An array of fintechs and neobanks are pursuing small business customers with digital banking services intended to eliminate the pain points they often experience with traditional lenders.

While Square is the Goliath among the fintech competition, others are making inroads with this coveted segment as well.

Their approach offers strategic insight for executives at traditional banks and credit unions. It also points to opportunities to add some lucrative services into the mix for small and midsize businesses.

For example, it’s becoming increasingly common for businesses of this size to have employees, suppliers or buyers in other countries, so Bluevine integrated international payments into the digital banking account it offers to these customers. Its service can handle payments in eight countries and 26 currencies, with more to be added.

Though Bluevine wants to attract small business customers of all kinds, digital banking challengers often start out with a focus on solving problems for a specific niche. Some have zeroed in on startups (Brex and Rho among them). Others target freelancers (NorthOne and Novo) or even social media influencers (Karat Financial).

Despite upheaval in the crypto sector, it too has gotten attention (Arival, for example).

In some cases, these challengers later expand, as Square did, adding more to their product lineup and broadening their appeal. But others remain hyper-focused on a niche and, when layering in additional services, banking and otherwise, they tailor these to the unique needs of their target audience.

For Brex, this includes simplifying travel booking and expense management. Novo checking accounts come with free invoicing software. It also partnered with an online legal firm to help entrepreneurs who want to pursue an LLC application.

Even though fintechs and neobanks work with their traditional banking counterparts on the back end to deliver some of their offerings — savings and checking accounts, credit cards and sometimes even treasury services — they generally shine with an intuitive user experience on the front end.

Many have an all-in-one dashboard that combines banking, payments, borrowing and other financial details in a single place to make money management easier.

Here’s a gallery of digital banking challengers with details on their approach to wooing small and midsize business customers.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

