The beginning of a new year often means creating a New Year’s resolution. Starting fresh at the beginning of the year offers a clean slate, a new perspective and the opportunity to create a resolution that will potentially change bad habits or establish new behaviors that will make the prospects for the future better.

Although the original goal and thought behind setting their resolution is often good, the reality is that by mid-January about 50% of all these New Year Resolutions will have already been abandoned. Research shows that out of all the people who have made a resolution, only 8% will actually accomplish them. So how can we ensure we will keep our Digital Banking resolutions, and follow them through until completion?

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Setting Digital Banking Resolutions

Most advisors will say that the success in achieving a goal is predicated on the beginning of the change process. If the process does not start well, it will not end well … usually resulting in abandonment of the resolution altogether. One key thing to remember is that the resolution process is not a sprint but a marathon. In fact, there are some small steps that can get you and your organization on the right track to keeping to your Digital Banking resolution.

- Start small: Make digital banking resolutions that you can keep. For example, if your goal is to create a digital new account opening process, begin with changing the back office processes that may lead to excessive steps in new account opening.

- Write it down: Similar to a personal resolution, it is important to write your resolutions down in a place where you and your team can remind yourself daily of your intentions.

- Make it public: The more people in your organization who are aware of your resolution, the more likely you and your team will be to achieve the goal because public declarations equate to accountability.

- Make changes: Simply converting paper to PDFs is not enough. You need to change the way things have been done in the past, not replicating the process and procedures that create friction and complexity.

- Define SMART goals: When it comes to setting a digital banking resolution, an acronym can help. Make sure the goals are specific, measurable, attainable, relevant and time-specific. Setting SMART goals can be the difference between failure and achievement.

- Track progress: Monitoring is important to show progress towards the accomplishment of a resolution as well as providing the basis for rewards.

- Reward achievement: Don’t just reward the total accomplishment of a major goal. Provide rewards along the journey to act as an incentive for reaching the ultimate goal.

- Learn from failure: There will be setbacks in your digital banking journey. Don’t let these stumbles stop you and your team from reaching your goals. Consider any setback a learning experience that will help you and your organization in the future.

Becoming a Digital Bank

The Financial Brand and Digital Banking Report continually outline what is needed to become a ‘Digital Bank’ , outlining the importance of becoming a digital bank and examples of how organizations around the world have embraced the digital revolution. There is no option but to change the way we have conducted business in the past. We can’t continue to put off the inevitable, hoping that banking will go back in time. We must embrace the change that is occurring, take the risks that are needed to move forward, and disrupt the way we provide financial solutions to consumers.

Every person, department and ‘silo’ within a bank and credit union must commit to digitizing their domain. This includes front-office, back-office, senior executive, managerial and administrative personnel.

Below are some of the most important resolutions organizations must to consider in 2019. The priority of importance will differ from organization to organization based on where each institution is in the digital journey.

1. Use Data and Advanced Analytics Universally

Advanced analytics empowers banks and credit unions with solutions that are so smart, they learn on the go, automatically refining their algorithms and improving their results over time. This is not the rudimentary data analysis from the past — spreadsheets, data tables and crunching numbers on a calculator. This is artificial intelligence (AI) and machine learning (ML).

We are at a point where banks and credit unions can increase customer stickiness by having digital assistants effectively manage routine inquiries and provide personalized advice. All this can be achieved with minimal day-to-day oversight. It can run in the background, adhering to compliance protocols, and can dynamically adapt to new regulations.

According to the Innovation in Retail Banking 2018 report from Efma and Infosys Finacle, financial institutions understand the potential impact and benefits of AI, but that they are still hesitant to act. They are approaching it piecemeal, slowly building towards AI competency by stacking on more and more of the innovative technologies they know they will need — creating the foundation they need one building block at a time.

Making data and analytics a primary resolution in 2019 is not an option. According to Louise Beaumont, “In the future, consumers will have complete control of their personal identity, and access only those services that enhance their daily lives based on the value transfer provided in exchange for their transaction and behavioral insights. Winning brands will not be segmented based on specific products, but on how much they are trusted on a personal, and emotionally-engaged, level.” This level of engagement is only possible with strong use of data and advanced analytics.

If you are just starting out with the use of data and advanced analytics. you will want to develop a data analytics strategy that is big in its long term potential, but one that provides interim milestones based on the reality of available resources. Trying to do it all at once is like trying to lose 20 pounds in a month … it can end in disappointment and a resolution soon forgotten. It is important from an internal and cultural point of view to develop pilot projects that deliver small but impactful wins — early and consistently.

2. Digitize Account Opening and Onboarding Processes

It is clear that digital experiences and expectations are being set by industries and platforms outside of banking. From Amazon shopping to Uber ride sharing, consumers are expecting digital engagement to be quick and easy to initiate and use over time.

An increasing share of consumers – primarily Millennials under 35 years old, mobile banking users, and newer customers – want an improved process. In other words, while current, less digitally proficient customers accept the status quo, the expanding digital consumer base wants a process that is faster, more intuitive and more contextual.

To respond to these consumer demands, banks and credit unions will need to invest in improved technology to improve the digital interface with customers and members. There is also the need to leverage internal and external insights that can improve the sales process.

Beyond supporting a mobile account opening process, organizations must provide the technology and insight for front line staff (and digital applications) to engage easily and advise accurately. Engagements must be personalized for each customer, with cross-selling to be intelligent and contextual.

Finally, organizations need to remember that the new account process doesn’t end with the account opening itself. The process needs to include a digital onboarding process to satisfy an increasingly demanding consumer.

