Conversational artificial intelligence chat has become central to the digital banking strategy of financial institutions, no matter what their size.

The Covid-19 shift to remote banking will never be reversed. Banks and credit unions have an opportunity to build and retain market share in the new environment where customer engagement has shifted so rapidly to digital channels. The ability to self-serve, especially for younger clients, is an essential factor in achieving customer and member success.

Winners will be those who make their digital experience most compelling and convenient. Those institutions will be most successful at driving digital adoption and utilization. They will deliver better service, achieve higher loyalty and build broader product relationships.

Driven by high profile success at the largest banking providers, such as Bank of America’s Erica chatbot, financial institutions of all sizes are now in a scramble to add conversational AI as a component of their digital experience. Chatbots are critical for a best-in-class digital banking experience.

Banks and credit unions are deploying AI-driven conversations in mobile and online banking to increase convenience and success for customers and members. Consumer engagement becomes more intuitive and enjoyable using comfortable plain language across whichever channel people prefer.

By using natural language AI, financial institutions learn first-hand what consumers are concerned about in a way not possible from conventional channels.

Getting Started in Conversational AI

The biggest challenge for small- and mid-sized banking providers in competing with the giants like Chase, Capital One and Bank of America is resources — both budgetary and in-house expertise. Smaller banking providers have difficulty prioritizing the first steps to meet consumer expectations. What AI programs are within realistic reach, quickly?

There are three distinct phases of conversational AI chat on the road to adoption. They include specific banking functionality at each level, with consumer value increasing in each phase.

Giant banks and credit unions may implement all three in their first project, but the majority of financial institutions take a “crawl, then walk, then run” approach that delivers initial consumer value faster and puts them on a well planned path to the future.

Learn More: See a presentation by Warren Pattison, Head of Digital Innovation and Emerging Technology at United Federal Credit Union, describing his success with this approach.

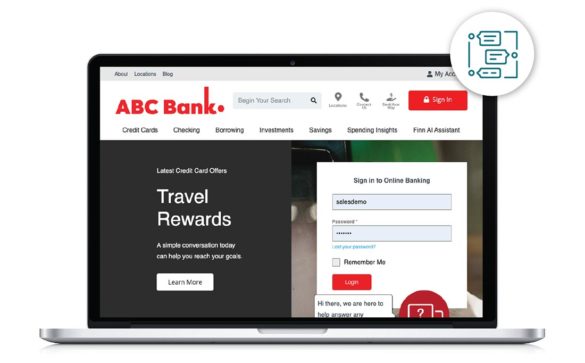

Phase One: Quick Answers on the Public Website

The simplest, most common first implementation for banking AI chat is to add a “Question and Answer” bot to the public “dotcom” website, both mobile and desktop versions. For the institution, the purpose of this “crawl” step is to drastically cut down the need for live assistance to answer simple, repetitive questions from new visitors and non-authenticated customers or members.

For financial shoppers, credit union members and bank customers, the impact is very real. First, it sends a message that this credit union is technically savvy, and has digital programs similar to what the big banking providers advertise.

Secondly, it gives quick, no-hassle answers to questions without searching on an unfamiliar website or waiting on a phone call. Even live chat requires the visitor to wait, and a public Q&A bot eliminates that. It can give instant answers or navigate to the right place on the site.

Question examples include:

- What credit card rewards programs do you offer?

- What are current branch hours?

- Where can I reset my digital banking password?

In fact our research shows that the “what’s my password?” question is continually among the top questions to live agents before the bank or credit union implements an AI chatbot.

Learn More: See the call driver analysis study for results of what consumers are really asking.

What Your Chatbot Needs:

A public-facing chatbot should have banking specific knowledge. It must understand the “user intent” for terms like branches, cards, routing, balance — all having different meanings outside banking.

But it doesn’t require integration or authentication, and the range of product destinations and topics on a public site is relatively limited. As a managed service, this bot can be live in 30 days.

The key value point of a public bot for both the end-customer and the institution is quick answers. The website visitor gets a friendly, always available answer instantly.. And the bank spends no contact center resources to deliver digitally savvy, advanced service. Easy win!

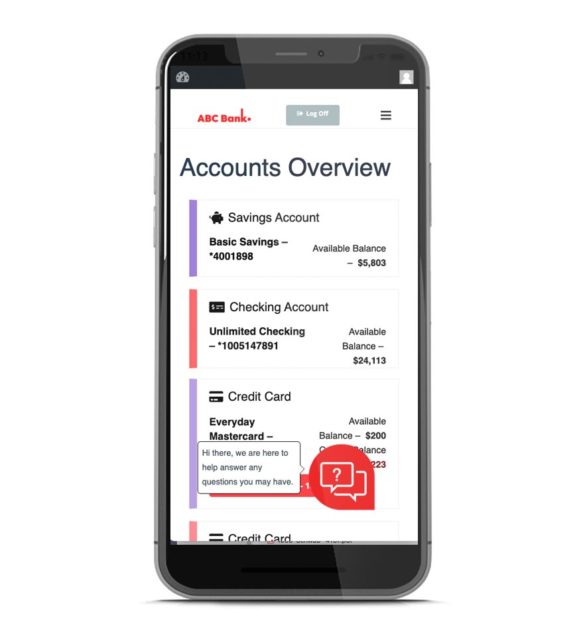

Phase Two: Navigating the Maze of Mobile and Online Banking

Once the value of a conversational AI chatbot has been demonstrated, financial institutions commonly accelerate to a “walk,” which involves making the power of conversational AI available on authenticated mobile and online digital banking.

