The hype around wearable technology is reaching a fever pitch as the potential for a new wave of wearable devices and applications could soon hit the market, beginning with a possible iWatch introduction from Apple. Some industry advisors believe now is the time for financial services companies to invest in exploring uses for wearable technology, such as smart watches, Google Glass, and other wearables that could provide a new access point for financial services.

There is no arguing that wearable devices could be used to access basic information such as balances and recent transactions, could provide fraud or account alerts and could facilitate funds transfers and potentially payments. Wearables could even leverage voice-activated commands relatively easily. But is this functionality enough to warrant an investment in this channel or even a discussion at the planning table?

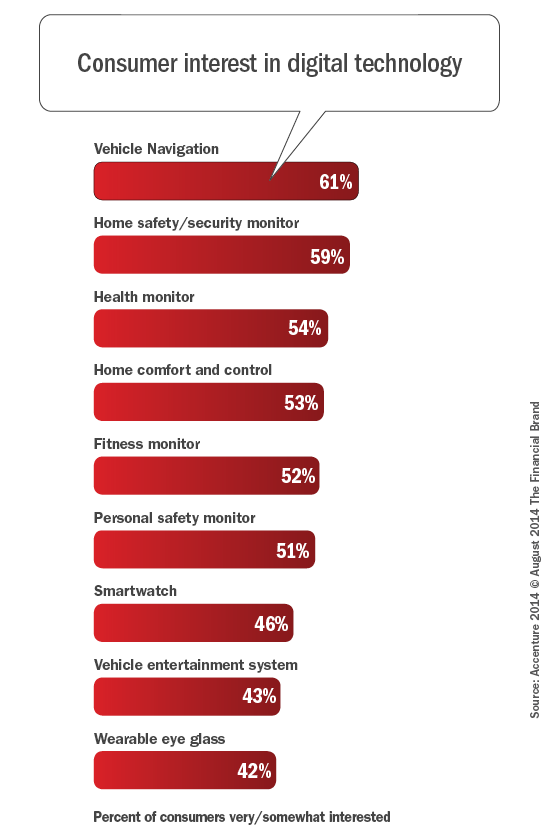

Accenture found that there is an interest in both smart watches and glass technology, but ‘interest’ does not necessarily relate to willingness to buy or use as a banking platform as we have seen with mobile banking overall. And even if interest is high, should wearable technology be a top priority for most banks?

Read More: Wearable Banking Still Not Ready for Prime Time

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Fintech Roundtable Perspective

To get a broader view on whether banks and credit unions should be allocating resources to the opportunities presented by wearables, The Financial Brand reached out to some of the most notable names in digital banking innovation globally. Their perspectives will surprise you.

Participants for the roundtable discussion were:

- Ron Shevlin: Senior Analyst, Aite Group

- Chris Skinner: Chairman, The Financial Services Club and author of Digital Bank

- Brett King: CEO/Founder of Moven and author of Breaking Banks

- Scott Bales: Speaker and author of Mobile Ready

- Claire Calmejane: Head of Digital Centre of Excellence, Innovation, Partnerships at Lloyds Banking Group

- Alex Bray: Retail Channels Director at Misys Banking Systems

- Bradley Leimer: Vice President, Digital Strategy at Mechanics Bank

- Michal Panowicz: Managing Director, Marketing & Business Development for mBank

- David Brear: Digital Banking Director for Gartner, Inc.

As banks and credit unions begin planning, how important do you think developing a strategy for wearable devices should be?

Shevlin: Seriously? Wearables? As a part of next year’s planning? No way. Maybe for 2025 planning, but not next year. In the list of things that banks and credit unions must fix and/or develop, wearables is pretty low on the list. Unless, of course, there’s a bank that’s got everything already in place in its online and mobile offerings, and is delivering those things perfectly (if you know of a bank like this, PLEASE let me know).

Skinner: It’s interesting but not important. Most banks have not worked out basic strategies for digital engagement yet. They are still struggling with tablet computing, and realising that creating apps is not just shrinking internet sites to smaller screens that you can touch. Until banks have really got to grips with their digital presence and strategy, wearables are a distraction.

King: I don’t think wearables per se is the key here. The more important issue is understanding context and what data the customer needs to make a decision. Banks need a feedback or personal data strategy for customers independent of the device.

