What will checking accounts look like in the future? And how will banks and credit unions retain the vital balances these accounts represent, while snatching market share away from others?

These questions matter more and more as Millennials and Generation Z become a greater portion of the banking public. Which financial services these younger consumers will be using in the future remains to be seen, especially as digital banking, and the infiltration of challenger banks continues to develop. Rumors of a fresh acquisition in the offing by JP Morgan Chase, reported by Business Insider, circle around Aspiration, which includes a socially conscious checking account, and Chime, which stresses convenience and access.

“The simple fact is that many of the traditional functions of a checking account are becoming obsolete.”

— Olivia Lui, Novantas

There’s a three-sided struggle shaping up in transaction accounts: strategy, design, and marketing.

In an analysis headlined “Your Checking Account May Need An Overhaul,” Olivia Lui, Principal at Novantas, summarizes the challenges financial marketers face regarding product design:

“The simple fact is that many of the traditional functions of a checking account are becoming obsolete. Check writing has significantly decreased in the past decade. The product’s close ties with the branch for deposits and withdrawals have been replaced by remote deposit capture and mobile person-to-person payments capabilities. The convenience of transferring money between linked checking and savings accounts is moot, with the emergence of alternatives like Zelle that make it easy to move funds between banks.”

There’s no denying that those changes are occurring, but many financial institutions are not about to abandon the checking account. While remote capture has changed the place of the branch for many, there are institutions that still emphasize its role vis-à-vis checking account promotion. Fifth-Third Bank, for example, offered consumers $250 specifically to visit a branch to build more personal connections, according to a report on checking account design and promotion by analysts Alexa Dalessandro and Anjali Ambani of Comperemedia, a Mintel Company. The analysts point to Capital One’s Capital One Cafés as another way of promoting that connection, while also providing a place for showing consumers the digital ropes.

Checking deposits continue to represent a substantial portion of the funding base that financial institutions rely on for lending, but the battle for those deposits may get tougher. Conditions have been changing. One symptom, as recounted in a Keefe, Bruyette & Woods report, is that the nine-year streak of double-digit increases in noninterest-bearing deposits held by small and mid-cap banks ended in 2018, falling to a median of only 5% in that size class.

As rates began rising, consumers began leaning towards CDs and other higher-interest deposit products. With rates easing again, it’s anyone’s guess how consumers will react. Millennials pretty much only know a low-rate environment.

Read More:

- T-Mobile Money Rocks Banking Model Using Fintech Engine

- Direct Banks May Be Good, But They’re Not Unbeatable

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Reaching the Banking Consumer of Next Week

Confronting the future of the checking account is not an easy matter. Product strategists and designers may have their eye on the ultimate fintech-style account of the future, but they also have to consider what will appeal to multiple consumer segments next week.

“Today switching may not be an obvious, trackable act, although no longer being the account where a consumer’s paycheck is direct deposited would be a strong clue.”

Even with all the talk about digital banking, PwC observes in a blog that “an odd thing has happened as a growing number of digital banks and price-led strategies have tried to attract more deposits — consumers now say product and location matter more” — bolstering the kinds of moves that Fifth-Third and others have made.

The firm notes that “while pricing continues to play a role, consumers see non-rate factors such as product type, convenience, and brand as more important.” PwC argues that digitization goes beyond how banking services are delivered. “The ability to rate shop, compare product features, and open or switch accounts are variables that increasingly matter not only for deposit growth but also deposit quality.”

That matter of deposit quality revolves around such factors as which checking account an institution holds. Ron Shevlin, Managing Director of Fintech Research for Cornerstone Advisors, has suggested that institutions can kid themselves that they haven’t lost accounts because they haven’t been closed. Yet consumers may have opened other accounts with other providers, that may be their primary account now.

The significance of this statement increases when it’s considered that Millennials are much more likely to switch institutions than other generations. And today “switching” may not be an obvious, trackable act, although no longer being the account where a consumer’s paycheck is direct deposited would be a strong clue.

Four Categories of Modern Checking

An analysis by Comperemedia, a Mintel Company, finds that in today’s banking market, there isn’t “one account to rule them all.” The firm breaks modern checking accounts into four broad categories:

- Basic checking features — emphasis on mobile check capture and other convenience features.

- Physical presence — “traditional service” tied to cash and checks, involving branches and ATMs. PwC’s research found that two out of five switchers put more importance on branch and ATM convenience than on interest rates.

- Digital features — basics like online and mobile banking.

- Advanced digital features — the full nine yards of tech, including Zelle, chatbots, locking and unlocking of debit card, financial planning tools, and more.

Raddon suggests that banks and credit unions need to be proactive, and ready to make a counteroffer when consumers show signs of getting ready to leave or letting their account dwindle.

“Monitor households for declines in deposit balances of $25,000 or higher and reach out to these customers with special offers,” advises Raddon in a report authored by Andrew Vahrenkamp and Karen Kislin. “Use your transaction data to determine the destination of the funds.”

Contacting those consumers with an enticing offer, either in deposits or wealth management, depending on where the funds are going, can help win back dollars, Raddon suggests. Destinations to watch for include Fidelity, Schwab and TD Ameritrade.

Read More:

- Have Traditional Checking Accounts Become Obsolete?

- Do Your Checking Accounts Undermine Your Marketing Strategy?

