The deal that New York Community Bancorp struck with the Federal Deposit Insurance Corp. for pieces of the failed Signature Bank is something of a dealmaking trifecta.

In one deal, NYCB has picked up a huge infusion of sorely needed deposits, loans that’ll help it diversify, and highly experienced employees with deep business ties who for two decades have made Signature into a growth engine.

“This jumpstarts many of the initiatives we were planning to roll out over the course of the next several years,” Thomas Cangemi, president and chief executive officer at NYCB, said during a call with analysts Monday.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

What Makes This FDIC Deal So Sweet for NYCB

From a strategic perspective, the government-assisted acquisition dovetails with NYCB’s plans to transition away from a savings institution to more of a commercial banking model. This shift has been underway since Cangemi took over as CEO in December 2020.

With Signature, Cangemi is doubling down, as the ink is barely dry on NYCB’s acquisition of the $25 billion-asset Flagstar Bancorp of Troy, Mich. Signature will be folded into the Flagstar Bank unit.

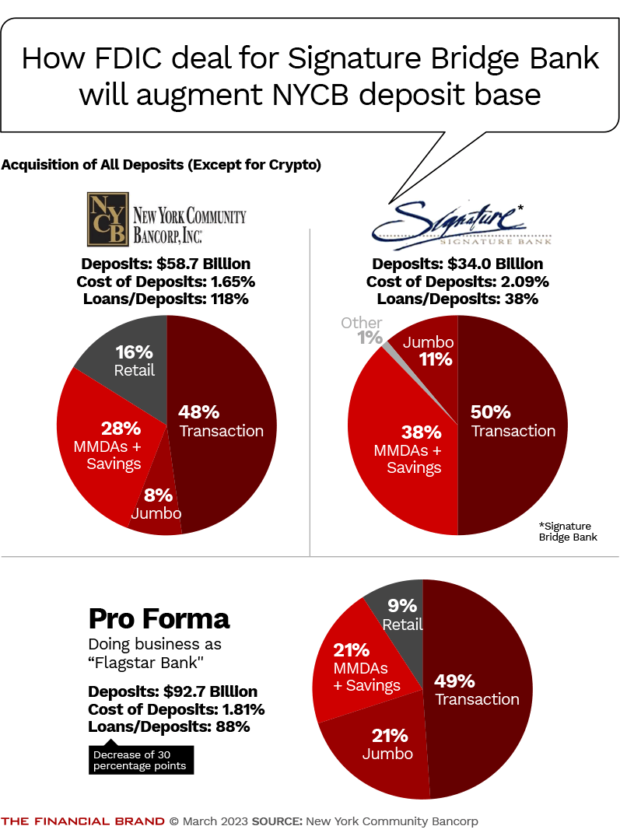

Of all the benefits that Signature offers NYCB, one of the most important is an influx of deposits. NYCB had a loan-to-deposit ratio of 118% at yearend, versus Signature’s ratio of 38%. NYCB assumed about $34 billion of Signature’s deposits, leaving behind only the deposits associated with cryptocurrency businesses. On a pro forma basis, NYCB’s total deposits will increase to $92.7 billion, and its loan-to-deposit ratio will shrink to a much more comfortable 88%.

NYCB also gains 40 Signature offices, 30 in the New York metro area, seven in California, two in North Carolina and one in Nevada. On a pro forma basis, that gives it 435 branches in 12 states.

The NYCB and Flagstar branch systems are operating separately for now, with the Signature branches as part of Flagstar. A unified rebranding for all locations under the Flagstar name is in the works.

And something not to be overlooked is the speed with which the deal got done.

NYCB’s acquisition of Flagstar, which closed in December 2022, took 18 months to wrap up. The deadline had to be extended twice, as it got caught up in changing regulatory policy on bank mergers under the Biden administration.

By contrast, the FDIC took over New York City’s Signature Bank on Sunday, March 12, and announced the deal with Long Island-based NYCB on Sunday, March 19. So the resolution took less than half the time in days than the Flagstar deal took in months.

NYCB will now rank as the 29th largest bank in the country, up from 35th place, based on its pro forma asset size of $128 billion. That’s just behind Discover Bank and right in the position the $120 billion-asset Signature formerly held.

But there’s another element in the acquisition that’s not so easy to quantify, as it is not something that shows up on a balance sheet or income statement. NYCB is inheriting a business strategy and a specialized workforce that Cangemi showed great enthusiasm for during the briefing with analysts.

Signature’s approach to developing business, especially deposit gathering, is through what it called Private Client Banking Teams.

