Financial marketers are often bedazzled by ecommerce, especially Amazon and its Prime service. Sure, there is much every business can learn from Amazon’s customer experience. But should banks and credit unions really follow in the footsteps of Jeff Bezos and fashion their strategy after Amazon’s blueprints?

Forrester’s Alyson Clarke cautions against this approach. As an analyst specializing in digital business strategy in banking, she says financial institutions will make missteps if they try to imitate the ecommerce giant’s approaches too literally.

As Clarke explains, Amazon is primarily a transactional platform geared around products — you buy a book, a gadget, or a month’s supply of Tide detergent. Amazon sells things — some services such as streaming video and music — but mostly tangible items. Banking, by contrast, is a service business centered around relationships. In Amazon’s world, straightforward transactional purchases recur frequently, and consumers are constantly in a position to reevaluate their options (e.g., provider, cost, quality and quantity). New banking relationships, however, happen very infrequently in a consumer’s life.

“Each banking relationship can be very complex and emotional,” says Clarke. It’s a person’s money, and the core of their financial life, that is being established when a checking account is being opened. People run their daily lives and also make their largest purchases out of checking.

Read More:

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

How Consumers Choose a Checking Provider Today

One in three Americans (30%) will speak to family or friends when researching where to open a checking account. And when they do decide where to open an account, two out of three will go to a branch to do so.

These statistics come from Forrester’s report How U.S. Consumers Research and Buy Checking Accounts, a continuation of research previously done in 2015. A striking development in the digital age is that the influence of friends and family on the checking decision increased over the earlier research. In that study, 22% of the sample said that they consulted friends and family before deciding where to open an account.

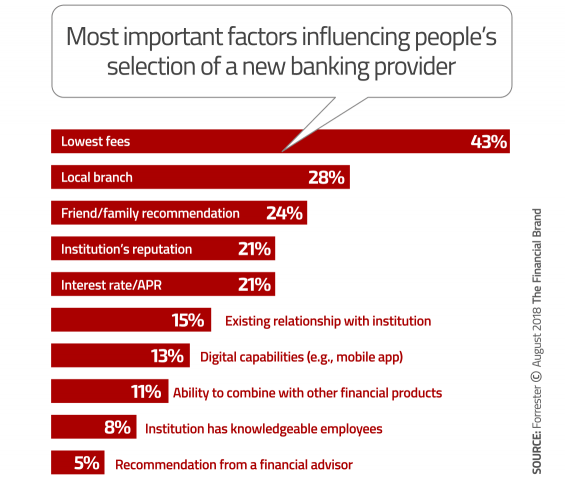

Not only do more consumers ask friends and family where to open a checking account, they give those recommendation quite a bit of weight. Personal recommendations ranked third as the most important reason for choosing a particular provider for this product, at 24%. This was far ahead of recommendations from professionals such as financial advisors (5%) and insurance agents or brokers (5%).

At 23%, the number of people who go to a branch simply to research an account is a stunning drop from the 42% who did so in 2015 (15% of consumers polled did no research). Yet the portion who opened accounts at a branch remained the same, at two out of three.

Sources used least often by consumers for researching offerings include social media and blogs, comparison shopping sites, online videos, and online ads — all at 7%. Also in the minority: direct mail (6%), provider emails (4%), and print ads (4%).

Marketing Myopia: Stop Ignoring The Switchers

A common blind spot that Clarke cites is U.S. institutions’ habit of treating every checking account opening as if every applicant is a newcomer to banking.

She says they fail to recognize that the customer journey of newbies is not the same as switchers. She counsels that switchers are likely unhappy with their current provider and want to quickly move the account — and all the financial tendrils connected to it.

“The branch offers switchers an easy and reassuring way to open the new account and get the assistance they need to make the switch,” the report states. In time, offering human intervention with an online opening experience, such as click-to-chat service, will bring the best of both channels together.

Speaking of channels, Clarke has one last word on Amazon. She doubts it will ever start a bank.

Why would it? Amazon has no need to reinvent the checking pipes. What it will look like is anyone’s guess right now, but she’s convinced the company will create a superior customer experience that consumers will love. A banking partner will handle moving the money around.

Read More:

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

On Mobile Devices or In Branches, Consumers Want Instant Gratification

Many assume that Millennials and Gen Z want to do everything on mobile devices. Not necessarily so when it comes to checking accounts. People want everything to go right when they open a new account, and for many, these assurances are found in a branch, according to Clarke.

“They want someone to help them through the process, the decisions,” Clarke explains. ‘This way they can make sure it’s done right.”

Clarke acknowledges that it can take 30 minutes to open a checking account at a branch, versus perhaps three minutes online.

