BofA is taking a mountain of flack for tacking a $5 monthly fee on customers who use their debit cards to make purchases. The backlash to the bank’s move from both customers and media alike (detailed in the article below) has been swift and ferocious.

The news broke September 29, just two days before the Durbin Amendment’s controls on debit transaction fees was to take effect. The plan was disclosed in an internal memo to senior BofA managers which was obtained by the Wall Street Journal.

Justifying its decision, BofA says that “the economics of offering a debit card have changed.” No joke. Those “economics” just became painfully clear to the bank’s 50+ million customers.

BofA says it will be waiving the $5 monthly fee only for those who have a mortgage with the bank, or $20,000 on deposit.

BofA isn’t the only bank slapping new fees on debit card activity. Consumers who swipe their debit card anywhere besides an ATM are staring at monthly charges ranging from $3 at Wells Fargo, $3 at Chase, $4 at Regions, all the way up to $5 at SunTrust. At $5 per month, customers would have to shell out $60 a year for a convenience that had been free for nearly two decades.

Consumers are left wondering what’s next? Are online banking fees on the way? Or maybe even a “Bill Pay Privilege Fee?”

Citi is the only big U.S. bank to openly declare it has no intentions to introduce a debit usage fee.

“We have talked to customers and they have made it abundantly clear that ‘if you charge me to use my debit card, I would find that very irritating’,” said Stephen Troutner, head of Citi’s banking products.

Citi is, however, jacking fees on its checking accounts. Its Easy Checking Package that had always been free, is being replaced in December with a new package that has a $15 monthly fee or requires a $6,000 minimum deposit.

Key Questions: Why did BofA think consumers would swallow a “Debit Card Usage Fee” more readily than an overall checking account fee?

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The media blisters BofA

In the first 24 hours after BofA’s new fee leaked to the press, mass media outlets pumped out no less than 2,000 articles about the $5 fee, with another 500 in the days that followed. The Philadelphia Inquirer was unabashedly telling its readers to switch banks. Fox News anchor Gerri Willis cut up her BofA debit card live on TV in protest. The Chicago Tribune say this is a reminder to shop around. The Washington Post is offering switching tips. As is MSN Money. The Kansas City Star is complaining that banks are adding new fees even after they got taxpayer bailouts. The LA Times says BofA isn’t just having its cake and eating it too, it’s serving itself another piece. And of course the Huffington Post is happy to chime in.

Outraged customers rip into BofA… Will they switch?

Check the web for consumer reaction to BofA’s $5 fee and you’ll find an avalanche of scornful, angry and derisive comments. Just about everyone with a keyboard is taking shots at America’s biggest bank, and every online article includes dozens — if not hundreds — of nasty comments.

Social media sites, of course, are alight with furious customers raging against the bank. The day after news of the $5 fee broke, there were 4,470 mentions of BofA on Twitter, up from the average of 1,750 per week. And that was on a Saturday. Sunday saw another 3,490 tweets about BofA. Most were negative.

If BofA makes good on its $5 debit fee threat, will customers change behaviors or change banks? In a Wall Street Journal poll, 93.1% said they would not pay a monthly fee to use a debit card. 4.2% said they might, and 2.7% said yes. Over 2,250 people responded to the survey question.

When Time posted a poll asking BofA customers how they planned to respond to the fee, 75% of nearly 1,000 respondents said they’d switch banks. 11% said they’d use their credit cards to dodge the fee, 7% said they’d switch to cash, and 4% said they’d go back to paper checks. Only 3% said they planned on paying the fee.

“I’ll go back to checks and cash before I pay to use the convenience of plastic,” said Dennis Couturier, a tech worker in Virginia.

Going back to paper checks is the option that would hurt banks the most, which is much more expensive than processing debit transactions.

“If consumers banded together and switched to paper, I think it would be a very telling impact,” Michael Beird, director of banking services at J.D. Power told Time.

“It won’t drive me to cash or credit, but it did prompt me to change my accounts to a credit union,” said Mark Olwick, a website manager in Seattle.

Jose Bucheli, a graduate student from Albuquerque, agrees. “I would not change my behavior, I would change my bank,” he said. “When this fee comes into effect, I am pulling my money from BofA and moving somewhere else.”

As Time reporter Martha C. White observed, “If consumers want to bank with a smaller institution that didn’t dive headfirst into risky, unsustainable business practices and now doesn’t have to nickel-and-dime its customers to make up for lost profits, that’s their call.”

