Acquiring new checking customers is the life-blood of retail banking, but today it’s harder than ever. In 2010-2011, nearly 15% of US households opened new checking accounts. In 2015, Novantas estimates that only 8% of U.S. households will open new checking accounts.

There are many factors behind the drop in checking account shoppers. For starters, consumers’ trust in financial institutions has returned to pre-banking crisis levels; they aren’t as angry and concerned as they once were, and thus less agitated about switching providers. Technology has also helped banks and credit unions improve their levels of service, while the increased adoption of technology has helped make banking relationships “stickier.” Competition for the precious handful of new checking consumers out there is made even more challenging because marketing budgets are tighter and branch density matters less to consumers than ever before.

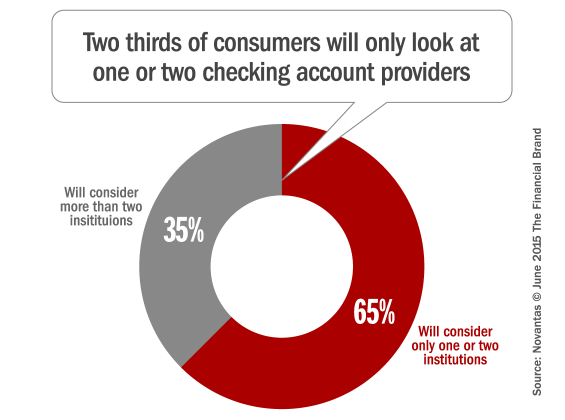

So how do banks and credit unions make sure they’re in the running when someone decides it’s time to open a new checking account? Research by Novantas has found that when consumers need a new checking account, 60% to 65% will only consider one or two institutions, while the remaining 35% to 40% will consider a broader range of institutions. Marketers must leverage different tactics to get on the short list of those who don’t shop around, while also ensuring they win a fair share of consumers who do shop around.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Fractional Marketing for Financial Brands

Services that scale with you.

Consumers who only consider one or two institutions must be persuaded before they even realize they want a new checking account. Experts refer to this as “upper funnel” marketing (based on the hugely popular “marketing funnel” model). What matters most? On-going brand advertising, branch and ATM locations (yes, still important for brand visibility and perceived convenience), reputation, and consumers’ personal experiences.

Consumers that actively research their options are “influence-able” when they’re within a 90-day window of opening a new account. Many of these consumers will draw on multiple resources in the course of their investigations. They will visit institutions’ websites, use online resources such as FindABetterBank.com, walk into branches, call contact centers, and seek advice from their family and friends. 70% of these consumers will shop online, so digital marketing strategies will play a major your plan of attack.