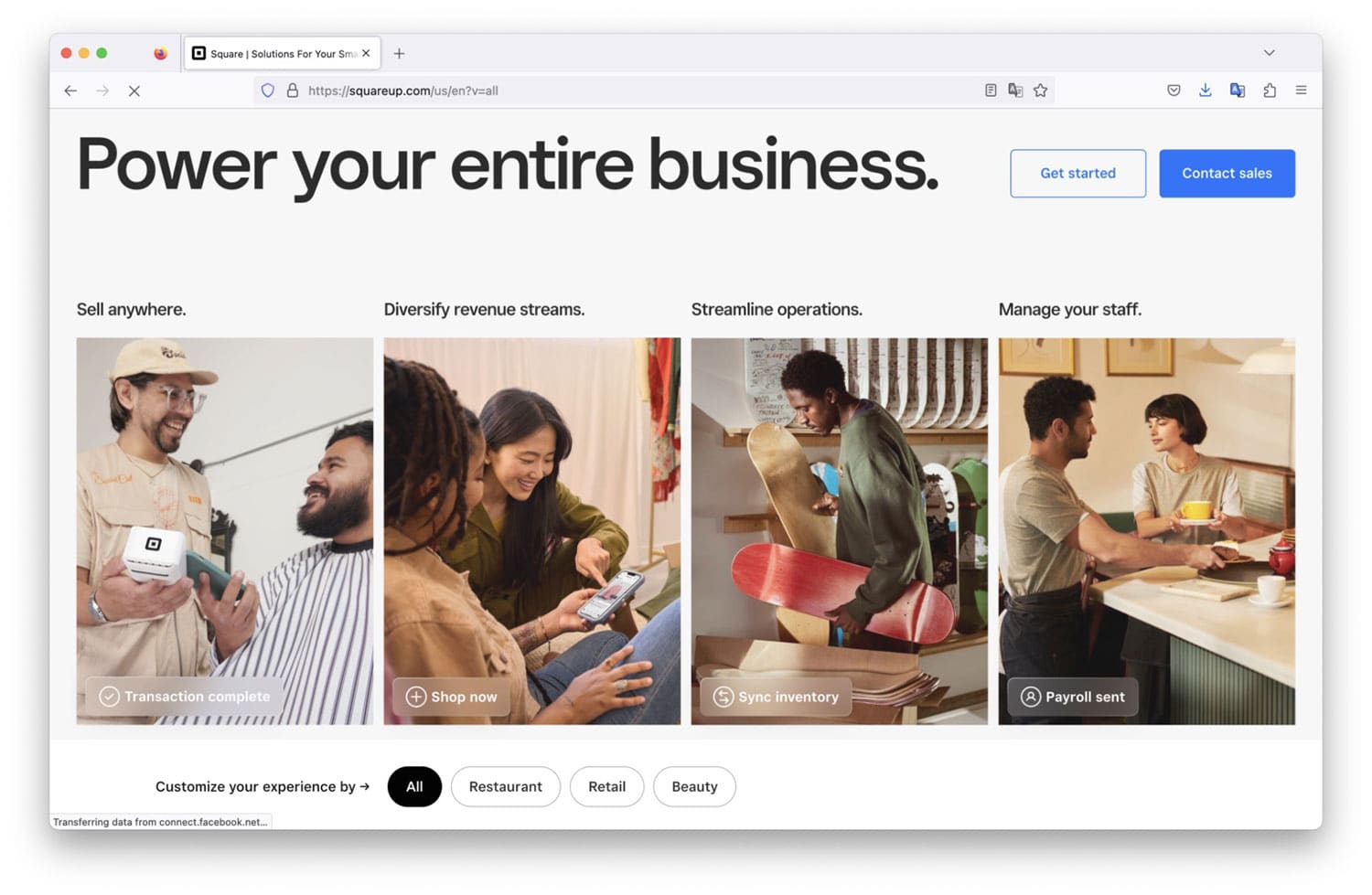

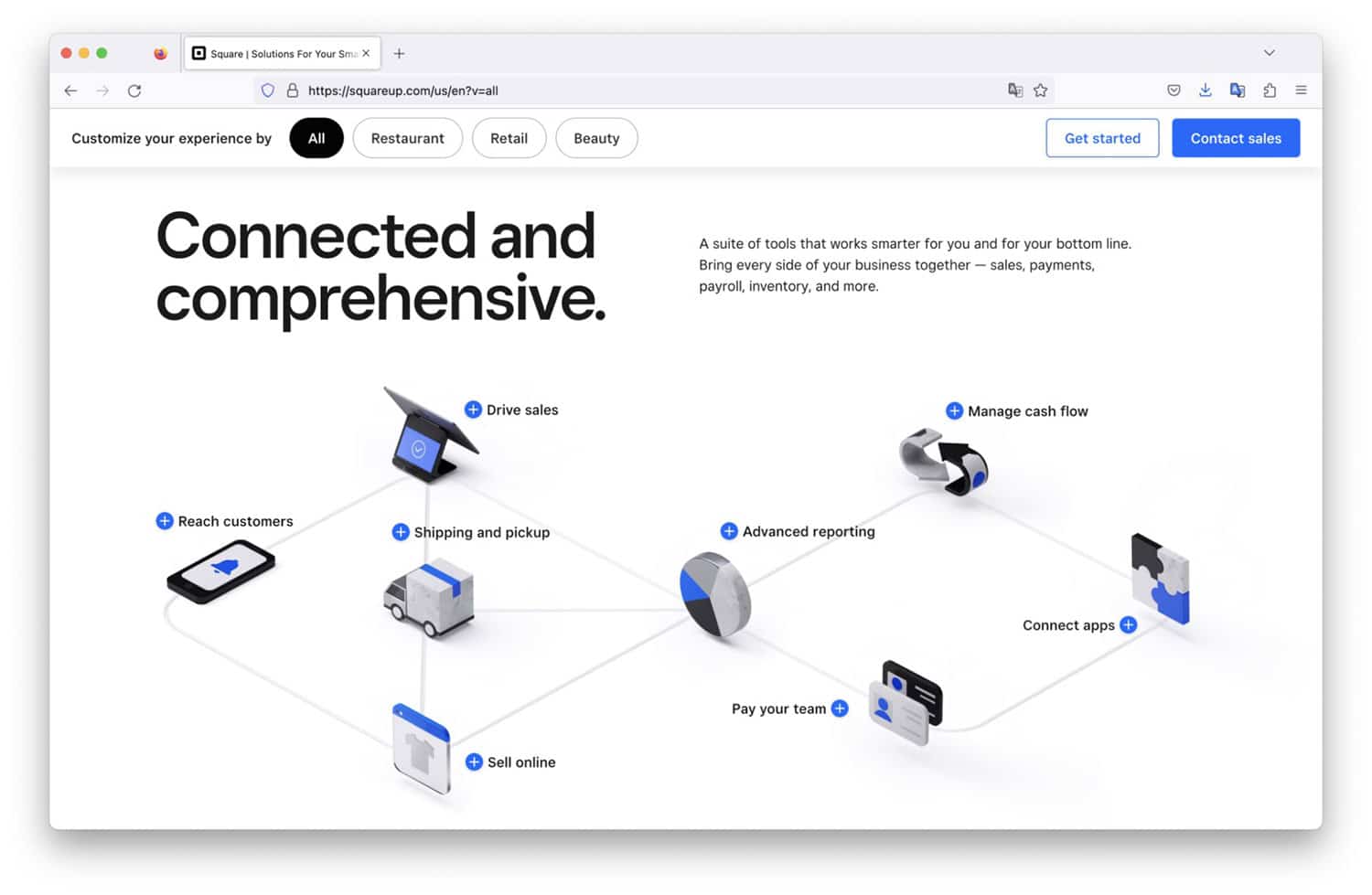

Square: The Catch-All for Businesses

Website: squareup.com

Checking accounts provided by: Sutton Bank

Savings accounts and loans provided by: Square Financial Services, which is chartered as an industrial loan company

What stands out: The user experience

Square is a traditional bank’s nightmare when it comes to competing for small business customers. The fintech built a banking empire on its first product — a simple dongle that could turn a smartphone into a card reader. Suddenly even people having a yard sale had the ability to accept credit card payments as long as they had a Square account.

Square now offers business owners a checking account, savings account, loans, a payment processing system, payroll and employee benefits systems, business loyalty programs, appointment scheduling software, gift card integrations, and more.

Through Square savings accounts, businesses can earn 1.75% APY with no monthly fees, no overdraft fees and no minimum balance. If a Square business customer needs a loan, that’s available too, anywhere from $300 to $250,000.

Through Square savings accounts, businesses can earn 1.75% APY with no monthly fees, no overdraft fees and no minimum balance. If a Square business customer needs a loan, that’s available too, anywhere from $300 to $250,000.

TrustPilot: 4.4/5 (3,879 reviews)

Apple Store:

- Square Appointments: 4.9/5 (145,000 reviews)

- Square Invoices: 4.8/5 (68,000 reviews)

- Square Payroll 4.8/5 (5,800 reviews)

- Square Point of Sale: 4.8/5 (335,000 reviews)

- Square Team: 4.8/5 (20,000 reviews)

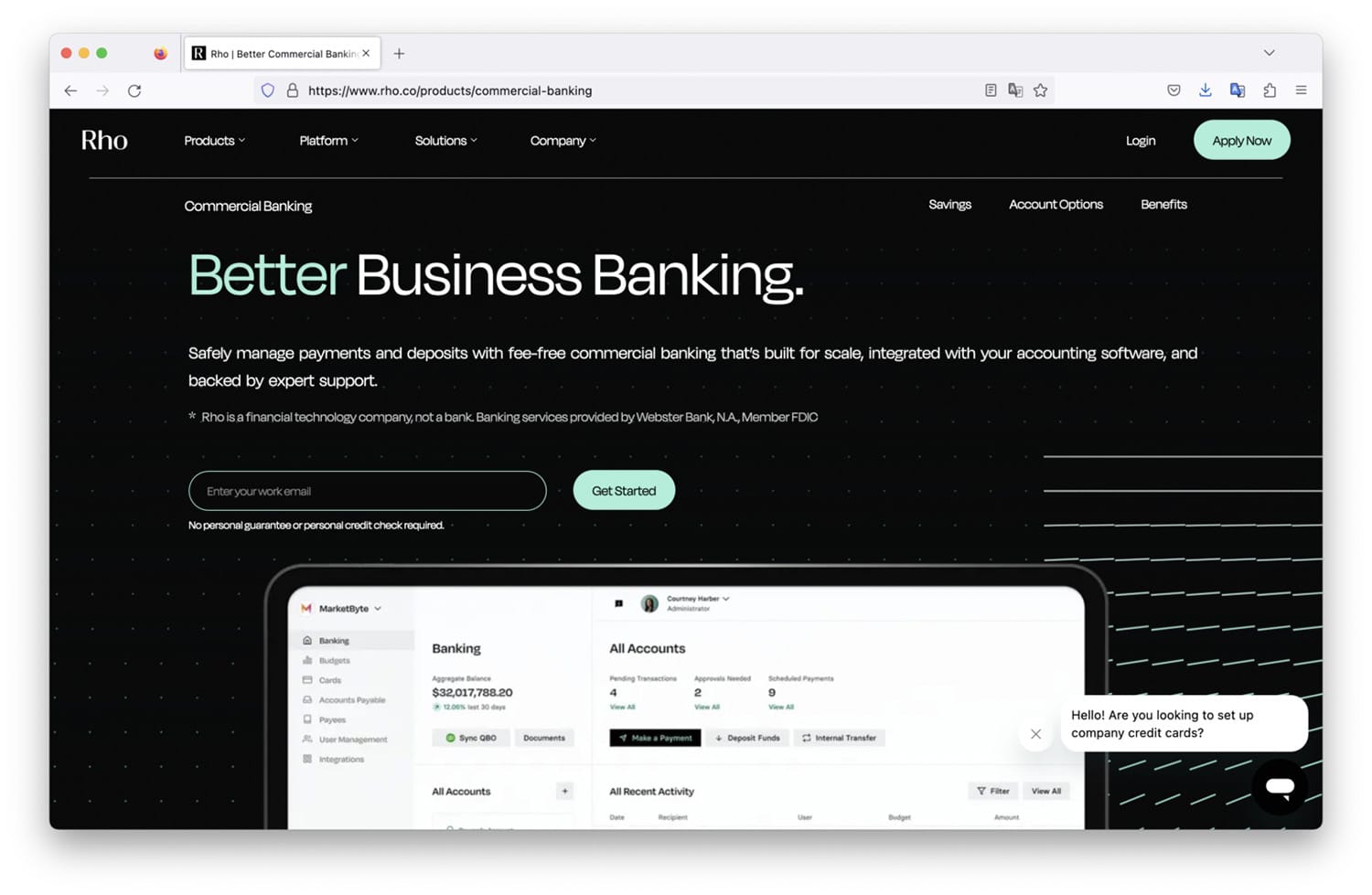

Rho: A Slick Corporate Banking Platform

Website: rho.co

Banking services provided by: Webster Bank

What stands out: Comprehensive management of finances via one dashboard

TrustPilot: 2.9/5 (2 reviews)

Apple Store: 4.9/5 (36 reviews)

Visitors to the Rho website will find that one of their first interactions is with a chatbot asking “Hello! Are you looking to set up any company credit cards?”