Bales: Should banks and credit unions consider them for next year? Absoluately NOT. Not only are wearables in their infancy, but banks and credit unions are still struggling in the basics of digital. Even today, as digital natives make up an increasing slice of the market, banks and credit unions are struggling with basic shifts in context, behavior and utility value in a digital world.

Calmejane: Wearable technology is a new opportunity for Lloyds Banking Group to be the best bank for consumers – therefore we are looking at it as part of our Digital Innovation Strategy. Wearable’s can offer various benefits to consumers such as personal health monitoring, up to date information, geolocation, contactless payments etc – which can be converted into useful tools for banking and to provide an enhanced experience to our customers. It is part of our planning for the future.

Bray: In the next year, a strategy for wearable devices could be a market differentiator. Already, La Caixa and St. George Bank (and several others) have launched wearable device apps. Wearables could help a financial stand out as an innovator.

Leimer: If every bank and credit union (regardless of scale) had a fully functional online and mobile banking application, then by all means I would suggest playing in the wearable space. The key is to envision what type of financial information is relevant (and what experiences might be best mapped) to a simpler function on a wearable. For most banks and credit unions, wearables will be a wait and see – and will be very partner dependent. It’s time to break out of that mode of thinking and see development beyond our big fintech providers.

Panowicz: In my opinion, wearables, given the state of user installed base (minimal) and financial’s general digital readiness (less than minimal) are a distraction. If I were to chose – crack mobile first – really, really well. Put all resources here before a single man day is spent on wearables.

Brear: Defining a clear strategy for anything is hugely important, but having a clear view may mean that you do nothing at this stage and take a ‘wait and see’ approach. Most of the forays in this space can be defined as either PR for how technologically advanced the banks is or exploratory missions to understand while they do in order to learn about their customers and their habits.

Read More: Wearable Banking – Banks Roll Out First Apps for Google Glass

Do you believe wearables will be a delivery channel banks and credit unions will need to plan for in the near future?

Shevlin: If near future is next two to three years, then no. Smartphone and tablet development will (and should) dominate “channel” efforts for at least another two to three years.

Skinner: I think that if the bank has really worked out its digital engagement strategy and really understands how digital underpins the bank, then yes, wearables are a touchpoint. But the industry needs to stop using the word channel. If we talk about wearables as the next channel, then all we’re doing is adding another overlay to our analogue strategy. Go back to the drawing board, read my book (shameless plug) and work out your overall digital strategy. Work out how wearables provide another way to augment and differentiate our services through digital outreach. Wearables are not a channel, but just another way to access digitalized offerings.

King: The most important question a bank can answer is still “Can I afford this?”

Bales: It amazes me how banks consider and worry about new emerging technologies when many are so behind on the elements of mainstream consumer needs. Financial instituitions need to invest in developing real, first-hand empathy for the shifts in context, behaviour and value that are occurring in the market. Technology will come and go, but consumers will always desire to do business with real people.

Calmejane: There are various uses for wearable technology which could be utilized by a bank, however the speed of consumers buying into wearable’s will depend on the speed of delivery to the consumer. As wearable’s could be further categorised into watches, smart bands, glasses and clothing – the banking industry will need to monitor each category closely to predict which wearable’s are popular at different points and launch banking wearable solutions at the ideal time that is relevant and timely.

Bray: Today, supporting wearables will make you an innovator. In two years, a wearable strategy will be a necessity. We expect a rapid adoption of wearable devices. Adoption curves are getting quicker with every new device. Smartwatches already have a low barrier to adoption, given how comfortable users are with watches. Glass devices may take a little longer – but we still expect adoption to progress faster than it did for the smartphone.

Leimer: Absolutely. In a fairly short period of time, we’ve seen mobile take over the most critical areas of customer interaction across so many industries. Mobile has reshaped our experiences and enhanced our lives through technology. Banks and credit unions haven’t been immune to the impact of digital, or the shift from online to mobile – so it’s only a matter of time before even simpler interactions on a wearable device cover many financial functions. We’re only seeing the beginning of the shift toward simpler (yet highly impactful) micro-interactions between customers and their financial data.

