Technology has often been the driver for the banking industry to reinvent itself. Over the last half century, technologies that we embrace today, such as ATMs, debit cards, online banking and mobile banking each have pushed the financial sector to meet evolving customer needs. Financial institutions today are again looking to incipient technologies such as voice recognition, biometric authentication, robo banking, and artificial intelligence to shape the future of the industry.

In today’s financial world, one of the most frequent touchpoints between a consumer and a typical bank or credit union is through online banking (Web and/or mobile application). In fact, usage of online banking is typically higher than contact through call centers and branches combined.

Given this regularity of usage, consumer satisfaction with their financial institution is significantly influenced by their experience with online banking. Despite the importance of this channel, the advancements in technology such as the Internet of Things (IoT) and voice recognition may be the ultimate demise of the online banking channel as we know it.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

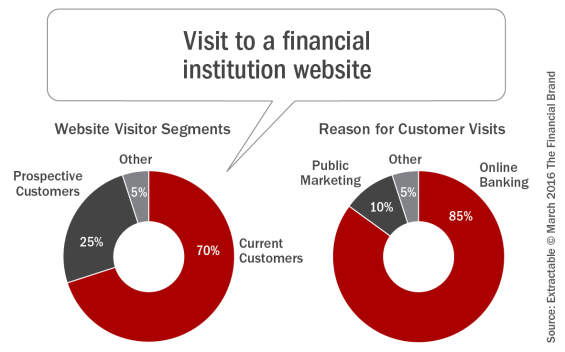

Online Banking Usage

Over the past 5 years, we have analyzed Web analytics data on public websites, Web online banking, and mobile applications for over 100 banks, credit unions, and other financial institutions. This research has spanned from large international financial institutions to small county-focused credit unions. In that research, we have found that, on average, over 85% of the traffic to a public website of a financial institution is there to login to online banking. Depending on how heavily the organization focuses on marketing to new prospects, the percentage of users on the site that are current customers can range from 55% to 98%.

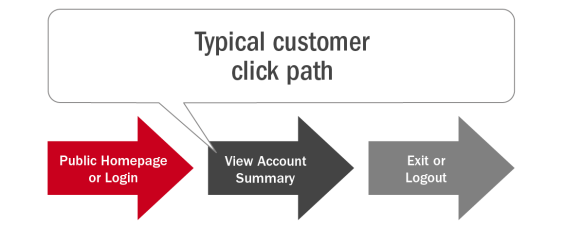

In almost every case, the majority of visitors to a financial website are current customers and the majority of those customers log into online banking during their visit. Furthermore, when analyzing the click-paths of these customers we find a highly task-focused group of users. Between 50% and 80% of the customers that come to the website have a short click-path that looks something like this.

These focused users can accomplish their task in less than 3 minutes viewing 2-4 pages in their session.

Technologies Driving Convenience in Banking

In 1967, Barclay’s Bank launched the first ATM enabling customers to perform simple banking tasks such as securely withdrawing cash from their account using a PIN without going into the bank. Later that same year, the first versions of ATM cards began to appear. Shortly after that important milestone in the early 1970’s, banks started introducing touch-tone systems, which allowed customers to call their bank using a telephone and securely check their personal balances.

These technologies helped banks reduce the costs associated with routine customer transactions while offering customers a much higher degree of convenience. Early providers of these technologies, such as Lloyds and Barclays were able to gain market share while increasing profits by offering these technological conveniences. Consumers embraced this new ability to perform banking tasks in their home (phone) and out on the town (ATM).

Voice Begins to Take Over the Keyboard

In 2011, Apple introduced a new version of their popular phone called the iPhone 4S. The S stood for Siri (Speech Interpretation and Recognition Interface). While the early versions of Siri (and even current versions) were far from perfect, the number of voice commands that can be interpreted successfully by the software have increased exponentially each year.

Apple is far from alone in the race to develop a friendly voice-driven digital assistant. All of the big players in Web and software are pouring large investments into voice-driven tools. Google Now, Amazon’s Alexa/Echo, Microsoft Cortana, Facebook’s M, and Nuance’s Dragon have all made huge improvements in voice recognition tools in the last 5 years.

In fact, Capital One’s announcement of account integration with several Amazon devices may signal the beginning of many more financial institutions following suit.

“Capital One claims to be the first company to let its customers access their bank account through the likes of Amazon Echo, the recently launched Amazon Tap and Echo Dot, and Fire TV. From today, if you’re a Capital One account holder who also owns one of these devices, you can gain access to information in your checking and savings accounts –including available funds, balance, recent transactions — and even pay your credit card bill.”

These organizations are not only using voice recognition to provide people with a more natural way to interact with devices and the Web, they also can use voice recognition for biometric identification and user authentication. Organizations such as Nuance, Wells Fargo, Authentify, and Barclay’s are currently developing voice biometric technologies to allow users to securely authenticate (login) with their voice and also with facial recognition from the devices camera (i.e., smartphone camera).

Tools like Siri and Alexa will be able to log users into online banking more securely than with passwords/usernames and allow them to check balances more quickly. The integration of voice recognition and devices like Amazon’s Alexa/Echo have already been tested by firms like Moven.

“Voice is going to be a huge growth area over the next 5 years particularly as personal AI becomes a feature in your home and on your smartphone. However, the key will be integration with services like Alexa, Siri, Cortana and Google Now. Customers won’t go into a banking app to check their balance or do a transfer … with voice, they’ll just ask Siri.”

Brett King, CEO of Moven, Host of Breaking Banks and Author of the book, “Augmented: Life in the Smart Lane”

The Future of Online Banking – Reduced?

In the next 5 to 10 years, we will most likely see Web traffic to banking sites and mobile applications drop by over 50%. We know that an average of over 50% of the traffic to online banking through browsers and mobile applications is there to perform the simple task of checking a balance and then leaving.

