7. Navigating Compliance and Regulatory Changes

![]() Similar to what we saw in 2017, most banks and credit unions worldwide are continuing to do business under a cloud of regulatory uncertainty that is expected to a challenge for the foreseeable future. Even though lawmakers and regulators aren’t expected to make many definitive changes, most financial institutions continue to do their best to meet risk and compliance parameters and supervisory expectations.

Similar to what we saw in 2017, most banks and credit unions worldwide are continuing to do business under a cloud of regulatory uncertainty that is expected to a challenge for the foreseeable future. Even though lawmakers and regulators aren’t expected to make many definitive changes, most financial institutions continue to do their best to meet risk and compliance parameters and supervisory expectations.

Since most institutions realize that they don’t have the ability to wait to see how things will eventually end up, many banking organizations are making progress, trying to keep in alignment with what is anticipated from a risk and business perspective. As one banker stated this past year, we are in a position to ‘beg for forgiveness’ rather than ‘asking for permission.’

According to Deloitte, “Banking organizations need to keep moving forward as planned, with deliberate linkage between regulatory strategy; business strategy; and building infrastructure for governance, regulatory reporting, and risk management that scales and is flexible.The good news is that many of the changes banking organizations are currently implementing make good sense from a business perspective—not just a regulatory perspective—and are worth doing no matter how the future unfolds.”

“Regulatory and consumer attitudes to data protection, controls, and data sharing are undergoing important changes in many markets around the world, and especially in Europe (e.g. PSD2 and GDPR). Managing customer consent for data usage and data sharing is rapidly becoming a critical skill for banks. While regulatory compliance matters, forward-looking banks will be thinking beyond compliance and seeking to turn customer consent into a valuable asset..”

– Zilvinas Bareisis, Senior Analyst at Celent

“The complexities and nuances of data management, privacy and security will come to a head for financial institutions and fintech. Both will need to assure data platforms are designed around the principles of transparency and trust, as governments role in oversight continues to evolve.”

– Bryan Clagett, CMO of Geezeo

“The most exciting activities in banking are happening in Asian markets, where commerce and financial services are blending within new everyday customer experiences and where government regulatory activities are encouraging and directly involved in innovation. The policies of the U.S. and Western Europe need to more rapidly evolve or else the banking and technology centers of innovation will continue to shift eastward.”

– Bradley Leimer, Managing Director and Head of Fintech Strategy at Explorer Advisory and Capital

“I worry about FIs response to regulators’ review of sales practices in the wake of Wells Fargo. Especially at a time when alternative service providers are expanding. Banks can ill-afford an over-reaction here.”

–Alpine Jennings, Director, Deposits at State Farm Bank

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

8. Exploring Advanced Technologies

![]() At a time when most organizations are still playing catch-up, a new wave of digital technology has the potential to change the way organizations deliver banking services even further. These new technologies include artificial intelligence (AI), the internet of things (IoT), blockchain, open banking platforms with application program interfaces (APIs) and robotic process automation (RPA).

At a time when most organizations are still playing catch-up, a new wave of digital technology has the potential to change the way organizations deliver banking services even further. These new technologies include artificial intelligence (AI), the internet of things (IoT), blockchain, open banking platforms with application program interfaces (APIs) and robotic process automation (RPA).

With the potential to increase efficiency, decrease costs and enhance the customer experience, these digital-enabled technologies will result in disruption of the way people do their banking and potentially what organizations deliver these services. We are already seeing organizations testing many of these digital technologies, hoping to win the battle to become the ‘bank of the future.’

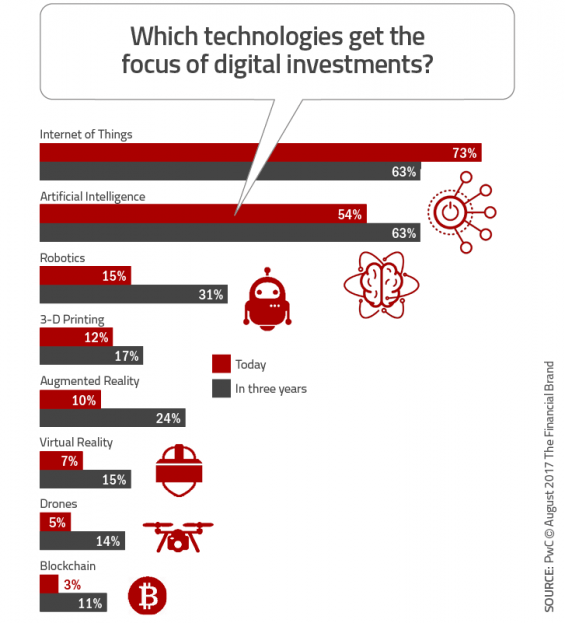

As quickly as past technologies have become the norm, a new wave of emerging technologies will combine digital technologies and the power of data to set new standards. According to PwC, these ‘essential eight’ technologies include:

