Historically, the battle for customers in every industry was based on the traditional 4 Ps of marketing; product, place, price and promotion. Organizations that prevailed often were the most trusted by consumers. Especially in financial services, where there was little differentiation between products, convenience (place) was often the primary criteria that a consumer used when selecting their primary financial institution. Most relationships were transactional, based on the transfer of funds and information, with human relationships being part of the value proposition.

In a digital world, location matters less than ever, since accounts can be opened and managed without ever walking into a physical facility. Human interaction, while still important, matters less as well. With digitalization, the 4 Ps of marketing are increasingly being replaced by the 4 E’s; experience, everyplace, exchange and evangelism. Combined, these components are shifting the criteria for gaining trust.

Instead of viewing a product or service entirely on the way it is built, the way the product is delivered (experience) is more important than ever. A digital experience must be easy, fast and empathetic across the entire customer journey. The experience starts during the research and shopping phase and extends through the buying and engagement period. Consumers value a financial institutions commitment to saving them time and making their day easier.

With more transactions being able to be handled digitally, financial institutions must be able to deliver products and services in a channel agnostic manner. The same is true with how services are marketed. Consumers must get a consistent message on a web site, through broadcast media, on social media, in the branch, and on all other channels. I a digital world, ‘everyplace’ replaces ‘place’ as part of the 4 E’s.

The final two E’s of the new marketing equation are ‘exchange’ (which replaces price) and ‘evangelism’ (that replaces promotion). With most financial services having very little difference in price – with less and less opportunity for additional cost-cutting – the value exchange instead of the price of the service has increased in importance. And, with the explosion of social media, word-of-mouth (evangelism) has never been more important.

Digitalization has irrevocably disrupted existing business models and the way financial services are delivered and customers are served. Technology has also changed consumer behaviors and preferences. Digital transformation is no longer an option … it is table stakes for ongoing trust and loyalty.

According to the NextWave Consumer Financial Services research by EY, some of the most impactful changes occurring in the banking industry include:

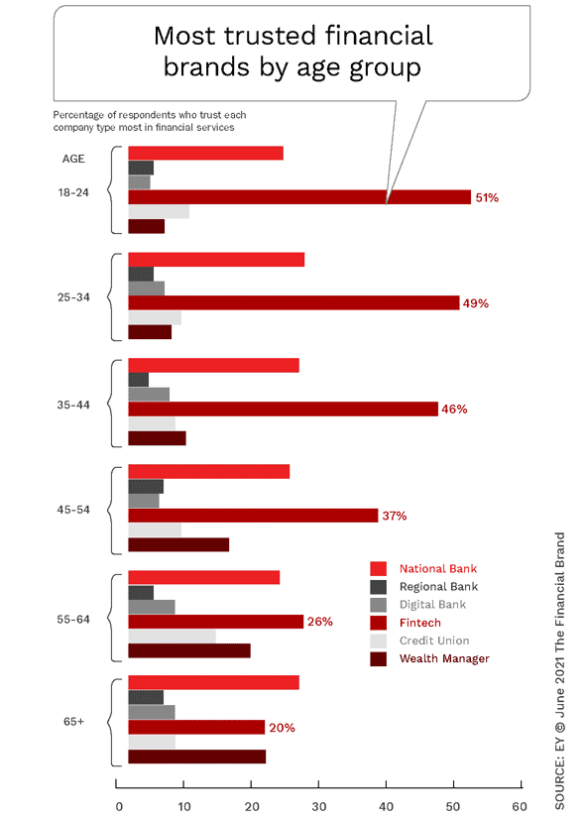

- Shifting levels of trust. Across almost all age segments, fintech firms are more trusted than legacy financial institutions.

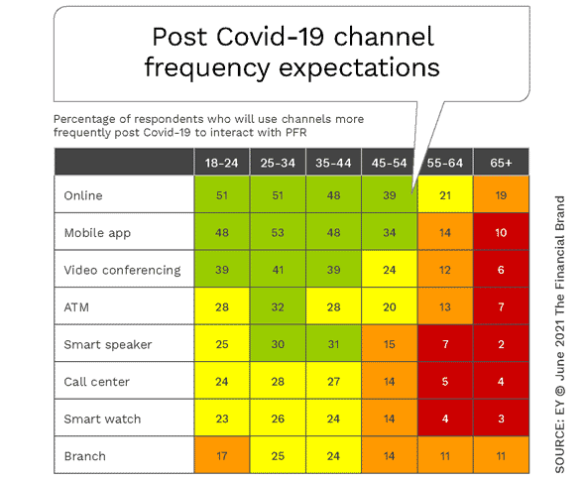

- Changing channel preferences. While branches are still important, the shift to digital channels continues to increase.

- Growing importance of experiences. Data and applied analytics must be used for unique experiences across channels, products and silos

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Trust Advantage of Traditional Banks and Credit Unions Diminishes

According to the EY research, 37% of consumers across age segments say a fintech or big tech firm is their most-trusted financial services brand, compared to 33% who name a bank and 10% who name a credit union. The trust gap is the most dramatic for the Gen Z and Millennial segments, In fact, only the senior population (over age 65) mentions national banks as more trusted than fintech firms.

Trust Erosion:

COVID-19 made a local physical presence, a traditional trust advantage for incumbent FIs, less meaningful.

