The growth of digital banking usage, the emergence of new technologies, the blurring of industry ecosystems and an increased focus on innovation are creating challenges and opportunities in banking. Consumers are increasingly turning to fintech solutions and big tech platforms, fragmenting existing relationships for essential financial services, such as deposits, loans, payments and investments.

The importance of developing and deploying new digital services, building new business models, and transforming from a product-centric to customer-centric culture should be the focus for all banks and credit unions going forward. No longer can these initiatives be long-term objectives. They must be accomplished now … at digital speed and scale.

Read More: Banking Must Combine Strength of Humans With Power of Technology

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Fractional Marketing for Financial Brands

Services that scale with you.

Competition Will Be Won by the Technology-Enabled

Recent increases in digital banking acceptance and utilization have benefited neobanks, product specialist fintech firms, and large big tech platforms. While the preference for digital-first solutions still is stronger for younger demographic segments, the increasing use of alternative financial organizations as a ‘primary financial institution’ should be a concern for all traditional banks and credit unions.

There is also a significant trend towards the desire for organizations that can integrate multiple financial solutions within a single platform, with a higher level of personalization than is evident at most financial institutions today. As the diversification of financial product portfolios across multiple organizations continues, the need to leverage modern technologies becomes even greater. Unfortunately, most organizations are not confident in their ability to leverage these technologies and do not have the skillsets internally to quickly upgrade capabilities.

While the pandemic served to escalate the investment in technologies supporting digital banking transformation, most of these investments were fragmented without an overarching plan for execution. As a result, the success of these investments was often uneven. In research done by Deloitte, only 11% of financial institutions globally said their organizations had fully modernized their core.

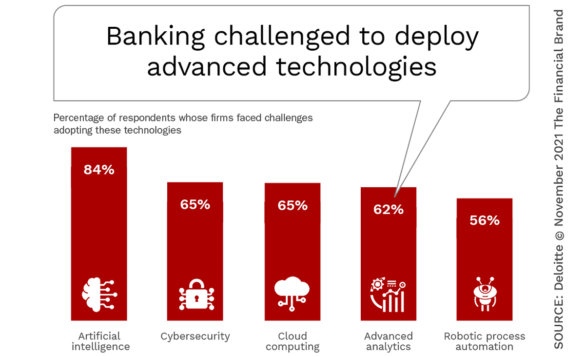

When asked whether there are significant challenges adopting new technologies, more than half of the organizations surveyed had challenges with each major technology needed to succeed in the future. Alarming is the fact that over four in five organizations are having challenges deploying artificial intelligence (AI) despite an influx of solution providers available to assist.

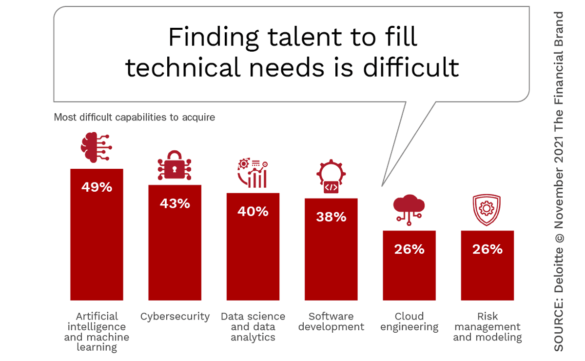

One of the reasons for the challenges in deploying advanced technologies is the difficulty in finding and developing a more modernized workforce. The Deloitte research found that four in ten financial institution executives said their workforce was not yet ready to adapt, reskill or take on new roles, while hiring new employees with niche technical abilities is harder than ever. In many cases, organizations have partnered with third-party providers to assist in upskilling internal teams.

To become future-ready, financial institutions will need to deploy modern technologies to support agility, efficiency, security and innovation. Technologies such as intelligent decisioning, open banking APIs, cloud computing, robotics and automation, embedded solutions, and cybersecurity will differentiate banks and credit unions in 2022 and beyond. In each technology deployment, the focus must be to elevate digital customer experiences at speed and scale.

1. Intelligent Decisioning and Communication

There has never been a time when the use of data, AI and applied analytics has been more important. As opposed to simply producing reports, data, intelligence and analytics must be used to identify opportunities, facilitate innovation, refine decisions and support contextual communications. This will not be done devoid of humans, but will be enhanced by humans and will enhance humans.

