Truebridge Financial Marketing today announced the launch of the Business Answer Center, a new marketing system that provides the bank and credit union clients of Truebridge with an innovative way to deliver financial education to their business customers and generate sales at the financial institutions.

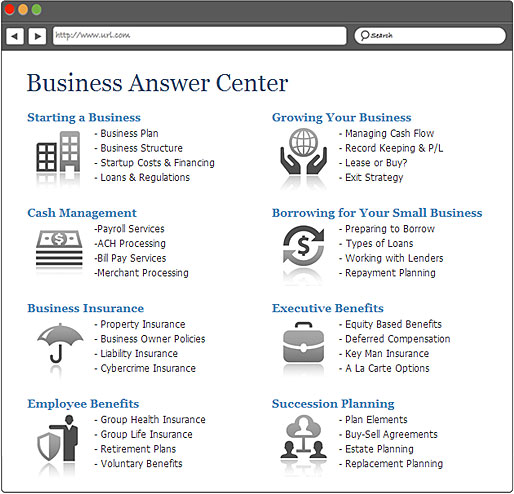

The Business Answer Center is a “How To” suite of online educational topics that banks and credit unions can offer business banking customers. The range of topics that the Business Answer Center covers for small businesses includes: How to Start & Grow a Business, How to Borrow, How to Manage Cash Flow, How to Save for Retirement, Exiting a Business, and much more:

- Business Loans

- Cash Management

- Payroll Services

- Bill Pay Services

- Health Benefits

- Retirement Benefits

- Investment Programs

- Property and Casualty Insurance

- Executive Benefits

- Key man insurance

- Deferred Comp

- Succession Planning Products

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

“The Business Answer Center is a simple addition to your marketing mix that enables your bank or credit union to be that point of information, creating dialogues that cement relationships while generating additional sales opportunities,” says Stewart Rose, CEO of Truebridge.

The Business Answer Center builds on Truebridge’s highly successful Financial Answer Center that its bank and credit union clients have been using to serve individual consumers who need financial education. Both can be delivered digitally or through branch channels and have the added benefit of generating more sales opportunities.

“The Business Answer Center is an outstanding addition to our product line,” Rose explains. “Banks and credit unions serve both individual consumers and businesses, and now we have the line extension to reach businesses as well. We understand that small business owners seek to become better informed before making important decisions, and research shows that they will buy from those who provide that information.”

Rose says Truebridge is now providing a broader education-based marketing system geared to bringing consumers and business customers to their financial institution for trusted advice and relevant solutions. Truebridge presents financial education as a value-added service with the objective to generate more selling opportunities for all products and services and do it in a way that builds customer loyalty.

Existing Truebridge clients will be happy to know that The Business Answer Center is fully integrated with all other Truebridge marketing services in the Smart Life Connect program.