This sets the tone for Rho, a fintech founded in 2018 that says it aims to take the friction out of finances. It targets businesses ranging in size from venture-backed startups to midsize companies.

Rho has integrated its offerings — which include a business checking account, treasury management services, corporate cards and more — into a business dashboard. Its expense management system allows a business owner to monitor employee spending, customize rules for corporate cards and automate transaction approvals. “Dedicated Rho specialists” are also available 24/7 to account holders.

Rho promises the usual deposit insurance up to $250,000 on its basic Rho Checking Account, but up to $75 million on its Rho Treasury Management account. Just the fact that it offers treasury management services differentiates it from the community banks and credit unions that don’t.

Its corporate cards offer 1.75% cash back and more than $600,000 in software deals and rewards.

Read more:

- The Hybrid Fintech Rho Foretells Banking’s Future

- How Data Can Supercharge Small Business Growth for Banks

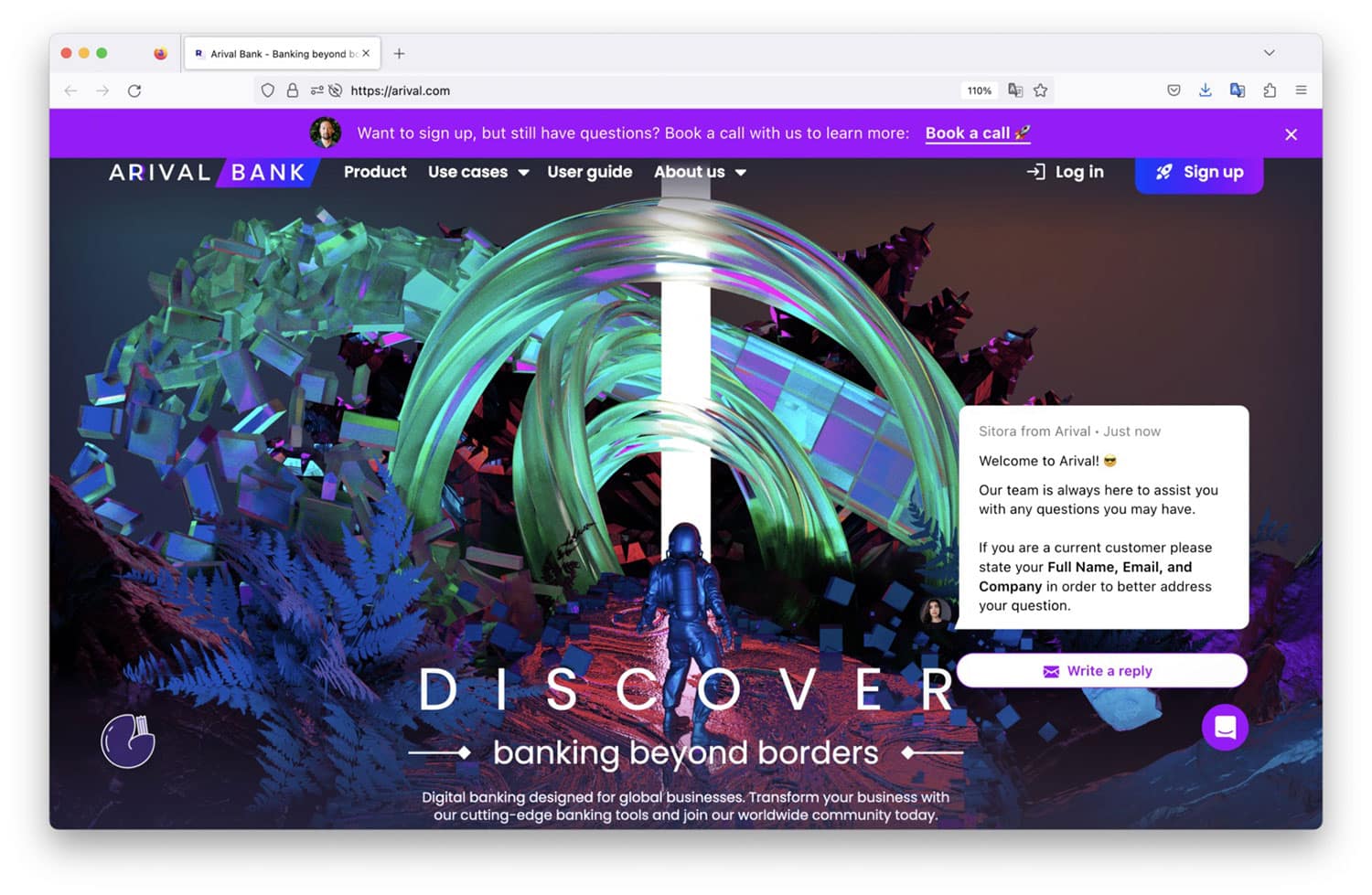

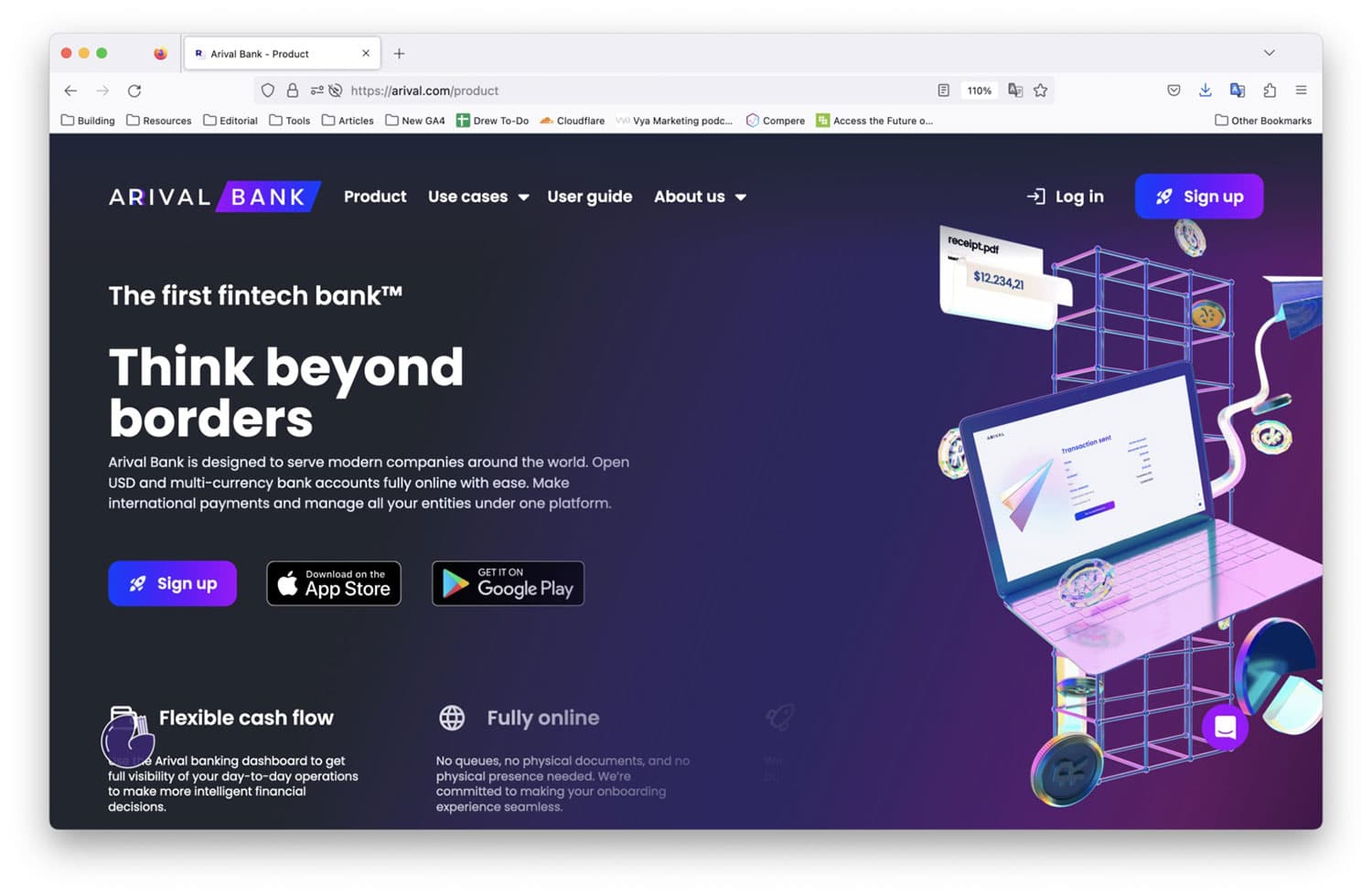

Arival: All About the Brand

Website: arival.com

Banking services provided by: Quaint Oak Bank (for U.S. customers)

What stands out: A tech solution to help its business customers with compliance

TrustPilot: 3.8/5 (2 reviews)

Apple Store: 5/5 (3 reviews)

Arival, which touts its “crypto-friendly onboarding,” targets what it describes as “abnormal” businesses that many traditional banks and fintech banking providers avoid. These include global tech startups and blockchain-based businesses.

It offers bank accounts, money transfers, debit cards, factoring and loans. Its system allows for multicurrency expense management. According to the product plans posted on its website, Arival eventually wants to add multicurrency accounts, FX payments and more.

Businesses using Arival also get access to technology that it describes as a “virtual compliance manager” to address challenges such as know-your-customer and anti-money-laundering requirements, onboarding, and transaction monitoring.

