Big banks dominate the small and mid-size business market. But there is hope for smaller institutions, if they fully commit to digital transformation to complement their strengths in personal touch, locational convenience, and trust.

But right now they’re not fully committed — or at least not as many of them on a percentage basis as among much larger banking institutions — and that’s holding them back, according to a survey of bank and credit union executives conducted by FIS.

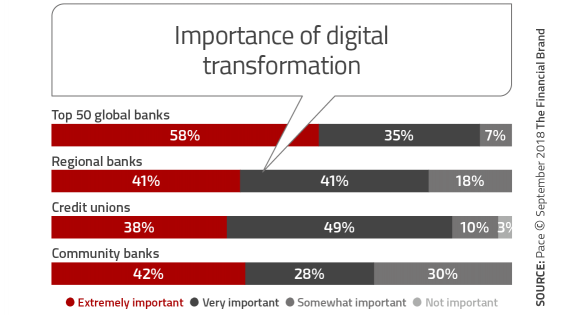

Overall, 84% of banking executives believe that digital transformation is an important strategic initiative, FIS found. That figure is strikingly close to what Boston Consulting Group found earlier this year, where 86% of banking executives said that “digitization will fundamentally change the competitive landscape and the economics of corporate banking business models.”

Financial institutions may openly acknowledge the significance of digital transformation projects, but only half said they have an explicit digital strategy.

The FIS research, part of its annual Performance Against Customer Expectations (PACE) series, indicates that at the biggest banking institutions’ investment in digital capabilities has risen to a level to match their view of its importance. 83% of the top 50 global banks and 75% of regional banks plan to increase their digital investments in the next 12 months. In fact, one in five of the respondents from the largest banks think even more spending is needed. One in four regional banks felt the same.

Read More: The Four Pillars of Digital Transformation in Banking

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Digital Picture at Community Banks and Credit Unions

More than one quarter of all credit unions think they are spending too much on digital, but one third of community banks think they are spending too little.

The picture at community banks and credit unions is quite different. A much lower percentage of community bank executives — only 70% versus 93% at the biggest banks — feel that digital transformation is “extremely” or “very” important. Credit unions are more in line with the larger banks, with 87% viewing digital transformation as at least very important.

However, the research uncovered that 28% of credit union respondents feel that their digital investments are too high. By contrast, 55% of the entire sample think their digital investments are on target.

Community bankers, on the other hand, have the highest percentage (37%) who say their institution is spending too little on digital, particularly in the area of digital payments. Here, 41% of community bankers say “payments related improvements” are where they are going to spend money. Another 22% will target “mobile payments,” including peer-to-peer. Taken together there appears to be some urgency to get up to speed in this area.

Credit unions’ top two tech investment categories are “enhanced digital channel functionality” and “payments related improvements,” both at 26%.

Among all survey respondents, the top three technology investments were payments related improvements (32%), fraud prevention (25%), and enhanced digital channel functionality (21%). The bottom three were ATMs 10%, onboarding automation 9%, and open banking APIs (9%).

Read More: Digital Banking Strategies for Small Business Customers

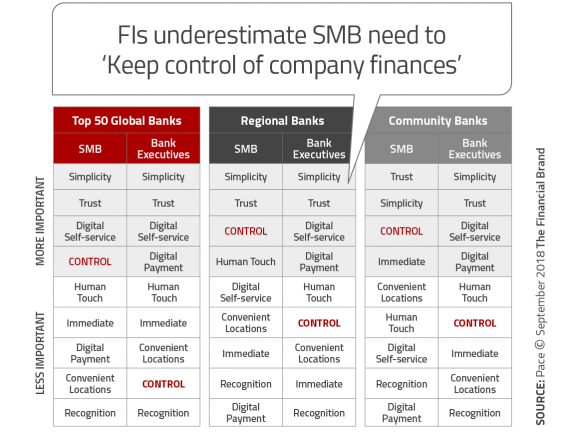

SMBs Say They Want More Control

The PACE reports from FIS include feedback and observations from three key constituencies: executives in the banking industry, retail banking consumers, and small- and medium-sized business (SMBs). In the study, banking providers and businesses were asked to rank a list of attributes — e.g., “trust,” “control,” “digital payments,” and “recognition” (i.e., how much the financial institution rewards a company for its business). SMBs picked which were most and least important attributes to them, while banking execs were asked what they thought their SMB customers would say. In the table, the SMB responses are matched to the size category of their primary banking provider.)

Overall, both sides rate simplicity and trust among the most important attributes. Of course, “trust” is a non-starter — an “ante” that must be present in any banking relationship. However, there were large perceptual gaps in several areas, notably the subject of “control.” This refers specifically to helping SMB executives “gain and keep control” over their company’s finances. Among executives at SMBs, control ranks as the third-most important attribute in their banking relationships. Bank and credit union executives believe it is significantly less important than it is.

