How Many Are Switching?

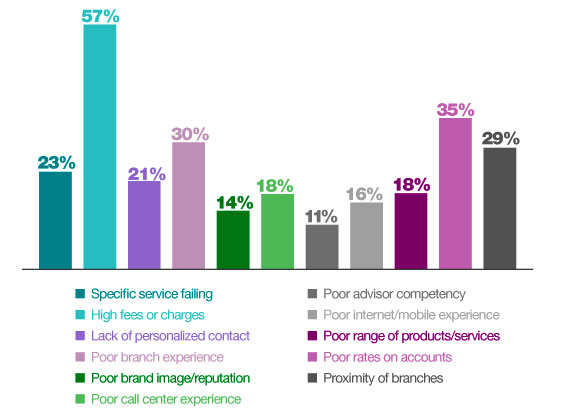

Worldwide, the number of customers planning to change banks has increased from 7% to 12%. The proportion of customers planning to change banks has increased since 2011, with 50% of customers globally citing high fees and charges as the primary reason.

Banking customers generally demonstrate increased sensitivity to high fees or rates on deposits and it is the primary reason that most switch their primary banks. U.S., Canadian and European banking customers cite poor rates on accounts as an important factor in switching banks.

Why Are U.S. Consumers Switching?

Customers appear to want more than a better deal; they want the flexibility to shape the relationship, contacting their bank whenever and however they choose. They may prefer online channels for simple transactions, but demand high-quality, personalized services for more complex transactions.

Fractional Marketing for Financial Brands

Services that scale with you.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

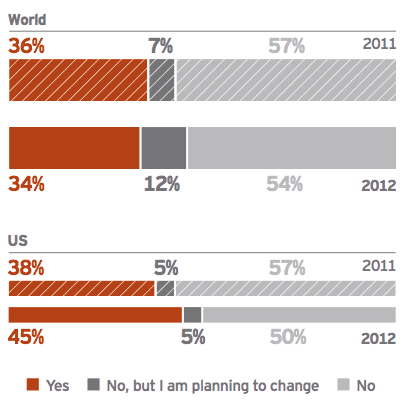

How Many Customers Have Ever Switched Banking Providers?

Worldwide, 34% of customers say they have changed their main banking provider and 74% have done so in the last 10 years. The overall figure is marginally lower than in 2011 but it conceals some wide variations across countries, with attrition rates rising significantly in several key markets. Specifically, in both the US and Canada, the number of respondents who have changed their main bank has increased from 38% in 2011 to 45% in 2012.

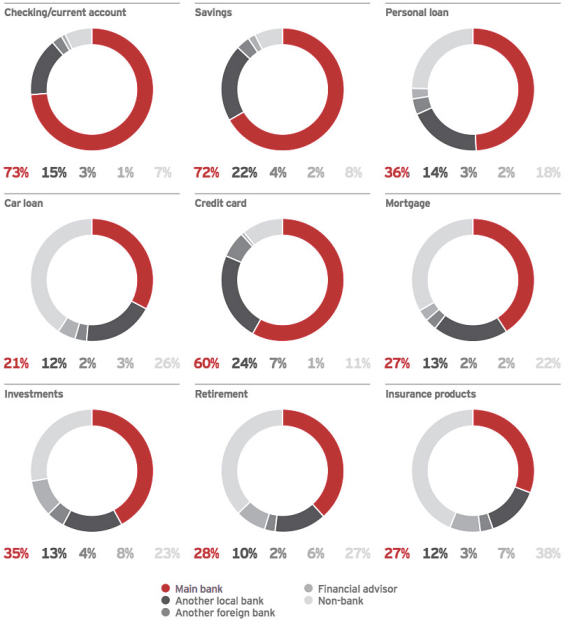

Which Institutions Consumers Use For Specific Financial Products

Satisfaction High, Trust Low

Although Ernst & Young found that overall satisfaction with banks remains high, trust levels remain low. Globally, consumer confidence in the banking industry has dropped 40%. In Europe’s more beleaguered countries it’s nearly double that — a 72% drop in Italy and 76% in Spain.

In the U.S., just slightly more than half say their confidence in the banking sector has decreased over last year. 9% say they are more confident, and 40% say there’s been no change in their feelings.

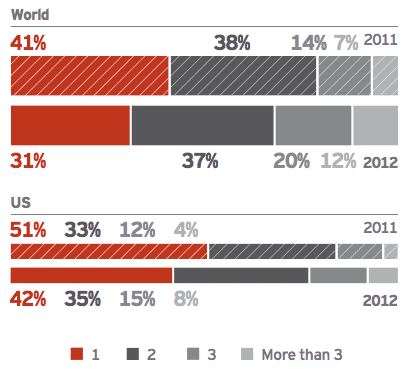

How Many Banks Do You Consumers Use?

Banking consumers are diversifying their relationships — spreading their bets around, as it were. Customers using only one bank have dropped from 41% to 31%, while those with three or more have increased from 21% to 32% since 2011.

What Should Banks Do?

How can banks provide a better customer experience, one that reduces churn and attrition rates? Ernst & Young offers banks this advice:

- Make low-cost digital channels customers’ preferred choice. Banks should encourage customers to use digital channels whenever possible by using price incentives.

- Make pricing and service promises transparent. Pricing is critical to customer satisfaction, but most customers have no idea how much they pay each year. Transparency over pricing and service promises is vital if banks are to deliver something customers value.

- Offer tiered levels of customer experience. Customers should have the option to buy into certain products and services, and the ability to earn upgrades through loyalty, whether in terms of longevity or the share of wallet handled by a particular bank.

- Encourage customer self service. Banks needs to improve the way they provide information and advice to interest and convince self-directed customers, including financial planning tools, ranges of product and pricing bundles.

Researchers say that in order to retain their customers, banks must adapt their business models to cater to increased demands to accommodate a wide range of customized services and products. The models most commonly pursued by banks are (1) based on low-cost competition, or (2) on high-touch service and others on accessibility. Large, full-service banks need to defend market share against new entrants and those offer greater specialization, while retaining the ability to meet a wide range of needs and sustain profitability.