Arival uses futuristic brand imagery that’s meant to convey an emphasis on innovation. Its mascot is an android named “Rocky the Rocket,” which is partly a gesture to Arival’s international scope, as an android is not a representative of any particular nationality. The intent is a “retro-futuristic” vibe, Arival’s design director, Stan S. Zubov, explains in a Medium blog post.

Arival uses futuristic brand imagery that’s meant to convey an emphasis on innovation. Its mascot is an android named “Rocky the Rocket,” which is partly a gesture to Arival’s international scope, as an android is not a representative of any particular nationality. The intent is a “retro-futuristic” vibe, Arival’s design director, Stan S. Zubov, explains in a Medium blog post.

“What humans need is meaningful, sincere interaction,” Zubov writes. “That’s why our focus is on making Arival 90% utilitarian and functional and 10% beautiful and fun.”

This fintech, founded in 2017, has a banking license in Puerto Rico, where it is regulated by the Office of the Commissioner of Financial Institutions. U.S. customers have up to $250,000 worth of FDIC insurance coverage through Quaint Oak.

Arival serves only businesses but says accounts for individuals are in beta mode. Its tag line is, “Banks are old. We’re not.”

Read more:

- How Wells Fargo Rebooted, and Personalized, Digital Business Banking

- See all of our latest coverage on small business banking

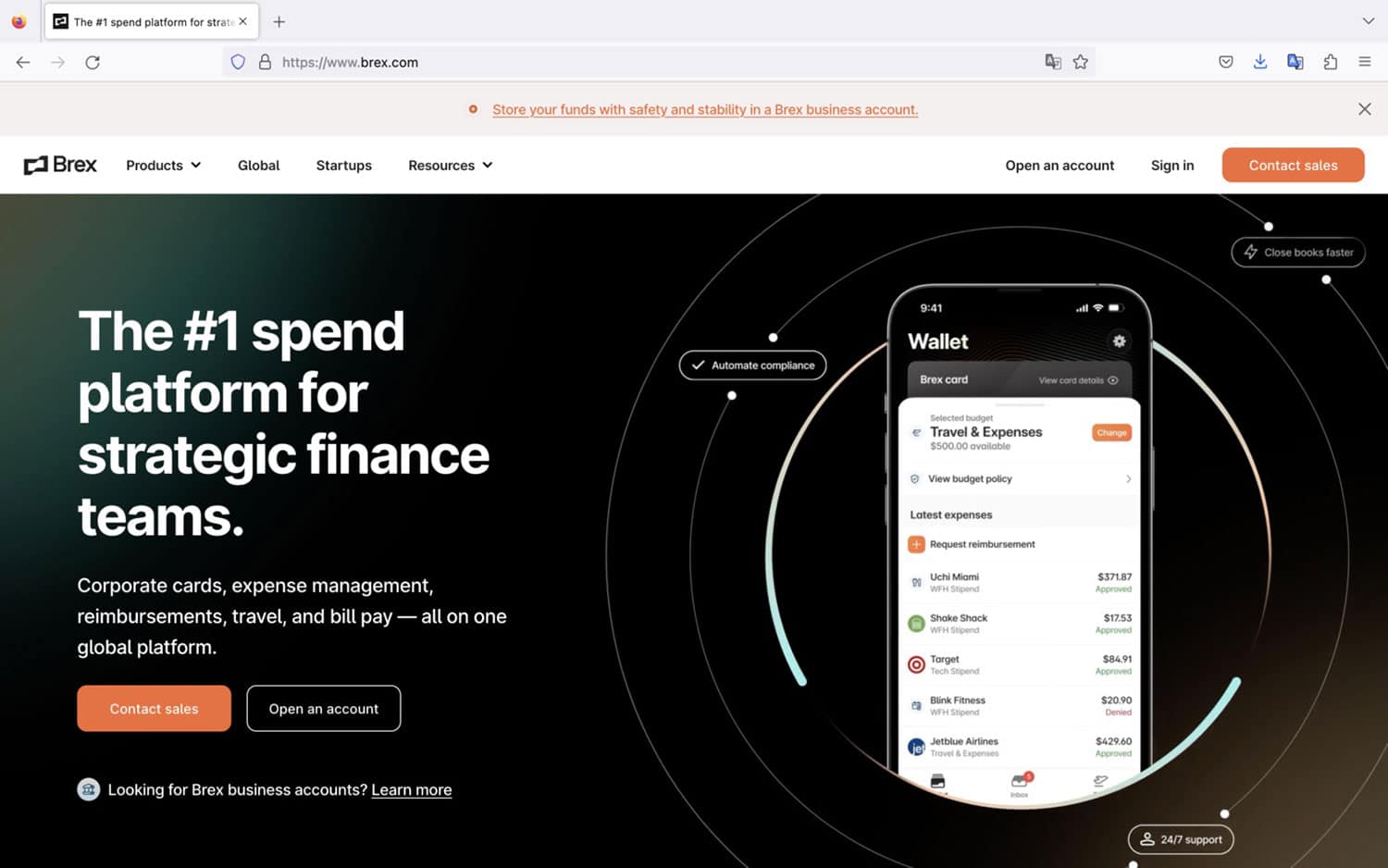

Brex: The Business Trip Manager

Website: brex.com

Banking services provided by: Emigrant Bank and Fifth Third Bank

What stands out: Its effort to simplify travel-related hassles

TrustPilot: 3.3/5 (559 reviews)

Apple Store: 4.9/5 (2,900 reviews)

Managing business trips can be a hassle, especially if there are a lot of them. Think about all the moving parts: Maybe one employee needs a corporate credit card to be issued. Another with a lost card needs reimbursement. Maybe a flight got delayed and a new reservation has to be made quickly. Others are late with submitting receipts.

