To understand the trade-offs shoppers make when choosing a new checking account, we analyzed to what extent accounts selected on FindABetterBank met shoppers’ feature requirements, and estimated the annual fees for those accounts. We found that many shoppers will trade-off feature requirements for accounts with lower fees. (FindABetterBank is a research tool designed to help consumers find new checking providers by providing apples-to-apples comparisons of accounts, based on people’s banking behaviors and desired features.)

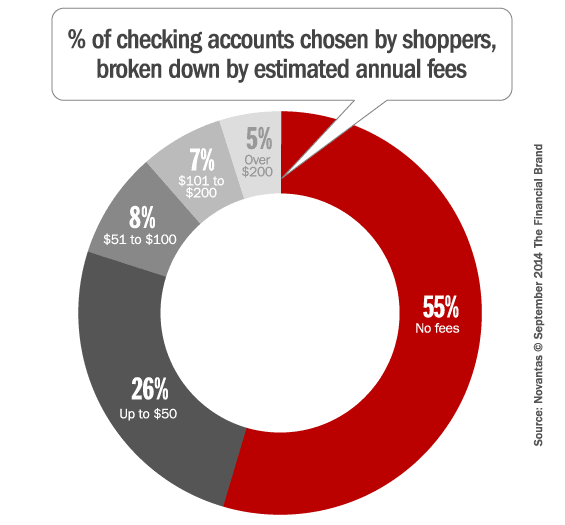

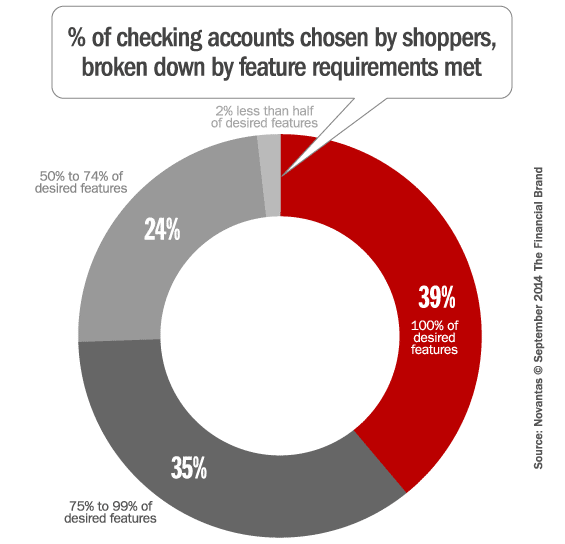

Overall, shoppers selected a checking account with a $0 estimated annual fee 55% of the time. Shoppers only selected an account that met 100% of their feature requirements 39% of the time. 62% of shoppers selecting an account with $0 estimated annual fees chose an account that did not meet 100% of their feature requirements.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Fractional Marketing for Financial Brands

Services that scale with you.

Demographic Profiles

Gen Y shoppers are more likely to select an account with no fees. Young adults tend to identify more feature requirements than older shoppers, but only 35% select an account that meets 100% of their feature requirements. 58% select an account with $0 estimated annual fees.

Women are less likely to select an account with $0 estimated annual fees. Even though women are more likely than men to clip coupons to save money, only 50% of women selected a checking account with $0 estimated annual fees compared to 59% of men.

Higher income shoppers are more likely to trade-off fees and features. One would think higher income shoppers would be more likely to select an account that meets 100% of their requirements over accounts that won’t cost them anything. But this is not the case. 62% of households earning over $100,000 a year selected an account with $0 estimated annual fees while just 33% selected an account that met 100% of their requirements.