One manifestation of the “control” issue FIS highlighted in its PACE report is that small businesses are eager for their banking provider to assist them in developing or implementing integrated payables and receivables systems, as well as payroll services.

Small businesses struggle with paperwork and want help with invoice document management and processing. They want to capture invoices digitally so they can integrate them with accounting software they use such as Sage Intacct and Quickbooks. 43% of SMB respondents want such a solution, but FIS reports that integrated payables/receivables is a low priority for banks. Similarly half of SMB execs would welcome payroll services from their banking provider.

Read More: How to Win The Small Business Banking Market

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

SMBs Don’t Realize Community Banks Are on Par With Megabanks

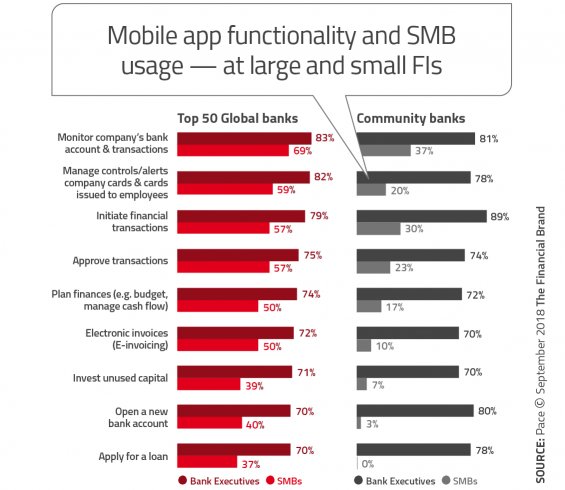

All shades and flavors of banks covered in the FIS study — including top 50 global banks, regional banks, and community banks — have similar capabilities with respect to their mobile apps. There may be varying degrees of functionality, of course, but the rising tide of technology has lifted all boats.

What is strikingly different in the responses, however, is that the SMBs using community banks don’t realize their bank has such mobile parity. Less than half of these SMB customers currently use their bank’s app for anything more than to check account balances, FIS notes.

This disparity highlights the urgency for smaller banks to educate SMBs about their mobile banking capabilities, the report says.

Researchers also asked community bankers how satisfied they thought their small business customers were with their bank’s digital payment and digital self-service capabilities. In both cases, three quarters of the banking execs say their customers are “very” or “extremely” satisfied, while significantly less SMBs agree.

SMBs Have Switching Fever

Notably 16% of small and midsize businesses say they plan to switch banking providers in the next 12 months, according to FIS. If you extrapolate the data and apply it to the six million small businesses in the U.S., that’s 960,000 business banking relationships that could be on the move in the year ahead.

These defections will come disproportionately from the top 50 global banks. According to the PACE study, one out of five of those planning to change banks are customers of the largest banks. For regional banks the number was about half that (11%), while only 3% of the SMBs planning to switch were community bank customers. However, according to a separate study from Raddon, nearly 70% of small business name a large bank as their primary financial institution.

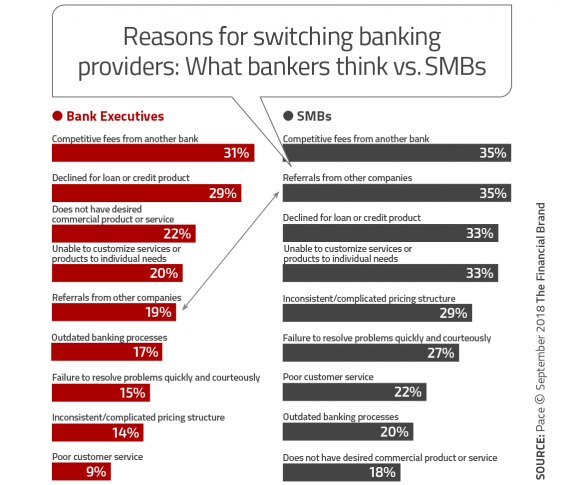

FIS queried both bank and SMB executives about the reasons why businesses would switch banks. The bankers were correct in identifying fees and being denied credit as top reasons.

However, the financial institution respondents significantly underestimated the importance of referrals as a reason for switching banks. As numerous experts have noted, in many ways small businesses follow the patterns of consumers in their financial habits. Therefore referrals from family, other business owners, social media, and other sources play an increasing role in where businesses as well as consumers do their banking.

As for where the defectors will go, the researchers point out that the four most important attributes of good banking relationships identified by SMBs were:

- simplicity

- trust

- control

- digital self service

Taking simplicity to mean “make it easy for me,” then three out of four attributes relate at least in part to technology.

Thus, community banks and credit unions shouldn’t expect a large windfall. As FIS points out, the data suggest that small businesses may simply switch from one big bank to another in search of better fees, as long as digital capabilities are equal. That makes it all the more important for community banks and credit unions to commit to digital transformation (and let their business customers know about it) if they want to remain relevant in the SMB market.