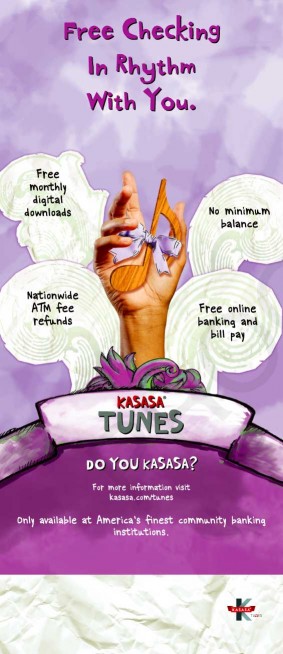

The Financial Brand sat down with Lori Peterson from BancVue to discuss the company’s Kasasa Tunes® product that the company offers exclusively to community banks and credit unions across the US. Kasasa Tunes is BancVue’s free “Rewards-style” checking account that gives consumers free iTunes downloads every month, including music, books, movies and iPhone or iPod applications, plus nationwide ATM fee refunds.

Kasasa account holders earn their downloads and refunds by meeting monthly qualifications, usually a combination of activities including using a debit card, accessing online banking, receiving monthly e-statements and making electronic transactions like direct deposit. There is no minimum balance requirement. The account is still free even if monthly qualifications aren’t met. The account holder simply has to wait until the following month to earn their benefits.

Kasasa account holders earn their downloads and refunds by meeting monthly qualifications, usually a combination of activities including using a debit card, accessing online banking, receiving monthly e-statements and making electronic transactions like direct deposit. There is no minimum balance requirement. The account is still free even if monthly qualifications aren’t met. The account holder simply has to wait until the following month to earn their benefits.

The Financial Brand (TFB): What is your role with BancVue?

Lori Peterson (LP): I am Senior Vice President, Kasasa.

TFB: How many financial institutions have deployed Kasasa Tunes?

LP: We’ve just started rolling out Kasasa Tunes and there are currently 16 financial institutions offering Kasasa Tunes in markets across the US.

TFB: What is the consumer profile of the ideal Kasasa Tunes account holder?

LP: Definitely those with a passion for music. With Kasasa Tunes our partner institutions have a great opportunity to attract Gen-Y and Millennials. It helps establish a consumer base for future growth.

TFB: What kind of results are financial institutions seeing from their Kasasa Tunes accounts?

LP: Since launching Kasasa, our partner institutions have seen a 40% lift in account acquisition without increasing their media and marketing budgets.

Even though Kasasa Tunes is still a relatively new product, the account represents 3.5% to 5% of new DDA accounts at an institution — post launch. Kasasa Tunes can represent up to 20% of total new Kasasa accounts opened at an institution.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

TFB: What percentage of Kasasa Tunes’ deposits represents new money?

LP: 42% of Kasasa Tunes deposits are new money, and 54% of Kasasa Tunes consumers are new relationships to the financial institution.

TFB: What about attrition? Do the relationships last?

LP: The Kasasa Tunes account have an attrition rate of 7.47% per year, vs. a free checking attrition rate of 11.36% per year, meaning on average, Tunes accounts stick around 52% longer than free checking accounts.

TFB: How is the profitability of these accounts calculated?

TFB: How is the profitability of these accounts calculated?

LP: The Kasasa Tunes account was designed to be a win-win for both the consumer and the institution. The consumer gets digital media downloads, something they love, and the institution makes or saves money by encouraging specific behaviors — i.e., the monthly qualifications.

TFB: What are the key metrics BancVue uses with clients to measure success?

LP: The business goals of our partner institutions vary greatly. While some are

interested in growing deposits, others are interested in growing new relationships, increasing share of wallet or even deepening relationships with current DDA customers. When an institution partners with BancVue, they are paired with a dedicated consultant who helps configure their account qualifications to meet their specific business goals. We provide the institution with ongoing monthly reports, based on data gathered from 1.7 million accounts per month.

TFB: How much does a Kasasa client have to allocate to media/marketing in order to achieve these results?

LP: Kasasa reallocates the institution’s existing marketing budget, generating superior results at no extra cost. Additionally, because nobody knows the market better than our partner institutions, we collaborate with them to assess the local landscape, values, attitudes and demographics. We then develop a media plan that works best for their market and budget. Maximizing reach and frequency through the most effective channels in the market, we help them develop Kasasa events, concerts, and festivals to captivate the local community.

TFB: What makes Kasasa Tunes a better option than a classic Rewards-style checking account? Why offer music vs. paying a higher interest rate?

LP: It’s not really a question of which account is better, rather it’s about which account is right for the consumer. The Kasasa Tunes product was designed with Gen-Y and Millennials in mind — consumers who are experience- and entertainment oriented. Whereas Kasasa Cash is a perfect for those who want a free checking account that gives them extra cash in the form of interest each month.

Here is an example of how the Kasasa Tunes product may be a better choice for some consumers who may have a lower balance and who are interested in digital media downloads. If a consumer has an average account balance of $800 and they put their money in a Kasasa Cash account making 4% annually, they’ll earn $32 in one year. If that consumer were to invest that $800 in a Kasasa Tunes account receiving $5/month in iTunes downloads, that is the equivalent of earning $60/year — that’s like earning 7.5% interest.

Here is an example of how the Kasasa Tunes product may be a better choice for some consumers who may have a lower balance and who are interested in digital media downloads. If a consumer has an average account balance of $800 and they put their money in a Kasasa Cash account making 4% annually, they’ll earn $32 in one year. If that consumer were to invest that $800 in a Kasasa Tunes account receiving $5/month in iTunes downloads, that is the equivalent of earning $60/year — that’s like earning 7.5% interest.

TFB: Kasasa Tunes has been around for a little while. What have you learned?

LP: That music is king and people have an emotional connection with music. We also learned that the biggest challenge is getting the word out about the account — that it actually gives you something back, in this case digital media downloads via iTunes