3. Improving Multichannel Delivery

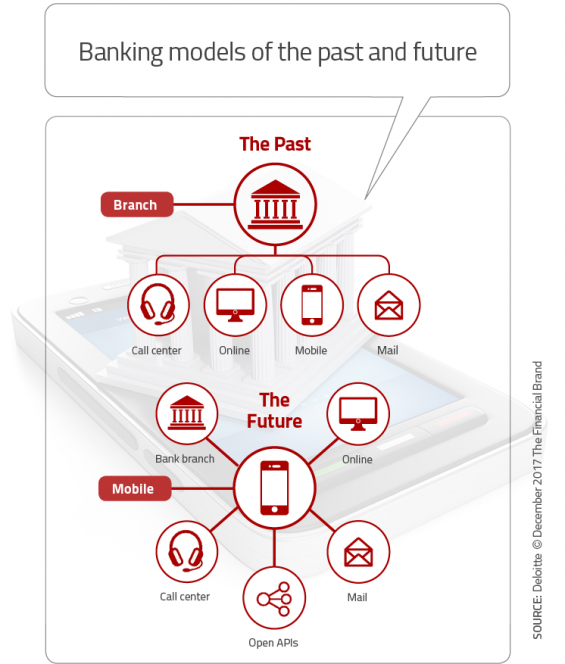

![]() Banks and credit unions will see less than half their customers face to face in 2018. Instead, an increasingly digital customer base will use self-service touchpoints as a first point of contact, only reaching out to contact-center agents or branches for the most complex engagements. This movement of transactional interactions to digital channels will mean that branch and contact-center interactions are more important than ever in building human relationships with customers.

Banks and credit unions will see less than half their customers face to face in 2018. Instead, an increasingly digital customer base will use self-service touchpoints as a first point of contact, only reaching out to contact-center agents or branches for the most complex engagements. This movement of transactional interactions to digital channels will mean that branch and contact-center interactions are more important than ever in building human relationships with customers.

Winning financial services organizations will provide all customer contact personnel with the digital tools required to access answers quicker, and will invest higher trained personnel who are better equipped to use these tools and present high value responses to inquiries.

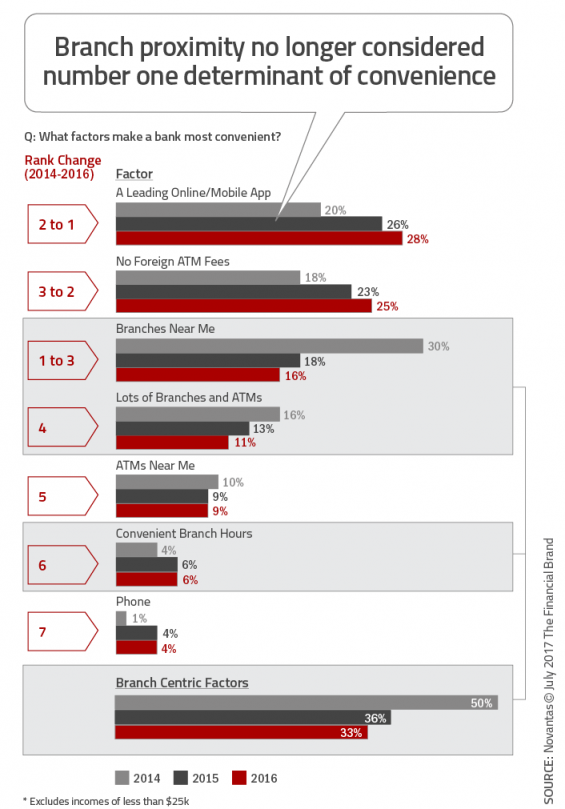

The traditional definition of convenience in banking has revolved around the proximity of the branch. With the growth in digital technology and the increased acceptance of online and mobile banking, access to banking products and transactions is no longer tethered to a physical location, resulting in a redefinition of convenience. Today, while convenience is still the primary driver of initial consideration, the importance of branches in that definition has gone down.

