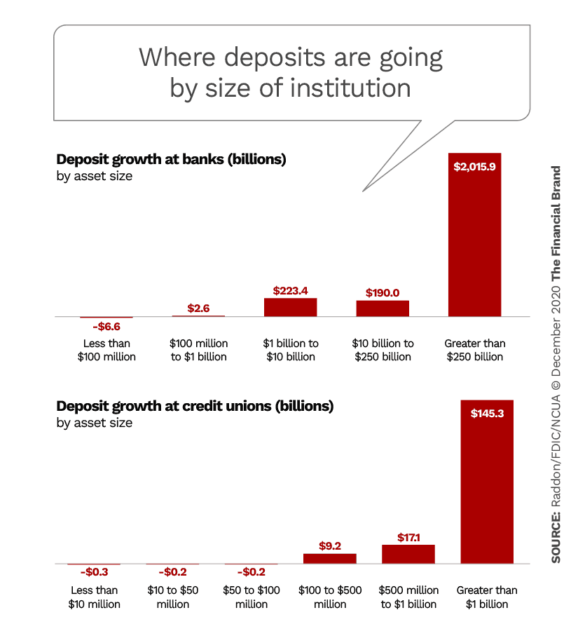

The lopsided distribution of new deposits among various financial institutions during COVID 2020 is almost as jaw-dropping as the size of the deposit inflows since the start of the pandemic. First-half deposit growth was a record-shattering $2.4 trillion, five times the size of the first two quarters of the Great Recession. Even in the third quarter, deposit growth still continued, albeit at a much slower pace.

According to FDIC data, $2 trillion (83%) of the $2.4 trillion in new deposits went to just 13 banks over $250 billion in assets. The preponderance went to three institutions: Chase, Bank of America and Wells Fargo. Collectively, banks below $1 billion in assets actually saw their deposits decline. A similar pattern was seen with credit unions, per NCUA data, according to a new deposit study by Raddon Research.

This deposit imbalance is a portent of trouble to come for community and even midsize institutions in the not-too-distant future, according to Andrew Vahrenkamp, Senior Research Analyst and Program Manager at Raddon Research.

“When the only rates you have experienced are in the 0% to 2% range, changes of 10 basis points or 25 basis points really matter,”

— Andrew Vahrenkamp, Raddon Research

Part of the problem, he maintains, is an ingrained approach to deposit rate setting and marketing that is hindering community banks and credit unions, particularly with regard to Millennials. That, and a fundamental difference in perspective on rates between Millennials and older consumers, which we’ll explore.

With loan demand slow overall, just 9% of community banks rank “core deposit growth” as their greatest challenge, according to a report issued jointly by the Federal Reserve, the FDIC and the Conference of State Bank Supervisors. The top challenges were “business conditions” at 34% and “regulation” at 16%. But when the economy picks up again, the deposit growth imbalance will play a bigger role.

Fractional Marketing for Financial Brands

Services that scale with you.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Key Drivers: Convenience and Technology

At issue is more than just deposits. The big banks are capturing more and more of consumers’ primary banking relationships as well as their primary savings relationships, according to Vahrenkamp. The reason is not primarily rate, he told The Financial Brand in an interview.

The big banks rarely lead on rates. A key reason comes down to convenience — both physical and digital — and to the fact that “they’ve stopped shooting themselves in the foot from a service quality standpoint,” the analyst observes. All of the big three banks have committed to a digital and physical strategy, but have invested heavily in digital so that they now rival or exceed what many of the challenger banks can do. This is not lost on consumers, especially Millennials and other digital natives, who expect the best technology and have come to believe that the largest banks have it.

Young people may create an online savings account with an Ally or another digital-only bank where they feel they can get additional return, but the bulk of their relationship is still going to be at the large bank, according to Vahrenkamp. “This will have a tremendous negative impact on community financial institutions unless they can somehow reverse that trend.”

There are some definite steps they can take, however, which are covered below.

Online Deposits, Yes. Online Banks, Maybe

The 2020 edition of Raddon’s Deposit Insights report, based on consumer research conducted in August 2020, looked closely at online deposit account opening.

