When bank shoppers have specific feature requirements, they’re more likely to choose a specific type of institution (e.g. national bank, regional bank). Small institutions are more likely to win consumers looking for surcharge-free ATM access compared to shoppers who aren’t interested in that feature. Big banks dominate with people who want debit reward cards. Direct banks get selected more often with people who prefer banking through digital channels.

For example, people that “must have” mobile banking are more likely to choose a direct bank compared to shoppers who “don’t care” about mobile banking (see “Direct Banks Are Winning Mobile-Centric Consumers”). But what about regional banks (institutions with 100 to 999 branches)? They’re more likely to be selected when shoppers say they “don’t care” about any specific feature.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Most consumers don’t make buying decisions based on a single factor. It’s usually a combination of factors, each with varying degrees of importance. These factors fall into four broad categories:

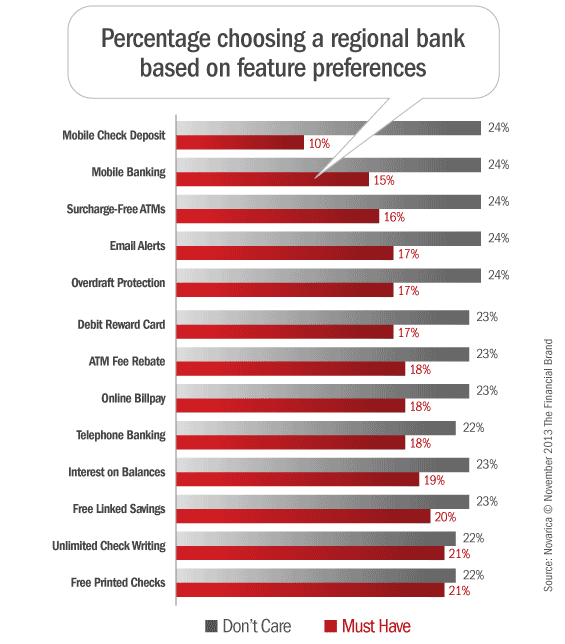

1. Product features. In Q3 2013, 24% of shoppers on FindABetterBank said they selected an account for specific product features. This is where regional banks perform poorly.

2. Price. Community banks, credit unions, and direct banks are more likely to be selected when price is the most important factor. For example, 41% of shoppers selecting a direct bank said they chose the account due to low fees. Only 34% of shoppers selecting regional banks indicated price as a motivating factor.

3. Convenience. Compared with small institutions and direct banks, regional banks are more likely to win when convenience drives the decision. However, big banks dominate convenience-centric shoppers.

4. Reputation. When reputation matters, big and regional banks perform better than small institutions and direct banks. For example, 18% of shoppers selecting a regional bank indicated that they heard positive feedback from a friend or family member. Only 14% of shoppers selecting a direct bank said positive word-of-mouth played a role in their decision.

For many reasons — like high overhead to maintain branch networks — regional banks don’t want to always win on price. While they win more convenience-based shoppers than small institutions and direct banks, the national banks are the ones most likely to win these shoppers. In 2014, regional banks must do a better job promoting the suite of product features their target customers want in order to win more product-centric shoppers.