The first rounds of the federal Paycheck Protection Program saw massive efforts by financial institutions to deploy the loans quickly as well as serious processing issues. The program also put a spotlight on a larger issue that could continue to hinder the banking industry: The antiquated set of procedures and technology used for most business lending.

This situation has allowed fintech lenders, using advanced technology, to pick up significant new business during the initial PPP rounds. Another round, expected to emerge from Washington, could further solidify fintechs’ gains. In short, it is a pivotal time for traditional banks and credit unions to reconsider the imperative of digitization.

Business lending has always presented a challenge for both borrowers and lenders, with significant risks for both parties. Even before COVID, it was difficult for businesses to secure enough funding due to lack of cash flow. The Federal Reserve reported that for small and midsize businesses that did receive funding, only 52% of their needs were met. In February, approval rates at big banks were at 28.3%. Only a month later, Forbes reported approvals plummeting to just 15.4%. Small banks dropped to 38.9% in March from 50.3% in February as well.

A factor in this is that the business lending process is still largely manual. After receiving an application a lengthy verification process takes place, which includes gathering financials, company information, projections and a long list of other data. The way lenders collect this information is time consuming, consisting of manually filling in forms and endless PDF scans. Not only is it frustrating for the businesses who have to supply this information, it is a resource-intensive process for the lender. Loan officers are hired to grow their books by 10% annually, but spend most of their time with unproductive manual work rather than building relationships.

Fractional Marketing for Financial Brands

Services that scale with you.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

What’s Holding Back Bank Digitization?

All this begs the question: Why hasn’t there been an upgrade in business lending technology within banking? Certainly there have been advances in consumer lending. There are several reasons including:

- The decision makers at the banks are not the lending employees experiencing the problem.

- Many banks lack leaders who are focused on digital disruption, according to research by MIT Sloan Management Review and Deloitte.

- Focus on short-term performance outweighs effective long-term investment. A 2017 Boston Consulting Group study, for example, found that 60% of lenders are concerned about the speed of implementation to override their existing legacy systems.

Speak to any business banker — or borrower — and the problems become clear. The forms are manual, even when they are electronic. The industry calls that ‘digitization,’ but true digitization is the ability to use the information on the forms. That’s the type of automation that has been adopted in other sectors but traditional bank lending remains decidedly dated. In addition, data within banks and credit unions too often is unstructured and difficult to access hindering effective use.

Banks and credit unions have long been aware of this reality but it was never a priority. Enter APIs — application programming interfaces — which, in this usage, replace the need to gather financials, calculate them and monitor them manually. They can be viewed with just a few clicks. By automating the manual calculation and processing, lending and credit officers are free to focus on relationships and strategy. Yet before COVID the prevailing trend was to ensure technologies were ‘mature’ prior to partnership, and API technology was seldom applied to business lending.

Read More: The Fintech Strategy to Steal the Small Business Banking Market

The Banking Weakness the Pandemic Exposed

In late March 2020, when flattening the curve translated to stifling the economy, the federal government launched the PPP in record time. Mass approvals supporting businesses happened in a digital environment with little to no warning. Banks and credit unions were left scrambling to approve businesses, and the reliance on manual processes meant that paperwork, time and technology investments were substantial. Many bankers have argued that the cost of overtime far outweighed the benefit of processing PPP loans.

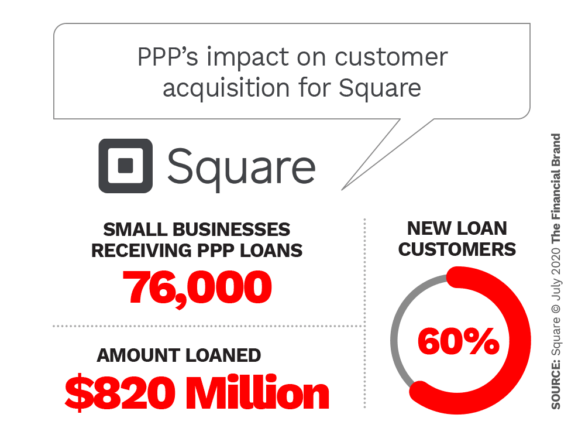

The PPP program offered support to over four million businesses in a few short months. That was exceptional, and many banks and credit unions pulled out all the stops. But where the industry as a whole fell short was in its ability to support new businesses, because it was impossible to gather enough information on these businesses in a short period of time using legacy processes. This was a major limitation for many traditional institutions who have not successfully deployed digital transformation at scale and even more who have yet to deploy the power of APIs. It is also where fintech lenders like PayPal and Square were happy to step in to fill the vacuum, gaining many new customers in the process.

Any bank or credit union that had this capability would have been able to experience a similar windfall. Had banks been open to adopting technology available to them earlier in the last decade, they would have been in the position to dominate the industry. In the end, it was human capital and legacy systems that largely supported the effort.

Will 2020 Be a Banking Game Changer?

What has really changed in 2020 is that the future has been propelled to the now. The last decade’s attitude of waiting is no longer sustainable as financial institutions now face a reality that is too big to ignore.

BCG’s report shows that financial institutions that digitize see a 20% increase in revenues and a 30% decline in expenditures. Those who specifically use customer personalization can achieve as much as $300 million in revenue growth per $100 billion in assets. Digitization is now part of business continuity, it’s no longer a nice to have, it’s a need to have.

McKinsey estimates a decrease of up to $200 billion in net interest income over the 2020-2024 period from the 2019 baseline. Many banks and credit unions are seeing the writing on the wall and taking steps towards fully digitizing. Accenture estimates it will take $1 trillion over the next three years to bring all banking operations online.

Given the cost many institutions are considering partnering with technology companies. Cornerstone Advisors reports that 65% of banks now view partnering with fintechs core to their future strategy, a jump of 15% from the previous year.

Read More: Fintechs Threaten to Disrupt the Small Business Banking Market

The Future of Digitization in Banking

It’s not too late to change. The potential of digitization in banking remains huge. An area that forward-looking financial institutions are seeking to take advantage of is the digitization of loyalty and retention. These are not new ideas, but they are made scalable by the latest technology.

With more data on businesses it’s possible to engage in personalized relationships and promote tailored solutions in real time, expanding the depth of the relationship from one product, typically a loan, to multiple products including deposits and cash management.

What’s exciting about this space is that it’s an area where banks and credit unions can compete over the fintech players that often offer just one main solution.