What if all of those pain points could be resolved using the same platform that manages the business’ bank accounts?

That’s the pitch Brex makes to its target audience, which consists of fast-growing tech startups, ecommerce brands and large businesses. Brex, founded in 2017, dropped traditional small and midsize businesses as part of a pivot in late 2021, when it decided to position itself as a software platform focused on financial management for companies with challenges like a globally dispersed workforce.

Users have access in one system to their business accounts, “borderless” expense management, travel, global corporate cards, bill pay, venture debt, financial modeling and a “travel and entertainment solution” to simplify T&E expenses.

DoorDash uses the platform to manage its DoorDashers all over the country. Brex, which is backed by the startup incubator Y Combinator among other notable investors, also claims that 91% of the latest Y Combinator cohort are among its customers.

Read more:

- Brex Wants to Be More Than ‘Just a Bank’

- 5 Ways Banks Can Prevent Small Business Defections to Fintechs

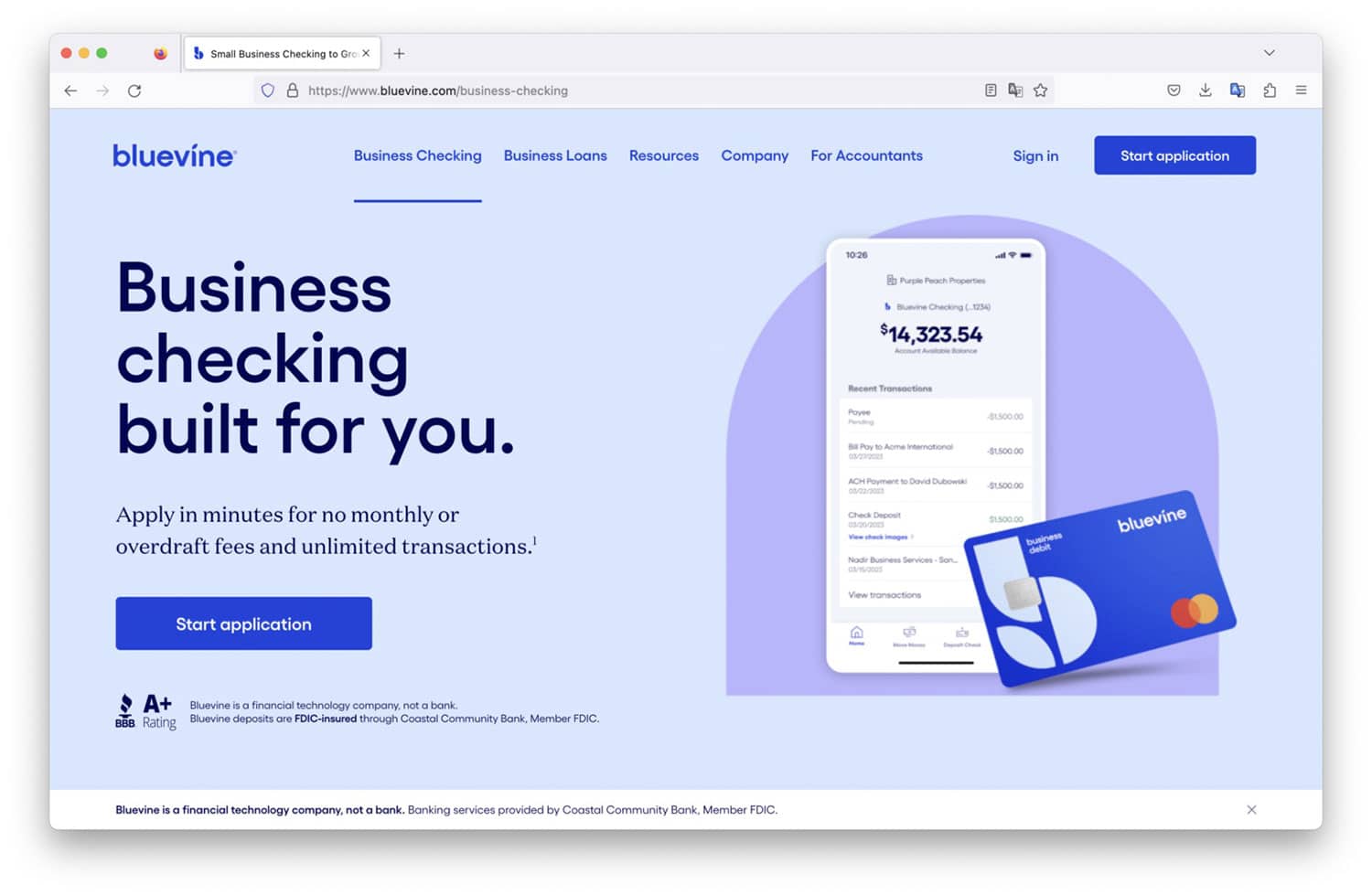

Bluevine: Smoothing Out Small Business Pain Points

Website: bluevine.com

Banking services provided by: Coastal Community Bank, Celtic Bank and First-Citizens Bank & Trust Co.

What stands out: Gives accountants insight into the finances of the small businesses they serve

TrustPilot: 4.3/5 (7,187 reviews)

Apple Store: 4.7/5 (1,300 reviews)

Bluevine’s small business accounts have no monthly fees or minimum balance requirements and allow for up to five sub-accounts with designated account numbers and limitless transactions. Eligible customers can earn 2% APY on business checking.

The fintech also syncs its system with QuickBooks and offers a revolving, on-demand line of credit.

Bluevine was founded in 2013 by a third-generation entrepreneur. “I know the pride that my dad had running a small business,” founder Eyal Lifshitz, told The Financial Brand, in an interview.

“Fundamentally, most small business owners just want to do their own thing. But they have a lot of problems,” he said, noting that his family found it difficult to get access to financial resources.

One of the unique offerings from this fintech is a banking platform for accountants allowing them to see their small business customers’ Bluevine checking accounts. There are no shared passwords or credentials and only limited permissions based on the wishes of each business customer.

Of course, the accountants can sign up as customers as well, with access to the same checking, line of credit and bill pay services as that of the Bluevine account holders they are serving.

In April 2023, Bluevine announced that it had partnered with Wise to offer international payments integrated into its all-in-one digital banking account. The service will be able to handle payments in eight countries and 26 currencies initially, with more to be added.