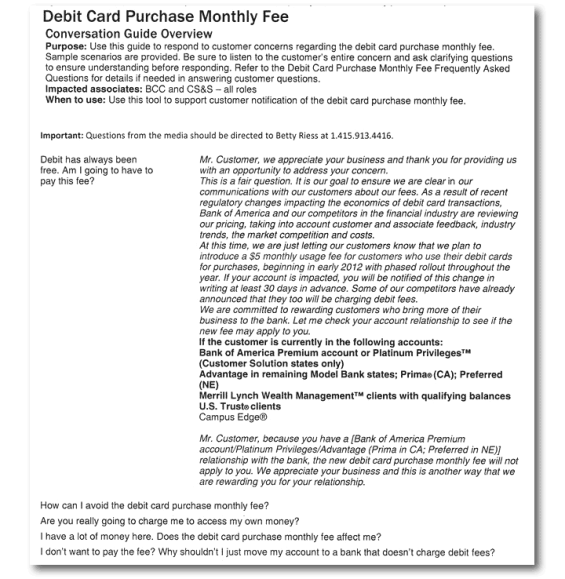

SCRIPTED RESPONSES

This internal training document circulating the internet explains

how BofA staff should answer questions about the $5 fee.

How much is really at stake?

BofA’s debit fee could come at a high cost to the bank. A study by America’s Research Group found 37% of customers polled would change banks if they felt the fees were becoming unreasonable. And according to research from J.D. Power and Associates, roughly two-thirds of people who threaten to switch banks follow through. Worst case scenario, BofA could see as many as 20 million customers close their checking accounts.

BofA’s fee income was already dropping, even before the Durbin Amendment took effect. The bank’s deposit portfolio generated only $1 billion in Q2 2011, down 34% from $1.5 billion for the same period a year prior. BofA’s card services division reported fee income of $1.9 billion, down 23% from $2.5 billion in Q2 2010.

So how desperately does BofA need to replace their lost debit fee transaction income? The Los Angeles Times tried running the math. BofA has 57 million consumer and small-business accounts. If a majority of them use debit cards, BofA’s looking at a windfall of about $3 billion a year — $1 billion more than they are currently making from debit transaction fees.

Here’s another way it could be calculated. Thanks to the Durbin Amendment, BofA’s debit card revenue drops from 44¢ to 24¢. Multiply that 20¢ difference by a customer’s average of 25 debit transactions every month and it comes to $5.

Anne Pace, a spokesperson with BofA, told the LA Times that the convenience of debit cards “comes at a cost,” and that BofA is “trying to be clear and transparent with customers” about its fees, but she declined to say how much it really costs the bank to process a debit card transaction.

“Until BofA and other banks come clean on how much it really costs them to process plastic and provide related services, we have to take others’ word for it,” LA Times reporter David Lazarus wrote. “The Feds say 21¢ is a realistic fee for a debit card sale.”

This will move more money than ‘Move Your Money’

Banks’ current fee-for-all frenzy will undoubtedly get more consumers to switch checking accounts than the Move Your Money project even dreamed about. The difference is that the Move Your Money effort appealed to people’s sense of justice and dignity — an intangible, purely psychological angle — while a heap of new fees hits consumers right where it hurts most: their wallets.

Credit unions, who have been unable or unwilling (or both) to get their collective act together with any kind of coordinated campaign attacking banks, are sure to benefit most from the recent spate of bank fees. In fact, banks’ new fees are probably going to do more to help credit unions than credit unions could ever do for themselves.

Online banks like ING Direct and Ally Bank will probably also be big benefactors from BofA’s decision. Ally is one of the most aggressive online advertisers in the financial industry, and its ads are sitting atop- or next to the thousands of anti-BofA articles consumers are reading on the internet every day. Indeed, even Ally’s latest “Don’t Accept It” TV commercial about bank fees seems to have taken on new relevance. Ally’s ubiquitous anti-bank message is sure to strike a chord with prickly BofA customers.

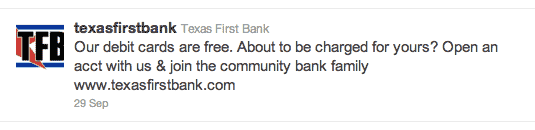

Financial Marketing Solutions noticed Texas First Bank had pounced on the opportunity created by BofA’s $5 fee with a tweet: “Our debit cards are free. About to be charged for yours? Open an acct with us & join the community bank family www.texasfirstbank.com”

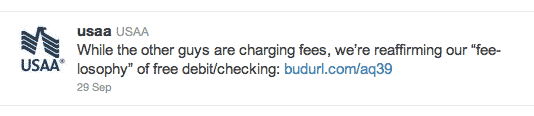

At the same time, USAA was sending out a similar tweet: “While the other guys are charging fees, we’re reaffirming our ‘fee-losophy’ of free debit/checking,” along with a link to a post on USAA’s blog about how they have “no plans to add fees to its debit card.”