“In the branch, it’s done. I get my card and I go my way.”

— Alyson Clarke, Forrester Research

The math might make the decision between mobile and branches a no-brainer, but things don’t always work so smoothly. Clarke says that many who attempt to open accounts digitally get “spit out” by the system for one reason or another. Identification issues are a common reason. Clarke herself, an Australian working in the U.S., says this frequently happens to her.

She says for many opening a new checking account “can be quicker in a branch” than fumbling through a digital process. In part that is because consumers open checking accounts because they need to use them, and they want to do so right now.

In many banks and credit unions, consumers can walk in, establish their identity, and walk out having opened an account and having received a working debit card. They can use ATMs and connect that card to Apple Pay or another digital wallet right then and there.

“In the branch, it’s done,” says Clarke. “I get my card and I go my way.” She praises those institutions that recognize this and provide easy ways to schedule appointments with branch staff to speed their in-person experience.

Clarke says online openings often result in waiting for the same utility that a branch experience delivers immediately. Clarke says that some institutions can produce such results digitally now, but many don’t. And in today’s world where instant gratification is table stakes for many impatient consumers, asking people to wait a few days may feel like a millennium.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

U.S. institutions lag much of the rest of the world in this regard, she adds. Even the name “checking account,” is anachronistic. In most other English-speaking countries “current account” is the preferred name.

Forrester’s study found that while 66% of respondents opened their checking accounts in person, other channels come in much lower. 13% opened them on a computer, 8% via smartphone, and 3% on a tablet. Phone call openings (6%) and mail (3%) still have a bit of share.

Clarke says the digital experience often still resembles the physical experience. Providers frequently just digitize the traditional paper process. Some mega-banks provide better functionality than that, she says, but many still don’t.

As a result, consumers who try to open checking accounts “find themselves typing information into a tiny screen.”

Beyond such inconvenience, providers often miss the opportunity to sell their checking offerings online, treating what they have as a commodity instead of playing up what’s new and different about their service. That’s a missed opportunity: Of those consumers who shop for checking online, more than half use a mobile device.

And Clarke says that market leaders make it easy to find branches and ATMs from every web page. Sometimes the value of innovation can be overplayed — customers may just want to find a quick way to get some good old cold cash.

Remember What ‘Checking’ Means to People

The continuing strong influence of friends and family — and the strong role of branches — initially came as a dual surprise to Clarke. But Clarke has a theory as to why these factors continue to dominate a banking landscape that is becoming increasingly digital. She also offers gives several examples of what banks and credit unions have been doing wrong, drawing on both the study and personal experience

As Clarke points out, banking providers open many accounts every day; it’s routine. But for most consumers, opening a checking account is something that typically happens only two or three times in their lives, so it’s much more significant to them.

For new banking consumers, opening an account represents a first major financial step. For people who already have accounts, changing providers represents either a need to establish a new relationship in connection with another life event — like a move or a divorce, or because they have grown unhappy with their current provider — and they want a better deal or a better relationship.

Herein lies one similarity between Amazon and banking: people rely on the opinions of others. It’s an important point for financial marketers to consider in their strategy — everything from including testimonials and quotes on their website, to managing their Yelp! reviews.

Checking accounts form the foundation of a consumer’s financial life. With links to direct deposits, automatic withdrawals, debit cards, overdraft lines and other services, checking accounts can be very sticky.

Which is why no one craves starting over again.

Switching banking providers is painful, and can suck up a lot of energy. That’s why financial marketers need to do everything possible to simplify and streamline the switching process.

Fractional Marketing for Financial Brands

Services that scale with you.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Power of Word-of-Mouth Referrals

There’s an idea out there that younger generations rely mostly on their own opinions. Clarke says that’s wrong — they are just as likely as older generations were to seek advice from other people. They may sometimes do so differently (e.g., social media), but fundamentally they want answers to age-old questions: “Where can I find a good experience? Whom should I go to?”

All of this argues that one of the best investments in securing future new checking relationships is keeping current consumers happy — and working that connection. The report points out that some institutions, such as BB&T and TD Bank, use incentives to coax people already doing business with them to refer friends.

Clarke believes the growing influence of friends and family relates strongly to this being a time of generational change for banks and credit unions. As more Millennials enter the banking sphere as adults — followed by Gen Z — they are influenced by their parents and others who they have accompanied to their depository institutions over the years. And first-timers will tend to go with what’s familiar.

“Many young Americans have spent years going to the branch with their mom or dad, standing in the teller line with them as they wait to deposit a check,” the Forrester report says. “When it comes time for them to get their own checking account — maybe a teen checking account or student checking account — they go with a parent to that same branch to open the account in person. They have learned from their parents that this is how it’s done.”