Even a cliché can still have some juice left in it if you squeeze it. Right now, “never let a crisis go to waste” is very timely. A major new report from McKinsey advises that banking institutions can not only survive, but thrive, through a crisis that in some ways is only beginning its serious financial second wave — if they take the opportunity to completely rethink their business models and learn from the first wave of the COVID-19 crisis.

What makes the timing of the consulting firm’s advice interesting is that it suggests that smart institutions will begin rethinking how and what they do even as they deal with a more immediate fire.

At the time that McKinsey released “A Test of Resilience: Banking Through The Crisis, and Beyond,” the health crisis aspects of the coronavirus crisis had run about nine months, depending on where you are and when you started counting. While financial institutions have had to make major strategic and tactical moves to keep doing business, the banking industry’s financial challenges from the pandemic haven’t really started yet. In addition, the coming financial crisis will be different from those in the memory of anyone working in banks and credit unions today.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

How Bad Can the Near Term Get? Pretty Ugly

McKinsey’s report gives scant comfort as it issues its warning:

“Unlike many past shocks, COVID-19 is not a banking crisis: It is a crisis of the real economy. Banks will surely be affected as credit losses cascade through the economy and demand drops. But the problems are not self-made. Global banking entered the crisis well-capitalized and is far more resilient than it was [during the Great Recession]. Our latest research indicates that in almost all COVID-19 scenarios, the vast majority of banks should survive.”

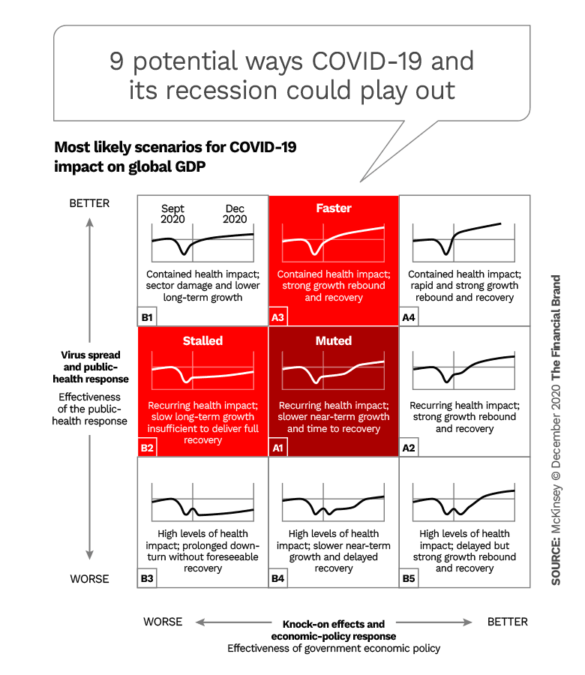

In the chart below, the center, dark red square (A1) marks the most common expectation for the combined health and financial crisis. The two lighter-red boxes (A3 and B2) denote other widely expected scenarios. The “B”s are harsher, the “A”s less so.

The report goes on to say that while many dollars of revenue surrendered to COVID-19 will never be recouped, the firm believes that most banking institutions will be able to regain their 2019 return on equity levels within five years. However, there is a caveat:

That scenario will only occur if financial institutions, in the words of the report, “are willing to do the hard work necessary on productivity and capital management.” Those willing to do that can build on efforts that began pre-COVID and those implemented to meet COVID’s challenges to come out of the approaching turmoil set for the future.

While the financial stage of the COVID crisis may not kill many institutions, it will cause some to cash in their chips. “Some banks are already pursuing M&A before things get worse,” the consulting firm says.

A good deal of COVID’s impact hasn’t yet hit banks and credit unions because of a combination of government assistance programs and regulatory ease. But McKinsey makes it clear that “few expect this state of suspended animation to last.”

Continuing, McKinsey warns that: “First will come severe credit losses, likely through late 2021; almost all banks and banking systems are expected to survive. Then, amid a muted global recovery in 2022, banks will face a profound challenge to ongoing operations that may persist beyond 2024.”

