Almost all traditional banks and credit unions have been hampered by legacy technology that has made it difficult for them to compete with new tech-driven competitors. But options are now available — and being used, in a few cases — that free up institutions to compete in a far more agile, consumer-focused manner.

The change could be liberating — but only if banks and credit unions embrace it and make the necessary staff and cultural adjustments to take advantage of more modern technology platforms.

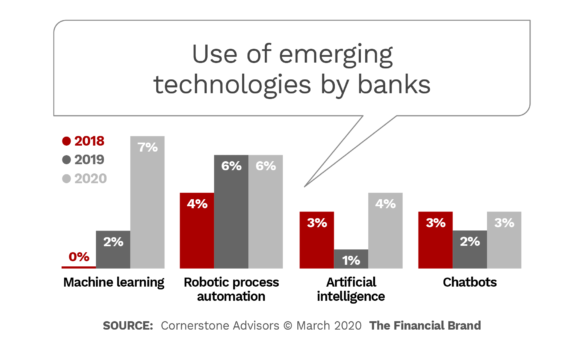

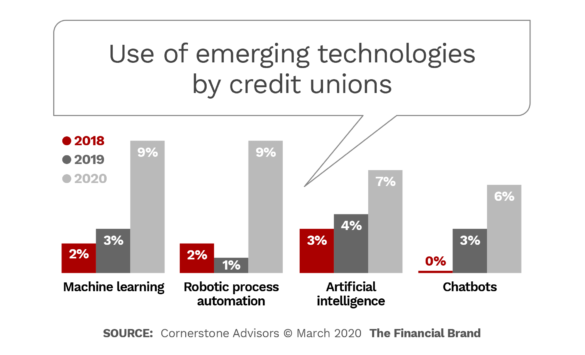

Other than the largest financial institutions, to date very few banks and credit unions have deployed advanced technologies such as artificial intelligence, according to Cornerstone Advisors research.

Although the numbers are beginning to move, particularly among credit unions, modernized core platform technology now available should speed adoption.

Retail banking in particular will benefit from this trend as that discipline has been impacted most to date by fintech and big tech competition. But all parts of banking are under siege and so the significance of new technology options is very broad.

“To a large extent, the main job of a core system today is to get out of the way.”

As EY points out in a new report, consumer banks have long recognized the need to upgrade their core technology platforms in order to keep up with ever-rising consumer expectations. The problem has been that core system replacements are complex and expensive jobs Often it is difficult to justify the investment, states Ryan Battles, EY’s Banking and Capital Markets Lead for the Americas. But modern technology options are much easier to deploy and maintain, he states. As a result, “banking is finally starting to catch the wave that began with Apple and Amazon raising consumer expectations,” Battles tells The Financial Brand.

The consulting firm believes that the concept of the core banking platform has significantly changed. The current systems that power most banks and credit unions won’t disappear, but will play a much different, and more limited role. Among middle-tier banks especially, Battles states, institutions are stripping away as much functionality from the core as possible, so that at the end of the day it becomes more of a transaction accounting engine.

“To a large extent,” the EY report states, “the main job of a core today is to get out of the way.”

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

3 Modern IT Platform Approaches

Traditionally banks and credit unions relied on in-house or outsourced “bank-in-a-box” core platforms. Among the retail banking functions these monolithic systems supported and serviced are: Transaction processing and accounting; Products, pricing and fee configuration; Channel and point-of-sale applications.

Even now the very largest banks rely on decades-old — although highly modified — core systems running custom software, and supporting a labyrinth of specialized platforms and applications, many of them now software-as-as-service — cloud-based — applications.

The rest of the industry relies on a handful of bank technology vendors for their processing needs. In both cases, the arrangement has come under increasing pressure from nimble competitors built from scratch using the latest technology.

Much of what the EY report covers is the concept of separation — “using an assembly of platforms versus a single monolithic core as a way to approach modernization,” Battles explains. “Honestly a lot of what this approach allows you to do is to synchronize your technology delivery with the speed of product development.”

EY identifies three options that together form a new generation of core platforms. As described in the report, these are:

Modernized legacy player: Traditional platforms updated to support modern architectures, cloud hosting and more open integration patterns that allow clients to partner more freely with external providers and increase their operational agility.

Digital banking platforms: Developed to disrupt the legacy [technology] players, these systems offer real-time processing; cloud-native architectures; and modern, open-integration patterns. While still monolithic in design, digital banking platforms allow customers to transact seamlessly with any device, 24/7 and from any location.

‘Headless’ cores: This model has stripped the core function to serving only as a product transaction and accounting engine. The assumption is that institutions adopting headless cores have prioritized an end-to-end digital strategy; enabled common platforms for integration, orchestration and data; and are developing an ecosystem of partners to facilitate a modern banking experience.