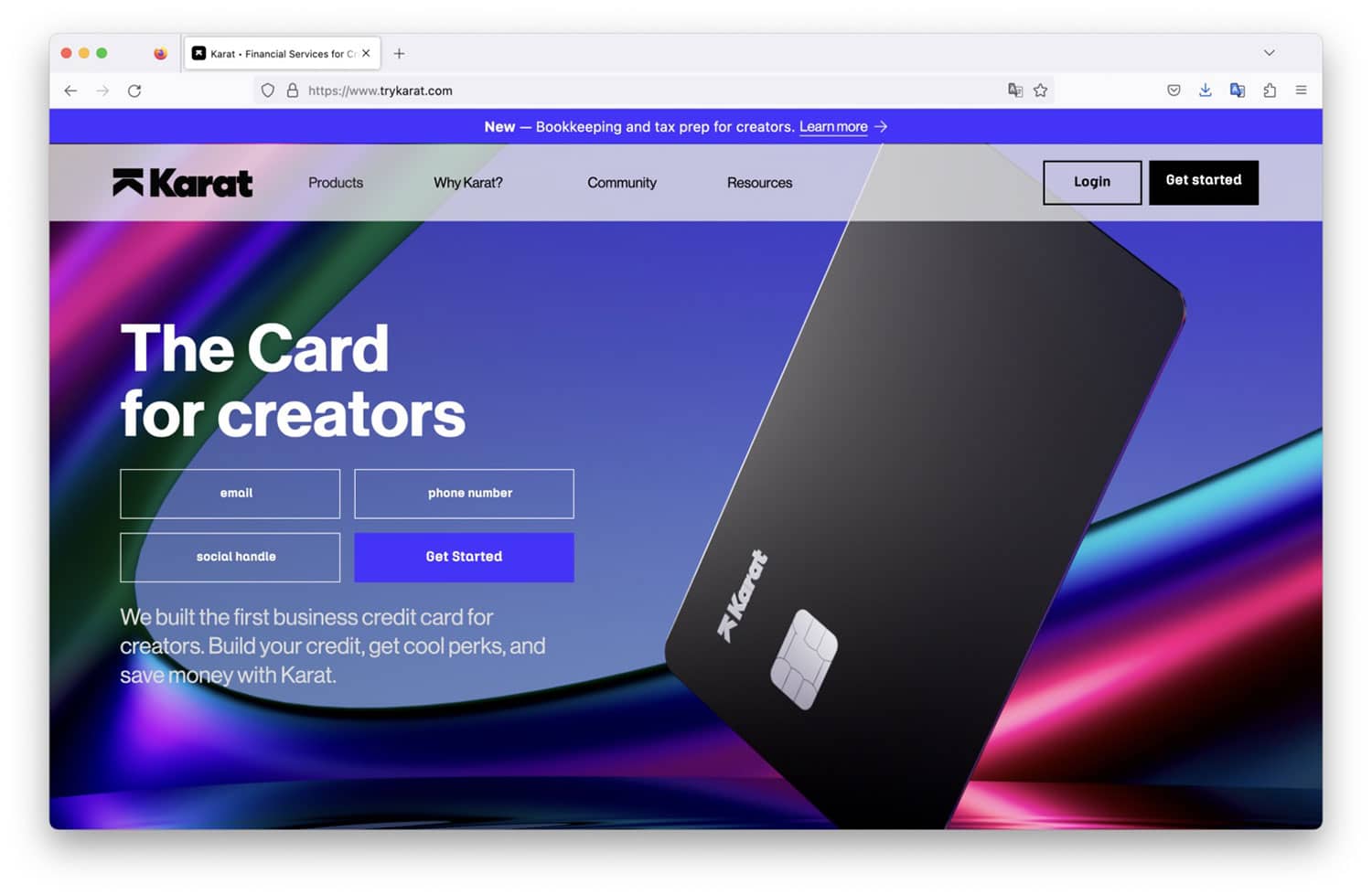

Karat Financial: A Credit Card and More for Digital Creators

Website: trykarat.com

Banking services provided by: Cross River Bank

What stands out: Services designed for a unique target audience

TrustPilot: N/A

Apple Store: N/A

Karat Financial, which is best known for its business credit card, tailors its offerings for gamers, bloggers, Instagram and Facebook influencers, Twitch streamers, and TikTok and YouTube creators, among others.

It’s a growing niche. The venture capital firm SignalFire, one of Karat’s backers, says about 50 million people monetize their content at least part time and more than 2 million earn over $100,000 a year.

In assessing the creditworthiness of its Black Card applicants, Karat factors in criteria such as the size of their social media following, level of audience engagement and current revenue. Cardholders get cash back in three of 18 categories (they choose which three and can make changes every few months).

“Karat is the best card for creators. They gave me a top-notch business expense card when other financial institutions had rejected me twice.”

— Alexandra Botez, Chess Master, Twitch streamer

“I have over $3 million in revenue per year and 20 employees, but traditional financial institutions still don’t trust me with financing. Karat gets it.”

— Nas Daily, Facebook influencer

“When we launched our own coffee line (Bankroll Coffee), Karat stepped up to provide the spending limits needed to run our business when other vendors were slow in processing our payments.”

— Graham Stephan, YouTuber

Customized tax and bookkeeping services are available for a fee. Karat describes the staff as experts who understand the creator business model. “No worrying about what you owe the government,” its website says.

Karat, founded in 2019, also offers its customers advances on sponsorship payments. (An example would be a well-known brand paying an influencer to post about one of its products.)

Read more:

