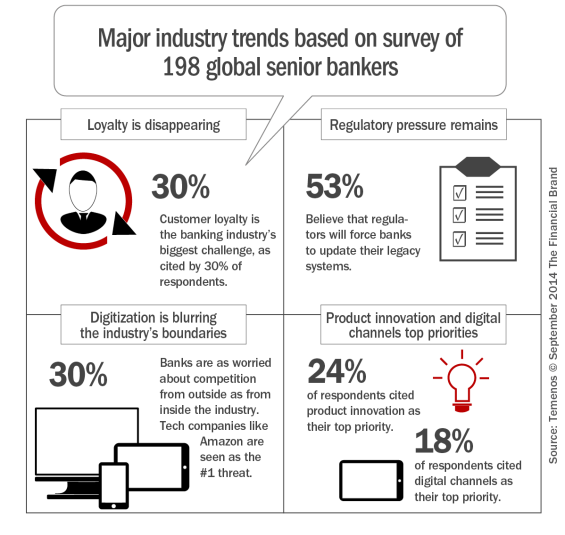

While compliance with new regulations and new competitors remain a major challenge, maintaining customer loyalty is considered to be the financial industry’s biggest challenge, according to a study by Temenos. Cited by 30% of global senior bankers, there is concern that more empowered and better informed customers may begin to switch providers in greater numbers.

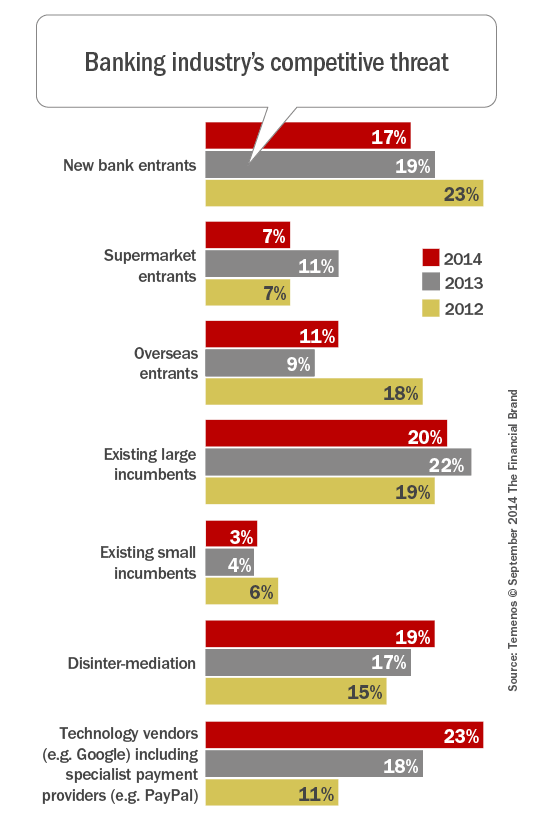

Temenos’ 7th Annual Survey of Challenges, Priorities and Trends in the Financial Services Sector found that the industry overall views their biggest threat as being technology vendors, such as Apple and Google (cited by 23% of respondents). In comparison, the retail bank and credit union sector found existing large incumbents and new bank entrants to be the biggest threat.

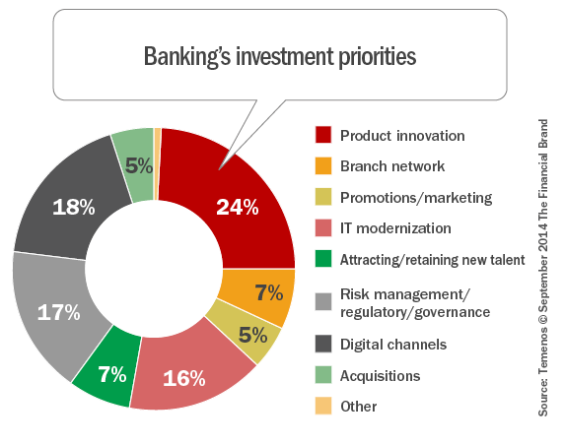

Banks are responding to these challenges by investing chiefly in product innovation, digital channels and in complying with new regulations. In fact, product innovation was noted as the industry’s number one investment priority, cited by 24 percent of respondents, while for the retail bank and credit union sector, 26 percent found product innovation to be the most important.

David Arnott, CEO of Temenos said, “The banking industry is undergoing a once in a generation shift, a second big bang. As our results confirm, it is digitization, changing customer behaviour and regulation that are driving the change. What is encouraging about these results is that banks appear to be both cognizant of the challenges ahead and making many of the right investments to be able to offer the customer-centric banking services to compete successfully in the future.”

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Loyalty in Limbo

For the second consecutive year, the survey found that the industry’s biggest challenge was satisfying the demands of better-informed and less-loyal customers. This challenge is felt most acutely by retail bankers, with 34% citing waning customer loyalty as their biggest challenge.

And while only 24% of corporate banks cited this as their biggest concern, the private wealth sector noted the increasing challenge of customer loyalty, with 32% of respondents indicating that this is their biggest challenge. This may be attributable to the influx of younger investors who have different needs and behaviors than their parents and grandparents.

Finally, loyalty was a bit stronger in the developed world than in developing countries, where younger populations and less established financial organizations prevail.

