” or some other bank-like entity built on blockchain technology?

Bona says that’s not in the fledgling company’s strategy at present. At this point Valora has established its marketplace of “dapps,” linking those outside providers with wallet holders. All of them are part of the “Celo ecosystem.”

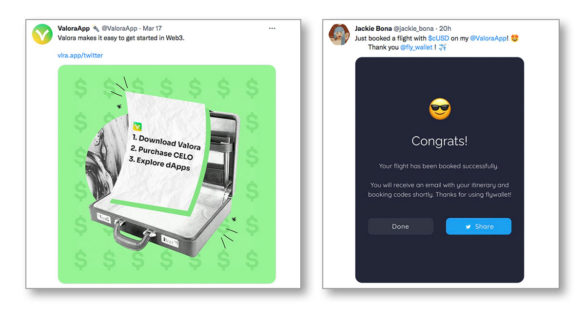

As of early 2022, there were 21 dapp providers listed in the Valora marketplace, including dapps for booking travel with stablecoins (Flywallet); lending, borrowing and pooling funds (Moola); and tools for spending crypto on real-world products and services (ChiSpend-Super App).

What of the future? The most recent figures regarding Valora indicate that it has over 200,000 users that maintain a balance and 53,000 monthly active users in over 100 countries.

“We’re very focused on growth at the moment,” says Bona, when asked how the company will eventually make a profit. “We’re focused on delivering value to our users before we turn the monetization model on.”

Valora uses social media actively to promote its offerings and works to get user referrals to build its community. Educational content about crypto and related subjects is also important to spreading the word about the company’s wallets and additional services as they are conceived and introduced.

A new twist on a traditional banking practice is being used to encourage growth, the “Supercharge” program mentioned earlier. Valora pays rewards on the balances on the highest-value holding in a wallet in one of three stablecoins, with the rewards paid on average weekly balances. (Wallet balances are not bank deposits and are not FDIC insured, to be clear.)