An innovation revolution is roiling business banking just as it has consumer banking.

When it comes to sleek new tech and shiny new digital products and features, much of the innovation has long been focused on the consumer side of banking. Business banking, meanwhile, remains stuck in neutral, saddled with legacy tech and processes, many of which are still largely paper-based.

But banks that can ramp up their game when it comes to business banking services stand a good chance of getting a leg up on competitors and driving revenue. Individuals that use business banking services are, after all, consumers as well, and increasingly they are demanding the same type of innovation they get in their consumer lives from their business banking relationship.

One area banks can start with is enabling real-time treasury management services. The treasury management space is still riddled with legacy payments processes that often take days to clear. The transformation of legacy and inefficient treasury operations into real-time management holds enormous potential, with a chance for treasurers to step back from repetitive tasks and fulfill their risk and liquidity operations more strategically, advises consulting firm Capgemini in a report titled “Top Trends in Commercial Banking 2022.”

‘Exhibit A’:

Treasury management services represent an area primed for innovation (and disruption) as it is typically rife with inefficiencies.

“Real-time payments enable banks to provide 24/7 or after-hours services, enhancing a traditionally cumbersome and unpleasant customer experience,” the report states. “Treasurers can take advantage by exploring foundational solutions such as intra-day sweeping, virtual accounts, and advanced cash-flow forecasting, as well as real-time FX conversion and hedging.”

By offering real-time treasury services banks can enable their clients to save significant time on the daily cash management processes, Capgemini notes, and ultimately deepen the relationship.

“Real-time balance and transaction reporting help the treasury minimize idle balances and track the movement of cash effectively, reducing the risk of fraud,” the firm adds.

Read More:

- How Square is Building a Small Business Banking Powerhouse

- Community Institutions’ Golden Opportunity to Grow Small Business Loans

- Good Digital UX Is Now Table Stakes for Small Business Banking Success

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Pressure Grows from Fintechs

Banks have faced pressure to up their game over the past decade due to competition from fintechs when it comes to consumer facing technology. This pressure is now rising significantly when it comes to business banking as well.

Going for the ‘Core’:

Fintechs are increasingly taking business away from banks in areas such as commercial lending.

“In the past, fintechs made incremental inroads into commercial banking with niche products to improve process efficiency,” the Capgemini report states. “But, now, new-age players are rebundling commercial offerings using the modus operandi they successfully deployed in retail banking.”

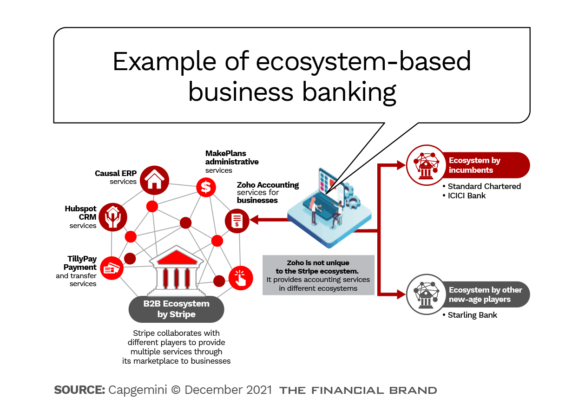

The consulting firm cites fintech firms such as Stripe and U.K.-based Paysme as examples of new types of competitors that are creating business banking ecosystems, as well as many of the so-called “super apps” gaining traction as well, including PayPal. Intuit is another example of a tech company expanding further into business banking.

Banks are especially vulnerable to losing small-to-medium sized businesses to new entrants. This is a segment that has typically been underserved when it comes to tech innovation or new digital services. In fact, more than 60% of small and medium-sized business go outside their banking partner for business services such as payments and receivables, Capgemini states.

“Such trends demonstrated a strong case for fintechs to orchestrate super apps for businesses,” the firm continues. “The evolution of APIs and the nimble technology stack of fintechs has streamlined the integration of banking and non-banking players into the ecosystem. Moreover, platformification, with its full view of all the integrated finances, allows business owners to make quick decisions, which creates a win-win scenario for all players.”