Novantas found the correlation between ‘perceived convenience’ and ‘consideration’ to be slightly stronger than the correlations between ‘perceived convenience’ and ‘purchase’, with both being very strong. The biggest news is that the drivers of ‘perceived convenience’ start with an organization’s digital capabilities. In fact, the importance of branch-centric factors have dropped in each of the past three years of the study. This is especially true for consumers aged 18-54.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Aligned with the preference to shop digitally, there has been a corresponding increase in the preference to open accounts digitally, according to Novantas. Over a third of consumers prefer to open their account digitally, with the number being significantly higher (46%) if the consumer shopped using digital channels exclusively. In fact, the mobile channel has replaced other channels as the centerpiece of the banking relationship.

“In 2018, mobile will surpass desktop as the top digital channel for retail bank account opening. Consumers will move from just browsing to actually buying financial products from their phones. This move will be supported by superior security from mobile, vastly improved customer interfaces, and the convenience of off-hours access that mobile provides.”

– Don Bergal, CMO at Avoka

“Operational processes and technology infrastructure created for branch-centric workflows will become the limiting factor for adequately serving digital-first customers. Institutions will be forced to migrate from digitizing self-service to providing exceptional service digitally.”

– Wade Arnold, Advisor at BillGo

“Advertisers will realize that context does count. While they’ve appreciated the precision targeting of social platforms, there will be a growing appreciation in 2018 that the trustworthiness of the content on each platform has a big impact on their brand message.”

– Jennifer Grazel, Global Director, Vertical Marketing for LinkedIn

“One of the biggest trends is clicks to bricks. We are working with many of our clients to connect the online digital experience to the traditional branch experience with the use of tablet friendly, open branch workflow experience for loans and deposits.”

– Kyle Kehoe, President, Action Division of CRIF Lending Solutions

“The emergence of Gen Z (born 1996 and after) will underscore the urgency for small- and mid-sized institutions to accelerate their digital evolution; both in terms of customer experience and workplace culture. As this constantly-connected generational cohort enters adulthood, their digital preferences (e.g. mobile-only, immediacy, personalization, security) and pragmatic, independent personalities will challenge financial service managers and marketers alike.”

– Jim Perry, Consultant and Strategist for Market Insights

“2018 will see banks getting much more serious about digitizing their current analog processes with a particular focus on their commercial customers and on mobile. Loan processing, account opening, service subscriptions, problem resolution and one-to-many payments are all examples of current processes that are ripe to be reimagined in order to gain speed, efficiency, and scale.”

– Chris Nichols, Chief Strategy Officer at CenterState Bank

“Especially for emerging markets around the world, there will be increased importance of the mobile channel and increasingly the growth of smartphones changing access to banking (and financial services in general). The use of new ways to interact with customers, and increasingly the use of chatbots, will be a key trend.”

– John Owens, Senior Advisor for Digital Financial Advisory Services

“Financial institutions will pull back from dramatic changes and take a more practical approach to the industry’s challenges, such as service delivery and channel utilization. With 2018 being the year of small business banking, there will be increased investment in technology (or partnering with fintech firms) to simplify business loan processes, using branch staffs for selling these services.”

– David Kerstein, Founder of Peak Performance Group

4. Embracing PSD2 and Open API Banking

![]() While APIs are not new to banking and are nothing more than a structure for how software applications should interact, they provide the gateway for innovative, contextual solutions that would be difficult to offer without Open Banking. As outlined by the World Retail Banking Report 2017, published by Capgemini in conjunction with Efma, there are three types of APIs:

While APIs are not new to banking and are nothing more than a structure for how software applications should interact, they provide the gateway for innovative, contextual solutions that would be difficult to offer without Open Banking. As outlined by the World Retail Banking Report 2017, published by Capgemini in conjunction with Efma, there are three types of APIs:

- Private APIs: These are APIs that are used within the traditional banking organization, reducing friction and enhancing operational efficiency. A vast majority (88%) of banks viewed private APIs as essential in 2015.

- Partner APIs: These are usually between a bank and specific third-party partners, enabling the expansion of product lines, channels, etc.

