Treasury Secretary Janet Yellen said the government is open to covering uninsured depositors in banks of any size — given the right circumstances.

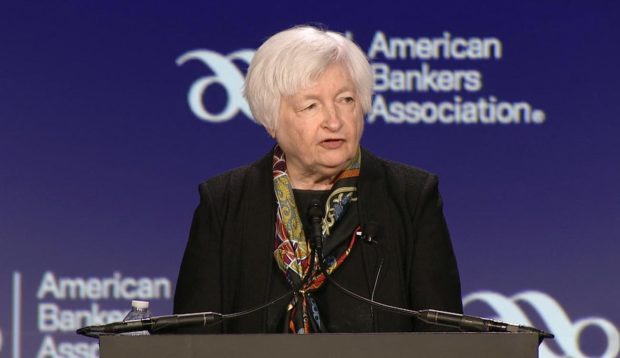

Her remarks about deposit insurance, made in a short keynote address Tuesday, March 21, at the American Bankers Association Government Relations Summit in Washington, were worded quite precisely.

Yellen said she believes that the government’s actions after deposit runs led to the collapse of Silicon Valley Bank and Signature Bank lessened the risk of more bank failures.

But the decision to extend protection to uninsured deposits at those banks has been controversial. Many critics say it creates a “moral hazard.”

“The steps we took were not focused on aiding specific banks or classes of banks,” Yellen said. “Our intervention was necessary to protect the broader U.S. banking system. And similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Yellen Calls for Regulations to Be Reviewed

Yellen said the banking industry is much stronger than it was during the financial crisis. She credited this to post-crisis legislative and regulatory reforms that increased capital requirements for banks.

But the regulatory and supervisory framework must be evaluated to ensure it addresses “the root causes” of the current crisis, she added.

“I don’t want to speculate at this point on what those adjustments might be. What I’m focused on is stabilizing our system and restoring the confidence of depositors,” Yellen said.

That effort is going well, in her view.

To prevent a contagion, the Federal Reserve introduced the new Bank Term Funding Program. It provides liquidity for banks and credit unions so they don’t have to sell assets at a steep loss to cover withdrawals.

The Fed said that $11.9 billion in loans had been made through the new program in its first three days. (The March 15 report is the most recent data available.)

The program is working as intended, and “the situation is stabilizing,” Yellen said, noting that deposit outflows from regional banks are no longer worrisome.

Read More:

- SVB Post-Mortem: Communications Lessons Amid the Collapse

- Why Silence Isn’t Golden on SVB & Signature Bank Failures

- 3 Effective Tactics to Calm Customer Fears in a Banking Crisis

What Role Did Social Media Play?

In his own remarks at the beginning of the summit, ABA President Rob Nichols mentioned the role of social media in the crisis several times and noted that the Fed is conducting an internal study of the situation.

“We hope that as part of that review, the Fed examines — among other things —the speed at which longtime customers pulled their deposits out, and the significant role social media might have played in encouraging that behavior,” said Nichols. “We see that the Justice Department and the SEC may be looking into some of those issues as well — which we welcome.”

Yellen had been asked about social media’s role during a Senate hearing on the federal budget. She said at the time that no matter how strong an institution’s capital and liquidity are, an “overwhelming run that’s spurred by social media” could put a bank into danger of failing.

Multiple venture capitalists and other notable Silicon Valley executives had used social media and other communications to urge technology startups to withdraw funds from Silicon Valley Bank.

“One of the reasons we intervened and declared a systemic risk exception is because of the recognition there can be contagion in situations like this, and that other banks can then fall prey to the same kinds of runs,” Yellen said during the hearing. (For more, see The Financial Brand‘s Crisis Timeline, March 16, “Who was the ‘Mr. Potter’ of the Silicon Valley Bank run?”)

How Yellen’s Message Has Evolved

Yellen’s speech at the ABA summit appeared to walk back comments she had made previously.

Speaking before that Senate committee last week, Yellen sparked concern when she implied that smaller banks likely would not warrant the “systemic risk exception” that had been made for Silicon Valley Bank and Signature Bank. The exception had allowed for uninsured deposits at the two failed banks to be fully reimbursed by the Federal Deposit Insurance Corp.

“A bank only gets that treatment if a majority of the FDIC board, a supermajority of the Fed board and I, in consultation with the president, determine that the failure to protect uninsured depositors would create systemic risk and significant economic and financial consequences,” she told the committee.

Community bankers worried this policy approach would create an incentive for customers with large accounts to move their money to big banks.

Yellen seemed focused on making amends Tuesday, as she described small and midsize banks as “vital” to the communities they serve. She stressed the importance of a “dynamic and diverse” banking industry, saying that while large banks play a key role in the economy, so do small and midsize banks.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Yellen: Not a Replay of the Financial Crisis

During a question-and-answer session with ABA’s Nichols, Yellen brushed off comparisons that have been made to the financial crisis. She suggested the current situation is less dire.

“2008 was a solvency run. What we are seeing now is contagious bank runs.”

— Janet Yellen, Treasury Secretary

Nichols asked Yellen about what the industry could be doing collectively to help.

“Banks need to reassure their customers that they are strong and resilient and the government needs to do exactly the same thing,” she replied. “I believe we do have a very strong and resilient banking system, and all of us need to shore up the confidence of depositors that that is the case.”

Read more: Trouble With the B-Word: How Bankers Should Counter Talk of ‘Bailouts’

Should the Deposit Insurance Limit Be Changed?

Following Yellen’s ABA summit speech, the Independent Community Bankers of America issued a statement, saying that her comments align with its goal of ensuring policymakers do not use deposit insurance to “pick winners and losers” in the banking system.

“If policymakers decide to provide unlimited deposit insurance to some institutions, they cannot leave others out — certainly not the community banks that have, as always, operated on a safe and sound basis,” ICBA President and Chief Executive Officer Rebeca Romero Rainey said in the press release.

On March 16, ICBA had attacked Yellen for saying that uninsured deposits would be protected only at banks posing systemic risks.