More than any other segment of the economy, small business has experienced great stress during the pandemic. More than half of 3,000 small businesses surveyed by J.D. Power report significantly reduced sales or even temporary suspension of their business.

When business owners come under pressure like that, they can grow hypercritical of their relationships, including with their financial institution. Card issuers tend to get more of this pushback than their counterparts in retail banking. That’s because people overall — business or retail customers — are less forgiving of card brands than bank brands.

“Right now there’s a negative halo around the small business credit card experience,” observes John Cabell, Director, Banking and Payments Intelligence for J.D. Power. “Small business owners are just not in the mind frame to be enthusiastic about their financial services experience.” That came through in the company’s survey results where there was a consistent decline in satisfaction across many metrics from 2019 to 2020.

So should banks and credit union card issuers chalk-up the decline to tough times and not worry about it then?

That could be a costly mistake.

Small and midsize businesses (SMBs) are among the most engaged users of credit cards, and are far more loyal than the average consumer, who will switch cards for a few extra points. Cards are a much bigger deal for small businesses — serving as a key operating tool. But J.D. Power detected several disturbing trends in analyzing results of its second annual study of small business card satisfaction.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Greater Digital Use Reveals ‘Rocks in the Stream Bed’

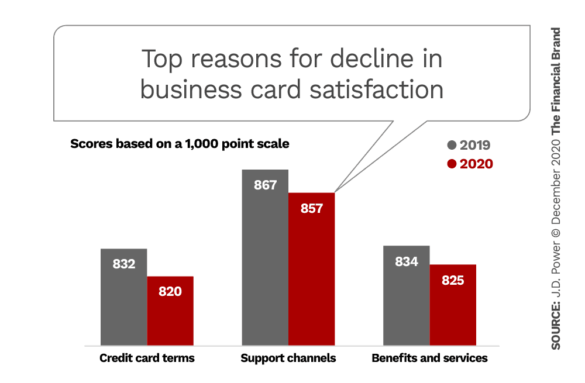

Overall satisfaction among small business credit card customers declined nine points (to 840 on J.D. Power’s standard 1,000 point satisfaction scale) from 2019 to 2020. The decline was sharpest among middle market small businesses (down 15 points). These are companies with between roughly $100,000 and $1 million in annual revenues.

Three factors in particular drove the overall decline in satisfaction: support, benefits/services and terms.

The decline in support channels reflects several factors, including restricted availability of in-person assistance. Small businesses as a whole depend more on bank branches than retail customers. As one survey respondent stated: “While having over-the-phone and online services are great, meeting face-to-face [when possible] is the best way for me to understand what I am getting into … and gives me the most sense of security.”

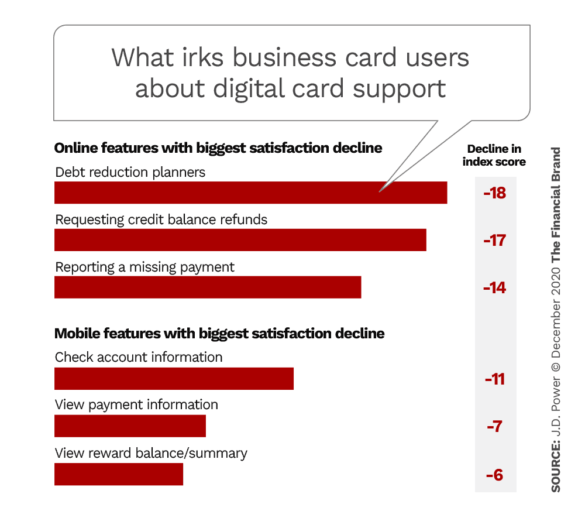

But a bigger factor by far is that card issuers’ digital support channels have fallen short during the pandemic, which has driven business customers to use the phone more often, putting greater stress on call centers. Satisfaction with business card websites and mobile apps declined by 13 and 10 points, respectively, according to the report. The declines were related to specific digital features, as shown below.