Small Business Lending Up for Grabs

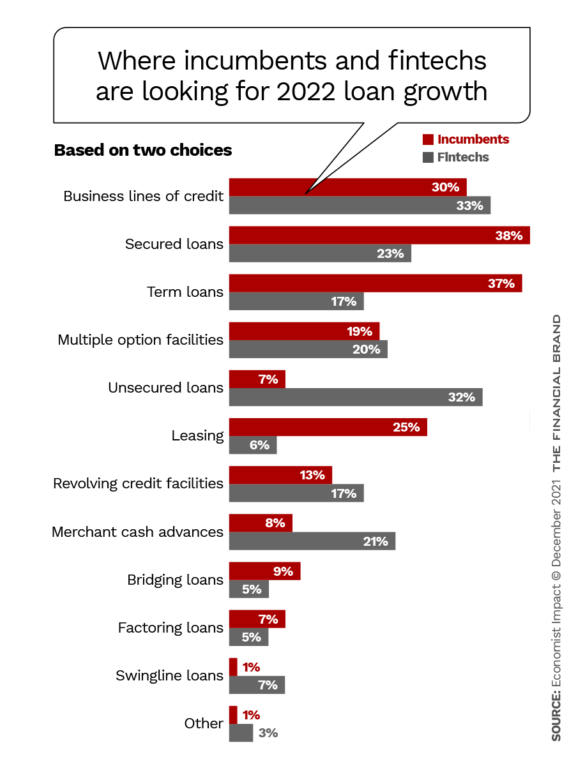

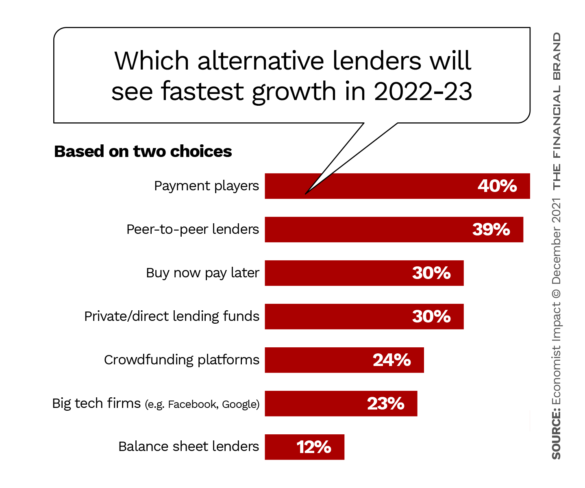

This trend is also playing out in small business lending, where new fintech entrants are serving needs that have largely gone unmet by traditional financial institutions. In an Economist Impact poll of 300 lenders, comprised of both traditional financial institutions and fintechs, alternative lenders such as payments firms, peer-to-peer platforms and buy now, pay later services were seen as gaining the biggest rise in market share in small business lending over the next two years.

These new entrants are mostly active in the smaller loan space (defined as loans less than $50,000) — an area not often targeted by banks — but are gaining traction now even in larger loan amounts.

“Fintechs such as payment players, peer-to-peer lenders and crowdfunding platforms use sleek user interfaces and insights from predictive algorithms to attract customers with speedy, personalized and flexible lending solutions,” the Economist Impact report states.

Read More: What Millennial & Gen Z Business Owners Want from Banks

Of course, banks cannot rest on their laurels as fintechs and other new players whittle away at their business customer base. And many are not; incumbent players are leveraging their branch presence to combine technology and the human touch into a “high-tech high-touch” customer experience, the survey found.

Traditional banks are also seeing the importance of investing in cutting-edge technologies in order to serve business clients better. Nearly half of the survey respondents said investing in new technology would be the most important trend over the next two years, with artificial intelligence being the most popular technology cited.

“However, it is the differences in how traditional lenders and fintechs perceive borrowing appetite that is telling,” the Economist observes “An impressive 47% of fintechs saw an increase in borrowing appetite, against just 28% of traditional lenders. These findings are supported by research by Roland Berger, a consultancy firm, which states that 86% of small businesses are considering alternatives to traditional bank loans.”

When it comes to where they are looking to grow lending as we move into a Covid-coping world, lenders worldwide are most focusing their growth efforts on business lines of credit (selected by 31% of respondents), secured loans (31%) and term loans (27%), according to the Economist survey.

The Importance of Open APIs in Business Banking

The concept of open banking is gaining significant traction in the retail banking space, but it also has a role to play in business banking as well. Adopting an open mindset can allow banks to act as platforms connecting their business clients to a wide range of products all offered through their ecosystem.

Open World:

Banks and credit unions have the opportunity to offer business clients a platform-like service in which they can integrate fintech and non-finance offerings in an ecosystem.

“This means APIs can enable banks to access more customers than they ever could through their own channels, and drive innovation and partnerships in a faster, cheaper and more effective way,” says technology vendor Finastra.

Banks in this model can also utilize competitor’s APIs, as well as fintech innovations, to create better business banking services.

“Through platform service models, banks can attract a more extensive customer base at a lower cost,” says Capgemini. “This opens an excellent opportunity for banks to integrate their services with fintech and non-finance offerings, open new businesses at attractive margins, and obtain a deeper understanding of consumer behavior through more data.”