Google Trends is a fascinating utility, using the search giant’s vast database to shed light on everything from the spread of flu outbreaks to economic predictions. While initially considered little more than a cool way to visualize search volumes, Google Trends is now widely regarded as a scientifically respected forecasting tool.

Using Google Trends, you can gauge the level of interest in virtually any given topic. The data can be reported globally as far back as 2004, or broken down for a specific country and/or time period.

The horizontal axis for each Google Trend graph represents time. The vertical axis represents the relative increase (or decrease) in the number of searches Google’s users performed for each term over time, with the top line signifying peak activity.

Read More: Is Google’s ‘Site Diversity’ Policy Hammering Your Bank’s Website?

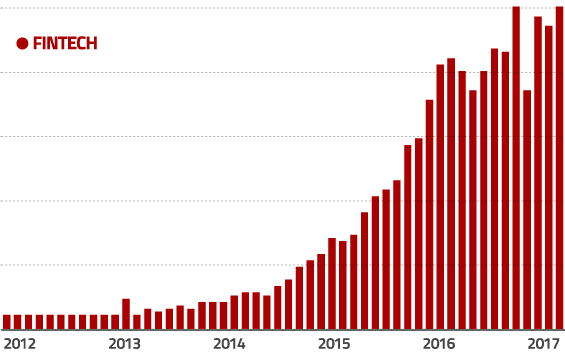

Fintech: Friend or Foe?

Few topics have captured the attention of the banking industry over the last couple years more so than fintech, and you can see this trend clearly reflected in Google’s search data. Financial institutions still haven’t decided whether the “fintech” craze represents a threat or opportunity. Either way, most are intimidated (if not downright afraid). Which explains why everyone is paying such close attention.

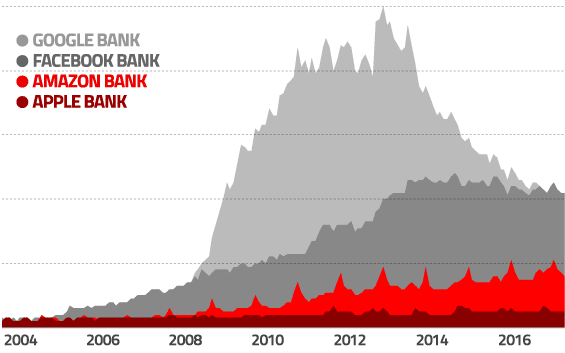

GAFA Banking Models

Many industry pundits and analysts have theorized what would happen to traditional institutions if Google, Apple, Facebook or Amazon (GAFA) decided to enter the retail banking space. Based on the trend data in the chart below, it seems that the most likely contenders are Google and Facebook, although the hysteria surrounding both has ebbed substantially.

While such speculation is always interesting and can be pretty frightening, the challenges are massive and should not be underestimated. Assuming this kind of thing would even be legal, does someone like Google or Apple really want to take in deposits, which will result in oppressive regulatory scrutiny? Or do they just want to make certain types of payments easier — to simplify processes that represent friction within their existing business models?

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

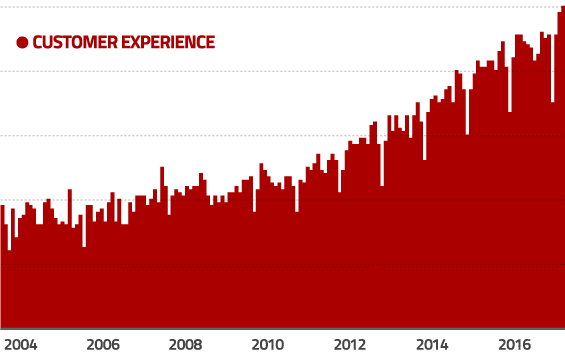

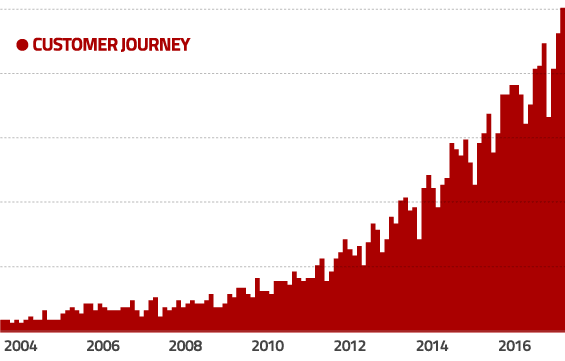

CX, UX and the Customer Journey

Thanks in large part to the digital experiences consumers enjoy in other industries like travel and retail, banking providers are paying more and more attention to the customer journey. You can see that searches for related terms like “customer experience” are on the rise, with no sign of easing up any time soon.