As voice recognition and voice authentication mature, banks will be able to offer customers the ability to perform their most common banking tasks such as checking balances by simply talking to an Internet-connected device (i.e. car, television, watch). The integration of more voice devices (and WiFi connections) in automobiles may be one of the major tipping points.

The Cost of Convenience

Home Depot has deployed self-checkout systems at over 1,200 of their stores over the last decade. With the rollout of these technological conveniences, Home Depot has found that customers using self-service checkouts tend to ignore impulse items such as batteries and candy during checkout. This is attributed to the customer not standing in line as long, as well as focusing on scanning their items.

Home Depot has also found that while the self-checkouts have gained favoritism with many customers, they have led to a 40% decrease in sales on impulse items (Greg Buzek, President of IHL). Grocery stores have also found that installing self-service kiosks, while satisfying consumers, have decreased sales on impulse items such as magazines, soda, and candy by >27% (Schuman, 2006). These are examples of where there may be substantial disadvantages to offering customers more satisfying (streamlined) experiences.

Similar to the risks of self-checkouts, with the advent of ATMs, customers had fewer reasons to walk in to their local branch. In-branch customers represented the most cost effective way to increase wallet share and grow assets. By offering customers the accessibility of ATMs, banks risked their relationship with their customers, which was based on the expertise and friendliness of physical bank tellers and loan offices.

If banks start to lose Web traffic because of voice recognition systems, this drop in traffic could pose a serious threat to the banking industry. All banks rely upon growing wallet share with current clients to profitably increase assets. While the majority of visitors to a banking website are customers that are there solely to login to online banking and check their balances, these highly focused users will also typically browse the public marketing content on a website at least a couple times per year and these rare visits can lead to product applications.

“It’s obvious that voice recognition will become ubiquitous as an authentication technique in financial markets when you consider we all have a cellphone. What’s a cellphone for anyway? Talking!”

Chris Skinner, President of the Financial Services Club and Author of the book, “ValueWeb: How Fintech Firms are Using Bitcoin Blockchain and Mobile Technologies to Create the Internet of Value

Additionally, those banks that offer personalized content to current customers visiting public marketing pages see even more cross-sell opportunities. If these visitors stop coming to the site because they are getting their balance information from their voice-enabled devices, they will not browse the marketing promotions, denying these banks the opportunity to cross-sell current customers.

The Opportunity in Customer Tracking and Service

With the large-scale deployment of voice-driven platforms, a new level of customer tracking will be available. As the users’ voice commands will be part of their authentication, all tracking will be user-based, and the platforms will likely be able to track nomenclature preferences (i.e. “home loan” vs “mortgage” vs “home financing”), tone (i.e. frustrated, happy), and variances in talking speed over multiple visits (i.e. rushed, curious).

Since many of these engagements will be on a smartphone, locational insights can also be collected (where people bank, path to purchase). This level of tracking will lead to excellent insights that can drive personalization and customer service across all platforms (i.e., Web, phone, email), while also providing additional security capabilities.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Will Online Banking as We Know It Disappear?

When Barclay’s introduced the first ATMs in the 1960s, they took a gamble in allowing their customers to perform financial actions without coming into the branches where relationships were strong and upsell opportunities were abundant. But it didn’t hurt business. In fact, it strengthened Barclay’s relationship with their customers and helped increase brand loyalty.

As ATMs began to roll out, branch banking staff were able to spend less time serving the needs of common products, such as checking deposits, and focus more of their time on higher-end products such as loans and advisory services. Similarly, when Home Depot rolled out self-service checkouts they realized that impulse sales would go down but it would allow checkout cashiers to go out into the stores to focus on sales of higher end items such as installations.

As voice recognition functions begin to displace traditional online banking traffic, it is likely that the financial services industry will evolve its Web presence to focus on superior experiences around higher-end products such as business loans, mortgages, and financial planning tools. While the customers will decrease the time they spend interacting with their financial institutions for basic services, they will likely see this new convenience as a benefit of a good partnership.

With the financial Web experience shifting from consumers checking balances to other more involved interactions, banks and credit unions can start to become experts in making these complex actions (i.e., LOC applications, Refinancing, Equipment Financing) more enhanced from a digital perspective. Paper will be replaced and advanced analytics will make engagement … even with the more complex transactions … more enjoyable. Even in these complex financial transactions, voice recognition functions might aid users since the majority of the process will be driven through Web forms.

In the very near term, we will see a world in which users will apply for mortgages through a Web interface, but verbally ask support-related questions to the website when the forms are not entirely clear. Websites will no longer be convenience tools that concentrate on showing balances quickly, but will evolve to focus on superior experiences for financial education, planning, and simplifying the complexities of our financial lives.

These new technologies and conveniences will allow financial institutions to move from providing a consolidated look at what has already occurred, to providing insights to the consumer about what might occur in the future. Combined with advanced analytics, the bank or credit union will be in a position to look out for the consumer in a way never before possible, interacting proactively through text alerts and even automated voice warnings/recommendations.

But, the banking industry must evolve around this new technology quickly, since voice recognition opens the door for new players, with only the frontrunners gaining market share and brand loyalty.

“We will always be looking for what’s next after apps and services, whether that’s building around messaging services, or conversational UI’s like Siri or Alexa – and it reflects the desire to construct new discovery models to find users. The challenge will not just be that banks will have a tough time orchestrating these, but that as we leave the web and app ecosystems to go in to messaging and smart assistants, those ecosystems will tend to be an asymmetrical relationship compared to the AppStore, favoring Facebook or Amazon and the like.”

Cherian Abraham, Mobile Commerce and Payments lead at Experian