- 5 Digital Banking Products & Services Critical for Growth

- See all of our latest coverage of fintechs

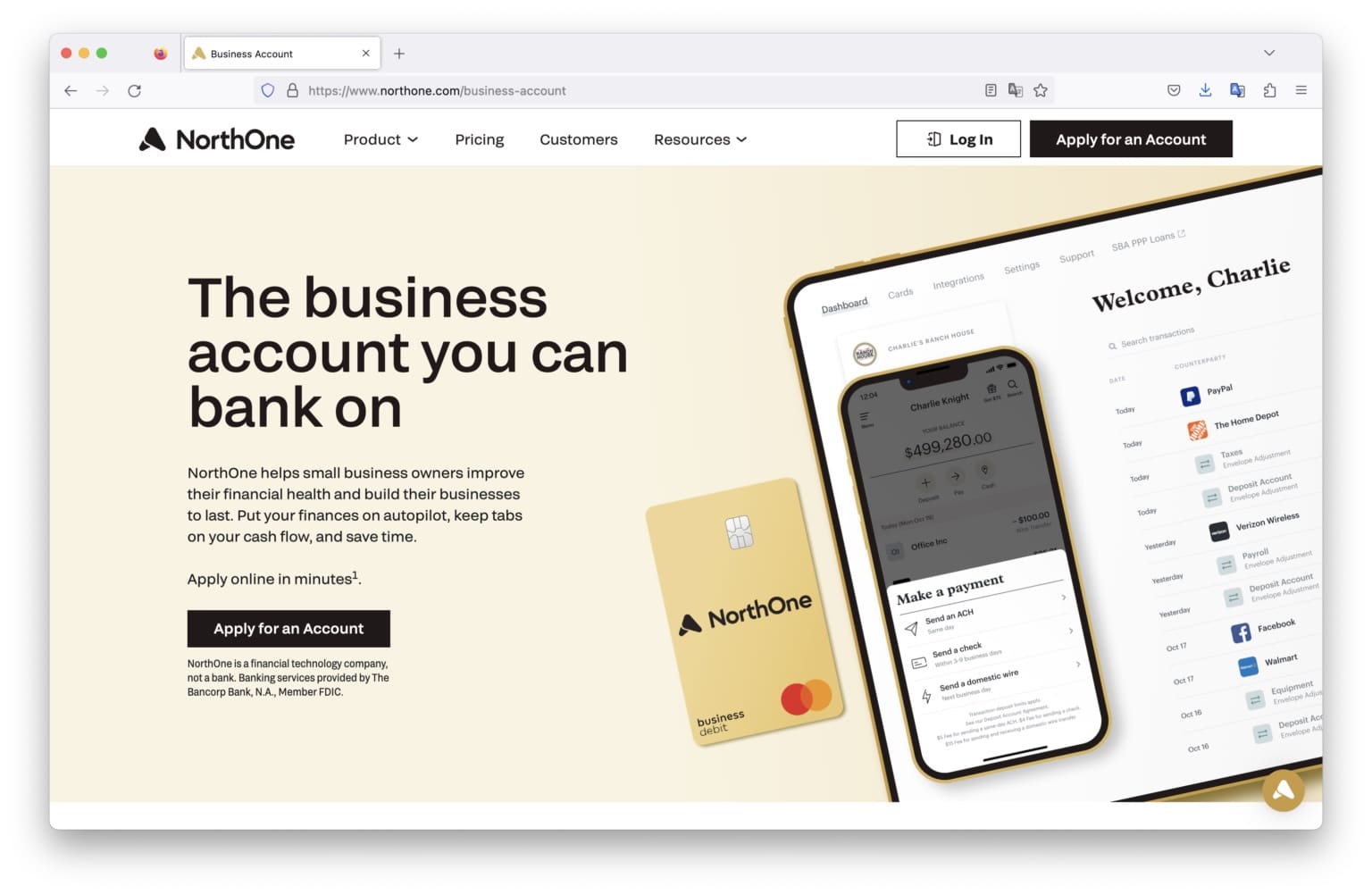

NorthOne: Automating Financial Management Tasks

Website: northone.com

Banking services provided by: Bancorp Bank

What stands out: Integrations with ecommerce platforms

TrustPilot: 2.4/5 (114 reviews)

Apple Store: 4.8/5 (2,000 reviews)

In a NorthOne survey, more than three quarters of its customers (77%) agreed that they spend less time on their finances since they signed up to use its digital banking service.

The fintech chalks this up to the fact that account holders can connect their NorthOne business account with their accounting software and e-commerce platforms, to automate tasks they might have to do manually otherwise.

Integrations with Amazon, Etsy, Shopify, AirBnB and other platforms allow users to have money from individual sales go directly into a NorthOne business account.

“By connecting the data layer between accounting, receivables, payables, lending, payroll – all the financial operations – and the bank account ledger, we can provide a transformative offering that’s always felt out of reach for our customers: a world-class finance department built for their business,” NorthOne’s cofounder and CEO Eytan Bensoussan told FinTech Magazine in an October 2022 interview.

NorthOne began offering its services publicly in 2019, a few years after it was founded, and claims to serve more than 320,000 small businesses and freelancers. It charges a $10 monthly fee for a business account, unlimited transactions and access to various digital tools.

Its users can also take advantage of assorted deals: 30% off the first 6 months of accounting platform Quickbooks, first three months free on payroll app Gusto, free processing on the first $20,000 of revenue through payment processing company Stripe, and more.

Read more: Intuit Is Drilling Even Deeper into Small Business Banking

Fractional Marketing for Financial Brands

Services that scale with you.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