Key Insight: CX will be a major differentiator for both banks and credit unions in coming years. Those that deliver an experience that meets or exceeds consumers’ (rising) expectations will have a major advantage over everyone else.

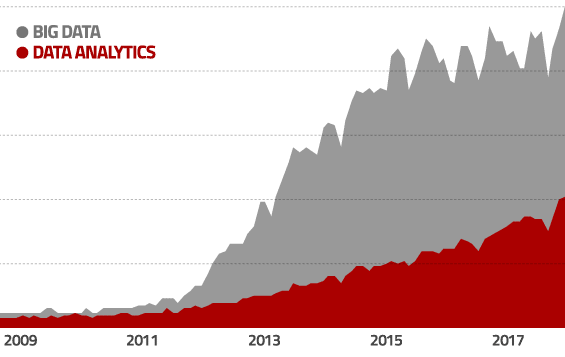

Data Sciences

Whether you’re talking about “data analytics,” “big data,” “predictive analytics” or “artificial intelligence,” all indicators suggest this is one of the most important trends facing the financial industry today. No sector (besides perhaps the government) sits on larger repositories of data than banking providers. If anyone is poised to capitalize on the promise of big data and data analytics, you’d think it would be retail financial services companies.

Key Insight: You had better be ratcheting up your data science skills, or you’ll be in deep trouble… soon.

Read More: Banks Need to Buckle Up for These Big Data Trends

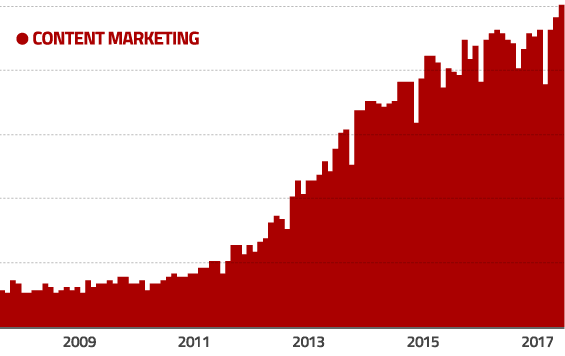

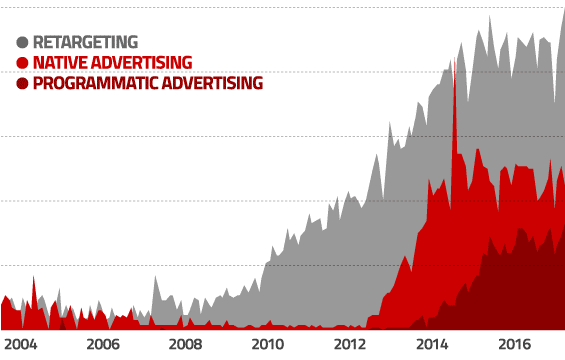

Shifting From Traditional Advertising to Digital Marketing

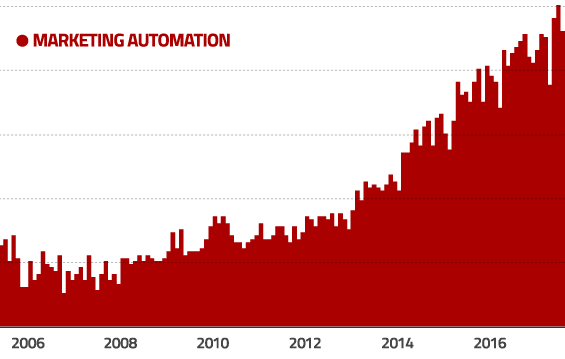

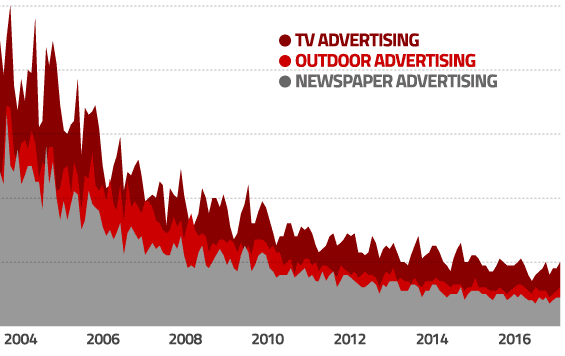

Looking at Google’s trending data, it’s obvious that digital strategies are redefining and dominating the new marketing landscape. Searches for “content marketing”, “retargeting”, “native advertising”, “programmatic advertising” and “marketing automation” platforms are all skyrocketing. You’ll see a sharp contrast in this trend when looking at more traditional forms of advertising — TV, outdoor and print — all down sharply.

