While the federal Paycheck Protection Program has been controversial and had a bumpy start, Brad Elliott knew even before the CARES Act passed Congress that he wanted to be able to jump on the opportunity for Equity Bank small business customers as soon as the new loans became available.

The bank, with $3.9 billion in assets, does business in four states, out of Wichita, Kan., and many of the small businesses it lends to serve the aircraft manufacturing business in the area. Major area aircraft makers, including Boeing, Cessna and the Learjet division of Bombardier, have all shut down as a result of the coronavirus crisis, and the smaller firms have struggled since.

Given that a huge but finite amount had been appropriated for the PPP by the CARES Act, Elliott, Chairman and CEO, says he saw the need to act fast.

“We were trying to be front of the line instead of back of the line,” he explains, so it became imperative that the bank pull out the stops.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Getting Set Early for a Financial Assistance Sprint

Elliott says that when the general idea of the PPP began to surface in the House and Senate the bank’s staff began working on a way to implement the program. At each legislative stage changes became necessary as the law evolved. Even after Treasury and the Small Business Administration announced initial details, more changes came, and bank staff kept refitting and tuning what had been developed.

“It was a two steps forward, one step backward process,” says Elliott. For example, a spreadsheet developed by bank staff to use in the program was revised four or five times before it was finalized, he explains.

Elliott had his loan officers reach out by phone to every key business customer to let them know the program was coming and that Equity Bank would be ready to roll as soon as Washington gave the green light.

“Our customers need this,” says Elliott. “This is something the government could do for them to help them survive.” (Pending as this was written was the next step after a terse Federal Reserve announcement that the central bank would set up a program to purchase PPP loans. In addition, there is already talk about adding to PPP funding.)

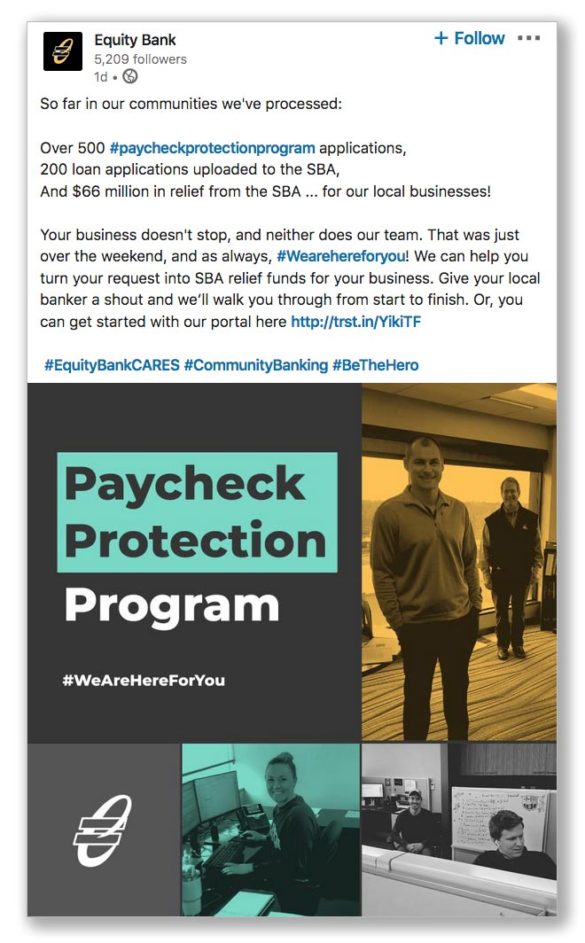

The bank used social media, customer emails and an extensive website special page to let businesses know that it was going to participate in the program.

In an early LinkedIn post, for example, Elliott aired a short video explaining the basics of the program. He explained how quickly the government had put the program together and how the bank had been actively setting up the forms and processes to be ready to move the applications to SBA as soon as the window opened. He urged customers who had not already started working with loan officers to contact their branch or their loan officer to begin compiling required data “so you can get these funds as soon as possible.”

One thing that helped the bank ramp up is that it was already an SBA participating lender and had multiple log-ins for the agency’s systems. As customers began completing their packages, Equity bankers worked through the first weekend — April 4 and 5 — to upload them to the government’s system.

Less than a week later, on April 8, Equity had had 450 loans approved by SBA for a total of $354 million. Elliott explains that the bank’s loan portfolio comes to about $2.8 billion, so this represents over 10% of it already. Thus far the largest PPP loan made by Equity has been $9.6 million for a large area restaurant chain and the smallest was for $5,400. About 75% of the proceeds to date have been earmarked for maintaining payroll, he says, although the federal program permits funds to be applied to certain other purposes such as mortgage interest and utilities.

At the time of his interview with The Financial Brand approximately 1,000 more PPP loan applications from the bank had entered the pipeline. Elliott says his lenders anticipate that there will be between 3,000 and 5,000 applications processed through the bank by the time demand has been met. So far, nine out of ten applications have come from existing business customers — the bank has about 10,000 in its four-state footprint. Since word got out that the bank was processing applications, however, a growing number of noncustomer firms have been asking about applying through Equity because their own financial institutions haven’t been able to serve them.

Walking the Talk Proves More Critical than Ever in Coronavirus Crisis

Elliott says that the bank’s constant message in the COVID-19 period has been that it will find ways to meet customers’ needs. He points to some of the large institutions that hung back early on in the program or that have put restrictions on who they will work with and says that this is a time for community banks to step up and demonstrate that they are essential to their communities and willing to stand by that commitment.

He admits to some disappointment with the details of the program, noting that some aspects of it don’t reflect the way banks typically work. In addition, he points out, while the legislation authorized loan rates of up to 4%, the implementing regulation capped the loans at 1%.

At that level, he says, “the banking industry probably breaks even or loses money on this,” he says. “But the right reason to do this is because our customers need it.”

As for Treasury and SBA, he adds that “they were dealt a difficult hand and did very well,” considering that the program went live within a week of the law being signed. Typically nothing happens that fast in Washington’s bureaucracy.

Long term, Elliott says, making the effort that Equity has made will help build customer loyalty and potentially cause some non-customers to move their business to the bank when the smoke clears.