Some fundamentals of the banking business are already eroding. How and if they come back won’t be known for some time. Extremely low rates are affecting the basic role of intermediary played by most banking institutions. They have historically lived chiefly off spread income — the difference between loan and deposit rates. But the challenges of tiny spreads in most credit areas, with losses potentially coming on top of that, makes what’s in the offing seem like a game changer.

McKinsey speaks in terms of “a long winter of 0% interest rates.”

The firm also suggests that financial institutions stop and take a fresh look at their traditions. McKinsey makes that point that a growing number of challenger institutions have been encroaching on banking, but that they leave the spread income conundrum to traditional players and make their money in other ways, such as interchange fees.

Traditional institutions will have to address whether to adopt pages or whole chapters from the challengers’ playbook.

Read More:

- Why Financial Institutions Must Build Long-Term Digital Strategies Now

- Digital CX Now The Ultimate Factor In The Fate of Banking Brands

Blocking and Tackling Followed By Adaptation and Innovation

The road immediately ahead is ugly.

“No one should confuse survival with success. With capital and revenue greatly diminished, banks could face the risk of a kind of twilight existence.”

“The crisis will play out in two stages,” the report states. “For most banks, the chief concern through 2021 will be credit losses of a magnitude not seen in decades. In 2022-24 and possibly beyond, decreased demand and anemic net interest margins will surpass risk cost as the industry’s primary ailments.”

At the same time, as the economy turns down further there will be less demand for credit. And McKinsey expects lenders will generally tighten their standards in evaluating those requests for credit that do come in.

Many institutions have ample capital buffers to chew through and the credit expertise to make it through the credit storm. However, as McKinsey states, “no one should confuse survival with success. With capital and revenue greatly diminished, banks could face the risk of a kind of twilight existence.”

The solution to the immediate crunch, beyond strengthening credit and risk management muscles, is to further develop productivity enhancements already begun.

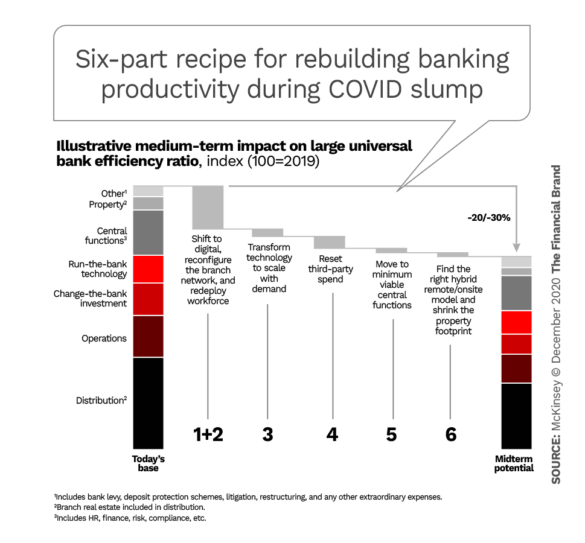

As outlined in the chart above, many of the steps necessary to McKinsey’s idea of building a “productivity engine” aren’t brand new. Institutions have been using these ideas to varying degrees for some time, such as rethinking their real estate footprint.

But now, the stakes are much higher.

Looking at the six productivity steps in a bit more detail:

Accelerate the shift to digital and revamp the branch network. “Trends are going against the branch.” says McKinsey. “But capturing productivity gains is not a matter of bluntly reducing the branch network.” The report advises that institutions need to reinforce the COVID-necessitated shift through consumer education and other measures. Simultaneously contact centers must be improved to handle more volume, while branches must be reimagined. For example: The study recounts how one bank used machine learning to study usage of seven core products, enabling it to cut branches by 15% while losing virtually none of the branch network’s profitability.

Redeploy and reskill the institution’s workforce. The study projects that as the need to use staff more efficiently rises, many more employees will be trained as universal bankers, or even beyond that. A branch banker may spend part of their time working for a contact center, adopting permanently a stopgap measure from the early days of the pandemic.