Read More:

- Digital Transformation Requires More Than Technology Upgrades

- Banks Can’t Be Agile With Outdated Tech and a Legacy Core

Ability to Offer Real-Time Insights Key

Battles explains that the “digital banking platform” described above is a broader concept than bolting digital banking capabilities onto a traditional core system.

“Having a digital layer on top of the core banking platform is table stakes today,” he states. “Being able to extend that beyond traditional products is what consumers expect. If you want to use real-time insights to offer a much more personalized set of services, it will be very difficult if you limit that to just what’s supported in your core system.”

The EY report does not mention specific vendor options. Other sources, however, indicate that examples of the newer types of bank technology providers include 10X, Thought Machine and Mambu, all based outside the U.S. and Finxact, based here. Digital platform providers include MX, Kony (Temenos), Q2 and NCR D3. In addition, the three largest U.S. bank technology companies — Fiserv, FIS and Jack Henry — have all responded to the threat of fintech and big tech entry into banking with an increasing sense of urgency. However, the responses vary, some say, with the providers that focus more on the upper end of the banking market moving more aggressively.

Differentiation Now the Tech Driver

Because competition is much different now, traditional institutions must rethink their view of a core technology platform. “The need to differentiate is now a primary driver of tech innovation,” the EY report states. However, the real differentiator is not technology per se, but “the ability to deliver personalized experiences, value-adding data and insights, and ancillary services that extend from a modernized core that can make banks stand out.”

“Financial institutions can move from using technology simply to improve transaction experience to being a value-added partner in financial well being.”

— Ryan Battles, EY

Right now, though, fintechs have the edge over traditional institutions, because with their current technology, banks and credit unions have a hard time providing such value-added insights and services, according to Battles. But by using one of the three modern core options described above, traditional institutions will be able to better harness the data they have to provide insights and personalized products and services. “That will be a very sticky advantage,” Battles maintains. “Once consumers feel like they have a trusted partner in their bank they’re much less likely to leave.”

Mortgage applications are a good example of how new technology can give traditional institutions a leg up. “We can now apply for a mortgage with just seven pieces of information on our cell phone,” says Battles. It would be very difficult to improve upon that, he adds. But by focusing on helping people manage and leverage the equity in their home, “financial institutions can move from using technology simply to improve the transaction experience to being a value-added partner in people’s financial well being,” Battles states.

AI and Machine Learning Should Get a Boost

Today’s more powerful enabling technologies didn’t exist when most banks and credit unions implemented their current core platforms, EY notes in its report. the result has been mostly ad hoc deployment of AI and other cognitive technologies. Instead, they need to be managed as part of everyday IT operations, and modern core technologies enable this.

Battles tells The Financial Brand that the next big push in AI and machine learning will be extracting data from within banks’ own firewalls.

“If you have somebody’s primary checking account, you essentially understand their spending habits and can build a pro forma cash flow just with the data you have. That helps you direct [more personalized] offers to them.” He notes, however, that traditional institutions need to be sure their data models are supervised and certified — allowing them to “learn and adapt in the background at a pace that demonstrates the right amount of control.”

Read More:

- 5 Pivotal Technology Trends in Retail Banking

- Traditional Bank Stakes Its Future on Daring Digital Strategy

Cloud Usage Certain to Grow

With the amount of data produced and consumed in banking increasing exponentially, EY states that financial institutions must have systems that scale, including cloud-native technologies that provide critical access to storage and computing power on demand.

The advantages and disadvantages of using the public cloud remains a hot topic in banking, although Bank of America’s collaboration with IBM on a new public cloud tailored for financial institutions could change the view of many.

Cornerstone Advisor’s research found that more than two in five of the community and midsize financial institutions it surveyed plan to invest in cloud computing improvements in 2020, as shown in the table below.

| Modify/Improve | Add New/Replace | |||||

|---|---|---|---|---|---|---|

| 2018 | 2019 | 2020 | 2018 | 2019 | 2020 | |

| Cloud application deployment | NA | 24% | 41% | NA | 16% | 15% |

| Core processing systems | 23% | 19% | 23% | 9% | 9% | 10% |

| Network/server virtualization | 45% | 42% | 45% | 9% | 8% | 11% |

| Telecom/datacom | 26% | 28% | 32% | 10% | 8% | 9% |

| IT service management tools | NA | 30% | 38% | NA | 8% | 8% |

As EY’s report notes, cohabitation of data and services in public clouds, private clouds and traditional infrastructure will become the rule, rather than the exception in financial services.

Culture Shift Needed to Embrace New Tech

The cultural impacts of the technology changes described above are “fairly vast,” Battles states. The increased speed at which consumers expect new product features and improved experiences really changes the way financial institutions do almost everything. Finding the right balance of control within the design process is key.

“Many times institutions will start projects and spend months just looking at the impact that the change will have. Really that has to be done in real time now,” Battles maintains. He recommends embracing the concept of continuous change so that an institution can measure progress along product roadmaps.

“All of that has to really come together more for institutions to exploit the capabilities of these modern platforms.”