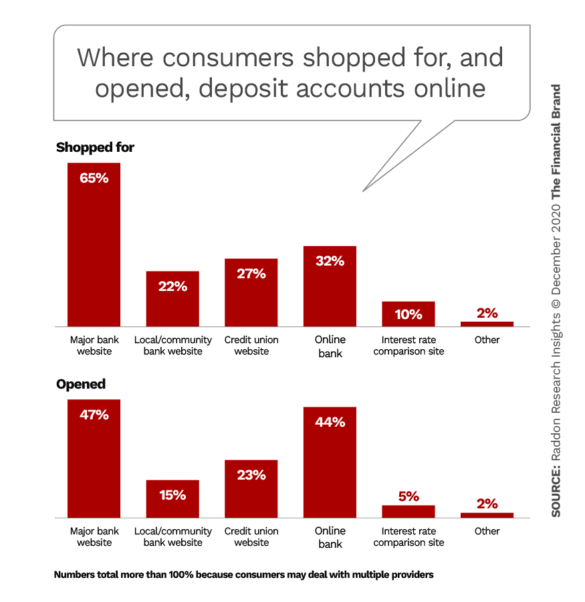

“Much of the continued expansion in online accounts comes from the process of shopping for and subsequently opening deposit accounts online,” the report states. “While the percentage of consumers opening an account online remained relatively consistent from 2019 to 2020 (14% versus 16%), as rates fell, a significantly larger number of consumers took to the web to look for better opportunities to earn interest.”

Online deposit shoppers overall increased year to year from 20% to 31%. But two segments, Raddon found, were online much more: Half of all Millennials shopped online for a deposit account in 2020 and nearly as many (49%) “high depositors” did also. (The latter are consumers who have at least $50,000 in deposit balances.) The most sought-after accounts were checking, 69%, and savings, 60%.

While major banks were the predominant place consumers looked for deposit products, online banks obtained a higher share of openings, Raddon states.

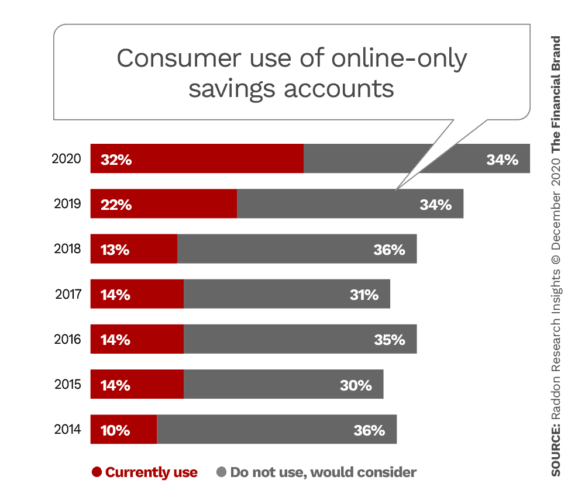

Consumer interest in internet-based savings accounts in particular advanced strongly after being pretty static from 2015 to 2018. Online institutions jumped all over rising rates in 2019. Of those using an online savings account, 41% said it was opened within the past year, Raddon states.

However, the success of online banks like Ally, Axos and Discover was mixed. Most savings accounts opened with them were not primary savings accounts, according to Raddon. “Only 8% of consumers say that their primary savings account is at an online bank, while 39% hold their primary savings at a [nationwide] bank.”

Read More: How Financial Marketers Can Prepare for the Next Switching Surge

Why Rate Sensitivity Is Soaring Among Millennials

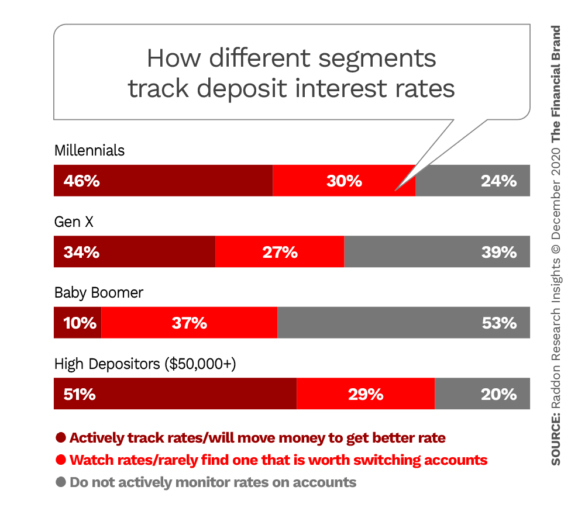

Rate sensitivity among consumers has been climbing for several years, but jumped sharply in 2020 even after rates hit rock bottom again. In 2018, only 9% of consumers were actively tracking rates, according to Raddon. That grew to 16% in 2019 as rates climbed, and to 27% as of August 2020. The two segments tracking rates most actively are “high depositors” (logically enough) at 51% and Millennials at 46%.