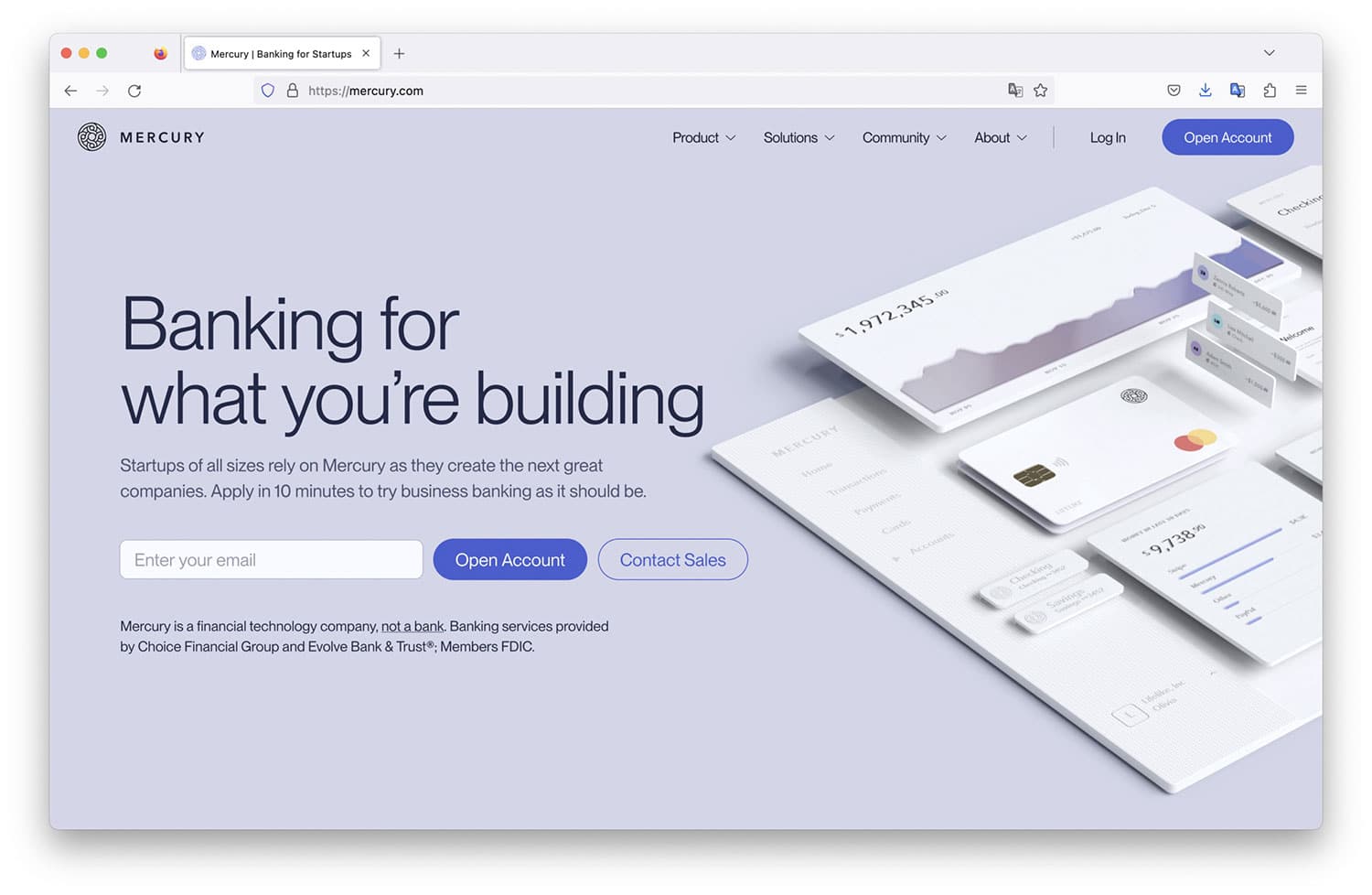

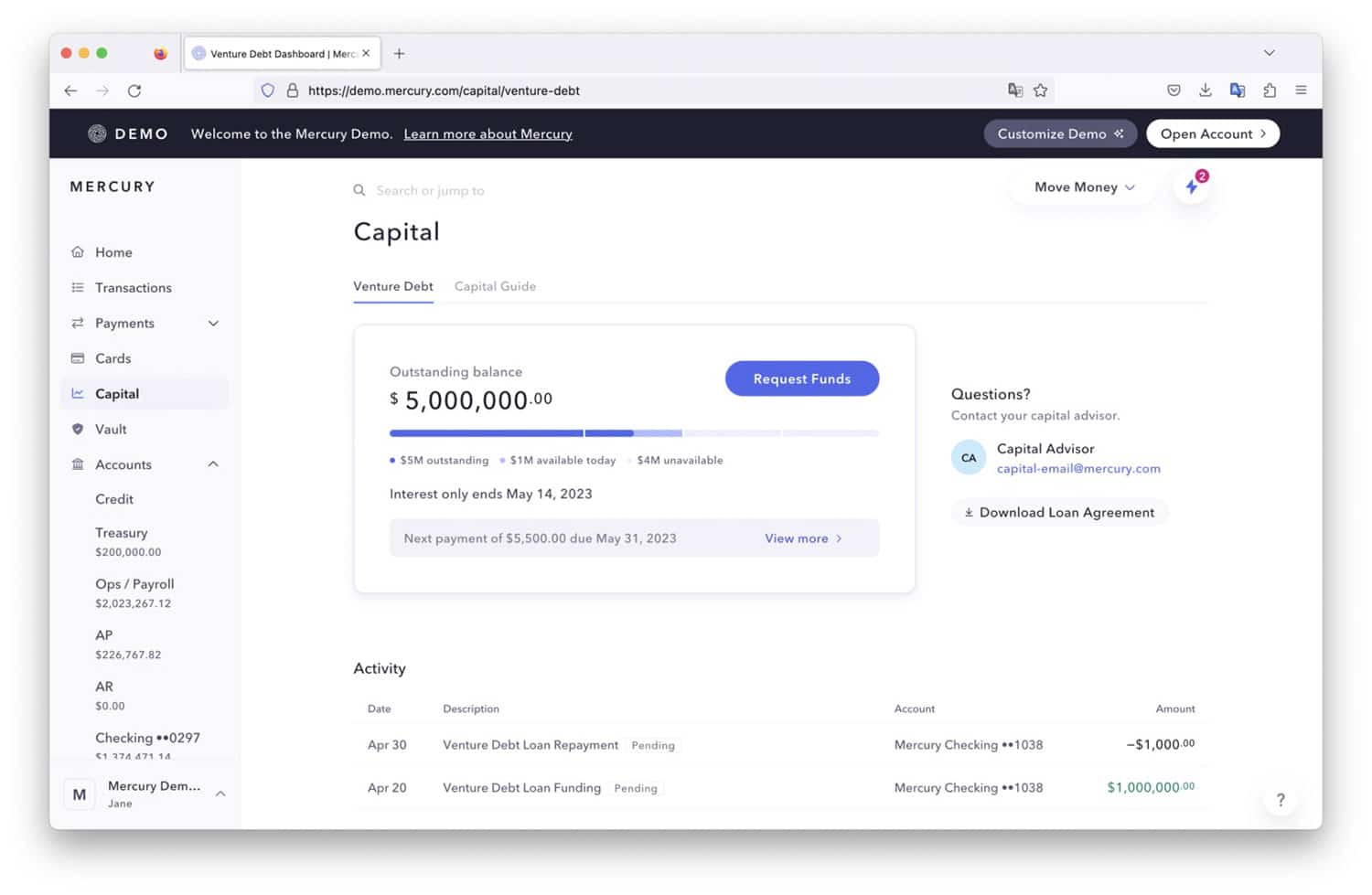

Mercury: A Financial Command Center for Startups

Website: mercury.com

Banking services provided by: Choice Financial Bank, Evolve Bank & Trust and Patriot Bank

What stands out: The lineup of startup-specific services, including venture debt

TrustPilot: 3.6/5 (582 reviews)

Apple Store: 4.8/5 (1,600 reviews)

Mercury’s digital banking dashboard is meant to be a command center of sorts for startups. It displays bank account balances, transactions, payments, active cards, lines of credit, venture capital statements, and payroll expenses all in one place.

The fintech offers checking and savings accounts, with no monthly fees and free domestic and international wire transfers. A credit card pays 1.5% cash back on all spending.

Assorted treasury products, offered through Vanguard and Morgan Stanley, earn up to 5.10% annually. Users can either do an automated option or get personalized management.

Startups across stages and industries can also apply for venture debt through Mercury, which is proud to declare that it’s not a bank. “From unnecessary red tape to clunky rules and processes, banks usually block progress rather than accelerate it,” its website says.

Startups across stages and industries can also apply for venture debt through Mercury, which is proud to declare that it’s not a bank. “From unnecessary red tape to clunky rules and processes, banks usually block progress rather than accelerate it,” its website says.

Mercury, founded in 2017, claims to have 100,000 users in 180 countries.

Read more:

- Financial Institutions Are Overlooking 68 Million People in This Segment

- How Small Business Owners Size Up Their Banking Relationships

OnDeck: Loans and Lines of Credit

Website: ondeck.com

Banking services provided by: Celtic Bank

What stands out: Straightforward products and speedy funding

TrustPilot: 4.7/5 (3,826 reviews)

Apple Store: N/A

OnDeck offers term loans and lines of credit primarily to businesses that are too small and risky to get financing from traditional banks.

Loans range from $5,000 to $250,000, with repayment terms up to 24 months, and can be used for investments such as large purchases or expansion projects. Origination fees run from 0% to 4%.

Lines of credit, which are from $6,000 to $100,000, have 12-month repayment terms that reset after each withdrawal. A $20 monthly maintenance fee is waived for the first six months for borrowers who withdraw $5,000 in the first week. Small businesses can use the revolving line to manage cash flow, including buying inventory and making payroll.

To qualify, business owners must have a personal credit score of at least 625, have a business bank account, have been in business for at least a year and bring in annual revenue of at least $100,000.

OnDeck, founded in 2006, sold itself amid the pandemic to Enova, a publicly traded online lender that operates about half a dozen brands focused on nonprime consumers and small businesses.

Read more: 5 Ways Banks Can Prevent Small Business Defections to Fintechs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Novo: Growing LLCs from the Ground Up

Website: novo.co (No, it’s not “.com”.)

Banking services provided by: Middlesex Federal Savings and Patriot Bank

What stands out: Free invoicing software that’s great for freelancers

TrustPilot: 4.1/5 (2,123 reviews)

Apple Store: 4.8/5 (13,000 reviews)

Novo’s business checking account has no minimum balance requirement and no monthly fees, refunds all ATM fees, provides users with financial insights, and has free business invoicing software built in. It does not allow cash deposits, only checks and money orders.

The fintech, which targets small business owners, entrepreneurs and freelancers, offers its customers deals on services from about a dozen fintech partners. They can get $5,000 in waived Stripe processing fees, for example, and “Novo Boost” is a free feature that provides access to Stripe payments two days early.

Through another partnership, small business owners pursuing an LLC can get 20% off a LegalZoom account.

Novo also provides direct account integration with some popular services, including QuickBooks, Xero, Shopify, Wise and others.

Check out our Neobank Tracker for a comprehensive list of digital banking providers.