The most dramatic change to the financial services industry in more than a century may be the integration of digital technology as part of the back office and customer facing banking ecosystem, Whether if you consider these changes disruptive or merely just transformational, they are changing the way banking services are delivered to the consumer.

These shifts have impacted both the day-to-day operations of banking organizations as well as the long term strategic vision in boardrooms, conference rooms and innovation labs. Standing still is not an option – and the viability of being a ‘fast follower’ could be challenged, as changes are coming at the industry fast and furiously. These changes are coming in response to the dual threat/opportunity of consumer expectations and new financial technology players.

The underlying role of banking has changed much less than the way banking is delivered. The result has called into question not only the value of banks overall, but also the possibility that large tech companies could take on the role of distributors of banking services in the near future.

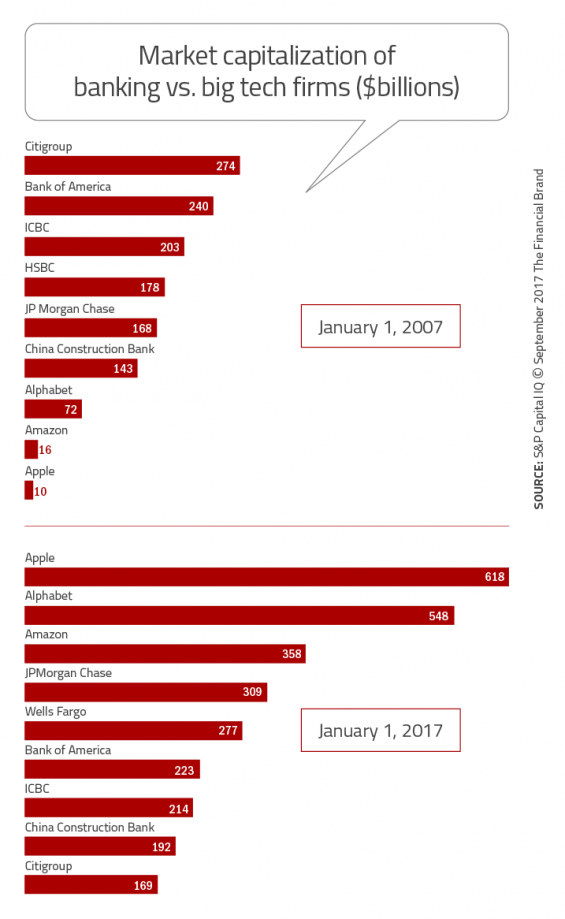

Firms like Google, Amazon, Facebook and Apple (GAFA) are often mentioned as being in the best position to be at the center of banking ecosystem in the future. Their market capitalization and use of data to deliver increasingly improved consumer experiences is a threat that can’t be ignored.

“More than ever, the banking industry needs to manage for the long-term, through cycles, even as they adapt in the short term through continuous test-and-learn experimentation,” according to the authors of the Bain and Company study, Banking Strategy for the Long Game. According to the study, the following questions must be understood:

- What are all of the possible disruptions that are relevant to our organization?

- How will these changes impact revenue, competitive positioning and the operating model?

- What can our institution do to protect the core business, take advantage of new opportunities, create options and hedges and place some long-term bets?

Read More: The Top 10 Retail Banking Trends and Predictions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Macroeconomic Trends

Each of these questions should be evaluated while taking into account interrelated macroeconomic trends, knowing that the impact on each organization would differ based on bank or credit union positioning, financial structure, customer base, etc.

- Capital abundance, low interest rates and continued pressure on spreads (market efficiency will keep spreads narrow forever).

- ‘Extended adolescence’ caused by later family formation due to less financial security. There will also be an extended ‘pre-retirement’ life stage.

- IoT and other automation devices that will disrupt employment and home/work environments

- Ease of start-up creation as computing power and other technologies become cheaper and more readily available

- The creation of value through third party integration and ‘banking as a platform’ models. (this also creates risk as large tech firms can encroach on traditional banking turf.

- Spacial disruption where location will be redefined as physical and digital reconfigure marketplaces.

- An increasing importance on trust, reputation and localization

Read More: Ten User Experience Design Trends for Banking

Preparing for Change

Bain emphasizes that not all organizations will be equally impacted by every macroeconomic trend. The key is to set in motion the planning and strategizing necessary to prepare for how each trend may impact an institution.

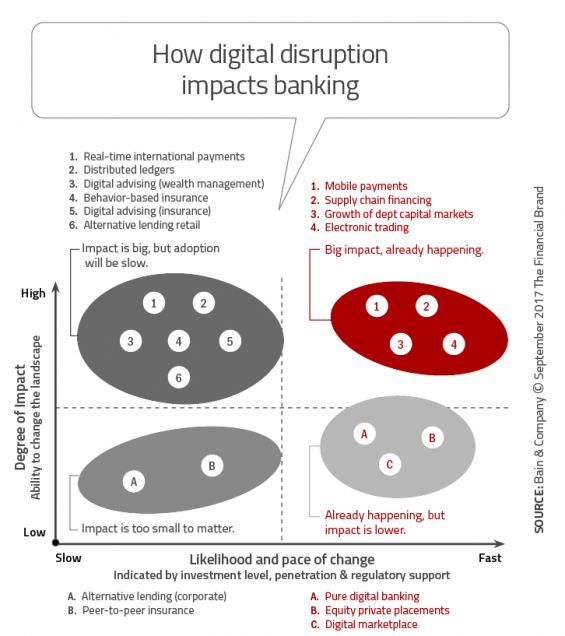

Bain recommends the possibility of using a matrix with the ‘likelihood of change’ as one dimension and ‘degree of impact’ being placed as the other. Obviously, those trends that will have the greatest impact and are most likely to occur will be of greatest urgency.

Read More: Banking Needs an ‘Amazon Prime’ Marketing Strategy

Proactive Preparation for Opportunities

Taking a ‘wait and see’ approach to planning is not a viable option. Instead, banking management teams need to commit to investments that limit risk and allow an organization to take advantage of market opportunities. Bain suggests that the best strategies blend 1) No-regret moves that add value with minimal risk, 2) Options and hedges that protect against major negative shifts and allow for participation in significant positive movements, and 3) Big bets that will define the long-term viability of an organization.

Just because these discussions and decisions are significant to the future vaibility of an organization does not mean that they need to be done only in the executive suites of banks and credit unions. The inclusion of managers and key personnel at all levels of the organization allows for better field views of situations. The inclusion of the board of the directors in the early planning stages also allows for a bank or credit union to leverage outside perspectives that often are included only in the latest stages of planning.

“Incorporating macro themes into the long-term planning process helps banks build a strategy that will accommodate a future well beyond the next few quarters,” according to the Bain report. The key is to monitor what is occuring in the industry on an ongoing basis as opposed to just during traditional planning phases. Change does not occur in annual cycles – it happens daily, with the impact on the banking industry sometimes being dramatic.