The report explains that consumers currently 40 or under have spent most of their adult life in a low-rate environment. “When the only rates you have experienced are in the 0% to 2% range, changes of 10 basis points or 25 basis points really matter,” notes Vahrenkamp. Baby Boomers, who still remember 12% CD rates, are much less rate sensitive now. Many community financial institution leaders don’t seem to grasp how such small changes can be meaningful, the analyst observes.

Rate sensitivity is much less about the actual rates and more about the direction of the rates, Vahrenkamp points out. Rates can be either low or high, but if they don’t change there won’t be rate sensitivity. “It’s when they are rapidly changing that we see sensitivity,” says Vahrenkamp.

In the most recent situation, he explains, rates had risen fairly rapidly in 2018-19, sparking a lot of interest. When the pandemic hit, “rates went down like bang,” says Vahrenkamp. “So there wasn’t the normal plateau that we would typically have before rates dropped back down again.” As a result, rate sensitivity — already high — got much higher. All of a sudden people were seeing rates fall quickly and thought, ‘This is crazy. I need to move money somewhere else.’ That’s why we saw such willingness to move for very low premiums.”

The most recent Raddon deposit survey backs this up: “While a year ago only 23% would move to a new institution for a 1% increase in rate, today 39% of consumers would make that move.” In fact a record 39% of respondents say they have closed an account at one institution and moved it to another to earn a higher yield in 2020, up from 27% in 2019. Half of the movers were Millennials.

Just under a third of consumers (31%) overall would never move for any rate. Many of them are likely to be older, Vahrenkamp points out. “At some point all the money that’s being held by these older Americans is going to move to descendants.” That makes it crucial, he emphasizes, for community banks and credit unions to build relationships with those descendants.

Read More: Why BofA – Not Fintechs or Amazon – Should Keep Bankers Awake at Night

6 Steps Community Institutions Can Take Now to Grab More New Deposits

The following six suggestions come from the Raddon report and from Vahrenkamp who, in addition to being an experienced analyst, is a former credit union CFO.

1. State-of-the-art mobile technology is not an option. To attract younger consumers, above all make sure your mobile banking app works flawlessly and makes it easy to open and fund new accounts. Otherwise Millennials will drift to the big three banks or fintechs.

2. Look beyond rate. The reason people save isn’t just because they want to make more money in interest. There’s usually a more specific goal. Speaking to that in your marketing can make a big difference. Many savings apps and some savings accounts stress the use of different categories or “buckets” to separate savings by goal.

3. Stop pricing from the yield curve. Traditionally most financial institutions give the lowest rates to the most flexible deposit product — free checking — while paying the most for longer-term CDs. Vahrenkamp argues that if your targets are Millennials and Gen X, who prefer to stay liquid, then it makes sense to start pricing your liquid deposits ahead of your CDs. “The big banks do this now,” the analyst states. “Give the rate benefit more to those products that are going to resonate most with the younger customers you need to get,” he advises.

4. Abandon CDs. Not the product, the name. Millennials and younger consumers think a “certificate” is something you get for finishing in sixth place at a swim meet. “CD” is even worse. “A CD is something that your dad uses in the car to listen to the Rolling Stones,” says Vahrenkamp.

Raddon tested this with Millennials and found that when they heard a description of a savings product that would give them a much higher rate in return for tying up their money, they loved it.

An Indiana credit union rebranded their CDs a couple of years ago as “Savings for a reason,” Vahrenkamp relates. The product had the same rate, terms and qualifications as their CDs, but weren’t called that. “Of the several hundred credit unions we work with, they are number one in terms of getting deposits from Millennials, says Vahrenkamp, because they speak their language.

5. Use rewards to boost rate. Many large financial institutions offer reward checking accounts where if you reach a certain number of debit card transactions in a given period, you can earn a significantly higher rate on savings than you would if you simply placed the money in savings. It’s basically a package account or relationship account combining checking and savings, says Vahrenkamp.

6. Don’t ignore investments. Many institutions offer investment options, but Raddon found that only 45% of consumers overall were aware that their primary financial institution offered them. Worse, this figure drops to 21% and 27% respectively for customers of community banks and credit unions. Making Millennials more aware of your investment options would be a good move, Vahrenkamp believes. Growth in non-retirement investments is almost all centered upon under 45 consumers, he states. “They’re looking at the market as being an alternative to low rates, despite the volatility.”