Read More:

- Other ‘Signature’ and ‘Republic’ Banks Tackle Marketing Crisis

- Let’s Talk About the B-Word: An Industry Response to ‘Bailouts’

Signature Bank Was Built on its ‘Team’ Approach

In just over two decades, Signature Bank vaulted from a startup to the 29th largest bank in the country, mainly through strategic hiring. The key to its success was “team liftouts.”

Over and over again, Signature would hear about a team of bankers that was unhappy with their current organization. Management would make them an offer, and uproot the team as a whole, replanting it in Signature’s garden. The bank became so adept at recruiting people — thus, acquiring the relationships and the deposits that those bankers brought with them — that in a 2016 profile of the institution by Banking Exchange the management team was dubbed “Raiders of the Lost Staff.”

Joseph DePaolo, its longtime president and CEO and one of its founders, was quoted in that profile about the strategy: “Everyone thinks of banking as lending. I think of banking as bringing in deposits. If I have to give you money, it’s easy to bring you in as a client. If I have to get your money, it’s harder. Fundamentally, our belief is you build the bank for the deposits.” (A succession plan had been announced in late February, with chief operating officer Eric Howell adding the title of president on March 1, only days before the FDIC took over the bank. DePaolo was slated to transition to an advisory role in late 2023.)

A key aspect of the strategy was that it was a “single-point-of-contact model,” in Signature’s parlance. The result was white-glove service that overcame client roadblocks.

In its 2021 annual report, management stated that “by creating a network of private client banking teams comprised of veteran bankers who serve as a single point of contact to meet all client needs, Signature Bank visibly distinguished itself in an overcrowded banking arena.”

Incentive compensation helped ensure that the teams produced. Team members lived under an “eat what you kill” approach.

Read More:

- 8 Deposit-Raising Tactics You Might Not Be Trying

- Why FDIC Deal for Signature’s Loans Thrills Customers Bank

Bolting Together Two Compatible Business Plans

Signature built on this strategy initially in the east, most notably in New York City and surrounding areas, and in recent years took its approach to the west coast. The bank started in 2001 with a dozen teams, but had well over 100 at the time the FDIC took over.

Cangemi, who took the helm at NYCB after the abrupt retirement of its longtime CEO Joseph Ficalora, said Signature bolts on expertise and experience that complements the existing business model at his bank.

“This is a remarkable opportunity. You know, we’re in the midst of rolling out a unique model with very similar attributes when it comes to compensation. But we’re just getting off the ground floor. This is adopting a proven platform, with a long history, where Signature has done an amazing job as deposit-gatherers.”

— Thomas Cangemi, New York Community Bancorp

The only teams that NYCB opted not to retain were those that served crypto businesses and venture capital firms — which, Cangemi said, “didn’t fit our niche.”

Deposit-building has been a high priority for NYCB — Cangemi joked with analysts that since he came in it’s been “deposits, deposits, deposits and funding, funding, funding.” He sees the deal as buying him a lot of “boots on the ground” in hard-to-penetrate business sectors. Signature had an enviable roster of clients among New York City law firms and real estate management firms, for example. Both of these make use of escrow accounts, which can be a good source of deposits.

Signature’s team approach “is an entrepreneurial way of deposit-gathering,” said Cangemi.

“NYCB has effectively fixed its funding challenges overnight and has significantly more flexibility than it previously had,” Keefe, Bruyette & Woods analysts said in a note about the Signature deal.

“We see the FDIC transaction for Signature as a significant signal from regulatory agencies in favor of NYCB,” a Janney Montgomery Scott analyst note said.

Still, the proof will be in the results.

With both the Flagstar and Signature acquisitions to integrate with its legacy operations, NYCB will be marrying three institutions simultaneously, which creates some execution risk, as DBRS Morningstar analysts noted. But “NYCB has a strong track record integrating acquisitions and FDIC-assisted deals and has typically outperformed other banks in times of stress,” they wrote.

The once-acquisitive NYCB had not done a deal in more than a decade when it acquired Flagstar.

Prior to that, its most recent transactions had been FDIC-assisted deals for failed banks in 2010 (Desert Hills Bank in Arizona, $452 million assets, $375 million deposits) and in 2009 (AmTrust Bank in Ohio, $11 billion assets, $8.2 billion deposits).

Read More:

- What to Do About the Surprise Risks of Social Media and Mobile Banking

- Why Silence Isn’t Golden on SVB & Signature Bank Failures

Signature Helps NYCB With Diversifying Its Loans

NYCB was built on serial acquisitions of mostly savings institutions in the New York metro area and several other states. The 2022 acquisition of Flagstar was the boldest, biggest move away from NYCB’s historical core before the FDIC deal for Signature was announced.

