In strategic planning meetings, new ways to increase fee revenue are often discussed. One option that inevitably comes up is raising overdraft/NSF fees. Does raising the fee by 10% add 10% to the bottom line? The answer is a resounding “no!” Raising your overdraft and NSF fee amount will impact you in three areas:

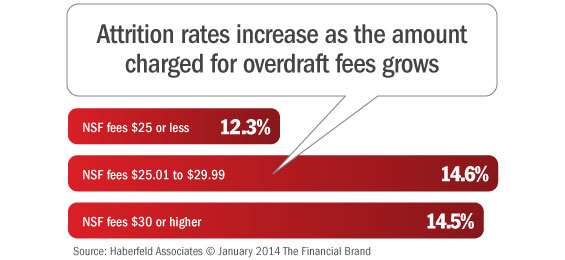

1. Attrition – The higher the price, the greater the attrition. Banks and credit unions charging less than $25 average an attrition rate of 12.27%, while financial institutions with prices between $25 and $35 average an attrition ratio of 14.6%.

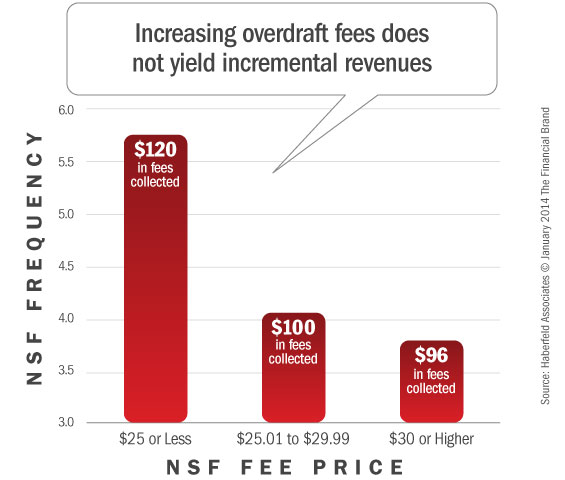

2. NSF Frequency – The higher the price of an NSF item, the lower the NSF frequency (number of occurrences the average customer experiences per year).

3. Collected Fee Income – The decline in frequency more than offsets the increase in price.

Bottom Line: Increasing your price per NSF item may lead to less fee income per customer and attrition rates will rise. That will result in even more negative impact on overall profitability.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services