There has been quite a bit of debate over the past year around the future of fintech. From the long-term viability of the fintech model, to the need for increased transparency and regulation, the concept of new players disrupting a business that has been around for hundreds of years is sure to spark some level of controversy.

The passion for change in the marketplace is headed by the founders and management teams of the new start-ups, those in the industry who understand that the legacy banking system is broken, and by consumers, who appreciate the new levels of personalization and better experience provided by fintech firms.

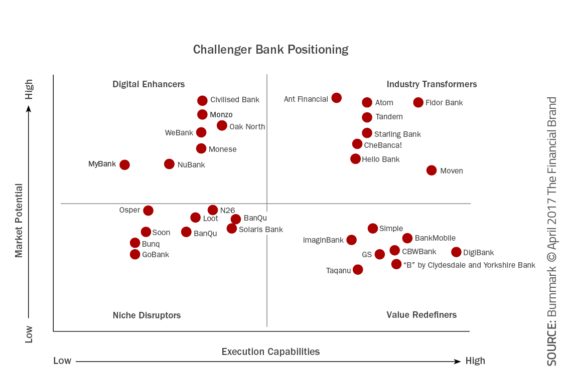

When the Digital Banking Report published The Challenger Bank Battlefield, it was expected that the report would be a useful guide for those in the financial services community who wanted to better understand the strategies and positioning of more than 30 of the newest players from countries across the globe.

What wasn’t expected was the level of controversy around the way we categorized the fintech players. The discussions started almost immediately, as financial services industry influencers and fintech insiders debated how many of the firms were categorized (and even if some of the firms should have been included at all).

The conversations, for the most part, centered on the chart below, which was used to help define the positioning of the start-up challenger banks that were evaluated.

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect. Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance. Read More about The Power of Localized Marketing in Financial Services

Why Industry Cloud for Banking?

The Power of Localized Marketing in Financial Services

The determination of marketing potential and execution capabilities for each of the organization was done by ‘scoring’ each of the fintech firms based on the following criteria. The scores were then tallied to determine the placement of each firm.

Marketing Potential

- Branding momentum

- Consumer adoption propensity

- Regulatory and government support

- Financial performance

- Breadth of offering

Execution Capabilities

- Technical capabilities

- Process Improvement

- Customer engagement

- Executive leadership

- License and launch status

To better understand the outcome of the research, the evaluation and scoring of each organization was done using publicly available information at the time of the analysis. As could be expected with any analysis of new startups in a rapidly changing competitive, regulatory and financial investment ecosystem, some of the evaluations could be considered ‘out of date’ the day after the analysis was performed. In addition, any individual score could push a firm into a specific quadrant, where comparisons to other firms in the same quadrant could spark controversy… which it did.

Online Discussion from Industry Insiders

A tremendous amount of dialogue and debate surrounding the merits of the analysis — namely the placement of many of the fintech firms evaluated — immediately ensued on LinkedIn. The exchange has been both passionate and at times biased by the root interests of those involved. As the dialogue continues we are learning more about the fintech battlefield and about the organizations involved. Many of the points made have merit and will allow for a re-evaluation of the analysis going forward. Below is a sampling of some of the dialogue.

“Great report on challenger banks. Very insightful”

Roberto Ferrari, CheBanca!

“[The chart] speaks to lack of knowledge about how these banks are architected and their strategy. For instance, Atom Bank. Have you seen it?”

Simon Taylor, 11:FS

“I agree with Simon. How can you put Atom as an industry transformer and Monzo as a digital enhancer? N26 as a niche disruptor is interesting, seeing that they are gaining 1,000 customers per day on average. The flow and categorization in the graph is wrong.”

Kevin Shingles, WHSmith PLC

“The analysis feels to me like a bank procurement exercise, where things get scored on a spreadsheet and the output doesn’t fit the axis or intended outcome. The idea is right. But as you know, the picture travels far faster and further than the underlying report. I’m sure there is plenty of context missing, but I’d rather the facts be debated on merit.”

Simon Taylor, 11:FS

“There are over 15 parameters used to make the categorization including home country demographics and how well or poorly [the fintech firm] has captured a willing demographic. Happy to discuss once the whole report has been read.”

Devie Mohan, Burnmark

“Add Firebase Analytics SDK to all of these guys and their mobile clients, and then look into the underlying metrics on open, install, reopen, active time inside app, notifications received, notifications opened and how fast they are usable, on a cross comparison basis using heat map by country and in real time to show interactions by neotech… Yes, the uniquely named features and use cases are harder to compare, but not impossible.”

Andrew Finlay, Royal Bank of Scotland

“Tandem is not open for business. Neither is Starling. Moven is mostly a TD-captive play. You are missing Compte Nickel, perhaps the only European neobank with sustainable economics and customer acquisition strategy. NuBank is a digital enhancer, and Atom is an industry transformer? N26 a niche disruptor? I don’t think your categories are well defined honestly, or you don’t really know that much about the startups in question.”

Mariano Belinky, Banco Santander

“The report has the great merit to open it up and stimulate thinking, as it tries to bring together players at different stages, in different geographies (and legislations), with also very different business models. All of this in a context that changes everyday (Compte Nickel was just acquired by BNP and Monzo just got their license for example). Since the landscape is changing so fast and there is so much interest in the topic, perhaps you try to make it a) more crowdsourced in the future – asking for open contributions and suggestions, b) with six month updates. Let’s also not just look at the players from a technological and architectural standpoint but from a market/consumer standpoint … what kind of impact are they making (in terms of number of active customers, transactions size, deposit gathering and market share) and how are they different.”

Roberto Ferrari, CheBanca!

“This must be a wide definition of ‘challenger bank’ as it includes at least one non-bank in the guise of an eMoney institution. That’s not a criticism, I just wonder how different the chart would look and feel if all eMoney and PSD firms which ‘issue’ cards and BICs/IBANs were included. Still quite thought provoking. “

Peter Oakes, TransferMate

Future Analysis

There is nothing better than to conduct an analysis that can create dialogue and debate. And, with the fintech marketplace being ever changing, the positioning (and underlying strategies) will change as well. In other words, continue the discussion either on this specific article, the original article on the report or on social media. This will allow updates of the analysis to be performed as the market changes.

Fractional Marketing for Financial Brands

Services that scale with you.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Purchase the Report

The Challenger Bank Battlefield report provides insight into more than 30 fintech challenger banking organization globally. Beyond a review of the strategies and products offered, this report includes an analysis of the competitive positioning of the organizations reviewed.

report provides insight into more than 30 fintech challenger banking organization globally. Beyond a review of the strategies and products offered, this report includes an analysis of the competitive positioning of the organizations reviewed.

The report also includes interviews with challenger banking organization founders and financial services industry leaders. The report has 82 pages of analysis and 15 charts/graphs. Finally, the report includes secondary research into the competitive marketplace and guest articles from organizations who are close to those organizations involved.