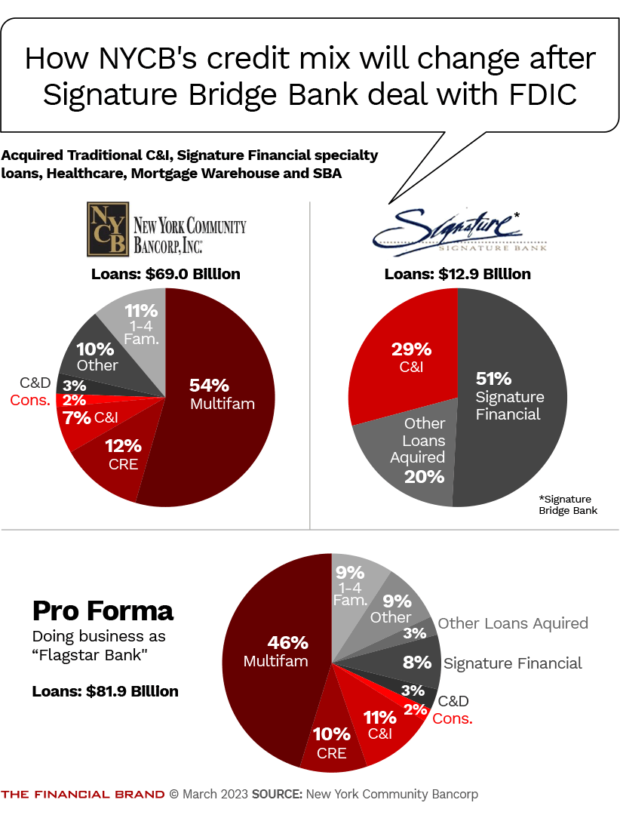

One area where NYCB is eager to bulk up is in commercial and industrial lending, commonly called C&I for short. Both Flagstar and Signature provided a boost in that loan category.

In the Signature transaction, NYCB is taking on a total of $13 billion in loans from assorted business lines. The largest share is from specialty commercial lending such as equipment financing. C&I loans make up the second-largest category. The rest are a mix of healthcare lending, which includes hospitals, large medical practices and nursing homes, among other things; mortgage warehousing lending; and Small Business Administration loans.

A lot of the loans NYCB left behind are in two areas where it has some concentration, multifamily and commercial real estate. But under the terms of the FDIC deal, NYCB has the option to act as a fee-based servicer of those Signature loans. It also has the option to service Signature’s loans to venture capital and private equity firms.

NYCB historically has been the country’s leading on-balance-sheet multifamily real estate lender, often in competition with Signature itself. NYCB is not taking ownership of any of Signature’s multifamily loans, partly because of a desire for diversification, but also because of the economy. “It’s clearly being prudent in the current marketplace,” said Cangemi.

He added that NYCB also opted not to take on office-CRE loans from Signature, both to avoid additional concentration and in recognition that “there’s a lot of grumbling about office” at present.

Will Signature’s Deposits Be Sticky for NYCB?

Unlike some other large regionals, NYCB had minimal deposit runoff in the wake of the failure of Silicon Valley and Signature banks. NYCB’s expectation is that whatever depositors wanted to leave Signature have done so.

Analysts questioned NYCB’s ability to retain the Signature deposits it gained, but Cangemi was optimistic, saying he not only expects those to stay, but is hopeful some that left will come back.

He pointed out that the majority of the deposits NYCB is getting from Signature are tied to the efforts of the private client banking groups. Approximately 40% of those deposits are operating accounts and payroll accounts — true relationship banking balances and not hot money — according to Cangemi. Most of the deposits come from middle-market businesses, including law and accounting firms, manufacturers, healthcare businesses and real estate management firms.

NYCB’s stability — and its plan to keep Signature’s “white-glove” teams intact — should give the failed bank’s depositors comfort, Cangemi said. “A lot of the money that left, left fast,” he said, adding that he hopes that those depositors understand that NYCB “is there for them and there for the relationship managers.”

Cangemi also told analysts that some legacy Signature customers could develop broader relationships with NYCB, given its leading role in the multifamily market.

Bookmark This for Daily Updates:

Rebranding Effort Ahead for NYCB

With the addition of Flagstar and Signature, the “New York” in NYCB’s name no longer reflects its geographic scope. It now has locations on the eastern seaboard, and in the Midwest around the Great Lakes, the Southwest and the West.

Going forward, NYCB will be adopting the Flagstar name, albeit with a new logo and new branding. It aims to start rolling those out in late 2023. Its systems conversion is slated for the first quarter of 2024. (The NYCB and Flagstar branch systems are operating separately for now, with the Signature branches as part of Flagstar.)

At NYCB’s earnings briefing for the fourth quarter, Cangemi predicted that 2023 was going to be a “block and tackle year,” where the company would be busy integrating Flagstar to create a bigger, more diversified business. With Signature, NYCB faces that much more blocking and tackling.