Technology innovation is always spawning new words, but it is rare that the name of a company becomes a verb. Google is clearly the most prominent example of this phenomena, but now it seems, at least in the business world, that Uber may be becoming a verb meaning to ‘radically disrupt’ an entire industry.

While Google grew out of the first ‘dot-com-boom,’ Uber is one of the largest companies to have grown out of the second tech boom. This time round, the boom is being built around two main themes, ‘apps’ and the ‘sharing economy’.

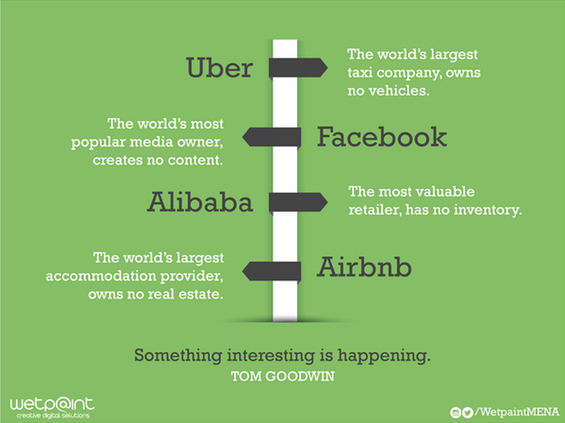

An interesting infographic has been making the rounds on social media, highlighting the success of new ‘sharing economy’ disrupters. The references, first discussed by Tom Goodwin on TechCrunch, illustrate how the middle men get cut out and how companies that take over the customer interface are the ones to gain.

“The new breed of disruptive companies are the fastest growing in history. Uber, Instacart, Alibaba, Airbnb, Seamless, Twitter, WhatsApp, Facebook, Google are indescribably thin layers that sit on top of vast supply systems ( where the costs are) and interface with a huge number of people ( where the money is),” states Goodwin.

While this is a fun infographic to share with our more luddite friends, there are fundamental questions we need to ask to understand how these companies have been this successful. We might also ask what this means for innovating in the financial services industry.

To answer that question, we must first understand the attributes of both the industries they serve and their solutions, so we can see what is applicable outside of these spaces. Then, we can look at how this can, and will, be applied to banking, investing, insurance and other financial services.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Attributes of Disruption

Some innovations are 100% new. Before Google (or before search engines) it was just not possible to find most of the world’s knowledge, or cat videos, in seconds. And while Apple may not have invented the MP3 player, it was their innovation of the iTunes store that made it possible to legally, and easily, fill your iPod with music.

Other innovations make existing tasks so much easier and accessible that they can create whole industries and markets. Ebay is a good example. Before Ebay, you could buy and sell items and collectables through classified ads and special publications and events. But it was hard and time consuming to do, and hence dramatically limited the people who would participate in these activities.

Ebay’s innovation was twofold – scale and ease. Ebay saw that the global reach of the Internet allowed small pockets of interested parties to easily find each other, and their Pez dispensers. And, they made it easy. A few clicks, and you were done. They created a truly massive marketplace (with very low friction) that let individuals easily participate.

Uber and Airbnb are in this latter category … simplifying an existing process and providing an easy customer interface. Before Uber, you could get a taxi or car service and before Airbnb you could rent a property. It was just much more complicated for both the property owner and the renter, especially if the property was in a more obscure location. Again, they have taken the friction out, and created true marketplaces.

While the ‘sharing economy’ is a bit of a misnomer – after all, you are not ‘sharing’ your house on Airbnb, you are selling it for a defined period – Airbnb has created a completely new type of market that was just not open to participants before.

Like Etsy before it, Uber, Airbnb, and other ‘sharing apps’ have allowed participation in markets as a secondary income stream for millions of people. In essence, the ‘sharing economy’ is better applied to the idea that these services provide people with a share of their income, based on using a share of their time or assets, rather than being their full-time role.

They have enabled the efficient application of millions of ‘shares’ of peoples’ time or assets to a new marketplace.

So before Uber, the taxi was a physical thing (a car) that was only applied to being a taxi (it was not used for going to IKEA with your spouse) and driven by a person whose job it was to be a taxi driver. With Uber, there’s a person that may be working a few hours, using their own car, amplified by thousands of people.

As with the eBay example, these new disrupters also make it very easy for consumers. They have a beautiful digital experience, and with a few clicks on an app you can be on your way. And, that ease moves through the total customer experience.

Finally, and most relevant to the financial industry, Uber and Airbnb have targeted highly regulated industries and fought them head on – to the point where new laws have been written to fight, or allow, these services. Beyond the safety issues (e.g., ensuring properties have fire escapes, etc.) it can be argued that the regulation in this area was overbearing to the point of damaging the market. And because issues tended to be local in nature (e.g., taxis are typically regulated on a city basis), they were more prone to cronyism – something less true with financial industry regulation.

Looking at these ‘sharing economy’ services and technology-led innovations, we see consistent attributes that are key to success:

- Consumer need. Addresses a core human need, whether for a ride across town, somewhere to stay, or to buy a handmade unicorn ring.

- Simplification. A model that reduces friction in existing ecosystems or creates a new way to address the customer need. They just make it much easier.

- Marketplace Creation. Brings many people to one source and creates large, transparent marketplaces for customers and sellers.

- Scalability. The ability to scale the model quickly, and to take advantage of the network effect.

- Experiential. Makes the customer (and seller) experience accessible, easy and virtually pain free. This is a critical attribute.

While a company does not need all of these to be successful, the more qualities that are embraced, the more successful the disruptor seems to be.

