Creating a consistent customer experience across the entire financial institution is paramount for creating digital growth. As consumer habits change and environmental factors shift, leaders may ask: Is my organization ready for digital growth?

A webinar hosted by The Financial Brand, “Digital Growth – Is Your Institution Ready Now?” provided answers to this question and others. Two leading industry experts — James Robert Lay of the Digital Growth Institute and Sam Kilmer of Cornerstone Advisors — joined me in discussing four ways financial institutions can achieve digital growth in 2021. This article highlights the key themes.

The Power of Human Relationships in a Commoditized Industry

Consumer habits have changed and not just for financial services. People have become accustomed to the interpretive ability of social media and Amazon to give them what they want to see, hear or buy. The next step for banking products and services might seem to be an algorithm-driven, impersonal experience. In fact, we’re seeing the opposite. Financial services will continue to find growth through digital channels by doubling down on human connections, not the other way around.

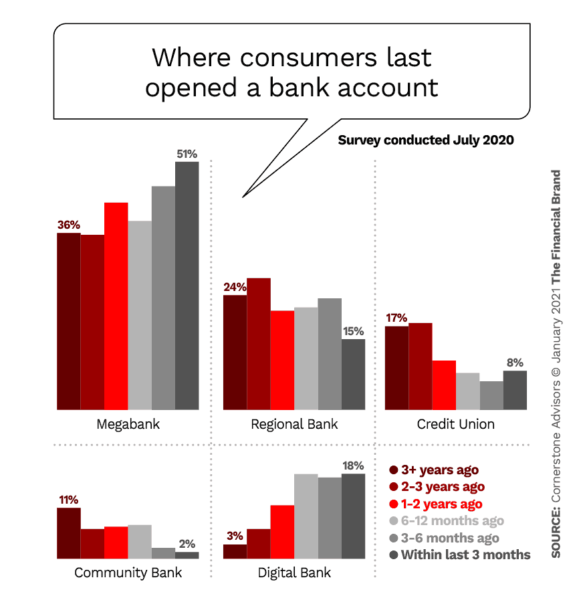

Large, nationwide banks and digital-only banks are reaping the growth benefits of offering products through digital channels. Polling data from the pandemic shutdown period — when digital was the preferred way to bank — paints a stark picture. During the three months leading up to the date of the survey (July 2020), nearly seven of ten consumers (69%) who opened new deposit accounts did so at a megabank or at a digital bank, according to Cornerstone Advisors. Close to the same percentage holds for those who opened an account six months prior to the survey.

Where did growth come from for large, nationwide banks and digital-only banks? Sam Kilmer, who is senior director at Cornerstone, said polling data indicates the growth came “at the expense of predominantly community banks — and credit unions to a lesser degree.” Mega and digital banks “have gotten the scale of marketing and technology right,” he added. “This is a real threat to smaller financial institutions.”

So, does this mean impending doom for local banking? Have nationwide and digital banks arrived at all they need for long-term digital growth? The answer is a resounding “No” to both. There are clear paths for both groups to grow by helping banking consumers to thrive.

Meaningful Interaction Is a Universal Opportunity

The days of the traditional “rainmaker” salesperson are gone. Financial institutions can’t just think about how they can close more loans or open more accounts. It’s ultimately about how lenders build relationships that are valuable to the organization and the customer.

As illustrated by the pandemic performance for new accounts, nationwide banks have invested in technology. Digital banks were ready for the pandemic by virtue of their business model. Volume, however, while important to return on investment, is not a long-term game-winner.

The threat to very large and digital-only institutions is a lack of human interaction. Their opportunity is to couple their tech investment with education targeted at the worries that keep customers up at night.

Community institutions have the inverse threat and opportunity. They have the power of deep, personal relationships built on the expertise of staff helping at branches. In-person interaction remains their competitive advantage. As we’ve seen, the threat is that they lose their advantage when consumers stop interacting in-person, either by government mandate or change in preference. Local banking’s opportunity is to use technology to bring staff expertise to customers, especially to those who do not go to branches.

These opportunities and threats are summarized in the graphic below.

Delivering Expertise as a Differentiator

Digital banking enhancements like account opening are becoming table stakes very quickly, regardless of institution size. The differentiator for consumers has become education that helps them make financial decisions, especially in an age where the internet clarifies and confuses in equal amounts. After consumers come in the door from a financial institution’s current digital offering, there is a huge open field of opportunity to engage and interact with them in a way that’s going to create tremendous loyalty and advocacy.

How can banking institutions provide consumers advice that they value? James Robert Lay, best-selling author and CEO of the Digital Growth Institute, shared a three-step process for learning consumers’ needs:

- Ask about what keeps them up at night.

- Learn from their responses.

- Craft solutions to those pain points.

When an institution has an “open and empathetic ear,” said Lay, the process of providing valued advice becomes much easier. “You don’t have to wonder how to help consumers,” he said. “They will tell you how they want to be helped.”

With the knowledge of customer or member needs in hand, digital can magnify growth, especially when technology provides scale. “If I’m a community banker or credit union leader, or just a legacy financial brand, digital has been viewed as an expense because it requires some investment, whether that be on the technology side or the content-creation side,” Lay stated. “After that investment, though, it becomes an accelerant.”

Given the banking technology available today, financial institutions also can learn consumer pain points by combining data with knowledge about personal finance. Data can inform consumer engagement centered on big financial milestones. Delivering relevant and more helpful recommendations builds significant trust.

Further, smart managers at community banks and credit unions are asking how they can use digital to their advantage. They are looking at how they position their business as that guide and financial partner. By looking for ways to put their arms around the consumer, digitally speaking, customers will feel taken care of and understood, creating serious opportunity.

Building a Winning Team

As organizations seek to pivot on consumer needs, community financial institutions have an advantage in their smaller scale. As Lay said, “They can pivot faster. It’s like the dinosaurs. The smaller, more-adaptable, nimble creatures survived and then thrived.”

Management at institutions of any size will need to be agile with staffing to make way for digital growth. Often financial institutions use legacy staff in roles not paired with their skillsets. In order to truly transform, they will need to develop staff or hire new capabilities. Even after a financial institution has the right players in the right seats, said Lay, training remains continuous because “digital will evolve at an exponential pace in the years to come.”

Banking is traditionally a financial accounting industry that focuses on the profit and loss statement before matching talent to strategy. Now is the time for bank and credit union managers to rethink how sales and marketing come together. Lay, Kilmer and I agree, the two must align and become “the growth team” if institutions want to achieve success in the digital age.