Key Insight: When it comes to digital marketing, banks and credit unions are about a decade behind other industries like retail and travel. You need to work hard and work fast to close this gap as quickly as possible, because the entire marketing ballgame is almost exclusively played in digital channels.

Brick-and-Mortar Channels

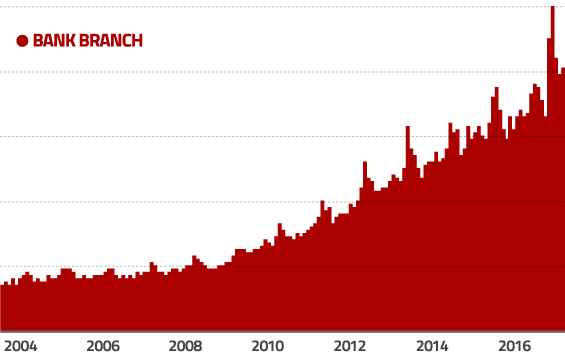

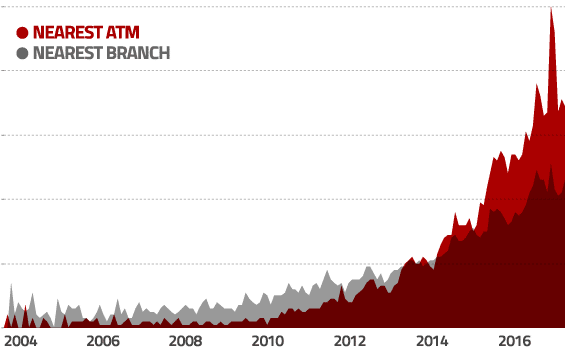

It’s difficult to reconcile the rising trend in searches for terms like “bank branch”, “nearest ATM” and “nearest branch” with the decline in traffic financial institutions are experiencing in their physical locations. If people need branches and ATMs less, why are they searching for them at record-breaking levels? Perhaps it’s because they visit physical locations so infrequently that they don’t even know where they are anymore?

Key Insight: Every retail bank and credit union needs a robust geo-locational branch and ATM finder on its website, and within its mobile app.

Consumer Confidence = More Loans

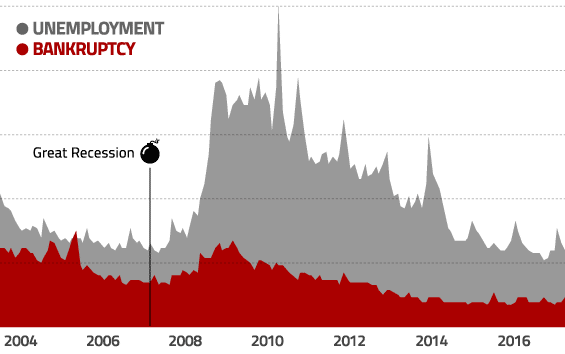

Republicans and Democrats love to bicker over the health of the economy and quibble about the statistical relevance of reports from the Bureau of Labor, but if you look at Google’s data, it certainly looks like things have improved for consumers… at least since the economy collapsed back in 2007. Searches for terms like “unemployment” and “bankruptcy” peaked shortly thereafter, and have been easing ever since.

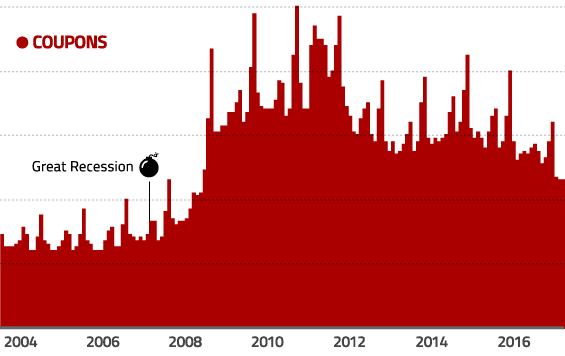

Similarly searches for “coupons” suggest that consumers were intensely interested in saving every penny they could as the reality of the Great Recession set in. But this has also subsided.