The Foundation for Disintermediation

Many financial services firms rely heavily on intermediaries to drive distribution for their business, such as insurance agents or financial advisors. It could be argued that bank branches can also be seen as intermediaries, although clearly not independent.

That said, the first dot-com boom promised, and delivered, a lot of disintermediation. The poster child for this was the travel industry. It moved away from travel agents to direct booking with airlines, hotels, and others, as technology enabled the transparency needed to price and select the choices we all wanted in our travel plans.

But some of the new ‘sharing economy’ firms are intermediaries, in the sense that they are between you, the customer, and the actual service provider. Where they differ from the old travel agent model is that it’s the technology and the algorithm that is now the intermediary, not a person in a local office. And that technology is transparent and enabling to the user, not limiting and obfuscating.

“In the modern age, having icons on the homepage is the most valuable real estate in the world, and trust is the most important asset. If you have that, you’ve a license to print money until someone pushes you out of the way.” – Tom Goodwin

It’s this kind of new technology-based intermediary that could well disintermediate financial advisors, agents and even branches. The new crop of ‘robo-advisors’ such as Wealthfront, Betterment and Personal Capital, are doing just that. They focus on exceptional digital-led customer experiences based around the technology/algorithm doing the heavy lifting. And for many people in the mass market and mass affluent market whose finances are not particularly complex, these firms can easily replace the value of a financial advisor.

The same could be said for the mass market use of branches. We have already seen a tremendous exodus of physical branch transactions to online and mobile banking. We have also seen a tremendous battle for the customer interface from fintech providers such as Simple, Moven, PayPal, Venmo and hundreds of others that are unbundling banking.

The Future for Financial Services

So, what does this analysis of Uber and its ilk tell us about the financial services industry and the opportunity (and need) to innovate? Firstly, it says the industry, despite its sheer size and level of entrenchment, is not safe from radical innovators and disrupters.

Like Uber not owning cars, could a bank exist without capital or a vast physical distribution network? In some places this is starting to happen. Peer-to-peer lending is growing strongly with firms like LendingClub and others. Payment technologies (Apple Pay, Square, etc.) are nipping at the toes of lower-end banking transactions, although many piggy-back on traditional financial services providers.

While there may not be a single large disruptor, traditional banks and credit unions are being targeted from many sides, and as each profitable business gets disrupted, it becomes harder for a bank, insurer, or investment firm to sell more products to each consumer.

In fact, this may be the biggest challenge to the financial industry. As customers use more and more of these disrupter apps and services, their expectations of their bank or insurer (and every other type of service they use) changes rapidly. They want powerful services, delivered at the swipe of a smartphone screen, wherever and whenever they happen to be. And as more of their financial services are delivered in this way, it will be easier and easier for them to step away from the inertia of their traditional bank, insurer or investment firm.

To adapt, the financial services industry needs to get ahead of the disrupters and disrupt themselves, and maybe slay a few sacred cows along the way. They need to:

- Become customer advocates. Learn and focus on their customers and deliver around what those customers need to have positive outcomes in their financial life.

- Become digital delivery platforms. Focusing their operations on efficient use of technology to seamlessly delivery their services.

- Understand change is good. Some lucrative businesses will go away. Other new models will enter. Focusing on past success will not prove successful moving forward.

And some of the sacred cows that need slaying:

- Branches. Saving the money from a few oversized and/or misplaced branches and investing in innovative technologies has a much better ROI. But, branches are banks, and it’s hard to let go.

- Low-value intermediaries. Most if not all basic administration and activation type tasks are more easily achieved with technology, and it’s what customers want. Agents and advisors need to be focused on true expertise and advice, not pushing paper. The initiation of a new relationship must be simplified and provided for those who want to open an account on their mobile device.

- Unnecessarily complex products. Any product that ‘needs to be sold’, should not be sold. If the value is not clear, the product is designed badly and is ripe for disruption.

We are on the verge of some exciting times in financial services. We all carry around a powerful computer in our pocket, and are ready to manage our finances in exciting new ways. If we can deliver the disruption that is needed in the core financial industry models, maybe driving positive outcomes for our financial situation will be as easy as grabbing that Uber uptown?

Simon Mathews is Chief Strategy Officer at Extractable. Simon leads the business strategy and experience design teams at Extractable, focusing on bringing innovation and next generation experiences to market for clients. He has over 20 years of consultancy experience spanning communications, advertising, and digital agencies working with clients including AIA, ACE Group, AIG, Autodesk, Bank of Oklahoma, BMO, Emirates Airlines, First Republic, LVMH., McAfee, Merrill Corporation, Micron, Newport Group, Reebok, Seagate, Southwest Airlines, TD Bank, ZoneLabs, and WL Gore. Simon has visited 56 countries and counting, and enjoys “board and wind” sports including kiteboarding, snowboarding, and paragliding. Mathews can be followed on Twitter.

Simon Mathews is Chief Strategy Officer at Extractable. Simon leads the business strategy and experience design teams at Extractable, focusing on bringing innovation and next generation experiences to market for clients. He has over 20 years of consultancy experience spanning communications, advertising, and digital agencies working with clients including AIA, ACE Group, AIG, Autodesk, Bank of Oklahoma, BMO, Emirates Airlines, First Republic, LVMH., McAfee, Merrill Corporation, Micron, Newport Group, Reebok, Seagate, Southwest Airlines, TD Bank, ZoneLabs, and WL Gore. Simon has visited 56 countries and counting, and enjoys “board and wind” sports including kiteboarding, snowboarding, and paragliding. Mathews can be followed on Twitter.