![Biggest_challenges_facing_the_banking_industry_according_to_global_ba nkers_10-1-2014[1]](https://thefinancialbrand.com/wp-content/uploads/2014/09/Biggest_challenges_facing_the_banking_industry_according_to_global_ba-nkers_10-1-20141-565x767.png)

Regulation Challenges Remain

While the pace of regulatory change has abated somewhat, complying with complex new rules continues to require operational adjustment and high financial and human commitment. The challenge of complying with new regulations is considered much greater in the US and western Europe, where governments have potentially overcompensated for a perceived lack of regulation before the financial crisis.

Private wealth management (PWM) and the universal banking sectors viewed regulation as their biggest threat in 36% and 28% of cases, respectively, caused by sector specific regulations that are onerous.

Digitalization Breeds Competition

As a new breed of digital consumer has emerged, so has a new breed of competitor. These competitors are differentiated by the ability to turn big data into meaningful customer insights. In addition, as the banking industry value chain continues to fragment, more competitors are ‘nipping at the edges,’ offering discrete financial services without becoming full fledged banks (Square, PayPal, Apple, etc.).

Interestingly, while the overall industry views technology vendors as the biggest threat (23%, up from 11% in 2012), retail banks and credit unions view existing large incumbents (25%) and new bank entrants (24%) as the biggest threat, with the threat of technology vendors (13%) viewed as less of a threat than supermarket banks (17%).

An often ignored competitive threat is disintermediation, which could take the form of peer-to-peer services (such as Lending Club), the use of capital markets, third party product offerings (like prepaid cards) or a complete vacating of banking services overall.

Product Innovation Prioritization

Correlating with the challenges of increased competition and consumer demands, product innovation was cited by 24% of the senior banker respondents to the Tememos survey, with 26% of retail bankers citing product innovation as their number one priority.

The picture is similar with investment in digital channels, with 18% of overall respondents and 20% of retail banking respondents mentioning digital channels as top priority. Interestingly, 22% of private wealth management sector respondents said investing in mobile channels was their top priority, suggesting the importance of younger investors.

Not to be forgotten, investing in branches remains a priority (7% vs. 12% in 2012), indicating that retail banks are updating branch formats, increasing investment in new branch technology while converting physical facilities to centers for sales and advice as opposed to transactions.

IT Spending Explodes

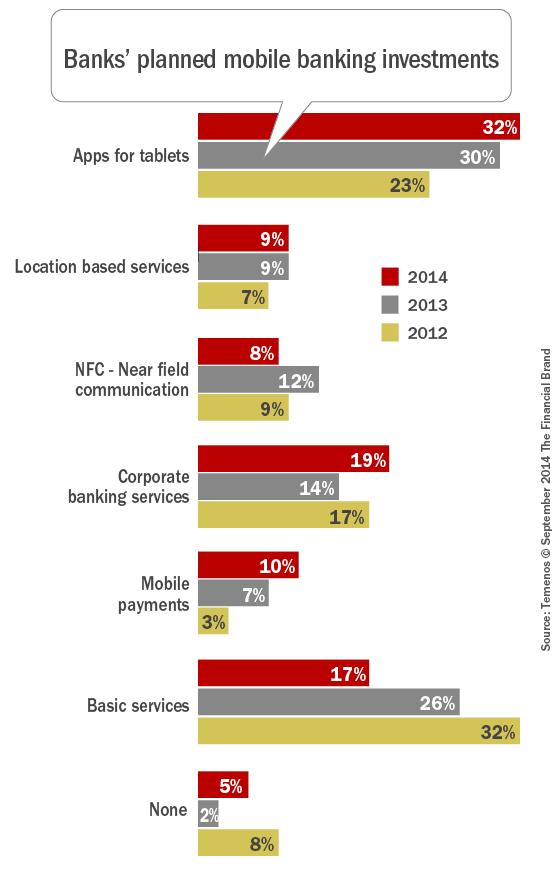

Aligning with other studies, the Telemos research found that 67% of respondents expected higher IT budgets in 2014 and just 11% anticipated their IT budget to shrink, giving a net positive delta of 56%, higher than in 2013 (53%) and in 2008 (46%).

The trend illustrates how all banks, regardless of sector or geographical region recognize the priority of investing in IT to sustain competitiveness in the digital age. Real-time core banking system renewal built around customer records and not products, was cited as the number one IT investment priority for banks in 2014.

The second biggest priority for IT spending, cited by 23% of respondents, was digital channels, with the single biggest area of investment being mobile apps for tablets and smartphones, cited by 32% of respondents. Overall, 17% of respondents were directing most of their mobile bank spending to building out basic services, such as balance requests and transfers, illustrating the game of catch up that many banks are faced with.

Financial institutions must move from being data custodians to being data analysts that seek insights from customer data

Finally, the third largest priority was investing in analytics, cited by 14% of respondents. This priority is aligned with the need for improving customer service and expanding product offerings as well as using customers’ data to offer real-time value-added services, such as digital money management and location-based offers.

The Future

Juan Pedro Moreno, Senior Managing Director of the global Banking practice at Accenture, which partnered with Temenos on the study said, “For many banks, product innovation will need to go hand-in-hand with a new mind-set. The most innovative banks will no longer think of themselves as mere providers of financial products and services and enablers of transactions. They will be solution providers that play a greater role not just at the moment of transactions, but before and afterward as well.”