One out of three Americans is doing at least part of their financial business with a nontraditional provider, and for those among your own institution’s base, their activities in the “shadows” may be nearly invisible to you and to the recordkeepers that typically track financial activities on a macro level.

“Shadow banking” isn’t shady — it’s all legit. The term is now being used to describe having deposit, credit, alternative borrowing arrangements, investment accounts and other relationships with nontraditional providers such as challenger banks. This is the world of Chime, Dave, Robinhood, Aspiration, Affirm, Klarna and many others.

That one-in-three figure mentioned above breaks down this way generationally, according to a study by Cornerstone Advisors, sponsored by FICO: 47% of Millennials have at least one shadow relationship, as do 36% of Gen Zers, 36% of Gen Xers, and 21% of Baby Boomers.

In fact, according to the study even 14% of seniors engage in some form of shadow finance.

During the early 2000s financial crisis, the adjective “shadow” was applied to mortgage and personal lenders whose activities hovered around the cusp of legitimacy, but no such smirch is intended in the study’s usage.

“They’re shadow because consumer behaviors evade observation from the legacy financial institutions with which they do business,” writes Ron Shevlin, Director of Research at Cornerstone. Whereas a ton of information can be found online about traditional financial institutions individually and in aggregate, no such data exists for challenger banks and other shadow providers. (Shevlin’s report makes the point that there are some dark sides to the shadows.)

The firm’s report, “Americans’ Shadow Financial Lives: The Mobile Apps Banks Don’t Know They Use,” paints a detailed picture of how the newcomers have infiltrated traditional institutions’ turf. The findings are based on a survey of over 3,000 U.S. consumers.

“Increasingly, Americans’ financial account activity and behavior is ‘off the radar’,” i.e., not reported by governmental agencies or credit bureaus or tracked by traditional means,” says Shevlin. “As a result, financial institutions have a limited view of consumers’ financial relationships and true activity.” As an example, an official of one of the three major consumer credit bureaus noted that data on “buy now, pay later” plans has only recently started being pulled into consumer credit databases in a meaningful volume.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Fractional Marketing for Financial Brands

Services that scale with you.

Shadow Banking Changes The Ground Rules of Transaction Accounts

The checking account used to be the core account that institutions could use as the foundation of broader relationships. Increasingly, that strategy is proving as dated as the term “checking account” in an age when use of checks keeps falling.

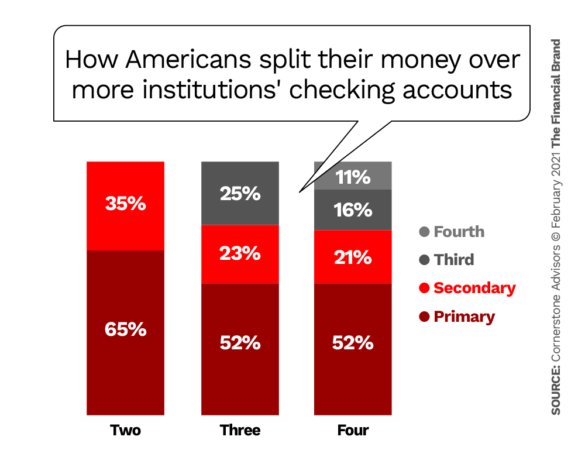

The study found that 35% of consumers surveyed have more than one transaction account, with some holding more yet.

The report found that consumers with two checking accounts hold about two-thirds of their total deposits in their primary account. One third goes to their secondary account. However, among those who have opened more than two accounts, most keep about half of their money in the primary account and divvy up the rest among their other accounts.

In terms of generations, Millennials hold multiple transaction accounts the most:

- Millennials 42%

- Gen X 36%

- Senior 34%

- Gen Z 32%

- Boomer 31%

Why have more than one account? The survey asked and found no more than 18% of the sample gave any one reason. This led to some reasoning by suggestion.