AI and advanced analytic algorithms can illustrate what’s happening across the organization, why it happened and what will happen next. This enables employees to take actions that can improve back-office operations, reduce costs, save time, improve customer service, loyalty and profits. This can be done faster than ever before, providing flexibility and agility during times of uncertainty.

The High Road:

“Responsible AI helps achieve fairness, even though biases are baked into the data; gain trust, although transparency and explainability methods are evolving; and ensure regulatory compliance, while grappling with AI’s probabilistic nature.”

— Svetlana Sicular, Research VP at Gartner

With data, AI and applied analytics, financial institutions will be able offer the most value-added features in terms of customers’ needs and preferences. Personalized and contextual communication will convey how products and services meet customers’ needs in close to real-time, positively impacting both cost of engagement and financial results. Proactive and dynamic recommendations can also be delivered, at scale and in real-time.

Beyond outbound communications, the use of data, AI and applied analytics can facilitate customer access to financial tools, advice, and embedded solutions that can improve trust and differentiate a brand by empowering the customer to partner on their financial wellness journey. This level of sharing also can assist in protecting the customers’ privacy and security.

2. Expansion of Open Banking APIs

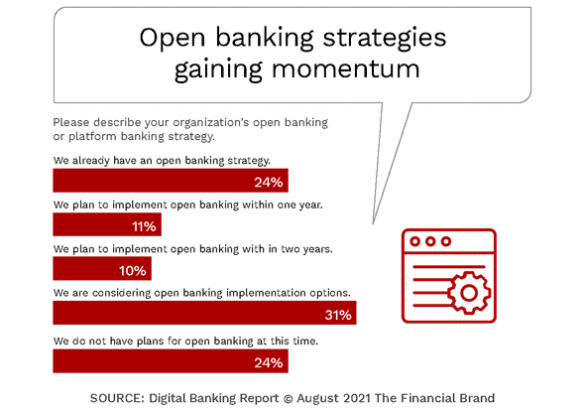

Open banking has become one of the major drivers of digital banking transformation, impacting technology and infrastructure investments, data modernization and decentralization strategies, fintech partnerships, and even reskilling programs. The primary beneficiary of these efforts will be the consumer, according to research done by the Digital Banking Report.

To prepare for this shift in the way banking will be done moving forward, banks and credit unions must determine the most appropriate business model that will meet their future business objectives. Then institutions must assess the capabilities required to deploy against the model selected and build partnerships with third party providers to make the strategy successful.

Need for Speed:

85% of financial institutions believe the greatest impact of open banking will occur in the next 5 years.

For some institutions, the decision may be to build a banking-as-a-platform (BaaP) model or a banking-as-a-service (BaaS) model to open doors for selling products and services to an expanded prospect universe. Open banking also provides the opportunity to streamline and automate back-office processes, build a stronger innovation culture and improve customer retention.

Consumers are increasingly demanding relevant, timely and personalized experiences that can save them time and money. The pandemic illustrated how well organizations in every industry could respond to the opportunity to bring technology and digital delivery together to meet consumer needs. In banking, traditional and non-traditional financial services providers can play an important role in creating open banking opportunities that can serve the institutions while also providing valuable customer experiences.

3. The Move to the Cloud

The majority of banking and financial services organizations have yet to deploy core systems to the cloud due to significant complexity and concerns over security, risk, governance and control. In fact, according to a 2020 IBM banking on open hybrid multicloud survey, “While 91% of financial institutions are actively using cloud services today (or plan to in the next nine months), only 9% of mission-critical regulated banking workloads have shifted to a public cloud environment.” This presents a significant opportunity gap.

To address the need for capacity and speed, banks and credit unions must look to cloud computing solutions to store data and support applied analytics. The result is increased customer insights, improved efficiency, enhanced innovation, greater agility, and a reduced risk of security or business continuity breaches. As an overarching organizational advantage, cloud solutions can augment human productivity, providing insights that can positively impact both front-office and back-office transformation.

Cloud Computing = Flexibility + Agility + Scalability:

Cloud-based infrastructure can help banking organizations react to marketplace changes in an instant.

