At the beginning of the previous decade, I was working as a strategic consultant for a large marketing services organization serving the financial services industry. I was 55 years old, and concerned that the way banks and credit unions were going to connect with consumers would change drastically, moving from direct mail to digital communications. Just as concerning was the prospect of clients assuming I was too old to keep pace with these changes relatively late in my career.

Rather than being complacent and continuing with “business as usual,” I decided that I needed to embrace the marketplace changes that were inevitable, take personal risks, and disrupt my career that had been quite successful for more than 30 years. I decided that I needed to learn new skills and build a personal brand that would show that I was still relevant to clients, prospects and peers.

This is the same crossroads that every financial institution executive and manager faces today. Will people who have built successful careers for decades be able to adjust for the massive changes taking place? Or will they hope that change will not impact them, or that they will retire before they are forced to change or asked to leave the organization?

Change is Inevitable … and Accelerating

One thing is certain in today’s marketplace: Change is happening faster than ever before and will not happen slowly ever again. New technologies are being introduced that are replacing current jobs and dramatically changing the way all jobs are performed. At the same time, competition and consumer expectations are changing the way every organization will go to market in the future, requiring new skills and insights from executives and managers at all levels of the organization.

This era has been labelled the 4th Industrial Revolution, where data, advanced analytics and automation are upending existing business models. The challenge is that most organizations are not prepared for these massive changes, with many lacking the leadership and cultural foundation to be successful.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Responding to Change is Not Optional

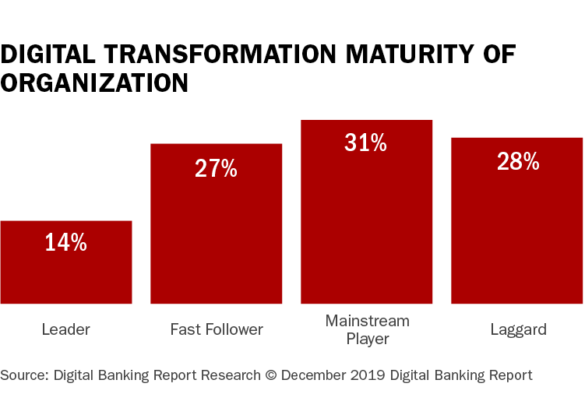

Research conducted by the Digital Banking Report has shown that there is almost universal awareness that change is happening and that business models need to be adjusted. The problem is that most organizations (and people who work for those organizations) are not acting accordingly. In fact, when we asked whether organizations considered themselves to be digital transformation “leaders”, only 14% said they were making the changes needed. Possibly more concerning was that 27% considered themselves to be “fast followers,” 31% said they were “mainstream players,” and 28% admitted they were “laggards.”

In other words, while organizations and their teams know that change is needed, the mass majority are either not taking action or are slow to do so.

When I was faced with the decision to either change my approach to market conditions or “wait to see what happened,” I decided to disrupt myself. I decided to change the way I approached the market by writing a blog that provided insights about what was going on in the retail banking industry. I used the blog as a way to force me to learn something new every single week. The research I did also provided me a “door opener” since I was still consulting banks and credit unions about financial marketing.

I became an “influencer”, not because I knew or did more than anyone else, but because I was becoming relied on by many to keep them informed on changes in the banking industry. It certainly didn’t hurt that I also was a very early user of Twitter and LinkedIn to supplement my growing communications to “subscribers.”

Lifelong Education is the Foundation for Relevancy

At times of massive change, being at the forefront of what is happening in the marketplace is the foundation for ongoing survival for businesses and individuals. While many may stop active learning when they graduate from school, leaders today need to continue to absorb knowledge in every form. Some people decide to reenter the formal learning system while others either rely on classes offered by their organization, or aggressively pursue self-development through reading, videos, podcasts, etc.

As we move from analog platforms to digital business models, learning new skills is imperative. Some of the biggest skill gaps in business today include coding, digital analytics and others not even thought of five years ago. For individuals who want to avoid being disrupted because of career complacency, these are areas where they should focus. And while organizations such as Amazon are embracing this need by committing to training more than 100,000 of their employees, most organizations won’t take this route, requiring employees to learn on their own.

