Retail banks have a strong financial foundation despite economic headwinds that appear to be getting stronger as inflation rises, unemployment increases, and consumer concerns about meeting basic needs continue. A major question still to be answered is whether retail banks will scale back digital transformation investments, or will they continue to move towards becoming more future-ready.

According to the 2023 Banking and Capital Markets Outlook by Deloitte, “The ripple effects, both direct and indirect, from a more fragile and fractious global economy will be felt disparately across the global banking industry. They will depend on the economic growth and interest-rate environment in the country/region, bank size, capital levels, and business models. Large, well-capitalized, diversified banks should weather the storms reasonably well.”

One area that will see a positive impact is net interest margins (NIM). In the short term, a rise in loan yields will most likely outpace hikes in deposit rates, continuing the trend in the last few tightening cycles. U.S. banks, in particular may benefit, due to higher rates domestically as well as stronger loan growth.

Most financial institutions are expected to focus on creating greater efficiencies through the deployment of advanced technologies, reducing branch footprints, leveraging third-party solution providers, and increased back-office automation. In the same context, Deloitte also believes that workforce optimization will become a greater priority in 2023.

In preparation for the long term, there has never been a more important time to pursue new sources of revenue beyond traditional products, find ways to leverage embedded banking and BaaS opportunities and rethink existing business models. Most importantly, financial institutions must commit to embracing change, managing risks, and disrupting legacy thinking and processes to become more competitive in the future.

Read More: The Future of Banking as a Service and Trends in Embedded Finance

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Retail Banking Opportunities in the Future

Despite having to deal with an uncertain economy, there still are significant opportunities for retail banks willing to continue their commitment to improving the customer experience and building greater customer engagement. Going forward, those organizations able to leverage data and analytics for contextual engagement in real time will be the winners. To accomplish this will require a back-office that is build for both speed and scale.

As consumers try to manage their financial wellness, they will be looking to their financial institution to assist with providing personalized advice in real time. This will require seamless integration of both digital and physical delivery channels as well as partnerships with third-party providers that can expand the traditional realm of retail banking.

According to Deloitte, “Banks should also be prepared to deal with potential challenges from the housing and auto lending markets, heightened regulatory scrutiny on fees, and data security. In the long term, they should develop inventive new applications for ESG, embedded finance, and digital assets.”

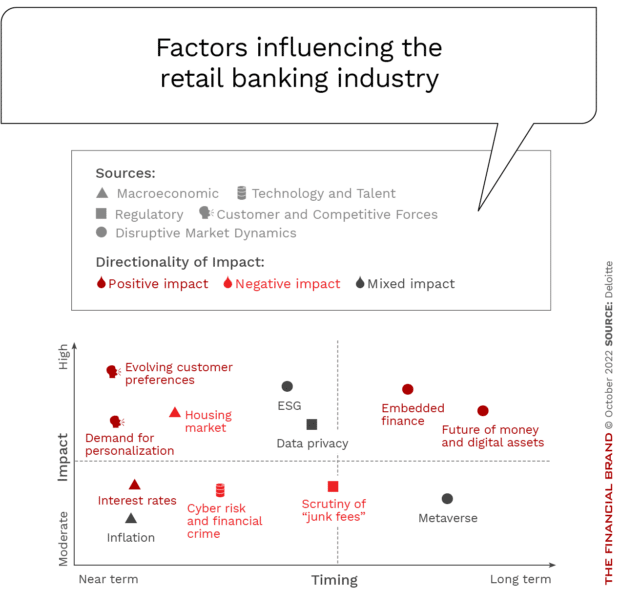

A visual summary from Deloitte of the impact and timing of factors influencing the retail banking business is presented below.

Being Responsive to Consumer Needs

According to J.D. Power, the biggest influence on customer satisfaction during this period of economic uncertainty is providing a personalized mix of financial advice, hands-on help with problem resolution, and guidance on how to grow their money. If a financial institution provides this level of support, 63% of customers say they definitely will not switch banks, and 78% say they definitely will use their bank for additional services.

Despite this impact on customer satisfaction, only 44% of banks are delivering on this metric. The satisfaction scores are lowest for helping retail bank customers save time or money. When asked how they would like their bank to personalize their banking experience, 46% of customers say they want help in avoiding fees and 37% say they want to receive account alerts.

Financial institutions also are struggling to align back-office systems to deliver better ‘top of glass’ experiences. According to Deloitte, “Continued investment in front-to-back modernization – aided by cloud migration, low-code/no-code application platforms, and robotic process automation — can link customer-facing businesses with operations and back-end servicing to reduce inefficiencies.” The goal will be to make varied channel experiences as seamless and consistent as possible as organizations work to meet consumer needs.

Part of this channel alignment is for banks and credit unions to reevaluate how branches fit into new distribution models. Almost all organizations have excess capacity that will only be exasperated by the continued channel shift to digital engagement by consumers. The elimination of branches will not come easily, however, as legacy leaders within financial institutions as well as community leaders and government regulators often fight to retain branch networks.

Learn More: Rethinking Branch Networks Without Killing Sales or Jeopardizing Growth

Innovation Increases in Importance

Innovation in financial services is needed more than ever to rethink existing products and services, realign distribution options and increase the speed and scale of solutions. Banking leadership must find a way to encourage innovation at all levels of the organization, including accepting higher levels of risk, allowing more time for ideas to mature, positioning failure in a more positive light, encouraging innovation champions, and investing in new ideas.

To foster innovation and to encourage a ‘challenger mindset,’ many of the most progressive financial institutions are focusing on incremental innovations that can keep organizations moving forward on multiple fronts. Banks and credit unions should strive to transition away from periodic, point-in-time innovations to more continuous monitoring of key risk, controls, and performance indicators. This is more important as the market for embedded finance and BaaS is set to explode.

The metaverse could also transform customer experiences, requiring a focus on innovation that looks further in the future.

To be successful, banking leadership must change their response to failures from a source of fear and punishment into a learning tool to improve innovation. Once new ideas are encouraged, and barriers are removed, the ability to transform the innovation process will be in place.