Panowicz: You can do basic transactional apps easily (balance, recent transactions, even bill pay or payments) once you have mobile middleware ready. Cheap and fast. But it will not change the face of banking, definitely not in the next 12 months.

Brear: I think wearables will become mainstream, but that won’t be for the next 18 – 24 months. This could all be drastically reduced if Apple delivers the iWatch and iWallet integration to masses and get their price point right.

Read More: LoopPay, Visa, Wearables And The Changing Mobile Payments Landscape

What should financial institutions be more concerned about as they plan to become more responsive to the needs of the digital consumer?

Shevlin: Developing capabilities for smartphones and tablets that: 1) Add “convenience” to the banking experience (define that anyway you like), and 2) Improve consumers’ ability to manage their money (define that anyway you like).

Skinner: I think I’ve said it all already: work out your digital strategy.

King: If Apple launches their iWatch anytime soon, wearables will surge. But if a bank has no strategy for getting data to the customer in real-time, then it doesn’t matter what tech they support. It’s not about sending my bank balance to 20 different devices.

Bales: If financials want to remain relevant in the daily lives of people, they need to connect with those people … not the technology.

Calmejane: The pace of change particularly around mobile, tablet, social media and connected objects such as wearables is a significant opportunity to offer a digital inside out experience for the customers to interact with banking and banking services. The challenge is to ensure the application of new digital mediums offer a relevant experience, timely and applicable for our customer.

Bray: Banks and credit unions need to learn from the experience of launching mobile banking. We cannot port a mobile banking experience to wearables any more than we could port an online banking experience to mobile. We need to understand the use cases for wearable banking as we design user interfaces and functionality. Similarly, we should remember that these new devices and interactions will be able to help banks identify and meet customers product needs. By getting the user interfaces right – and by understanding the native capabilities of these new devices – we can transform sales processes and improve customer experience.

Leimer: How customers manage their money and obtain advice has to be a paramount concern – expectations are greater than ever that banks invest in ways to provide insight and advice on the most personal level. Financial brands must work to truly act as consumer advocates, tailoring specific advice based on aggregated account activity. To think that wearables, changes in consumer and merchant payment habits, and personalized actionable notifications won’t take part in these changes is simply ludicrous.

Panowicz: If I were to choose – crack mobile first and do it really, really well. Put all resources here, before single man day on wearables.

Brear: Most banks have not really come to terms with the required speed to market or internalised skill sets needed to keep pace with customer expectations as evidenced by most of the big banks taking two years to release significant mobile banking updates regularly. In order to unlock these and future benefits, financials need to put in place a framework and API structure within the bank to allow them to be proactive in the market. Only the agile banks are going to be able to defend their current revenue pots from new and existing players as well as grow new opportunities – The era of sticky back plastic and rigid architecture is coming to an end – Long live the API.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

What This All Means

It’s clear there lacks clarity regarding the importance of wearables to financial institutions in the immediate future. As illustrated by the perspectives of some of the most innovative minds in our business, ‘wait and see’ is a viable option. Alternatively, some organizations are already building wearable solutions.

William Sullivan, Head of Global Financial Services Market Intelligence at Capgemini may have summed up the conversation best when he told me, “There are so many other digital challenges related to mobile that will/should take center stage that will deliver a much higher return on investment. While there are opportunities to grab first-mover advantage and we may eventually see wearables gain traction, if I were prioritizing spend and mindshare, it wouldn’t be on wearables.”

Sullivan continued, “It’s the same question/challenge of mobile – Is the new technology going to reduce the friction and make life more convenient and/or deliver a more positive customer experience?”

For most financial institutions, it comes down to setting priorities based on where each organization is today, and how resources can be optimally allocated. Focus is key as the marketplace moves quicker than ever. Each institution will react differently to the emergence of new technology, but chasing the ‘next shiny object’ is not a viable strategy.

“Some developers and financial institutions initially will be satisfied with the softer ROI that can come with being the first to market and establishing a foothold with targeted products and services,” said Mark Schwanhausser, Director, Omnichannel Financial Services at Javelin Strategy & Research. “For FIs, justifying investments for wearables is likely to start with bolstering a tech-savvy brand image that can attract customers. But larger, sustained investments will require evidence that wearables are pervasive enough to result in cost savings and revenue.”