One of the benefits of being a co-publisher of The Financial Brand, being owner and CEO of the Digital Banking Report and most recently introducing the Banking Transformed podcast, is that my career is built around learning and sharing. Even my global speaking engagements have provided me the opportunity to expand my learning horizons.

Read More:

- How Financial Institutions Can Thrive in the Age of Digital Disruption

- Digital Future of Banking Requires New Leadership Model

Why Everyone Should Build a Personal Brand

Most people consider that building a personal brand is only important for those in the media or for those who want to create a buzz around a real or perceived “celebrity status”. In today”s marketplace, nothing could be further from the truth. With the explosion of search engines, social media and digital-based employment services, creating a digital persona has never been more important.

In much the same way that many consumers shop for financial services online as opposed to going to a branch, employers shop for new employees digitally as well. And, the only way to stand out from the masses is go beyond a simple LinkedIn profile with a chronological career history by including personal articles, shared perspectives, comments on current trends and potentially even videos or audios of presentations.

Organizations are increasingly looking beyond just career accomplishments. They want to know what a future employee stands for and how they think. Sharing articles, insights and perspectives is the best way to accomplish this. What is exciting about this process is that every time you share content digitally, it will be consumed by people with interests in alignment with yours. And the more you share, the more people see you in the marketplace. In most cases, this can also help your market value.

I didn’t think about the importance of personal branding initially when I started writing and sharing articles. Very quickly, however, I realized that my perspectives through articles, research, speaking and on podcasts were helping me create a unique brand in the marketplace. More importantly, I realized I was also supporting the brand of the company I worked for.

So, while you may think that building a personal brand is only for those looking for a job, it is actually a way to build a legacy of who you are (or who you want to be). It is also a way to connect with others in the industry as well as with clients and prospects. For many, it is the one of the most important ways to remain relevant in the marketplace.

The Importance of Social Media ‘Attention’

Last year, at the Financial Brand Forum in Las Vegas, I had the distinct opportunity to spend a great deal of time with our keynote speaker, Gary Vaynerchuk. Gary is best known for his perspectives on the power of social media. One of the key elements he believes every person should embrace is the importance of “attention” in the digital marketplace.

Similar to old school advertising with traditional media, social media attention is achieved by leveraging social media platforms to get your message to your intended audience. What is great about social media attention, it is still free for most personal objectives. So, beyond just posting your insights and perspectives on LinkedIn, you can expand your reach and effectiveness exponentially by using Twitter, Instagram, YouTube and many other social channels.

Using multiple social media channels helps to illustrate you are an active learner, are embracing the change in the marketplace, are refusing to become irrelevant, and that you have a personal brand. Beyond being a broadcast tool, each of these channels are also great ways to absorb market insights in an unfiltered, real-time manner and to connect with people who think like you.

Read More: Do Bank Management Training Programs Create ‘Leaders of Yesterday’?

Don’t Be Disrupted By Others

It’s been a decade since I decided not to accept forced retirement because I was viewed as irrelevant. I love to learn, share insights and help others in the financial services industry so being disrupted was not an acceptable option.

While change was very tough after doing things close to the same way for decades, I found that lifelong learning and disrupting myself was the key to survival. I found that doing research and sharing insights was a process that was ongoing, allowing me to be at the forefront of the marketplace. This helped me to build a personal brand that resonated with the marketplace. By leveraging social media, I was able to expand the awareness of what I had written and help more retail bankers succeed.

There are no rules or magic formulas to avoid disruption, except that staying on the same path that has been followed for decades is a recipe for failure — maybe not tomorrow or even this year, but the risk of disruption gets greater with time.

I have been fortunate to avoid becoming irrelevant at an age that many opt for retirement. I believe my path can be followed by people significantly younger than myself, providing the foundation to avoid displacement at a time of massive change.