- The Internet of Things (IoT)

- Artificial Intelligence (AI)

- Robotics

- 3-D Printing

- Augmented Reality

- Virtual Reality

- Drones

- Blockchain

Obviously, the prioritization and investment in each of these technologies will vary based on the industry, business model and strategic goals of each organization. For instance, while the marketplace as a whole does not foresee investing much in blockchain technology, the financial services industry ranks this as a high priority.

That said, investment in emerging technologies as a percentage of overall technology investment has not increased since 2007 (across industries). In fact, the share of the overall technology budget that is allocated to emerging technology is only 17.8%, according to the PwC research.

Especially for the financial services industry, it is imperative to think beyond individual emerging technologies. With the advent of open banking APIs as a way to bring external technologies and innovations directly to banking customers, and the emergence of non-traditional banking ecosystems that may include non-banking services, combinations of technologies will become the norm.

For instance, the use of customer data insights and advanced analytics may be combined with IoT technologies to allow payments directly from smart home devices. Likewise, the the expanded use of conversational AI and VR devices may come together, providing methods of banking interactions only imagined in sci-fi movies.

Being a leader in emerging technology is no longer a luxury only for the big players. It is important for all financial organizations to make emerging technology a ‘core competency,’ with engagement throughout the organization (not just the very top). In addition, the focus of every implementation much be both internal and external human experiences, as opposed to revenue, profit and cost savings.

“Artificial Intelligence is an ‘event horizon’ for financial services. You just cannot speculate on what is beyond the introduction of true AI in the financial sector. Why? Because the customers will have robots too. How exactly will the bank’s robot go about selling a pension to my robot? My robot couldn’t care less about the free pen, the nice advertisement on television or the reassuring mahogany in the advisor’s office.”

– David Birch, Director of Innovation at Consult Hyperion

“The most exciting of technology trend, as it enables unprecedented speed of innovation and requires a severe cultural change, is the DevOps evolution of many banks. This may be the single most important change to banking in the next few years.”

–Duena Blomstrom, Chief Growth Officer, Marketplace at Temenos

“In 2018, chatbots will become mainstream and grow out of the bank-owned channels (e.g., bank’s website, internet banking, mobile banking) and into the conversational platforms customers use most often. These platforms include messaging apps (e.g., Facebook Messenger, LINE, etc) and personal intelligent assistants (e.g., Google Assistant, Amazon Alexa, etc.).”

– Danny Tang, Channel Transformation Leader, Global Banking at IBM

“I see 2018 as a year of wide application of AI-driven solutions that will be mostly voice-driven, fast development of biometric authentication with special focus on facial recognition and voice, as well as a boom of commercial applications of blockchain, especially in SME and trade finance areas.”

– Sonia Wedrychowicz, Head of Technology, Consumer Banking Group at DBS Bank

“Virtual (VR), augmented (AR), and mixed reality (MR) will enable a 4th wave of computing power via a spatial computing revolution that integrates disruptive technologies such as sensors, Big Data, the cloud, AI, and wearables. Together with other innovation accelerators – AI, robotics, Big Data, and wearables – AR/VR/MR will drive efficiencies, transform established sectors, and create new business opportunities.”

– Dennis Gada, Regional Head, Financial Services at Infosys

9. Competing with New Challengers

![]() Modest-sized fintech firms and large tech giants continue to make retail banking inroads worldwide, providing services that leverage the best in digital technology to deliver a customer experience that removes cumbersome steps from both routine and more involved banking engagements. Relative financial newcomers like AliPay (China), WeChat (China), Rakuten (Japan), Atom (UK), Monzo (UK), Starling (UK), N26 (Germany) and Revolut (UK) have joined household names like PayPal, Amazon and Google to disrupt the banking ecosystem, leveraging modern infrastructures and innovative cultures.