With all the attention banks and credit unions have given to improving digital banking, the decline in satisfaction revealed above is all the more striking.

In an interview with The Financial Brand Cabell points out that as the pandemic impacted branch access and drove up wait times on call centers, small business customers have had to use their card issuer’s website or mobile app more often.

As a result, they likely were using some new functions online or in a mobile app, says Cabell. “That tends to expose the ‘rocks in the channel,’ so to speak, when you’re trying to solve problems or find information that you’re either not as comfortable with or don’t normally handle that way. It can create a decline in the experience.”

Cabell points out that the three most troublesome online functions shown in the chart were features small business clients may not have needed a year ago. By contrast, the three mobile card app functions that caused satisfaction to decline are pretty standard. Cabell surmises that more frequent use of these common functions may have surfaced flaws. But he believes that the “negative halo” effect could account for some of the decline in satisfaction.

Terms and Benefits Impact Satisfaction

Overall customer satisfaction among small businesses with credit card benefits declined nine points in 2020. The sharpest declines occurred with cards co-branded with a retailer serving the small business market.

Small business card benefits are pretty much the same as for consumer cards, Cabell notes — ancillary things like travel insurance or no annual fee, as distinct from points, miles or cash back.

The survey uncovered that a quarter of the respondents are now spending less with their business credit card, with one in five using it more for emergencies. That change in behavior alters the value proposition of card benefits as well as rewards. Customers who are paying annual fees are less thrilled with that now, Cabell observes, based on the fact that they’re not getting the same value from their rewards that they were previously. One small business owner commented: “As my air travel has been very limited, I would like to see no card fee for one year.”

Confusion about card term changes increased sharply in 2020, J.D. Power found. Terms changes are not new and are often couched in dense legalese.

“It’s probably fair to say that cardholders are now looking at the fine print on their card products to better understand whether the product can support them through this pandemic economy,” Cabell states. “That can expose some gaps in understanding. For example, a business owner might say, ‘I never thought I’d miss a payment before, but if I do miss a payment, how does the interest calculation work?’ The answer to that may not be immediately clear.”

Read More: How to Nail the Small Business Banking & Lending Market in 2021

Communication Makes a Huge Difference

The efforts of bank and credit union card issuers to moderate the impact of COVID-19 on their small business clients has not gone unrecognized or unappreciated. The two most-noticed actions by financial institutions are late-payment forgiveness and waived charges and fees. J.D. Power found that 71% of small business customers are aware of card issuer efforts to help them. This awareness is a major differentiator in satisfaction with their card issuer, boosting the score by 58 points (on the same 1,000 point scale) over the average for the entire sample. However, the segment of customers unaware of financial institution responses drags down the overall level of satisfaction.

J.D. Power notes also that the “aware” cardholders have higher trust, Net Promoter Scores, and brand image ratings compared to those who are unaware of issuer support.

Having an account manager greatly increases the satisfaction level of small business cardholders, the research firm states. Overall, less than half (43%) of respondents have an assigned account manager, despite the usual practice of having one manager handle multiple clients. Naturally, the larger customers are more likely to have them.

When having an account manager isn’t feasible, Cabell says it’s vitally important to ensure there is adequate communication with those businesses by other means. This goes back to the importance of an easy-to-use and well-designed website or mobile app for card customers. Self-service support is particularly important for business customers on the smaller end of the scale that lack a direct banker connection.

Will They Jump Ship?

Normally small business cardholders are less likely to switch card providers than retail customers. However, J.D. Power, in a separate study, found that small business customers were more likely to report that because of the pandemic their current business credit card may not meet their needs as well as it did previously. As a result, says Cabell, they were planning on switching.

Action steps that the research firm recommends could help forestall departure of these customers:

- Educate small business customers on credit card benefits, terms, digital capabilities and available business support.

- Assign an account manager when possible, and when not, ensure communications clearly define the business support available.

- Build a robust digital platform that is easy to log into, offers impactful features, and contains specific account information including card terms and benefits and rewards.