There are many providers of services to improve the digital account opening process. These firms can help remove friction, increase engagement and improve customer satisfaction. Providing a seamless, simple and engaging digital account opening process should be a top priority at all banks and credit unions.

3. Create and Support an Innovative Culture

Organizations continue to support innovation efforts with everything from innovation labs to hackathons. While such efforts are well received by investment analysts, and are great fodder for senior-level strategic planning meetings and competitive chest thumping, the one thing lacking from many of these efforts is a supportive culture for actually implementing new ideas that are generated.

Unfortunately, while many organizations say they are increasing their efforts to build a work environment that inspires innovation and creativity, research indicates that many corporations may have a surplus of ideas that aren’t being nurtured. Worse yet, a risk-averse approach to innovation is creating incremental improvements rather than the level of innovation needed to generate meaningful ROI. Finally, the structure of banking makes the entire process too slow, resulting in lost revenues.

Most banking organizations may need to look no further than their own employees for innovative ideas. While potentially being overwhelmed by ideas that may have limited impact or revenue/cost benefits, it is still imperative to harvest ideas with potential.

If the banking industry is going to keep up with the new upstarts and fintech entrepreneurs, organizations need to find ways to cultivate, nurture, implement and reward ideas swiftly. The key is to avoid dampening innovative spirit while aggressively culling ideas with less chance of success, selecting innovative ideas that will generate returns.

4. Embrace Open Banking APIs

Organizations in all industries are battling for customers based on providing a superior customer experience. The banking industry is no exception. In fact, as digital banking applications have grabbed a greater share of customer transactions, the need to provide an easy-to-use, frictionless experience, with new digital services offered across a greater number of touchpoints has never been greater.

To satisfy these increased expectations, financial technology firms (fintechs) have entered the financial services marketplace. While most of this competition has not achieved significant scale, that shouldn’t signal that these solutions are not important to the industry. In fact, nearly one-third of banking customers have a relationship with at least one non-traditional firm.

Open APIs will enable banking organizations to gather actionable data from various internal and external sources, including buying habits, financial goals, rick tolerance and even social interactions. Insight derived from this data will enable more proactive (and accurate) multi-channel marketing, moving from reactive sales pitches to proactive solutions and advisory services. In other words, the difference between ‘rear-view mirror’ notifications and ‘financial GPS’ recommendations.

Open banking presents opportunities for creating and distributing a wide variety of both financial and non-financial products and services – with the banking retaining the customer relationship – but greatly expanding the number and variety of services to improve the customer’s quality of life. In an open banking model, an unlimited number of partners could insert themselves into the relationship development process.

What must be realized is that open banking allows consumers and merchants to execute direct transactions without going through banks, making it more difficult for banks to have a full view of the customer transactions and maintain customer relationships. It is hoped that the open banking concept can avoid this demise, as traditional banks and fintech firms work together to build the customer’s trust and offer products and services that will improve a consumer’s lifestyle.

The foundation of these partnerships will be the data that can be collected and cultivated for the benefit of the customer, the bank and the fintech firms. If applied diligently, the improvement in customer experience could be the differentiator that retains the overall banking (and non-banking) relationship.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

5. Collaborate With Fintech Firms

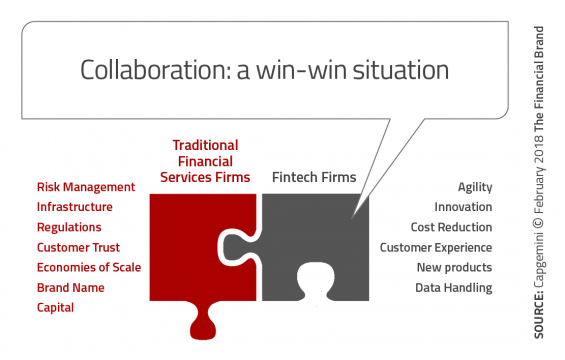

The relationship between traditional banks and fintech firms has moved from competition to collaboration. The challenge is trying to cultivate an environment where collaboration can flourish as opposed to stifling the beneficiary attributes of either partner.

The rationale for any strong collaboration is the ability to bring a synergy of strengths together that create an entity stronger than either individual unit could bring on their own. For most fintech organizations, the primary differentiators are an innovation mindset, agility (speed to adjust), consumer-centric perspective and an infrastructure built for digital. These are obviously advantages that most legacy organizations don’t possess.

Alternatively, most fintech organizations lack the ability to scale adequately due to brand recognition and trust. They also usually lack capital, knowledge of compliance and regulations and an established distribution network. These are inherent strengths of traditional banking organizations.

Even with the best collaboration, the ability for legacy and fintech organizations to compete in the banking ecosystem will most likely be challenged by the BigTech powerhouses such as Google, Amazon, Facebook and Apple as well as Alibaba and Tencent. Built on digital platforms, these huge organizations are efficient and have already found ways to reduce operational costs.

With a focus on using huge volumes of customer data to help predict behavior and improve the customer experience, BigTech firms could leverage customer trust and high engagement to introduce even more enhanced financial services. Add the potential to shift revenues from other businesses to enhance banking offerings and it is a brand new ballgame.

Making 2019 a Year of Transformation

Making a resolution is a good thing and highly encouraged, especially when we are talking about the objective of becoming a ‘digital bank’. Financial institutions of all sizes can benefit from this process. It gives your organization something to focus on and keep working towards. Even if some of the resolutions are not followed through completely, making a resolution shows that you have the belief and hope in your organization’s ability to change the way things have been done on the past and to provide the foundation for a more competitive future.