Based on more than 800 in-person branch visits by prospective small business owners at banks across the U.S., the ath Power “Small Business Banking Study” ranks the best business banks along a number of different parameters critical to small business owners.

ath Power singled out Bank of the West, Associated Bank and Chase as the top three best of breed. 96% of the small business owners who visited these institutions reported that they would become a customer, compared to 79% for all other banks in the study.

Comerica was the leading bank in the Midwest, and Citibank led in the Mid- Atlantic. PNC Bank scored highest in the Northeast, Chase led in the South, and in the West, Bank of the West achieved the highest overall score.

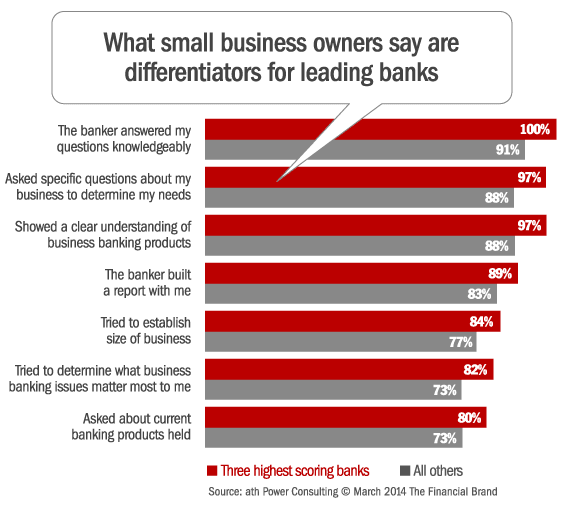

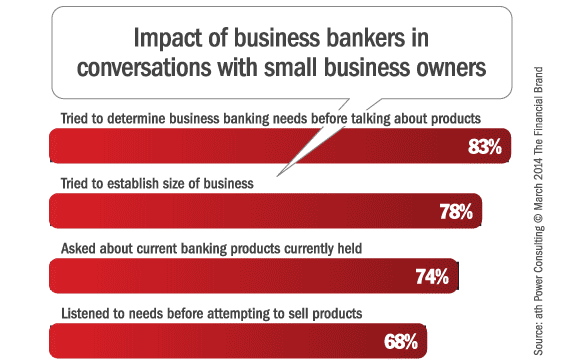

The report also makes a number of strategic observations. Bankers who worked at the top performing banks were better at asking questions to determine needs and answering a small business owner’s questions. They also showed a clearer understanding of products and services offered, and provided convincing explanations as to why their bank is better than others.

Read More: 4 Ways Banks Alienate Their Small Business Customers

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

What Differentiators Pass the Small Business Sniff Test?

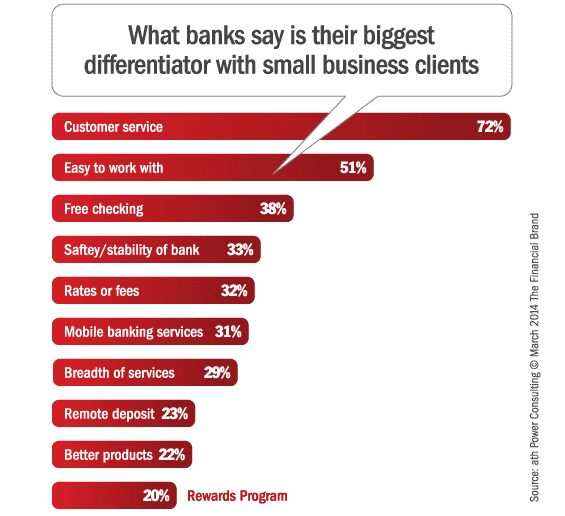

Slightly more than half of all business bankers promise it’s easy to work with their institution. One third of bankers dangle a price-based value proposition: lower rates and fewer fees. Only one in five suggest their banking products are better than their competitors.

Banks like to brag about their customer service more than anything else. Nearly three out of ever four bankers trumpets their institutions’ excellent service. Customers found this claim to be the least plausible (out of a list of ten different factors). Customers only believe the “great service” pitch 74% of the time.

The study uncovered a huge missed opportunity for sales: only about half (52%) of the small business owners were actually asked to open an account during their visit to the bank.

| Question: “What Makes Your Bank Better?” |

Proportion of Small Business Owners Who Found Response Convincing |

|---|---|

| Mobile banking | 83% |

| Remote deposit | 83% |

| Better products | 82% |

| Breadth of services | 79% |

| Safety and stability | 78% |

| Easy to work with | 78% |

| Free checking | 78% |

| Rates or fees | 78% |

| Rewards program | 77% |

| Customer service | 74% |

Read More: Small Businesses Prefer Traditional Banking And Rely Heavily On Branches

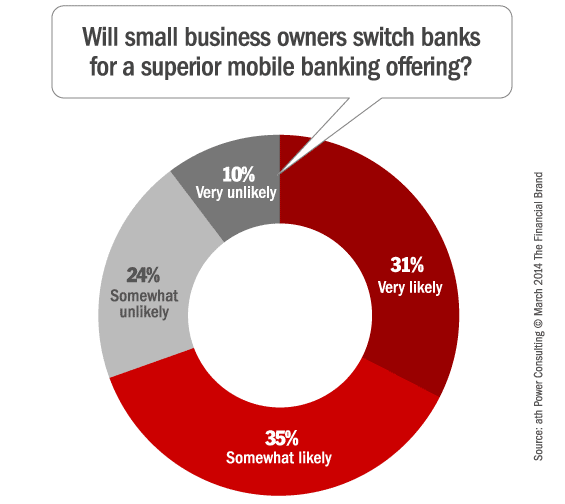

Mobile Banking = Critical Switching Trigger

A significant finding from the study was the impact of a bank’s mobile banking offering. 66% of small business owners said they would be likely to switch banks for one with a superior mobile offering.

Banks seem unaware of the tremendous potential their mobile services represents. Even though small business owners would respond to better mobile banking services, 37% of bankers in the study failed to even mention their bank’s mobile offering.

ath Power says banks could convert an additional 12% of prospects to clients merely by emphasizing mobile banking as a key differentiator.

“Mobile represents opportunities and challenges for banks to attract and retain small business clientele,” said Frank Aloi, CEO, ath Power. “Banks with mobile offerings tailored specifically for small business will achieve success by delivering differentiated features and functionality not available in standard mobile banking services.”

Read More: 5 Things Business Owners Expect From Their Bank

The Best Business Bankers Build Rapport

Results revealed that bankers from the highest rated banks were significantly better at determining needs of prospective small business customers and building rapport with them. Of those small business owners who felt their banker built a rapport with them, 91% said they would become a customer vs. 28% of those who did not.

“Personal connections remain critical for banks seeking to acquire new small business customers,” Aloi said. “The most successful institutions are training bankers on how to build rapport and then using applicable research and coaching to continuously improve.”