Consumers’ Biggest Problem:

People struggle the most with “where do I find it?” Conversational AI can offer instant navigation to the features they need.

Digital banking adoption is a key objective, and making consumers comfortable and proficient is a key to driving usage. Once customers and members can find whatever they need, the app is “sticky”, driving consumer retention. Starting off, many features are hard to find, and result in calls to the contact center as well as waiting or frustration. Additionally, when new features are added or app designs change, people don’t find their way.

Adding a detailed conversational navigation capability with AI knowledge of every digital banking function and location is a high-value proposition. The function is simply to navigate the user to the desired location so they can complete their objective. Example questions are:

- Where are my tax forms?

- How do I send money to a friend?

- What’s my routing and account number?

- How do I change my address?

All of these refer to common digital banking destination forms or destinations that are often challenging for users to find. Let the bot take them there.

Navigating to the right place in the app, using a simple chat request, creates a value-added experience and increases the likelihood of the consumer achieving their goal. The result is greater utility and satisfaction with digital banking, and reduced dependence on live support.

Importantly, this capability does not require integration with the digital banking platform or core system. It is purely a concierge, helping the user navigate the features already exposed by online banking. As a result, it can be implemented for online and responsive mobile applications in about two months, and with low technical complexity.

Tips & Tricks:

To solve the problem of finding the features in online and mobile banking, use a concierge bot to instantly navigate (and provide answers) with minimal need for integration.

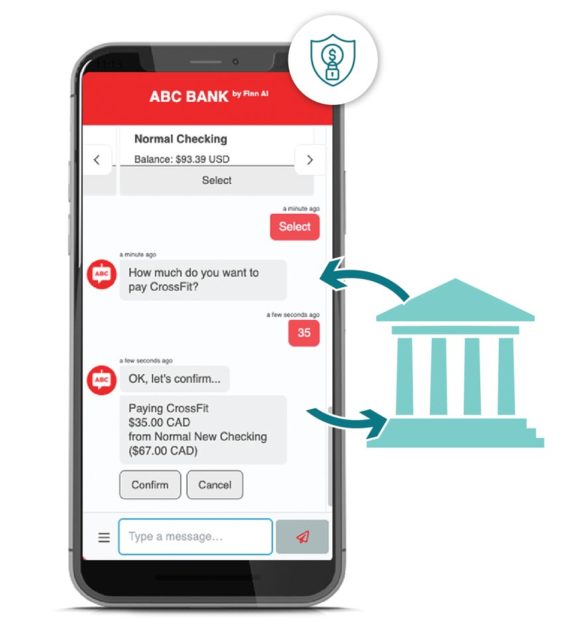

Phase Three: Chat-Driven Transactions

Ultimately, however, the desired end point — the “run” phase — is the ability to text or talk into your phone and conduct your business. Type “Pay off my Visa” and have the system take care of the rest. For institutions that have seen the adoption and loyalty benefits of giving answers and navigation, adding the ability to complete banking transactions is the logical next step.

Transactional conversations with a virtual banking assistant are the ultimate in digital convenience. For a consumer public accustomed to shopping with Amazon Alexa, it is an expected addition to the financial services experience. An intelligent chatbot turns the digital experience into private banking, where a virtual banking assistant takes instructions and delivers the requested outcome.

Call center and chat logs examined in the call driver analysis study indicate that a high volume of live service requests are trivial, such as balance inquiries. Transaction-enabled chat gives the easiest answer to “What’s my balance?” Other examples include:

- Pay my phone bill.

- Transfer $500 to savings.

- What’s my minimum card payment?

Transactional chat is only available for authenticated users. Integration with the digital banking platform is required, typically using the same APIs utilized by the mobile app. Using a managed service chatbot with a pre-built integration to a digital banking platform simplifies the implementation and delivers standard functionality. While it varies based on digital banking features, typical full implementation is three to six months.

Banking Transactions

The ultimate banking specific chatbot is the virtual assistant, capable of completing transactions on command. Whether by text typing, or mobile voice input to the chatbot, it creates a private banker, available 24/7.

Experience the Chat

The youngest, most desired banking segment by banks and credit unions alike use mobile chat and text messaging as their first method of communication. Projections from The Financial Brand in December 2020 show chat (61% of traffic) displacing voice (10%) by 2023.

Add changing consumer preference to the COVID driven digital shift and it is easy to see why so many institutions are already implementing conversational AI chatbots. For those reluctant to move ahead because of time, resources and risk, there are simple easy steps to get in the game.

The crawl, walk, run steps can have initial value in the market in one month, and put any bank or credit union on the path to digital competitive advantage.