Get serious with IT and use it for change. “Although several are already on the technology-transformation journey, many banks have barely left the starting line,” the study says. Less than ten cents out of the IT dollar spent at the average bank increases functionality. The rest of that tech buck goes to keeping up with demand, according to the study. This needs to be rebalanced. In addition, more attention must be paid to recruiting strong IT people. In leading institutions, 80% of IT staff write code versus 25%-50% at traditional institutions.

Simplify and streamline central support. Many functions like human resources, risk management, legal and marketing may lend themselves to a slimmer approach, using alternative no-frills versions to cut costs and raise productivity.

Find the right balance of work from home and work at work. “With new remote-working models in place,” the study says, “many banks see opportunity in permanently adding flexibility to the way people work.”

Reset spending on third-party services. “In the crisis,” the report notes, “some expense lines have soared, and others have plunged, presenting opportunities to reset the bank’s external spending.” In many cases a fresh look at vendor relationships across the board will reveal relationships where pricing no longer reflects what else is available in the market. The familiar and longstanding may no longer be the best deal.

Going Beyond Traditional: Finding A New Mission For Your Institution

So far, the steps suggested concern strategies and activities centered on financial institutions’ traditional roles from traditional viewpoints. With the role of spread diminishing for the foreseeable future, McKinsey suggests that some institutions may decide to ditch traditional approaches.

“The pandemic has given banks a glimpse of the potential for a different way of operating …,” the firm says. “Banks’ achievements have been made by adrenaline and force of will — and much more is now possible. Banks need to shift to a more sustainable speed by design, with customer centricity at its core.”

In some ways McKinsey’s suggestions come down to acknowledging the changes wrought by COVID and accepting that life won’t go back to what banks and credit unions had before. But the firm also suggests things that will definitely put many in the industry beyond their comfort zones. A sampling:

- Focus on the customer — finally and for good. Advisors have been calling for this for ages. What’s new here is that McKinsey suggests that measuring customer feedback needs to be continuous now. “Points of failure” must be identified and corrected quickly.

- Be willing to give up old irrelevant data, even deemphasizing traditional sources. If the COVID period could be summarized, financial institutions had to learn how to make significant decisions using much less data than usual while ignoring data and experiences that didn’t relate to the present. Says McKinsey: “In the crisis, a lot of banks’ data proved not just imperfect but nearly useless.” An example: Fresh, immediate data gathered via mobile tracking may be more valuable for some decision making versus traditional sources, such as the Federal Reserve’s Beige Book, that have long time lags when the industry needs “COVID speed.”

- Find the right blend of agile development and remote working. Two trends push and pull at each other. On one hand, the need for haste demands agile development, which classically requires physical proximity to enable continual collaboration. On the other, COVID pushes staff towards social distancing and working from home. New ways of reaching decisions, new ways of meeting more productively must be found.

However, beyond such measures, McKinsey thinks institutions must begin thinking about changing their business model.

Consider this, from the report:

“Over the past few years, financial-services business models that rely on fees, such as payment networks, have seen their valuations rise steadily faster than risk-intermediation businesses like traditional banks. For the first time, in 2020, the total market capitalization of the largest three payments companies globally surpassed that of the three largest banks.”

Between that and fintech players’ frequent ability to find income streams far removed from spread lending income, banking institutions have a strong reason to reconsider what being a “bank” means, and whether it matters, per se, anymore.

Adapting to a long-term low-interest environment, as discussed earlier, is unavoidable. Development of new fee-based services must be pursued, while acknowledging that some fintech rivals may be doing so by offering the services for “free.”

McKinsey urges institutions to explore new structures, such partnering through ecosystems.

A potential strategy to find the right path is to form a digital bank that intentionally steps out of the usual groove. The report makes a case this way:

“The digital-only bank can operate at very low cost, up to 70% lower in steady state compared with traditional operations. Creating such a separate entity often allows it to be launched faster, with fewer constraints related to legacy technology, and it allows banks to test concepts at lower risk before attempting to transform their entire business. Over time, the bank can move parts of the legacy business to the new system.”