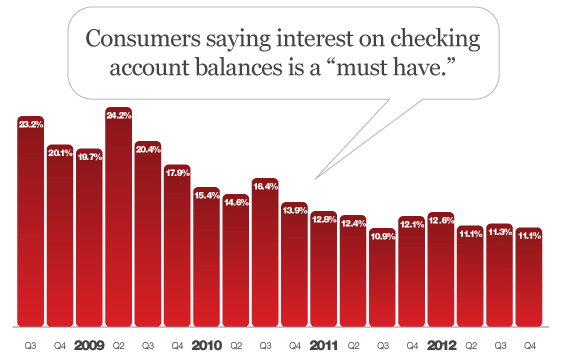

These days, with interest rates on checking accounts so low, it’s surprising anyone considers earning interest on balances a “must have” requirement when shopping for a new checking account. But in 2012 Q4, 11% of visitors to FindABetterBank.com indicated they must have interest checking accounts. This is down markedly from 2008 to 2009, when banks and credit unions were offering significantly higher rates with their checking accounts (see Figure 1).

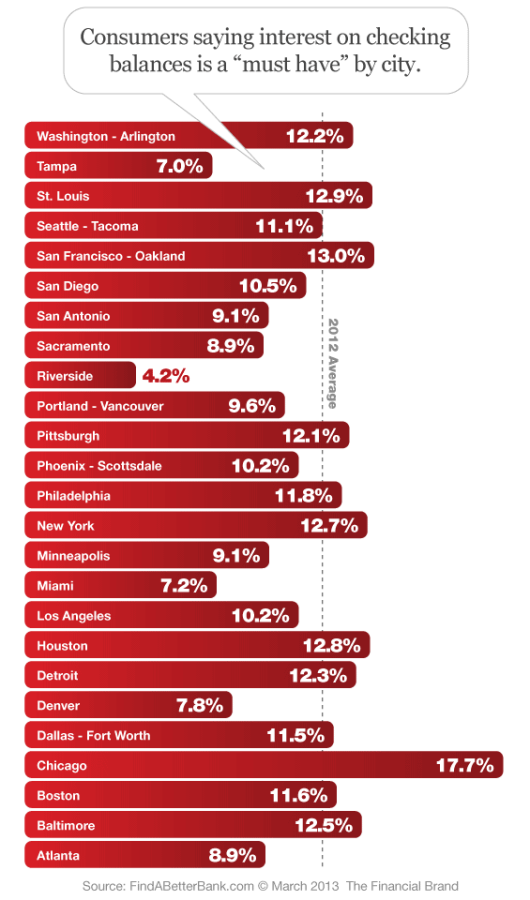

Demand for interest-bearing checking accounts varies significantly across the US (see Figure 2). Almost 18% of bank shoppers in the Chicago market “must have” interest on balances, for example, compared to only 4% of people living in the Riverside CA market and roughly 7% of bank shoppers in Florida’s 2 big markets (Miami and Tampa).

Why are Chicago bank shoppers so demanding? It’s an extremely competitive market. Have local ads and promotions trained Chicagoans to expect more? To what extent do readers think demographics (i.e., age and income) contribute to consumers’ desire for interest-bearing checking accounts?

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.