No one likes fees. And few fees make people more angry than banking fees. Many financial marketers may just chalk it up to human nature and say there’s nothing that can be done.

It turns out there is something that can be done.

The question banking should be asking itself is: What is the underlying reason people don’t like banking fees? Millions of people pay monthly charges for services that are far less important than their bank account: Netflix, Amazon Prime, cable, mobile phone, toll booth passes, etc.

Oddly enough, according to McGuffin Creative Group research, people find some of banking’s traditional fees (like overdrafts) to be fair. In fact, some of the consumers the marketing consulting firm spoke to could even cite why banks and credit unions charge fees in the first place. For its survey (in partnership with YouGov), McGuffin spoke to 1,339 adults in the U.S. with a checking and/or a savings account in mid 2021.

The authors of The McGuffin report insist that the periodic uproars over banking fees often don’t result from what banks and credit unions think they do.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

It’s All About Perception

McGuffin’s Senior Marketing Executive Danielle Filippone and Partner Betsy Fiden told The Financial Brand they conducted the survey because they saw a disconnect between how financial institutions perceived themselves and how customers thought about their banking provider. Filippone says the report was born out of their curiosity over one big question:

“Do customers even see banking as a ‘service’?”

While banking providers consider their institution to be a service provider relying on fees to generate revenue, their customers have a very different concept of what banking is.

“We know from working with banks that they certainly see themselves as a service, and they aim to provide high-quality services, which is something that really drives their marketing,” Fiden explains. “But many people don’t see them as a service provider.”

The McGuffin report uses cable and internet providers as a comparison, which over three quarters of people (77%) consider to be a ‘service’, whereas just over half of consumers (54%) see banking the same way.

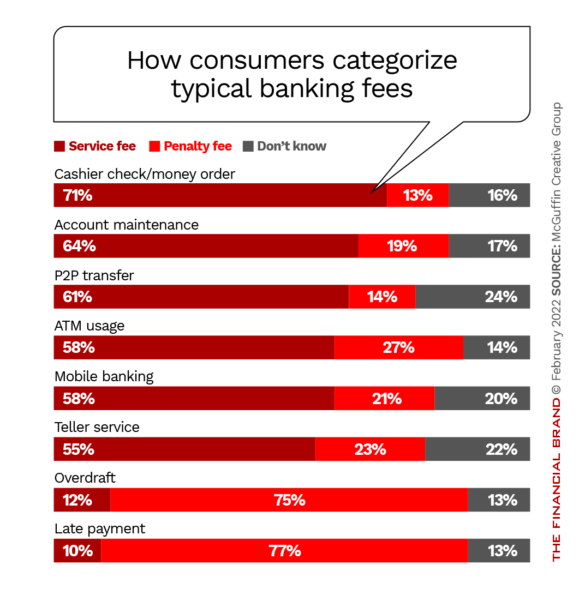

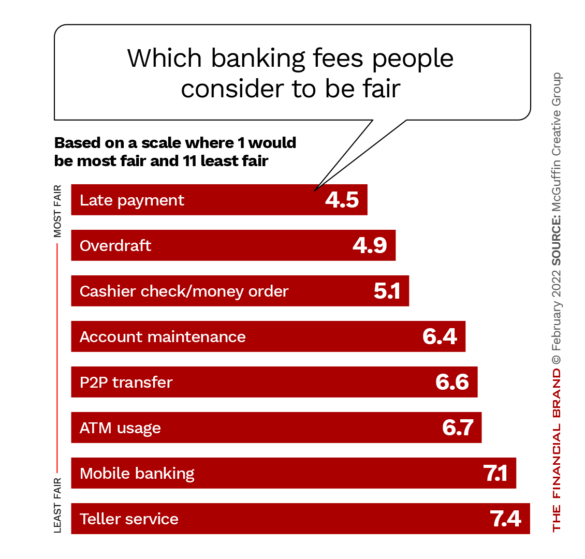

Even for those that do accept fees as an inherent part of the banking system, there are only some services for which they consider fees to be fair to charge versus what they think should be free, such as mobile banking.

The uproar over fees — particularly overdrafts — can be attributed to several factors. Among them from the consumer’s perspective are the high cost for what is often considered to be an oversight, paying multiple fees for one infraction, or simply annoyance at these penalty fees.

But, it’s not always that simple.

Know Your Customer Base:

Financial marketers may assume people are upset about all banking fees, but there are some fees that people consider more fair than others.

