Competition for consumers’ retail deposits could soon be heating up. The Federal Reserve kicked off what most believe is a slow-but-steady series of incremental interest rate bumps, allowing banks and credit unions to dangle increasingly more attractive deposit offers that could ignite a battle for market share.

Surely there will be many financial institutions using deposit promotions as part of an acquisition strategy to attract new deposits, but they could also wind up on the losing side of the attrition game — victims of “switch roulette,” where they lose more deposit dollars than they gain through defections.

This is one of the main strategic concerns outlined in a Raddon research study examining the strategies, opportunities and challenges of deposit growth in a rising rate environment.

“Marginal interest rate increases can be used to retain existing deposits while higher rates can be used to attract new deposits,” Raddon analysts write in their report. “However, financial institutions should be aware that higher-rate deposit offers may cannibalize existing deposits unless appropriate strategies are used to minimize this outcome.”

Inasmuch, Raddon recommends that the success of any deposit acquisition campaign should be measured by the acquired new money ratio and the marginal cost of those new dollars.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Rate-Sensitive Depositors Difficult to Identify

Before you can entice consumers with deposit offers, you should (1) understand the size of the potential market, and (2) identify those who are most likely to respond to such offers.

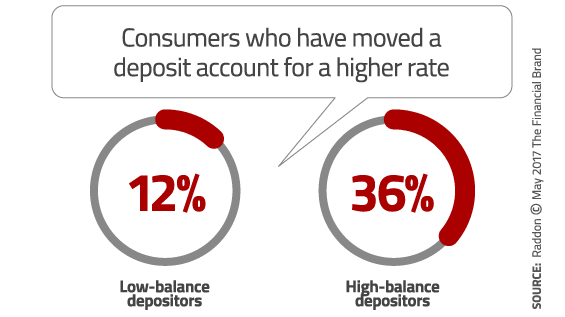

In Raddon’s research, only 21% of consumers said they had ever changed financial institutions to obtain a higher interest rate. Traditionally financial institutions have relied on this stability to manage deposit rates and net interest margins — the “inertia strategy.”

But with rates hovering barely above zero for so long, Raddon concedes it’s difficult to draw an accurate bead on any relationship between APYs and switching behaviors. Consumers simply haven’t moved their deposit dollars around much in the last decade (why bother?), so there just isn’t much data to crunch.

“The extended period of low rates and high deposits in recent years has made retention modeling difficult now that we face a rising interest rate environment,” Raddon notes in its report.

Does that mean it’s more likely that consumers will have grown complacent (or indifferent) and will keep deposits where they are at? Or will the banking industry will see consumers moving hundreds of billions of dollars around? No one can be absolutely sure what will happen, at least in the next few months.

“Most consumers said that they require a one percent or greater interest rate increase to move their money to a new financial institution,” says Raddon.

It’s going to take a little more time before rates increase that much — enough to spark a mass migration of deposits — but that day is on the horizon. There’s still time to prepare, but no time to wait.

Everything Hinges on High-Balance Relationships

Consumer deposits are highly concentrated in a small percentage of high-saver households. Raddon found that one quarter of consumers — those holding $25,000 or more in deposits — represent 89% of all balances. Moreover, the bottom half of all depositors — those with less than $5,000 in deposits — represent only 2% of balances. The remaining quarter of consumers with $5,000 to $24,999 in deposits represent 9% of balances.

Bottom Line: High-balance depositors are where the money is at. Literally. Financial institutions face big losses if their high-balance savers switch to other providers, so this is where banks and credit unions must concentrate their energy, both through the lens of acquisition and attrition/loyalty.

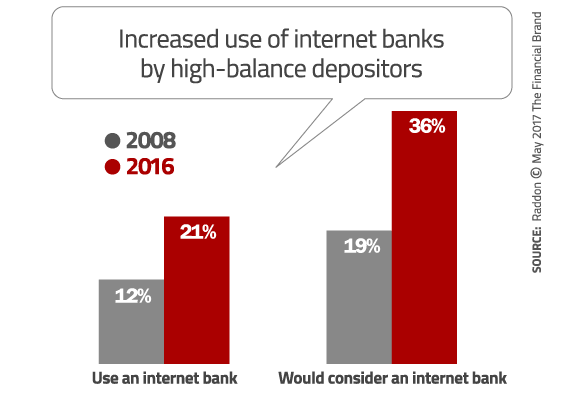

So who are these high-balance depositors? According to Raddon’s research, are older than average and have higher than average incomes. One third (35%) of high-balance consumers are 65 years of age or older. One in four high-balance fall into the upscale segment, which includes consumers over the age of 35 with incomes of $125,000 or more — 2.5 times the national average.

