With consumer business more competitive than ever, banks and credit unions recognize that small and midsize businesses (SMBs) are an increasingly vital market. Yet it too has attracted the attention of fintech and neobank competitors that seek to niche their way into a market that traditional institutions have long considered theirs.

The newcomers are exploiting gaps overlooked by banks and credit unions and building from there in a now familiar pattern. Incumbents are scrambling to capture or hold onto the dollars and loyalty the SMB market represents. To be successful they’ll need to take advantage of data they mostly already have and offer more services under one umbrella, according to a new study.

“For banks to compete for SMB relationships and win, they have to think differently about how they use data and partners to build experiences,” Fiona Roach Canning, Co-founder and President at Pollinate, told The Financial Brand. Pollinate provides digital payment tools for small businesses. It surveyed nearly 1,000 executives among traditional and neobank banking providers.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Key Differences in How Banks & Neobanks View SMBs

In its report, the company identifies different types of traditional banks in the SMB space including traditional banks, traditional banks with a digital arm and digital-first neobanks. While each of these types of banks wants to achieve a similar outcome, they all want to do so for different reasons.

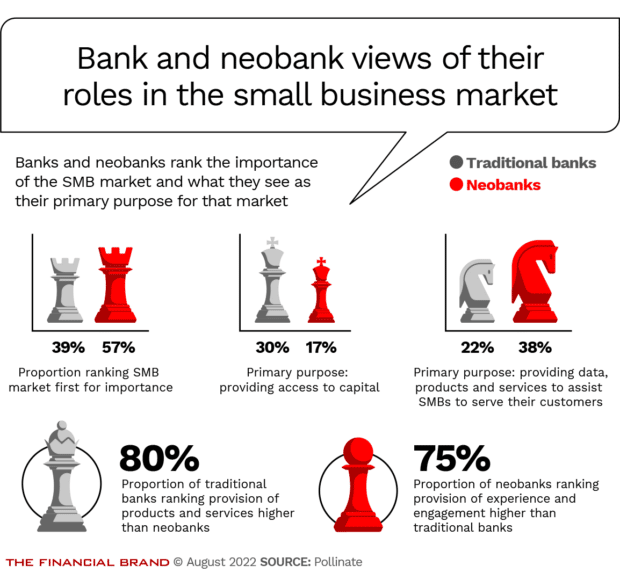

They may all have the same end-game, but the SMB survey found a stark difference in these banks’ priorities in how they operate in the SMB market. For example, digitally-focused neobanks prioritize engagement and relationship building and are 75% more likely to rank these factors higher than traditional banks. Meanwhile, traditional banks are 80% more likely to rank product-focused factors more highly than neobanks.

Additionally, traditional banks prioritize “access to capital” while neobanks rank “reducing bank’s risk of customer default” more highly. Neobanks, on the other hand, are more than twice as likely to rank “promoting wider business advice” as their primary purpose.

As SMB owners are often pressed for time and play multiple roles, they often need help, from decision-making to the day-to-day operations of their business. “The more services a bank can provide, the more it will help reduce the workload placed on SMBs in areas such as processing data, integrating dependent services, and updating systems, which will create more value for business owners and operators,” says Roach Canning.

Read More: How Square is Building a Small Business Banking Powerhouse

SMBs Seek a ‘Single Hub’ for Services and Advice

Digitization has enabled companies to serve small businesses in a more personalized and efficient way, leading digital-first disruptors to capture a larger market share. While banks have the benefits of a broader set of products, security, and brand trust, disruptors focus on serving SMBs with closed-loop ecosystems that have all the services they need in one place.

A single hub for SMBs provides a single point of access to all the services and data they need to run a business on a platform powered by payment data. This gives SMBs insights into the business to help manage cash flow, analyze customer insights and manage e-commerce and accounting. The study found fairly similar interest among traditional banks (56%) and neobanks (46%) in serving SMBs with branded and third-party products through a single hub.

Roach Canning notes the competition for customer primacy through such a hub is coming from digital disruptors like buy now pay later providers, who are creating closed-loop ecosystems grounded in point-of-sale lending. Block (formerly Square) is also building foundational relationships through payments and expanding into a whole ecosystem of services. “Big Tech is also driving innovation in this market — the latest being Apple’s Tap on Phone service,” says Roach Canning. (The service turns any iPhone into a payment terminal accepting payments from any contactless card.)

Read More: Bank as Fintech: The Future Model for Banking?

Turning the Data Disconnect Into Action

Despite the opportunities, banks have a notable disconnect regarding data. For example, while 65% of traditional banks say data is a key strength, many admit to losing business because they aren’t turning it into insights for SMB customers. Additionally, banks use only 20% of business banking budgets for SMBs.

As a result, data will be a crucial battleground of the small business market and the key point at which traditional banks compete with neobanks. When asked what the most significant areas were where data was most likely to have the biggest impact on profitable and sticky SMB relationships, 60% of traditional banks said it would be the ability to deliver more personalized customer experiences. Also, half or more cited improved cross-sell and upsell, decreased loan risk, and competitive advantage.

While there are different potential benefits as financial institutions compete for SMB business, one key one is reducing customer attrition. 38% of traditional banks say they have already lost customers because they cannot offer the required data and insights. “Although traditional banks see data as a core strength, they need to invest in harnessing its power in areas such as insights to deliver personalized experiences that business customers expect, to unlock cross-selling and upselling opportunities,” said the report.

Data Disconnect:

65% of traditional banks recognize data is a strength and 60% say it delivers more personalized experiences, yet 38% lost customers due to a lack of data and insights.

McKinsey analysts note that banks can capture many opportunities they’ve left on the table by rethinking their SMB-lending business with advanced analytics. Additionally, EY also notes that SMBs are now “more digital” in their banking expectations, with 46% citing frustrations with bank manual and paper-based onboarding processes.

Read More: 5 Ways Banks Can Prevent Small Business Defections to Fintechs

Delivering Personalized SMB Experiences at Scale

To fully capitalize on the SMB market, Pollinate noted banks need to do several things. First, they need to remove the causes of SMB attrition by enhancing their own product and distribution advantage by delivering digital experiences at scale., Additionally, they should focus investments for maximum impact by doubling down on customer acquisition and owning customer data. Finally, they should rethink supplier relationships.

They should also focus most of their investments on harnessing the power of data. Critical to this is owning the data that drives experiences and value-added services, says Roach Canning. While 96% of U.S. banks recognize the need to work with capable fintech partners they trust, only 31% have partnered with a fintech to build a solution from scratch.

Banks need fintech partners that go beyond basic transactional relationships or plugging in services, says Roach. They now need smart partners who can build alliances based on key qualities like security, collaborative working, being a trusted partner, understanding business needs, and sharing financial expertise. “Smart partners work collaboratively to not just implement tech, but also create a successful business for the bank,” says Roach Canning.