While a great deal of attention has been given to the impact of COVID-19 on traditional banking institutions, there is also a significant impact being felt in the fintech marketplace. This is best evidenced by the slowdowns in funding, drop in establishment of new fintech firms and the reduced revenues of most organizations already in business. In many ways, fintech firms are more vulnerable than their legacy banking counterparts, despite being better positioned for the digital transformation occurring in banking.

Unlike traditional banking organizations, the majority of fintech firms have been in existence less than a decade, with few showing operational profitability. In most cases, fintech firms have relied on investor funding which is far from guaranteed in the near or intermediate future, especially as revenues have dropped since the pandemic.

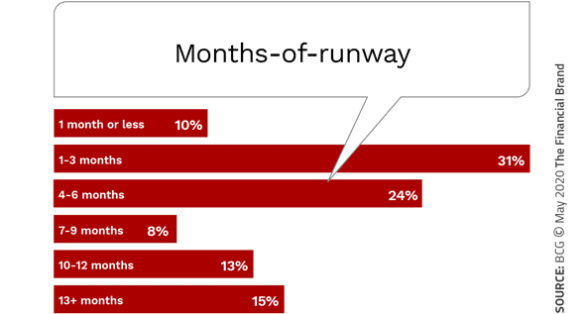

Making matters worse, very few start-up fintech firms have much cash on hand and even fewer have lines of credit. A March survey of more than 1,000 tech start-ups (not just fintech firms) across the globe by Genome found that more than 40% did not have enough capital to survive past June, with about two-thirds of these firms not having enough capital to survive past September.

Read More: How Banks & Credit Unions Can Fortify Stressed-Out Customer Support

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Limited Options Available

As with any small business, fintech firms are competing for a limited resource pool. From government relief packages to venture capital funding, decisions need to be made around how to save employees in the short term and continue operations going forward. Beyond an inflow of funds, other options include partnering with traditional banking organizations or selling the firm outright … all in an unfavorable market.

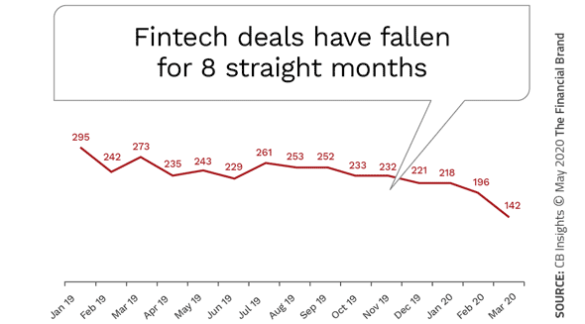

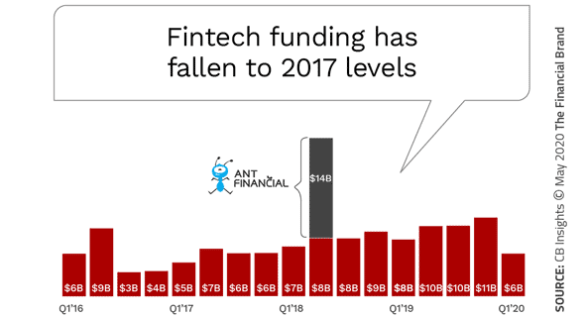

Some of the funding trends were already heading downward. According to CB Insights, financing activity in the first quarter of 2020 was far below historical averages. The data shows that through the end of March 2020, both the dollars raised and the number of finance deals for fintech companies are down month-over-month, quarter-over-quarter and year-over-year. It is expected that funding for fintechs in the first quarter of 2020 will resemble the lows recorded in 2017.

It should be noted that funding has continued to flow to some of the most established fintech organizations that have already achieved unicorn status and are showing positive growth trajectories. However, even some large fintech firms, especially in the cross-border payments and unsecured lending sectors, may find funding difficult to arrange because of the market conditions created by COVID-19.