Half of high-balance depositors have a money market account, and 40% hold CDs with an average balance of $60,000 each.

Raddon recommends starting with consumers age 50 and older with annual incomes of at least $50,000. This segment comprises 26% of households, but holds 58% of deposit balances. Financial institutions can then massage their segmentation strategy to include younger consumers and those with higher incomes.

How Rate-Sensitive Are Consumers?

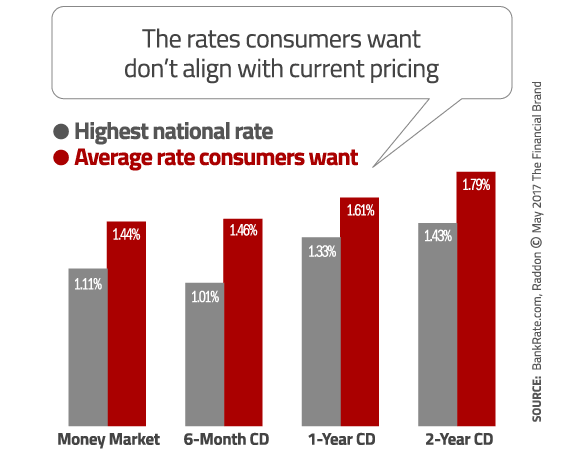

Raddon researched the percentage of consumers that would buy or open a deposit product at various interest rates. In the survey, consumers were asked to choose the interest rates that would get them to open a CD or MMA, ranging from 10 basis points to over 2.0%.

The research found that one quarter of consumers would open a MMA if the interest rate was 1.0%, while one in ten said they would open a two-year CD at that same rate.

Two out of every five consumers said they wouldn’t pull the trigger for anything less than a 2.0% rate — a fairly ridiculous expectation, as Raddon notes.

“The average interest rates sought by consumers are unrealistic given the current yield curve and rates offered by financial institutions,” the Raddon report said, noting that almost no one currently has a rate above 1.0%.

The good news, Raddon says, is that high-balance deposit households are more reasonable in their interest rate demands. 32% of high-balance depositors would open a money market account that offered an interest rate of 1.0% vs. only 24% of lower-balance consumers. While only 8% of high-balance consumers say they would open a 2-year CD with a 1.0% rate, 30% are willing to open a 6-month CD with the same 1.0% rate.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Minimizing Cannibalization is the Goal

Because each existing deposit dollar that is priced up as a result of a deposit acquisition campaign increases the total cost of borrowing for the institution, Raddon stresses that banks and credit unions must be careful that they don’t cannibalize their own portfolios.

Of particular concern with regard to deposit retention is the 8% of households that are single-service CD holders, and the 5% that are single-service money market account holders. Single service high-balance deposit households have historically shown higher attrition rates than multi-service households.

To limit cannibalization, Raddon outlines three strategies that financial institutions can employ:

1. Product Structure. Developing a product structure is as simple as offering a completely new type of deposit product that has no existing balances on deposit to price up. High minimum balances can be required in order to limit the existing deposits that convert to the new product. One example would be to offer a new CD with a “bump rate” conditional on depositing larger sums.

2. Product Promotions. Mass media, direct mail and in-branch promotions offering a 1.0% rate on a $25,000 minimum balance money market account to customers in the segments that currently have less than $10,000 on deposit should produce new deposit growth with negligible cannibalization, since these customers would need to bring balances from other institutions to meet the minimum requirement. Some institutions use media advertising for deposits but stipulate that the offer is for new money only. These types of offers can be effective, but tend to alienate high-balance customers who will complain about the new-money-only policy.

3. Product Availability. Some financial institutions limit new, high-rate deposit offers to branches or markets with a small depositor base and

no significant balances to price up. Likewise, bank holding companies use their smaller banks as funds providers as a way to grow deposits without pricing up large deposit balances. Others will only deploy a higher-rate growth strategy at branches in new markets with low deposits.

Deposit Growth Strategies in a Rising Rate Environment

Raddon’s study, which included online research encompassing 2,400 participants, is intended to help banking executives identify the needs of rate-sensitive consumers, and create a product and pricing strategy to achieve their deposit growth objectives. It also identifies key segments to target, while exploring both out-of-market and internet-driven deposit dollars.

Their comprehensive 32-page report, “Deposit Growth Strategies in a Rising Rate Environment,” is available for purchase at the company’s website.