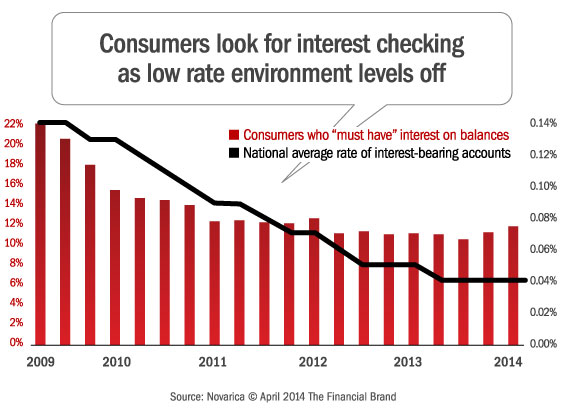

In our current low-rate environment, less than 12% of those shopping on FindABetterBank for new checking accounts say they “must have” interest on their checking account balances. However, in a rising rate environment, more bank shoppers will demand interest-bearing checking accounts and many will shop online for the highest rates. Winning institutions must be adept at competing for rate-sensitive shoppers while protecting their lower cost core deposit portfolios.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Banks and credit unions have been looking for signs of rising rates, hoping history repeats itself and deposit rates lag loan rate increases. The exact timing of the next upward rate cycle is unclear. In the past, institutions could wait until Fed Fund rates rise before reacting, but market conditions have changed since the last rising rate cycle (2004 – 2006) and many factors will make it more difficult to realize net interest margin improvements.

More people shop online. Direct banks were around during the last rising rate environment and they didn’t capture large shares of the market. But today, the Internet is more intertwined in consumers’ lives: Most consumers now shop online; more people will see high-rate deposit offers from direct banks and other institutions trying to aggressively expand their deposit books; heavy advertising of rates and market excitement could encourage more consumers to move their deposits.

Fewer people visit branches. Lower foot-traffic in branches will make attrition more difficult to detect and limit the effectiveness of “desk drawer” offers in branches. Winning institutions are preparing for rising rates now by building analytic capabilities to identify potential attrition and advanced segment- and customer-level deposit pricing strategies. Laggards that wait for rates to rise won’t have enough time to react.

Regulations place higher value on core deposits. The liquidity crisis and resulting new regulations has placed higher value on core deposits. As a result, many institutions now place more value on retail deposits than during the previous rising rate environment. This will increase the level of competition compared to the last go around.

As a result, the market will move quickly when short-term rates begin to rise. Institutions must invest now in analytic capabilities and deposit pricing technologies to stem attrition, capture and retain lower-cost retail deposits and compete for a new wave of rate-sensitive shoppers.