People like their bank a little more than they did last year, according to TD Bank’s second annual “Checking Experience Index,” a nationwide survey of more than 1,500 consumers with checking accounts. 85% of consumers say their bank’s accessibility and level of convenience as excellent or very good when it comes to, compared to 83% in 2013. And 86% of consumers rate their day-to-day experience with their checking account as excellent or very good vs. 83% in 2013.

Consumers Cheat on Banks They Say They Like

Although consumers are generally happy with their core banking provider, 22% of survey those with a bank account admit that they have used alternative banking products such as check cashing services (12%), money transfer agents (11%) and payday loans (4%) at some point in the last three months. When bank customers were asked why they used alternative banking products, 16% shrugged: “no reason.”

“One in five consumers with a bank account are using alternative banking products, which could add needless cost to their monthly budget,” points out Ryan Bailey, EVP/Head of Retail Deposit and Payment Products at TD Bank. Bailey suggests that banks aren’t capitalizing on opportunities to have conversations with these consumers about the less expensive financial options they offer.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

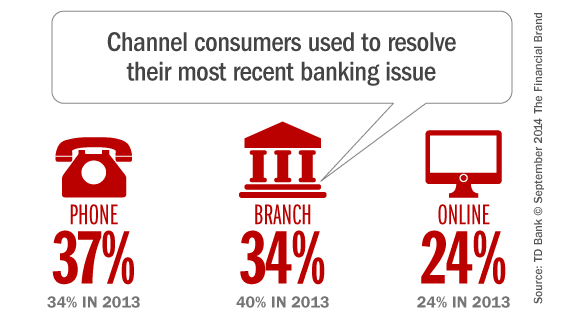

Consumers’ Channel Preferences: A Moving Target

When asked about the last time they had a question or concern regarding their checking account, the majority of respondents still rely on a telephone call or a visit to a bank location to have questions answered. But consumers preferences are evolving. Telephone outreach for issue resolution grew at a relative rate of nearly 9% over the year prior — 34% in 2013 vs. 37% in 2014.

The number of people saying they visit branches for service-related issues is down sharply. In-person resolution at a bank location declined by 15% (40% in 2013 vs. 34% in 2014).

51% of consumers cite online baking as their preferred channel to conduct checking account transactions.

Nearly two thirds (62%) of Americans say their bank is offering products and services that take advantage of new technologies like mobile apps and mobile deposit.

Triggers for Switching Banks Include Life Events and Fees

The TD Index confirmed that fees and life events are still the major triggers for changing banks. More than one third (38%) say they would close their primary checking account or consider leaving their bank over fees. However, only 8% of respondents had actually closed or switched their primary checking account in the past two years, down from 12% in the 2013. Of the 8% who reported closing or switching checking accounts in the past two years, the main reason for doing so was a life event such as moving (29%), followed closely by bank fees (27%).

Debit Cards Viewed as the Cornerstone of Checking Accounts

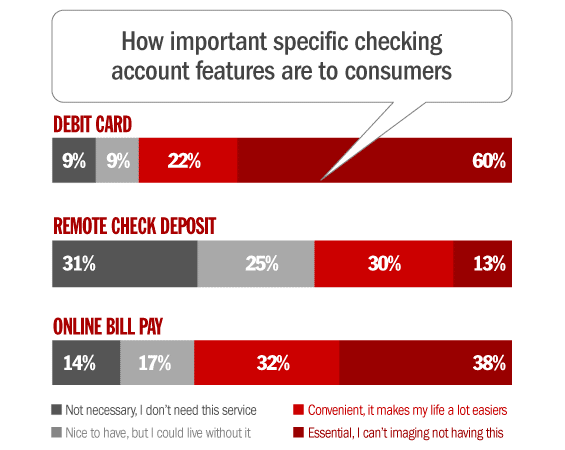

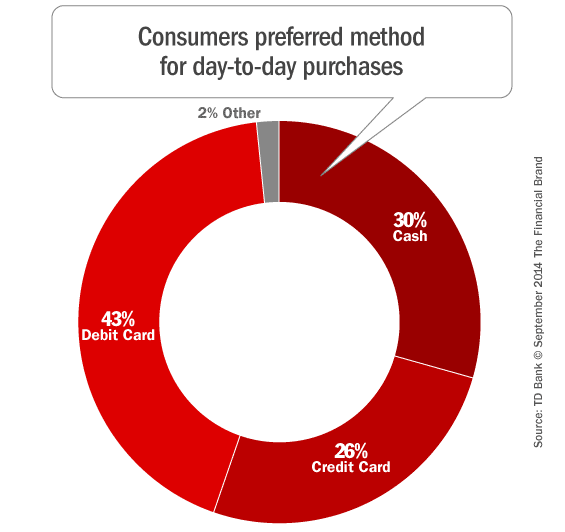

Debit cards and online banking play central roles in the banking behaviors of today’s consumers. Across all survey respondents, 60% of checking account owners said their debit card is an essential service. An even larger number of Millennials (74%) confess they can’t imagine not having a debit card. Two out of three said they would refuse to even consider a checking account that didn’t come with a debit card — an issue that may prove troublesome for banks pursuing a mobile-only model.

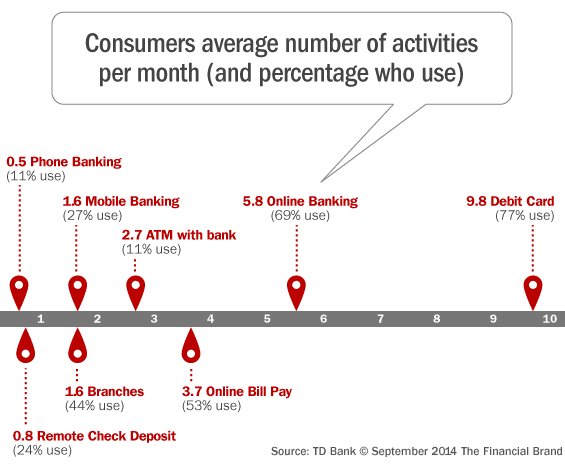

Of the 23 banking transactions that checking account holders report making each month, on average, 10 are debit card purchases and six are conducted through online banking.

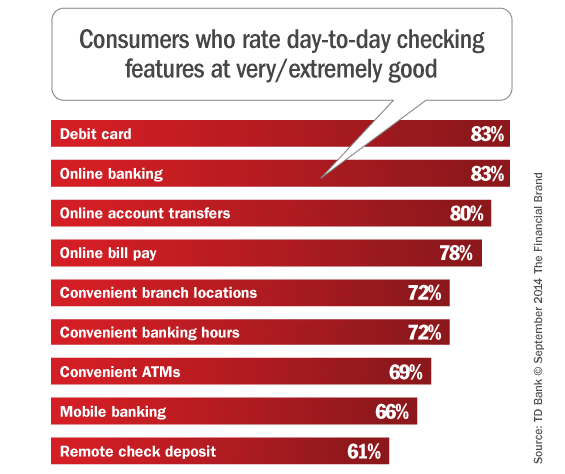

A large percentage of those surveyed reported that their experiences with debit cards and online banking are excellent or very good (92% and 91%, respectively).

Only 13% of Americans say they are using reloadable prepaid cards.