Modest-sized fintech firms and large tech giants continue to make retail banking inroads worldwide, providing services that leverage the best in digital technology to deliver a customer experience that removes cumbersome steps from both routine and more involved banking engagements. Relative financial newcomers like AliPay (China), WeChat (China), Rakuten (Japan), Atom (UK), Monzo (UK), Starling (UK), N26 (Germany) and Revolut (UK) have joined household names like PayPal, Amazon and Google to disrupt the banking ecosystem, leveraging modern infrastructures and innovative cultures.

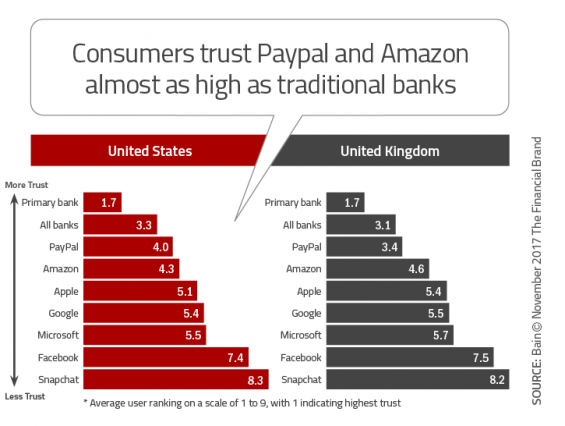

According to Bain, “Many of the tech giants possess the ingredients of success: digital prowess, large customer bases, organizations well versed in improving the customer experience, and ample leeway to extend their corporate brands into banking.” More concerning may be that some of these firms are generating a level of trust previously reserved only for traditional banks and credit unions. As a result, an increasing percentage of consumers are willing to use financial products offered from these non-traditional firms – especially where the experience is superior to that offered by legacy organizations.

It is expected that demand for products and services from fintech firms and large tech companies will only increase as more consumers become familiar with new digital offerings. This is especially true for younger consumers, who have grown up with digital devices. More and more, people will get annoyed when they’re forced by bank policies and processes to use non-digital channels for everyday banking business, states the Bain research. This includes rudimentary transactions as well as being able to open new accounts or apply for loans.

The best way to prepare for the inevitable increase in competition that the continued expansion of banking services offered by Amazon, Google, PayPal, Facebook and an increasing number of start-up banks will bring is to be proactive in the development of personalized digital solutions. This will most likely involve new partnerships inside and outside of traditional banking organizations and a redefinition of what a banking ecosystem includes.

In other words, if banks don’t reorient their approach and radically accelerate their rate of progress, loyalty will suffer, and they will watch technology firms poach more business. Meanwhile, their economics will erode as too many routine transactions continue to flow through expensive branch and call-center networks.

There is a great advantage in the customer and member insights that traditional financial institutions possess. The key is to apply these insights in ways that directly and positively impact the digital experience, similar to how large tech firms currently improve shopping, social, search and payments.

“The most significant change in the financial services industry next year will be the entry of 4th gen competitors. Not banks, not fintech firms, and not tech giants, but left-field players challenging banking indirectly with their own virtual currency ecosystems. Expect plays from the likes of Lego, Starbucks, Disney, McDonalds, Coca Cola, Shell & Budweiser.”

– Chris Gledhill, CEO and Co-Founder of Secco

“In 2018, we will see one of the tech platform players (Amazon, Alibaba, Tencent, Baidu, Google, Microsoft, Facebook, etc ) make a move in Fintech that will make all existing FinTech startup innovations look futile.”

– Peter Vander Auwera, Founder, Petervan Productions

“In 2018, open banking will move forward significantly in some markets. At the same time, firms such as Alipay will expand internationally, with both Alipay and Amazon pushing their payment solutions and getting into lending and other services.”

– Alain Enault, General Manager and Program Director at Efma

“E-commerce and payments giants from China (Tencent, Alibaba) will make significant inroads in the U.S. market, raising the stakes for Amazon and WalMart, and just about everybody in the payments space. Consumers will benefit from new digital-enabled experiences, simplified payment options, and heightened competition.”

– Steven Ramirez, President of Beyond the Arc

“2018 will see a US fintech get a full bank charter. Whether it’s with the OCC fintech charter, or SoFi is succesful in getting an industrial bank charter, it will happen one way or another. .”

– Bryan Yurcan, Senior Writer at American Banker

“Insurance will stay on top of fintech trends in 2018, as the industry faces a challenge to generate and collect more data on customers. We will see more incumbants developing ecosystems of tech/startups/partnerships around them to build the next insurance generation and better compete with new players (GAFA-BATX).”

– Florian Graillot, Partner at astorya.vc