The impact of this shift in trust is most evident in the changing view of fintech and big tech firms being the primary financial institution for younger consumers. Across all age categories, 31% of consumers name a fintech firm as their primary financial institution (PFI), compared to only 6% in 2019. In fact, 51% of these consumers have set up direct deposit with a fintech.

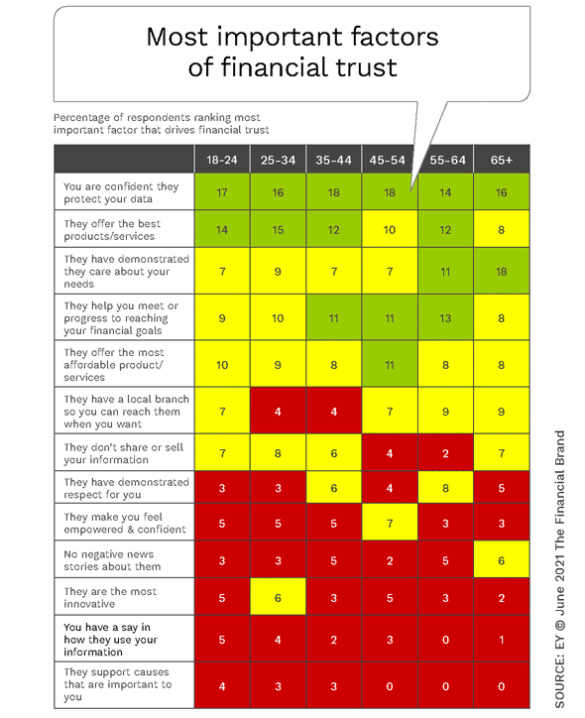

While traditional financial institutions still prevail as a PFI for most consumers – having the direct deposit relationship – the historical trust advantage is eroding. This declining trust advantage also appears to be accelerating, as the importance of location diminishes and the desire for personalization, speed and simplicity of engagement (empathy) increases. The importance of data security is also is still of paramount importance (which helps legacy financial institutions).

Channel Shift Continues to Accelerate … But the Branch is Not Dead

According to the research from EY, 35% of consumers expect to increase their use of mobile channels with their primary financial institution in a post-pandemic world. This trend is most pronounced with Gen Z and Millennials, where more than half expect online and mobile usage to increase, while the majority of consumers in the senior age groups expecting modest or little change in online or mobile behavior.

Need for Channel Integration:

FIs need to continuously improve and integrate existing and new channels to meet customer needs.

The research also found that while 24% of consumers expected to visit a branch less frequently in the future, 82% still said that the presence of a local branch was extremely or very important. While this can be considered an advantage for traditional banks and credit unions, the question remains … does this level of importance offset the impact of a differentiated digital experience.

Read More:

- Beyond Personalization: Three Reasons to Focus on Customer Journeys

- Data and AI Must Play Bigger Role in Financial Marketers’ Growth Strategies

- Rethinking Financial Services with Artificial Intelligence Tools

Experiences are the New Product

The pandemic taught the consumer what is possible in the digital world. From simple and seamless digital journeys, to proactive and personalized recommendations, the possibilities to deliver exceptional experiences are endless. Supported by data and applied analytics, organizations are increasingly competing on the experiences delivered, as opposed to the traditional product features and benefits.

More than ever, digital organizations are measuring success based on the level of engagement as opposed to product penetration and balances. This is because the more often a consumer or business relies on an organization, the stronger the relationship becomes. This dynamic completely changes the business model for traditional FIs, including the way an organization is structured, the importance of back-office automation, and the culture that needs to be supported.

The Importance of the ‘Last Mile’:

FIs have talked for years about pivoting to the customer, but few have embraced the organizational change required to achieve it.

With great experiences comes trust. But, when 24% of respondents to the EY research stated that PayPal was their most trusted financial brand (more than double the highest rated traditional bank), the historical trust advantage of legacy financial institutions is being eroded. The other big tech brands are also gaining ground based on experiences delivered. And, with bank charters being granted and partnerships being created between big tech and traditional banks, the threat in the future is real.

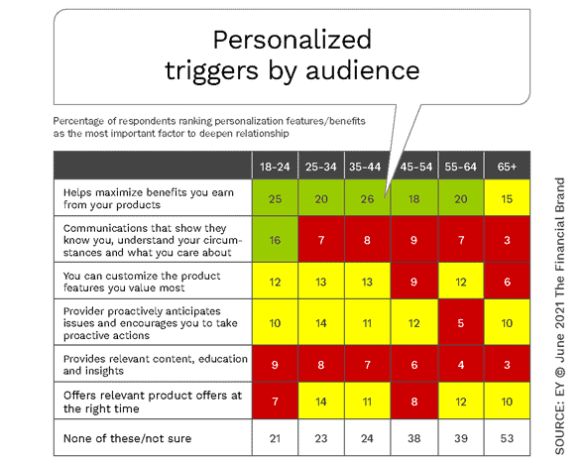

Personalization across the entire customer journey can help increase trust as the value transfer is viewed more positively. From product development and communication, to proactive recommendations and financial education, the consumer wants their financial institution to know them, understand them and reward them with enhanced customization.

More than ever, the need to build digitally agile organizations focused on enhanced customer experiences is imperative. This requires restructuring of delivery networks and rethinking internal processes to support much faster and simpler transactions and engagement. The foundation of consumer trust is at stake. Recovering lost trust will be a major uphill climb.