- Open APIs: In this scenario, business data is made available to third parties that many not have a formal relationship with the bank. Because of the structure of open APIs, many banks have a greater concern around security.

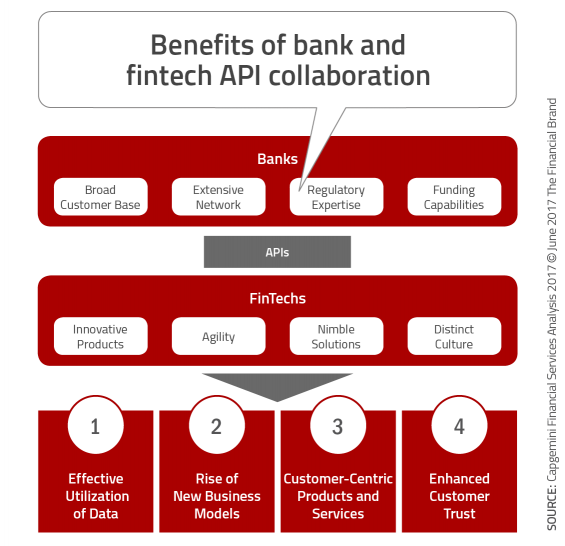

Most banks ease into the use of APIs, moving from private, to partner and sometimes to open APIs. It is believed that, over time, APIs will evolve to the more extensive options in response to the consumer desire for greater digital solutions not currently provided by legacy organizations. This will also occur as both fintechs and traditional banking organizations understand that they need each others strengths. This collaboration will enable both banking organizations and fintech firms to offer more to customers than previously possible.

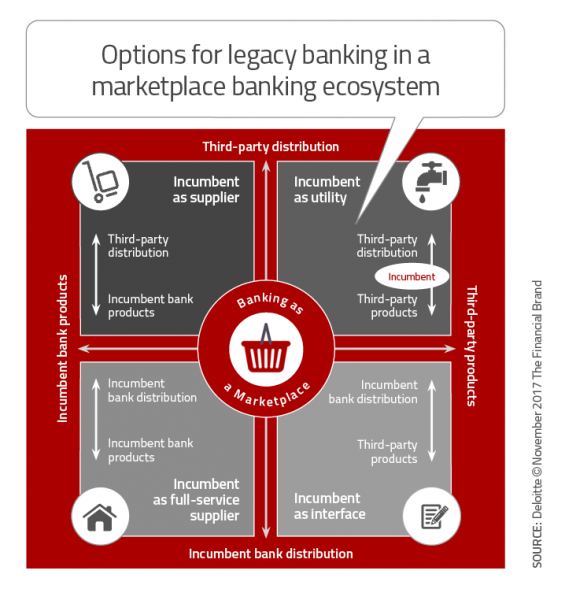

Deloitte believes there are four distinct strategic options for banks and credit unions in the future. In two scenarios, an institution remains in control of the customer/member relationship. In the other two, products and distribution become unbundled.

- Incumbent as a full-service provider

- Incumbent as a utility

- Incumbent as a supplier

- Incumbent as an interface

It must be mentioned that the options are not mutually exclusive. Organizations may want to play in multiple quadrants. For instance, they may want to be a supplier of services as well offering products in a third-party interface.

Perhaps the greatest risk of open banking is that it will allow consumers and merchants to execute direct transactions without going through banks, making it more difficult for banks to have a full view of the customer transactions and maintain customer relationships. It is hoped that the open banking concept can avoid this demise, as traditional banks and fintech firms work together to build the customer’s trust and offer products and services that will improve a consumer’s lifestyle.

The foundation of these partnerships will be the data that can be collected and cultivated for the benefit of the customer, the bank and the fintech firms. If applied diligently, the improvement in customer experience could be the differentiator that retains the overall banking (and non-banking) relationship.

“As PSDII enters in force at the beginning of the year, some truths will be revealed about the effects of such imprecise regulation, about the misplaced expectations of some start-ups, and about the real open banking strategy of the European banks. Over the year, I expect the bumps in the road to open banking to get smoother as new players learn to work together and deliver banking services in new ways. The rest of the world will be watching and learning from this.”

