Foresight Research surveyed almost 11,000 banking customers and credit union members in 44 markets during the 2019/2020 fall and winter to find out what is really going on in the world of banking from the customer/member’s point of view. Then we added another survey in July, 2020 of almost 700 customers and members to find out what the pandemic had changed in the banking industry. The respondents were over 18 and make or participate in the family banking decisions so they know what they are talking about.

In these surveys, two of the questions asked were “How long have you banked with your primary financial institution?” and “How likely are you to switch to a new primary financial institution in the next year or two?” In the 44 markets surveyed pre COVID-19 we found the answer to both questions to be about the same — 11% to 12% reported being with their financial institution less than 2 years, and 12% intend to switch in the next year or two. While there are some different patterns for large banks, community banks and credit unions, overall we concluded this is stable.

Churn Rates Will Rocket After COVID

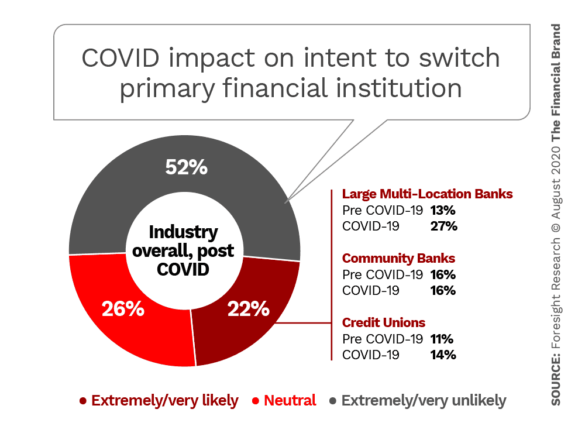

In the post-COVID survey, however, the world turned upside down. We found a hot spot of churn. The length of time with their primary financial institution remained about the same. But the intent to switch institutions (over two years) increased from 12% to 22%.

Let me say that again: 22% of these customers and members report that they are “extremely or very likely” to switch their primary financial institution in the next year or two. For the large multi-location banks the figure was a whopping 27%. And that is very different because we generally find the large banks to enjoy a very stable customer base.

The Cause of All This Customer Churn

We drilled down to get an answer to the question: Why had the numbers changed so dramatically? We looked at bank customer and credit union member expectations and satisfaction. We looked at what specific products are being purchased. We also looked at customer and member demographics and where they bank (primary and secondary institutions). We analyzed what it is the switchers are looking for in a new banking relationship. Then we compared all of that to our supplemental pandemic survey.

With that understanding, the current financial institution could slow the churn, or a competitor could attract the switchers. Here are some more of the findings.

During the pandemic expectations were much lower — not surprising considering that many customers and members realize the problems are caused by the virus, not the bank or credit union. However, satisfaction tanked on many specific attributes. This also does not seem surprising considering that many lobbies were closed or had limited hours.

(expectations and levels of satisfaction) and there was pretty much universal decline. Interestingly, credit unions fared significantly better and satisfaction improved on some attributes. Some of the fundamental banking operations (like processing transactions accurately or handling problems — high priorities for customers and members) were likely negatively impacted by lobby closure or reduced access. Bank customers and credit union members place a high priority on access — both traditional and digital.

Did digital banking become a lot more important? Some, but digital access was already important to most customers and members.

More grim news. Of the people who intend to leave their financial institution almost three out of four were Gen Z or Millennials — the very block of business that drives the future of your financial institution. And overwhelmingly they are men.

So, what drove the high churn? Even though satisfaction declined greatly (except at credit unions) that was not the culprit. Customers and members were generally empathetic, likely thinking “we are all in this together.” This showed up in an overall satisfaction measure which did not tank. The message is that while performance was rated noticeably lower on many specific measures, there existed a kind of forgiveness which showed up in the overall satisfaction measure.

But when it comes to products that are interest rate and fee sensitive it was all different. It was all about financial issues, not the banking experience or access. The switchers, while forgiving, also are looking to reduce cost or increase interest on items like money market accounts, CDs, personal loans, etc. The low interest rate environment likely plays a role, but that would be equally true in the months just prior to the pandemic.

So, blame the pandemic, which seems reasonable given the uncertain times we are living in. Millions of people are unemployed and under employed and worry about paying rent or mortgages. During a time of expanding food banks and the possibility of unemployment benefits being used up — cutting costs is a natural reaction. When it comes to banking, they are looking to get the most out of lower fees and higher interest rates. And that becomes fodder for marketing content.

This report contains a lot of detail that can be very useful to slow the churn or attract new customers and members because of the churn. Understand the specific actions that have the best impact in these uncertain times. Or, on the flip side, understand the marketing messages and targets that could attract new customers and members.

Other Reports on Many Marketing Issues

For many years, large banks and credit unions have had this type of information. The outcome: more effective messaging, better use of media, better personnel training programs, improved results. Now local banks and credit unions can compete on a level playing field with these new affordable reports — with the facts from the voice of the customer and member at your side.

A variety of reports are available — a few examples: The Excellent Banking Experience – Means Business; Attracting Gen Z and Millennials to your Bank or Credit Union and The Vulnerable Community Bank. And for many of these reports local market highlights are available — for 44 markets.

Foresight Research (a Michigan marketing research company) and a leader in cost effective syndicated market research has been working with Fortune 500 companies for over 20 years.