- True Digital Account Opening Totally Eliminates Need for Branches

Redesigning Checking Accounts

So, when you go back to the drawing board, do you work off the original blueprint? Or do you shred it and start fresh?

“For some, the redesign can be built on the foundation of existing products through simplification and the creative bundling of services and products,” writes Novantas’ Lui. “Much of it will depend on the business objectives.”

While all the digital features you can imagine have undeniable appeal to many, no one likes fees. And for some demographic groups, a free account or an account that has few or no fees resonates. Two out of three Americans have paid some type of bank fee over the last five years, according to Ipsos. Just over half of the consumers surveyed have had fees waived on request. So there’s room to make more consumers happier.

While all consumers have an affinity for free or waivers, Millennials seem to feel most strongly about banking costs. Gallup reports that fees and service charges are the top reason Millennials leave their primary bank.

“It might be more beneficial to overlook a few service charges when considering the long-term relationship with these customers and growing Millennial wealth,” Gallup states.

Comperemedia notes that regional banks seem more likely to communicate ways to meet conditions allowing consumers to qualify for established fee waivers.

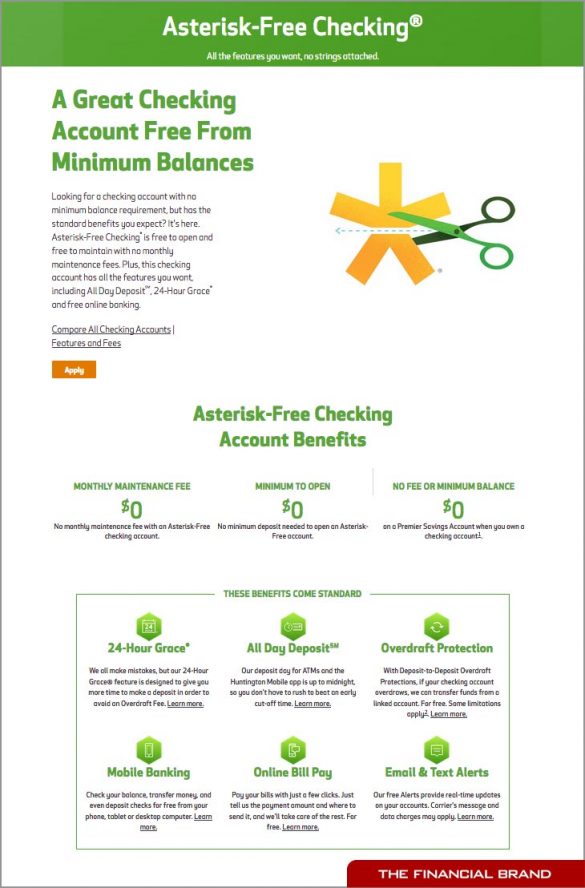

Other institutions promote fee-free ATM usage as a solution to consumer concerns over account costs. Personalization in communication plays a part for Fifth Third, the Comperemedia analysts note, with the bank emailing a map to a consumer who was charged an ATM fee, to show them where fee-free ATMs could be found. They also cite Huntington Bank, which promotes its Asterisk Free Checking as having “nothing to hide and a lot to give” and “No gotcha fees. No strings. No kidding.”

Another feature to consider is cell-phone insurance. For Millennials and others who live on their devices, this could have appeal as part of a package. One institution offering this is Renasant Bank, which offers “The checking account that checks all the boxes,” Renasant Rewards Extra. This account includes cell-phone coverage up to $400 per claim and $800 in a year, roadside assistance, ID protection, and more.

For Millennials and other consumers with some money to invest, institutions that offer brokerage services as well as banking could consider taking a page from some of the brokerage banks. Linking checking and brokerage accounts, or providing some type of sweep service, could help hold onto higher balance accounts. Bankrate.com makes the point that deposit insurance for the banking part of that relationship remains an attractive feature to many consumers.

Comperemedia points out that there are softer hooks beyond fees and rates that will attract some consumers. Selling accounts that offer solutions to common problems is one angle, as are programs that tie prestige and special service to the account. One example is the Portfolio by Wells Fargo Premier account, which includes a dedicated banker and discounts on loans and more. Cost of admission is a $250,000 opening balance.

Read More:

- Money Freaks Gen Z Out, Creating Opportunity for Financial Marketers

- Prevent Choice Overload in Digital Account Opening Or Lose Business

Convincing Consumers to Move Checking Relationship

Promotional rates, monetary or other perks, or expansion of existing relationships are among the gambits financial institutions are using to build banking relationships with consumers, according to PwC.

Speaking of prestige level service, the CitiGold relationship package, which requires a combined average monthly balance of $200,000 among deposit accounts, is being promoted with a feature tying into the popularity of certain subscription-based services. By invitation, CitiGold consumers will be reimbursed for up to $200 a year for subscriptions to Amazon Prime, Audible, Spotify, Hulu, Global Entry, and Costco. The high visibility of those brands has an appeal going beyond the usual cash incentive offers.

For most, however, cash incentives continue to be the marketing weapon of choice, especially among larger banks. Looking at the Comperemedia report, $100 incentives are the barest ante to be at the table. Institutions go much higher under certain conditions, even at times passing the $500 mark. The CitiGold idea might make the cost less — and hold onto people who want that annual reimbursement.