It is imperative for financial institutions to replace outdated on-premise infrastructure that has become harder and harder to update and increasingly costly to maintain. More than ever, successful organizations must look for flexible, scalable solutions that are both responsive and efficient. The technology is now available to help smaller banks compete. Waiting to leverage these new solutions is not a winning strategy.

According to IBM, “Organizations have an enormous opportunity to leverage cloud computing to drive innovation and improve their competitive position. Cloud computing – whether private, hybrid or public – enables organizations to be far more agile while reducing IT costs and operational expenses. In addition, cloud models enable organizations to embrace the digital transformation necessary to remain competitive in the future.”

4. Intelligent Process Automation

According to McKinsey, roughly half of all existing work activities could be automated in the next few decades, as next-level process automation and virtualization become more commonplace. “By 2025, more than 50 billion devices will be connected to the Internet of Things (IoT),” McKinsey predicts. Robots, automation, 3D-printing, and more will generate around 79.4 zettabytes of data per year. This equates to opportunities for greater efficiencies and enhanced data for improved decisioning.

Process automation tools such as robotic process automation (RPA) and digital process automation (DPA) will continue to enjoy healthy growth in 2022 as financial institutions realize the benefits beyond improved efficiency.

More than ever, banks and credit unions realize that an excellent digital customer experience can’t be delivered without a digital-first back-office. This includes more efficient new account opening, customer onboarding and digital loan application management. For RPA to help with these deployments, financial institutions will need to support RPA with intelligent automation.

5. From Embedded Banking to Embedded Finance

The appeal of embedded banking is to provide an easy and seamless way to deposit, save, pay or borrow without leaving a non-financial company’s app. The result is the ability for non-financial firms to retain customers and increase the overall value of the relationship. According to McKinsey, “Companies of all types and levels of maturity – including retailers, telcos, big techs and software companies, car manufacturers, insurance providers, and logistics firms – are considering and preparing to launch embedded financial services to serve business and consumer segments.”

In response to the desire to embed finance within apps outside banking, leading financial institutions are working with fintech firms and non-financial companies to provide banking-as-a-service (BaaS) offerings. While some institutions see embedded finance as potentially threatening traditional banking models and control of current customer relationships, there is also the potential to participate in an estimated $230 billion market opportunity.

Consumers Want Simplicity:

“Consumers want to stay within an app to research, engage, buy and share experiences.”

The future of embedded finance can have positive implications. According to a research report from Plaid and Accenture, “Embedded finance can not only provide access to new markets, it can also reduce customer acquisition and servicing costs. In addition, an underlying benefit of embedded finance is that it offers ways to monetize without charging customers more, and therefore enables companies to eliminate barriers to adoption of their core offerings.”

“If an organization has the primary bank account for somebody, and that bank account is being connected to a lot of the financial and non-financial apps that exist across the ecosystem, the consumer is much more likely to continue using that organization as their primary bank account than if that’s not the case, stated Eric Sager, COO of Plaid in an exclusive interview on the Banking Transformed podcast.

In fact, the Accenture research found that for those already implementing embedded finance solutions, 70% said they are using partners, buying, or licensing technology as part of their embedded finance strategy. This illustrates the desire by non-financial firms to partner with legacy banking organizations.

6. Increased Focus on Cybersecurity

Cyber threats have dire immediate financial consequences and threaten both the reputation and future business prospects for financial institutions. Security breaches can come from anywhere inside or outside the organization, with the use of mobile technologies and online data transmission creating increased threats of hacker attacks.

While cyber attacks increased significantly during the early days of the pandemic, the real damage occurred as financial institutions hurried to implement remote working and doubled down on digital banking transformation initiatives. Once-in-a-decade breaches (SolarWinds, Colonial Pipeline, Verkada, JBS foods, Kaseya) hit almost every news cycle. The importance of protecting customer information and critical infrastructure from cyber threats is only getting more urgent, while also becoming more difficult to counter.

One major trend that may gain traction will be the elimination of passwords. Humans are not prepared to generate and remember dozens (or hundreds) of unique combinations of characters that don’t resemble any spoken language.

Authenticator apps, Windows Hello, and SSO solutions are all reducing the need for passwords. Recently, Microsoft has allowed users to go passwordless by using their Authenticator app. While this won’t stop cyber criminals, it will certainly provide an added layer or protection as biomentrics are increasingly used.