Read More: When Opening Accounts in Branches Becomes Impossible

Outlook for Fintech Firms Differs by Solution Offered

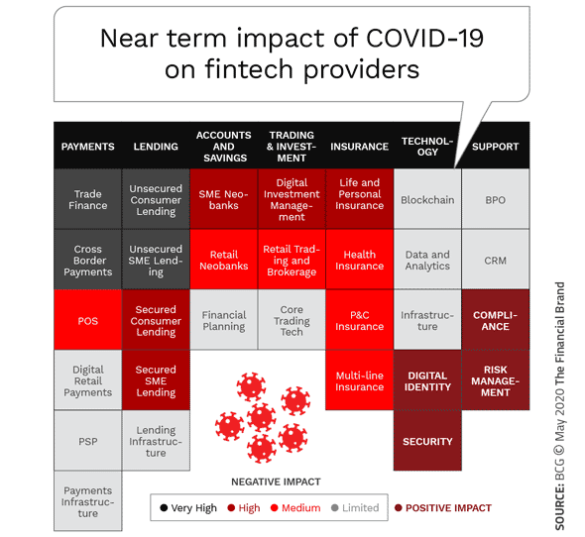

Besides their age, scalability and financial condition, the outlook of many fintech organizations will also be driven by the product category they are in. This is especially true in the near term, when the impact of the pandemic on consumer behavior is expected to be the greatest.

According to BCG, negative impact of COVID-19 will be more severe for those fintechs in international payments, unsecured and secured consumer lending, small business lending and for those where risks may be highest. It is believed that those fintech firms focused on B2B banking are less vulnerable as a group.

The outlook for some of product categories are the same for both traditional banks as well as fintechs, but the smaller non-traditional firms will not have as much capital to absorb the negative financial forces:

- Payments. Retail POS payments will continue to be negatively impacted by the slow recovery in spending at businesses globally. By contrast, P2P digital payments will continue to be strong as consumers opt for digital alternatives as opposed to cash or cards. High-ticket payments will be hardest hit, as travel and large consumer purchases will be slow to recover.

- Lending. While digital lending will be a strong category in the long-term, this category faces difficult short-term prospects as consumers and businesses miss payments or default altogether. While their advanced credit risk algorithms will help to limit losses and potentially allow them to serve consumers and small businesses that traditional banks won’t serve, there is still a concern around the risk these firms will be willing to assume.

- Deposits and Savings. While this category is expected to grow overall due to consumer behavior that shows a growth in account openings and money being saved, the fintech provider category may not participate in this growth due to an overall lack in trust. Offsetting this concern could be achieved through the offering of higher rates as was being done pre-pandemic.

- Investment Services. According to BCG, fintech firms in the retail brokerage space recorded some of the highest usage numbers early in the COVID-19 cycle as market volatility was at an all-time high. This is expected to continue for the foreseeable future as consumers continue to react to extreme market changes.

- Technology Providers. As could be expected, technology providers were some of the early winners when COVID-19 hit as traditional banking organizations scurried to deploy digital solutions to meet consumer demand. Many of the sales were initiatives already agreed to but not yet implemented until market conditions required immediate action. It will be interesting to see if investment in technology and digital solutions continues as traditional financial institutions are forced to reduce costs.

Future Fintech Opportunities

For those fintech organizations that can weather the COVID-19 economic storm, the future continues to work in their favor. The combination of consumer behavior and the economics of delivering financial services point to the need for a digital-first financial organization.

The power of advanced technology, AI and a comparatively low fixed overhead provides a competitive advantage over institutions that are saddled with a large number physical structures and staff that are often unprepared for a digital future.

Many fintechs are also well positioned to partner with, or be acquired by, either other fintech firms or a traditional financial institution. While consolidation of the sector is dependent on available capital, many organizations stand to benefit from increased scale and improved funding.

Listen In: Organizations Must Double Down on Innovation Now

The Missing Middle of Fintech and Traditional Banking

As mentioned earlier and reinforced by recent trends, there are indications that the smallest banks and fintech organizations have shown an amazing capability to pivot their business models and be responsive to dramatic marketplace changes. From the ability to build and deliver on SBA PPP loans to the immediate deployment of unique digital banking solutions, the smallest organizations have illustrated a focus and resiliency that indicates an ability to survive the impact of COVID-19.

Not surprisingly, the largest and most capitalized fintech and legacy banking organizations have also responded well to adversity. Not only were these organizations furthest along the path of digital transformation, but they also were able to respond to consumer needs quickly. Finally, they are also the most prepared for financial downturns.

Mid-sized fintech firms and legacy regional banks on the other hand are experiencing the worst of both worlds. These firms enjoyed the prosperity being experienced before the coronavirus crisis, but did not have the culture to see the risks of complacency. Whether it was not having a differentiated solution or not embracing the need to be digital, many of these organizations do not have the funds or vision to compete with the agile community banks or the well funded giants.

While the speed of consolidation will depend on the availability of M&A capital and competitive conditions, it is apparent that over time we will have a missing middle of both fintech and traditional financial institutions.