That community banks face myriad challenges is a given. They compete not only with each other, but with credit unions, large regional banks and often with megabanks. They also have to fend off competition from a variety of fintechs and neobanks, many of which excel in areas that have traditionally been the purview of community banks, such as small business, home or auto loans.

If that weren’t enough, add the growing threat — in many respects already a reality — of big tech companies and retailers like Walmart, Google, Amazon moving further into banking.

Given these and other stiff headwinds, how can community banks move forward to remain relevant in a very different landscape from even ten years ago? Do they need to invest heavily in growth and digital capabilities, or double down on what they already do well?

The answer will not be the same for every community bank, but will be nuanced depending on the size of the bank, location and its core customer base.

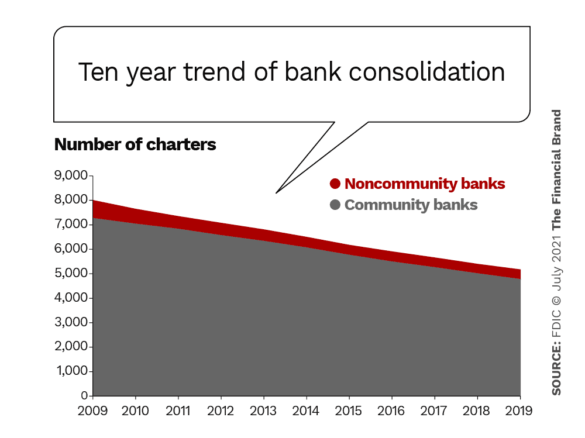

How community banks choose to answer these questions will play a pivotal role in the U.S. banking landscape. Community banks make up the overwhelming majority of the roughly 5,000 FDIC-insured financial institutions. How much that number shrinks further in the coming years remains to be seen.

While failures are few — just four in 2020 and none through June of 2021 — mergers and acquisitions continue apace. According to S&P Global Intelligence, there were 112 bank deals in 2020, with 82 in 2021 as of June, most involving community institutions.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The ‘All Things’ Model Is Done

In many ways, community banks are faced with a conundrum of whether to invest in innovation or focus on the hometown, personalized service they excel at. The key is to choose two or three things from a customer experience perspective they can sustainably deliver and focus on that, says Vincent Hui, Managing Director at Cornerstone Advisors, who leads corporate strategies for the firm’s banking and fintech clients.

“They can’t be all things to all people so they need to focus on clearly defined target markets that they can differentiate on and nail,” he states. “They also need to continually check the pulse of their customers on their behaviors and needs and adjust as needed.”

Read More: How One Community Bank is Reinventing Itself for Future Relevance

Hui adds that innovation in banking should be about filling an unmet need, not just investing in technology for the sake of it.

“Chime has been successful due to its get-paid-early feature — most banks have that capability today but they either don’t turn it on, don’t want to offer it and/or don’t know to market it,” Hui maintains. This is not just a community bank issue.

Hui points to Chase CEO Jamie Dimon’s comments in early 2021 in regard to the services Square offers to small businesses. Dimon said: “We could have done it, and we didn’t. …We didn’t have the imagination to do it.”

So innovation is not a function of asset size, says Hui, “it is about taking smart risks and having the discipline to monitor it closely and make changes on the fly, including killing an idea.”

Key Takeaway:

Financial institutions really shouldn’t ‘prioritize innovation.’ It should be part of their planning and something that is continually assessed.

Carefully Focus Your Tech Investments

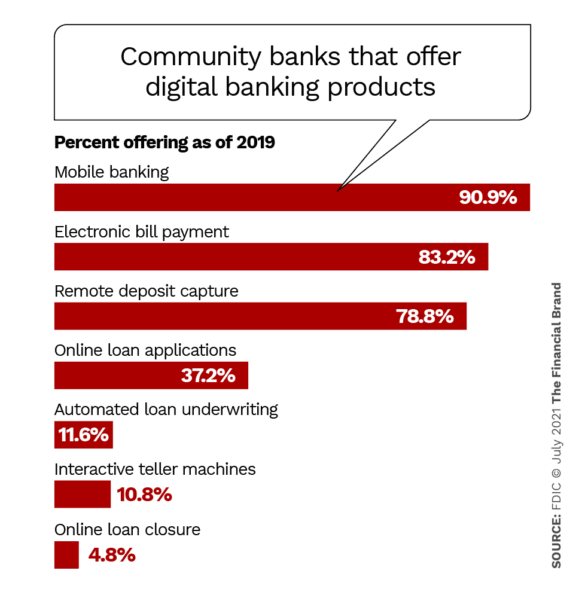

According to the FDIC’s 2020 “Community Banking Study,” the most common consumer-facing technologies implemented by community banks are mobile banking apps, electronic bill payment and remote deposit capture.

Perhaps not surprisingly, large community banks were greater technology adopters, according to the report.

“Differences in technology adoption were most evident between the largest and smallest community banks,” the report reads. “Only 6% of community banks with assets less than $100 million were high adopters, compared with 70% of community banks with assets more than $1 billion.”