On the positive side, if you look at search terms like “salary raise”, you’ll see those numbers further indicate an economy that’s rebounding.

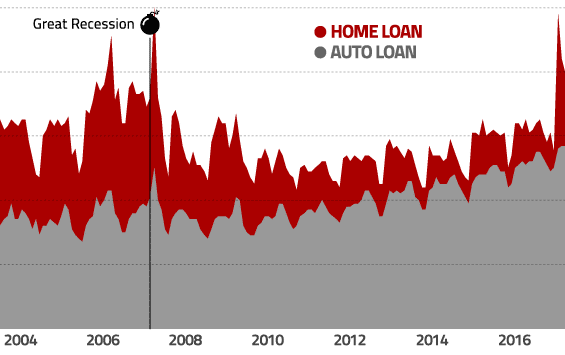

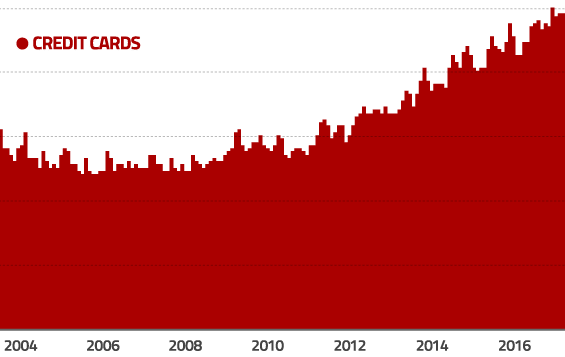

Key Insight: Rising consumer confidence reflects an increased willingness to take on debt. You’ll see this illustrated in Google’s search trends for both home- and auto loans, as well as credit cards. Search volumes for these two core lending products have essentially returned to their pre-recession levels.

Read More: Google Throws Digital Advertising Curveball at Financial Marketers

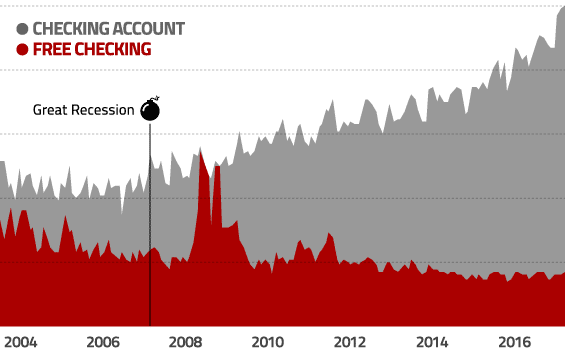

Is Free Checking Irrelevant?

Google’s tool for analyzing searches can uncover some interesting trends. For whatever reason, consumers are searching less frequently for “free checking”, but they are seeking “checking accounts” at unprecedented levels. What explains this shift in search terminology is anyone’s guess. But it’s impact on financial marketers, however, is much more clear; when crafting product landing pages and paid search campaigns, this type of objective data can provide meaningful guidance about which keywords are critical, and which ones aren’t

Key Insight: There is a wide range of tools out there that can help you massage both your SEO and SEM/PPC strategies, starting with Google Analytics and Google Trends. Use them.

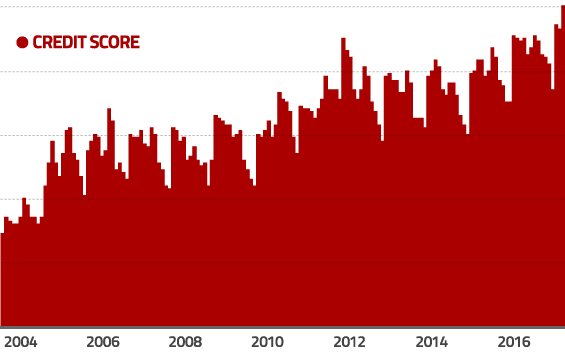

The Seasonality of Credit Scores

Searches for “credit score” follow a distinct pattern with obvious seasonality. People are most concerned with their credit score in the beginning of the year — in January, presumably part of their New Year’s resolutions — and tapers off steadily all the way through to December — presumably because they are spending with more abandon over the holidays.

Key Insight: If your financial institution wants to talk about financial health and well-being, you’d be wise to time your campaigns to synch with the start of the year. Follow the same marketing cycle that gyms and weight loss programs use, and you’ll be maximizing your efforts.