“The most frequently cited reason — wanting a bank with branches closer to them — implies that many consumers have their primary account with a bank whose closest branch isn’t anywhere near where the consumer lives or is branchless altogether,” the report states. In fact, the second-most-common choice, at 17%, was “Just wanted to try out another account.”

Four factors driving selection of challenger banks identified by the study include:

- Rates and fees. Three out of ten chose a challenger bank for the rates promised.

- Customer experience. One in four come to a challenger because they expect a superior experience.

- Special features. For example, one out of five Chime users chose the neobank because of its early paycheck access service.

- Affinity or specialization. Aspiration promotes itself as the challenger bank for the environmentally conscious, for example.

Read More: Does Being a ‘Primary Financial Institution’ Mean What It Used To?

Mix And Match Account Selection Marks Shadow Banking

The report portrays the popularity of having multiple accounts, including fintech offerings, as a reflection of consumers attempting to mix and match features they like. “But they don’t close out and switch accounts — they simply add another account,” it says.

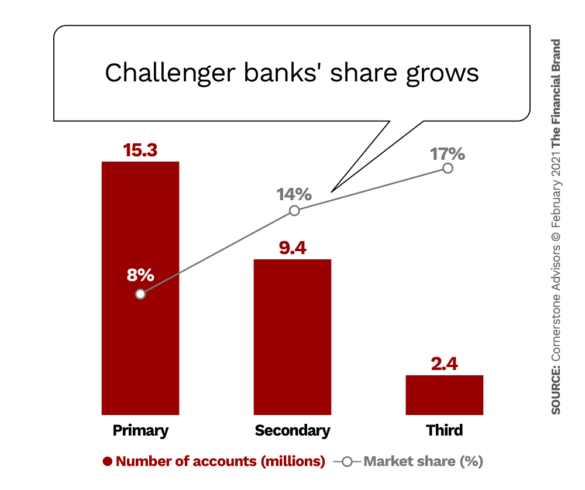

The boom in fintech alternatives to traditional transaction accounts, with multiple attractive features and typically no charge for the account, has given consumers more opportunities to try out additional providers at little risk. This has led to Chime, for example, having nearly 9 million customers, according to the report. In addition, challenger banks have become the primary bank for over 15 million Americans — 8% of the market.

Key Insight:

The more accounts a consumer has, the more likely they will overdraft. Four in 10 say they overdraw because they fail to track their balance, not because they’re broke.

Of course, in the past people could have opened transaction accounts at multiple traditional financial institutions. Today, notably, the challenger banks’ share of secondary and tertiary accounts is even greater, as shown by the solid line in the chart above. The study found that between 2017 and 2020 digital banks’ share of transaction accounts tripled to 18%.

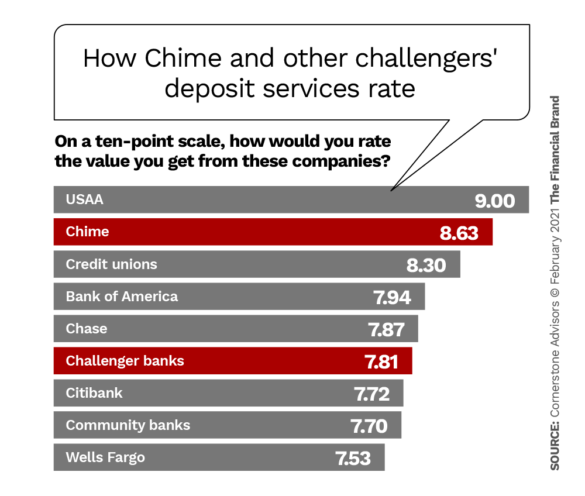

Something that should especially concern bankers and credit union executives is that the newcomers are keeping many consumers quite happy with their service. In the ranking below, based on the survey respondents, Chime comes in just behind USAA, which The Financial Brand once dubbed “the most beloved financial brand on Earth.”

While other challenger banks, summarized as a group, don’t reach as far, they rank higher than Citibank, community banks as a group and Wells Fargo.