The morning after BofA said it would start charging customers the $5 fee, Coastal Federal Credit Union announced it would pay customers to use its debit cards. Coastal’s members with Go Green Checking can earn 2.51% APY when they post 30 or more debit transactions to their account each month.

From bad to worse

It’s been a tough year for BofA, to say the least. Earlier this year, BofA introduced $7 fees on some accounts just for talking to a teller or requesting a paper statement, a move that was received with similar derision. The bank is also reeling from foreclosure problems, faulty mortgage paperwork, massive lawsuits, a battered stock price and even website outages.

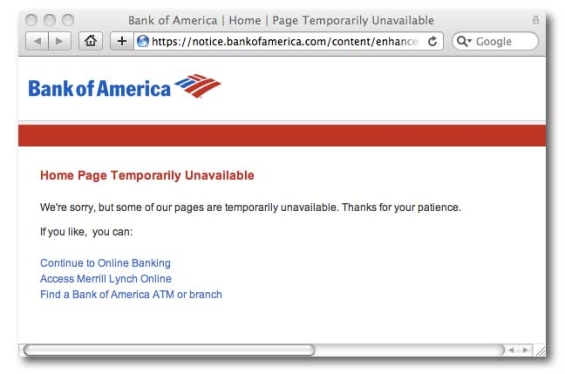

Only a day after news of BofA’s fee broke, their website went down. Hard. For everyone. The message: “Home Page Temporarily Unavailable — We’re sorry, but some of our pages are temporarily unavailable. Thanks for your patience.”

That was Friday. Then Saturday. And Sunday. By early Monday morning, the bank said its website was back to normal. But shortly thereafter, it was down again. The problem continued into its sixth straight day.

BANKOFAMERICA.COM WEBSITE CRASH

BANKOFAMERICA.COM WEBSITE CRASH

BofA swears the crash was unrelated to the uproar over the $5 monthly debit card fee. There are also no hacker groups laying claim to a denial-of-service attack.

In the meantime, a ConsumerAffairs.com analysis of 980,000 comments on Facebook, Twitter and other social media and blogs found net sentiment about BofA sinking from 45% positive to 20% negative over the last year.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

A dicey political blame game

BofA’s timing of its debit fee coincided perfectly with the start of Durbin’s interchange cap, which went into effect October 1. Was the timing deliberate? Maybe. Perhaps BofA hoped that the press would neatly link the $5 fee with “unfair government regulations.” If that was the strategy, it backfired. Badly.

There’s a nasty war between Congress, banks and retailers, resulting in a lot of finger pointing. Banks are pissed at retailers, who they blame for the Durbin Amendment. Retailers are upset with banks over their debit card usage fees, and complain that banks like BofA will force consumers to spend less. The ABA accuses Congress of meddling with burdensome and anti-capitalistic regulations. Congress says banks wouldn’t be under their thumb if they had behaved responsibly in the first place. It’s a vicious circle.

Meanwhile, consumers feel they are the ones getting screwed. In the wake of an economic meltdown — one that most people blame on reckless and greedy financial institutions — no one is in the mood to hear banks whine about what they think is fair and what isn’t. Do consumers care who started it? No, not really. All that matters to them is that they are paying more — a lot more — for basic checking.

A few weeks ago, the ABA distributed a press release with a headline stating that “71% of bank customers pay nothing for banking services.” It was cleverly crafted PR spin. More accurately, what the ABA study actually proved is that 71% of consumers would like to think they don’t pay anything, but people really have no idea how much they cough up for basic banking services. But now, if 50 million people — 20% of the U.S. population — are going to get dinged $5 by BofA, the ABA’s number just shifted down. Way down.

A recent study by Bankrate.com found that only 45% of checking accounts are now free, with no strings attached. This is down from 65% in 2010, and 76% in 2009. The trend has become irritatingly clear to consumers. As long as banks continue rolling out new fees, the hemorrhaging negativity and bad press will compound. Any financial institution toying with additional fees had better brush up on their PR and crisis communications skills, because you’ll have plenty of chances to practice the backstroke. Both customers and the media are primed for a fight.