– Andra Sonea, Solutions Architect at Anthemis Group

“The era of Open Banking is upon us. Banks have moved beyond exploration with Fintech companies and moved towards established partnerships. This evolution will continue in 2018 as consumers move closer to having the power to completely customize their banking relationship.”

– Matt Wilcox , SVP, Marketing Strategy and Innovation at Fiserv

“We’ll reach peak API excitement, but despite the investment, there won’t be many success stories from banks opening their APIs just yet as they realize its not a case of ‘build it and they will come!’.”

– James Haycock , Managing Director at Adaptive Lab

“The rise of open banking will force banks to decide whether they want to be the interface (in control of the relationship), or the pipe (providing third party ecosystems) with digitally savvy product and systems. Big internet players will test the water and offer unbundled financial services to support their core business (eg payment services, lending).”

– Paolo Barbesino, SVP and Head of Digital at Unicredit

“I believe 2018 will be a year of demistifying open banking driven by API, when many institutions will start seeing it as a new channel of customer acquisition and engagement, rather than a threat that will diminish their business.”

– Sonia Wedrychowicz, Head of Technology, Consumer Banking Group at DBS Bank

“I’m looking forward to U.S. specific “lessons learned” from the PSD2 enforcement in the UK. As usual, we will bastardize the guidelines to fit our unique needs. But open banking is coming whether we like it or not.”

– Sam Maule, Managing Director, North America at 11:FS

“2018 will be the point of no return due to PSD2. This will place banks and fintech services into equal positions, thus taking user experience design to the forefront as the main edge of competition.”

– Alex Kreger, CEO of UX Design Agency

“European MiFID2 and PSD2 will realize internationally the need and opportunities of digital wealth management, accelerating all B2B and B2C wealthtech trends.”

– Paolo Sironi, Director at IBM Watson, Financial Services

“As the fintech ecosystem gets more complex and end users look for more self-service tools, the ‘platformification’ of digital banking will be a trend that will bring consumer, business, and employee under one single solution to save money and lower the maintenance/complexity of managing disparate systems.”

– Tom Shen, CEO of Malauzai Software

“We’ll reach peak API excitement, but despite the investment, there won’t be many success stories from banks opening their APIs just yet as they realize its not a case of ‘build it and they will come!’.”

– James Haycock, Managing Director at Adaptive Lab

“Open Banking will be a massive game changer. The best hope is that banks become the next financial platform – finance 2.0 – offering consumers more choice and competition. Worst case scenario is that the big tech giants (Google, Facebook, Apple, Amazon, etc.) will leverage their data and open platform to dominate the market.”

– Liz Lumley, Global Fintech Commentator and Adisor to Financial Services Industry

“Open banking is the dawn of the next wave of banking like we haven’t known before. New entrants will be able to access interesting new sources of data and make payments, and old incumbents will be pushed to embrace the next wave of digital … with the result being intelligent digital services either as an end to end experience or as part of a distributed ecosystem. This is the year that David and Goliath will win, but which one wins most is going to be the most interesting thing to see. Its way too close to call.”

– David Brear, CEO and Founder of 11:FS

“PSD2 and open banking represents a huge opportunity for change and innovation in the coming year. Benefits will come to organizations with a PSD2-ready API and regulatory permissions to open a marketplace which collects and connects other financial services providers, all within the banking app.”

– Anne Boden, CEO of Starling Bank

“The frontlines in the battle for the new customer will shift in 2018. Tomorrow’s conversational commerce, AI, and big data will transform the Facebooks, Amazons, Googles, and Apples of the world into the key gateways for new customers. The only way to compete will be through real customer insights from personas/journeys and integration requiring API ready infrastructure.”

– Craig McLaughlin, President of Extractable

“The availability of APIs is a game changer for the industry as FIs gain the ability to decouple from inflexible vendor development processes and take more control over customer experience.”

– Alpine Jennings, Director, Deposits at State Farm Bank