“Our study found surprising nuance in customers’ distaste for fees,” the report reads. “While numerous banks have for years focused their marketing efforts on promoting ‘free checking’ and ‘no fee’ accounts, our study found that respondents were more accepting of fees they could control, ones they felt were ‘fairer’ — reasonable overdraft fees, late payment fees, etc.”

Maybe getting rid of overdraft fees isn’t the solution or required. Whether it is or isn’t, however, banks and credit unions should first learn what generated consumer perceptions of these fees.

Read More: The Beginning of the End for Overdraft Fees — What’s Next?

Why People Don’t Think of Banking as a ‘Service’

Trust in a brand and a company is what stimulates consumer loyalty — and is often why people will justify paying a price. Almost half of people say they depend on influencer recommendations before they’ll buy a product, according to the Digital Marketing Institute.

The problem is that McGuffin says “trust in banking is at an all-time low.” The marketing consulting group uses the Edelman Trust Barometer as a measure of people’s trust in a specific industry. In 2021, banking ranked second to last (15 out of 16), ahead of only the social media industry.

It boils down to a lack of transparency, the authors of the report insist.

Dig Deeper: Peoples’ Woeful Lack of Data Sharing Knowledge Could Hurt Banks

Just over half (55%) of the consumers surveyed maintain their bank is less than transparent when it comes to fees, while about a third (34%) say their primary banking provider is very clear about fees and when they apply. (The rest of the respondents weren’t sure.)

“That perceived lack of transparency, combined with years of highlighting ‘free checking’ in marketing campaigns over service and value, has created a race to the bottom,” the report reads. “These factors lower perceptions of the real value incumbent institutions provide their customers and members — value that is funded by fees that customers find opaque or unnecessary.”

What Marketers Should Do About It

One individual McGuffin heard from spelled out the steps they wished their financial institution would take regarding fees: “Clearly explain all fees associated with my type of account and have a list [of] them…. Explain different levels of service and what is included. Also, a discussion about online banking.”

Seems like easy enough fixes. Indeed, McGuffin’s teams insist this disconnect can be repaired with a few strategies that most banks and credit unions can easily roll out. Here are their suggestions:

Audit what you already offer

“It’s critical to really know your customers and what’s important to them. Dial those aspects of the relationship up or down in your communications,” Fiden says. “Above all, don’t chase customers that value ‘free’ over great service and products.”

With just a relatively small investment in time, banks and credit unions can re-evaluate their fee structure and whether it works for customers. McGuffin suggests the following:

- Review the marketing literature that details fees

- Determine if this literature is transparent enough — can people easily find out how much a single fee would be for a certain transaction?

- Scope out what is the most profitable customer segment, and which fees they are most often paying. Targeted outreach for these customers may be advisable.

Educate consumers that banking is a service

The focal point of the fee issue is the divide between customer and banking impressions. Fiden says part of this can be resolved just by explaining exactly what a fee entails and why the financial institution is instituting the charge in the first place.

Explain that “We charge a fee because we have to pay our employees, provide certain training and pay for lawyers and other professional services” — whatever the case may be, she explains. This connection between banker and customer creates trust in the process. It is also important, the authors maintain, that banks and credit unions understand exactly where their consumers are in their financial journey.

The Need To Open Up:

If people know what they are being charged for — and even more importantly why — they are much more likely to accept the fee.

Lastly, McGuffin advises considering “service guarantees” — almost like FedEx’s promise to deliver overnight — as a way to assure the customer. “That guarantee reflects value customers are willing to pay for,” the report reads.

Communicate and create a deeper connection

“We always tell financial institutions we’re working with to make sure you’re communicating in an easy-to-understand manner,” Fiden explains. “Don’t let someone open a checking account and say ‘Oh, here’s your fee schedule’ and not go over it with them.”

As important as it is for customers to understand the potential fees at the time of account opening, it’s just as imperative that they are informed along the way. For instance, the report advises banks and credit unions offer (and send out) annual fee reports and/or publish a blog post for easy digital access.

Additional steps include proactively notifying customers before they are going to be charged. If an individual’s checking account often reaches the threshold that would trigger an overdraft fee, reach out to let them know they could be charged and what it will cost.

Marketing teams can likewise rebrand the idea of a “fee,” by changing how employees pitch them. “By reframing the conversation through use of a different term with fewer negative connotations such as ‘value investment’ or ‘service assessment,’ you can better communicate the outstanding value your bank provides your customers — and reinforce the idea and benefits of banking as a service,” the report reads.