Besides explicitly consumer-facing technology, it’s also important for community banks to invest in back-end tech that improves the customer experience, notes Bruce Paul, Managing Director, Banking Research, for Rivel.

“How responsive and how knowledgeable the bank’s staff is, that is due to internal technology,” he says. “That enables tellers to, for example, serve customers quicker and be able to quickly access the relevant information needed for a transaction.”

And while community banks can never compete with the budgets of global megabanks, they have an advantage due to having fewer legacy systems and a smaller management structure, which in turn can make them nimbler, notes Chris Nichols, Director of Capital Markets for Florida-based SouthState Bank.

“Banks have to be smart where they deploy their tech investments and pick projects that make the customers the happiest while cutting cost for the bank,” Nichols states. “This likely means projects like a lead-generating website, online account opening, and online lending.”

“Banking should fade into the background, so it is fast, easy and pain free. Any time we can keep the customer focused on their non-banking problems and working towards their personal or professional goals we are doing our jobs.”

— Chris Nichols, SouthState Bank

Nichols adds that the goal for community banks should be to make banking as friction-free for customers as possible, regardless of the channel.

“Any time we can keep the customer focused on their non-banking problems and working towards their personal or professional goals we are doing our jobs,” he adds. “Banking should fade into the background, so it is fast, easy and pain free. Sometimes that means being able to transfer money via your mobile phone and sometimes that means meeting in person to set up an estate. Whatever channel it is, the goal is to have them not worry about banking.”

Read More: How Community Banks Can Compete In The Digital Age

The Hometown Touch Still Works

The good news for community banks is that customers are generally happy with them, according to Rivel data.

From Rivel’s most recent survey of 195,000 customers at just over 2,100 financial institutions, 31% of American households reported that they are unhappy with their banking institution and open to switching. But this varies greatly by size. For instance, at the 25 largest institutions (those with 400 or more branches) 34% of their customers are not happy and open to leaving. On the other end of the scale, at those institutions with fewer than ten branches, only 25% of customers are similarly vulnerable.

One reason for this customer stickiness could be because community banks strive to maintain a personal touch with those they serve, observes Jill Castilla, CEO of Citizens Bank of Edmond, Okla.

“As a community bank, we know our customers and make ourselves available when they need us,” she says. “One of our values at Citizens is to be authentic and accessible. We allow for our employees to be on social media and we even encourage it.

“Community banking is a beautiful business model, but we do have the threat of irrelevancy hanging over us. We have to use the opportunity of social good to be innovative in order to be around for the long term.”

— Jill Castilla, Citizens Bank of Edmond

“With the economic crisis caused by the pandemic,” Castilla continues, “we were seeing and hearing from our community in real time of their pain and fear. We could truly empathize with our neighbors and respond quickly to assist them in challenging times. This kind of response just doesn’t happen at the larger banks. Our customers trust us to have their best interest in mind.”

The banker adds, “Community banking is a beautiful business model, but we do have the threat of irrelevancy hanging over us. We have to use the opportunity of social good to be innovative in order to be around for the long term.”

Read More: How Big Do Credit Unions Have to Be to Survive?

Despite what you often hear from some analysts — and marketing materials from tech vendors — community banks don’t necessarily need to have the latest and greatest technology to survive and thrive, Rivel’s Paul notes.

“Customer service matters a lot, even to ‘digital natives’ like Gen Z,” he says. “What we find with technology is you don’t necessarily have to be the best, but you just have to be good enough.”

Food For Thought:

Physical bank branches are still very important to customers, even younger, digital natives like Gen Z.

Notwithstanding reports of their imminent death, even bank branches still matter a great deal to customers, according to Rivel data.

Among those surveyed, “even most of Gen Z say they will never bank at a bank that doesn’t have a branch nearby,” says Paul.

What Works in Tuscaloosa Doesn’t Work in Tempe

Ultimately, there is no one-size-fits-all solution for community banks. Unlike large banks, which have a presence in nearly all areas of the country, community banks must focus on what works for their customer base in their specific area.

Bruce Paul notes that geographic differences in the customers Rivel surveyed support this idea. For example, in Miami, financial institutions should not try to attract new customers by saying they are “very responsive” because customers in southern Florida are already very happy with how responsive their banks are. However, responsiveness is one of the top three messages to attract customers in Peoria, Ill., Rivel’s data shows.

And, Paul adds, don’t try to market yourself as “friendly” in Nashville, because all banks are friendly there (even the big ones) according to their own customers. But if you have branches in Los Angeles, you may be able to carve out a niche by being “the friendly bank,” at least in some neighborhoods.

For Castilla, the path to sustained success includes not only investing wisely in technology, but also having deep knowledge of customer needs and meeting them in ways larger institutions may not be able to.

“There is a happy medium and we are fortunate to have the agility and use our relationships with our partners to continuously find ways to improve our technology,” she says. “It’s critical to remain relevant in that area. We also understand that there will always be a place for hometown banking. Small banks can offer flexibility in areas where big banks cannot, and our customers come to us as a trusted financial partner.”