Credit Cards Have a Shadowy Side As Well

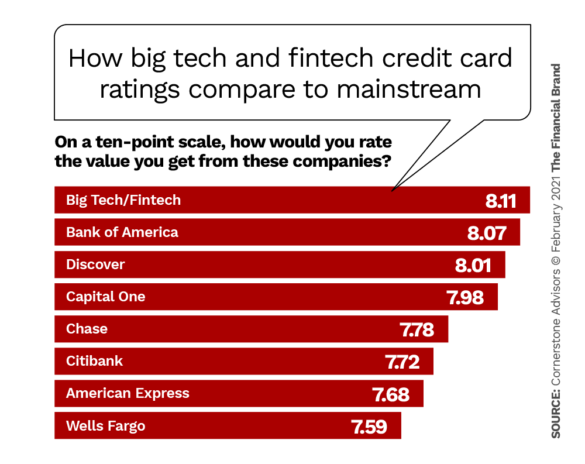

Big tech and fintech credit card offerings have opened up a shadow side for this common form of credit, as well. The report explores this.

On one hand are gainers. “Almost 12% of all credit cardholders in the United States have a credit card from PayPal — and consider it to be one of the top three cards in their wallet,” the report states. “Amazon’s share is slightly lower at 10%. This shouldn’t be surprising — six in 10 Americans are Amazon Prime customers, and 60% of consumers with a smartphone have the PayPal app installed on their device.”

The report notes that other providers have grown their share of the credit card market. Innovative approaches to building credit help make certain offerings appealing.

The features of the big tech and fintech cards appear to work well in their favor, based on the survey’s findings.

Reality Check:

Despite all the hoopla surrounding the launch of Apple Card in mid-2019, its market share is just 1.3%.

Read More: Consumer Frustration With Banking Apps and Mobile CX Lingers

Shadow Payments Rise As ‘Plastic’ Meets Mobile Payment Apps

The role of payments in today’s economy, which will grow as cash continues to be eclipsed in the wake of COVID-19, increasingly ventures into the shadow realm.

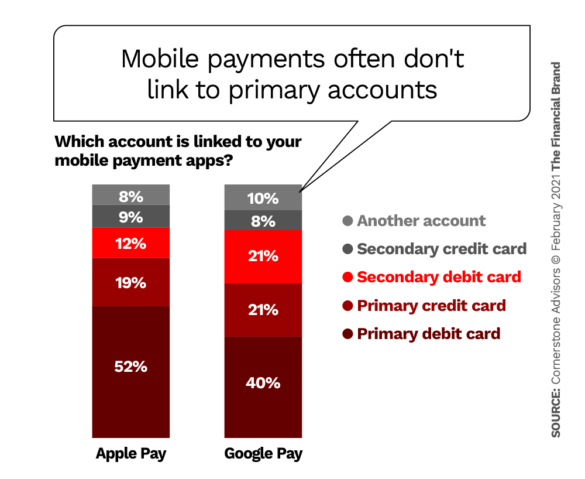

Mobile payment apps. These have grown more popular as many consumers seek contactless payment methods. That isn’t the shadowy part. What is, according to the report, is that many users of mobile payment apps link them to secondary debit or credit cards, not to their primary card accounts.

Buy Now, Pay Later. This method of purchasing and receiving goods up front, and paying in installments, revived elements of the old-time layaway plans. This relatively new payment and credit combination, sometimes even available via card accounts and related apps, has rocketed to nearly $24 billion annually in the U.S., according to the report. By far Millennials are the heaviest users.

Key Facts:

43% of buy now/pay later borrowers said they have been late on payments at some point. Two thirds say they lost track of when payments were due.

Merchant mobile apps. One example concerns merchant mobile apps, where consumers can pre-load funds for later spending. The report states that Americans have roughly $3.2 billion parked in ten of the most popular merchant mobile apps. The top five are Amazon (over $1 billion), Walmart ($731 million), Starbucks ($452 million), Uber ($317 million) and Dunkin’ ($130 million).

Using the apps to pay isn’t shadowy, the report points out, but shifting funds into the apps from other sources is.