As we consider the future of digital technology in the financial sector, it is important to take stock of the economic conditions that will play a role in accelerating or slowing the inexorable trend toward digitization.

In this article, we will look at both the secular and cyclical economic trends that will have an impact.

Quick definitions:

- Cyclical has to do with the shorter-term business cycle.

- Secular relates to longer-term structural changes in the economy.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Fractional Marketing for Financial Brands

Services that scale with you.

Cyclical Forces Impacting Bank Digitization

Most indicators point to a recession on the horizon. Inflation is outpacing wages (a concept economists refer to as negative real wages), and this has already impacted consumption. Simply put, the money we make does not buy as much as it did a year ago, and that’s important because two-thirds of the economy is consumer spending. Add the necessary tightening of monetary policy to deal with inflation and we have the recipe for a recession within the next few quarters.

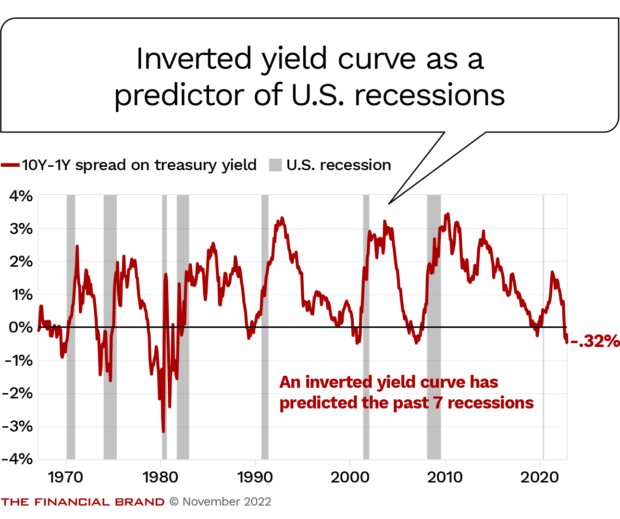

Perhaps the best indicator of future recession probability is the yield curve (the spread between the yield on one-year treasuries and ten-year treasuries). Any time the yield curve is inverted (one-year yields are higher than ten-year yields), a recession follows within 12 to 18 months. The chart below shows this pattern.

We have not had a recession in the past 70 years that was not preceded by an inversion of the one- and ten-year yields, nor has there been an inversion that was not followed by a recession. As the chart shows, anytime the yield spread line goes below zero, this indicates inversion and periods of recession follow. The yield curve has been inverted since July 9, 2022.

The real questions are: When will a recession begin? How long will it last? How deep it will be?

The recession will likely begin by the first quarter of 2023. Because we are heading into this downturn with a very strong labor market and financial sector, the recession should be shorter in duration and shallower than the previous two.

For example, unemployment normally peaks around 7% to 10% in most recessions. This time it will likely top out at less than 6.5%. In this really tight labor market, employers will be reluctant to lay off workers as a result of the difficulty they’ve experienced in recruiting and retaining them in the first place. Thus, financial conditions should hold up well and not exacerbate the slowdown, as they often do in down cycles. Additionally, the Federal Reserve could begin lowering rates in late 2023 to grapple with the recession.

Once we come out of the recession, labor markets will return to the tight conditions we see today within a couple quarters.

The implications of these cyclical forces will be to accelerate the move to digitization. The business recession playbook calls for finding efficiency and productivity improvements in lieu of hiring. Many businesses will look to deploy technologies to reduce labor costs, improve the productivity of workers and simply do more with less. With the likelihood of tight labor markets after the recession, businesses will have double incentives to turn to technology.

Read More:

- Economy Alters Retail Banking Outlook for 2023 and Beyond

- Banks Should Scavenge Troubled Fintechs’ Talent and Technology

- Embedded Finance Fuels Growth in Any Economy — Here’s How to Start

Secular Forces Impacting Bank Digitization

In looking at the longer-term trends of the economy, there are several secular forces that will have a dramatic impact on digitization.

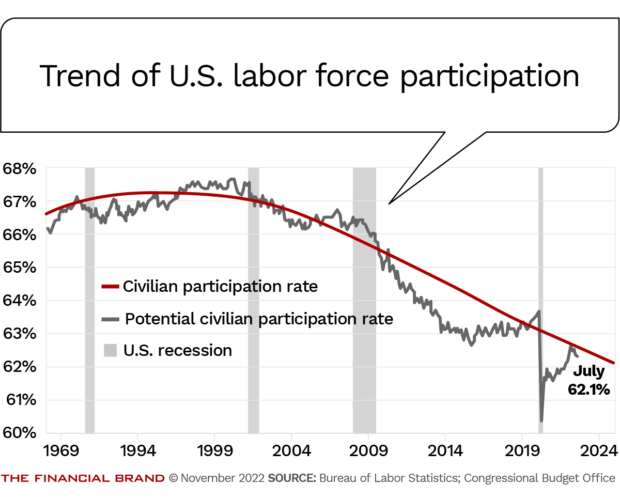

Aging Demographics. There is little doubt that the U.S., like much of Europe, Japan, China and Russia, is struggling with the economic and social consequences of aging societies. Simply put, Baby Boomers are retiring faster than their grandchildren are entering the workforce. As the chart below illustrates, the percentage of our population in the workforce has been steadily declining for two decades.

All of the U.S. workforce growth right now and into the next couple decades will come from immigrants and children of immigrants. The native-born contribution will continue to be a net negative number. Two things grow the economy: growth in the workforce and growth in the productivity of the workforce. With workforce growth likely to continue to slow, productivity will have to be the emphasis for policymakers and businesses. Out of necessity, digitization will be part of this productivity growth secular trend.

Public Debt. Many Americans know instinctively that high deficits and debt are not good for the economy, but few understand the mechanism behind this dynamic. There is a limited supply of credit in the world and when governments take more, it leaves less for consumers and businesses. In short, the government crowds out the private sector, thus driving up the cost of borrowing. This in turn slows the economy as higher interest rates act as a brake on economic growth.

There is little monetary authorities can do without stoking inflation, as our present circumstance has proven. The resulting slower growth in the economy will mean businesses have to gain market share to grow, because overall macro growth will be less of a driver. Deploying new technologies that create cost and service advantages will become even more critical for revenue growth.

Keep in Mind:

A slower-growth economy will put more emphasis on deploying new technologies to achieve cost and service advantages.

Technology Enabled Disruption. The pace of technological change is accelerating exponentially. As businesses deploy technologies and business models driven by technology, they are disrupting entire industries.

The winners are more productive by definition, and workers that are disrupted often take a step back in productivity unless they are able to increase their skills. In fact, the Federal Reserve Bank of Dallas estimates the average college graduate will have their jobs disrupted by technology five or six times during their careers.

This means lifelong learning and skills development will become essential to maintain and improve productivity and quality of life for workers. So not only will businesses have to advance digitally to remain competitive, but they will have to ensure their workforce does as well.

These secular trends of slowing workforce growth, increasing public debt and technology-enabled disruption will create structural challenges that will accelerate the need to digitize the economy. Disruption will also create a headwind to this trend as workers adjust their skill sets or get left behind.

Read More:

- 5 Investments Banks Must Make During a Recession

- New Consortium Seeks to Accelerate Small-Bank Tech Innovation

- Economic Fears Give Banks a Chance to Offer Personalized Insights

More Focus on Digital Solutions and a Digital Workforce

There are both cyclical and secular forces that will continue to accelerate the transition to digitization of financial institutions. These trends, coupled with shifting customer preferences and the quest for convenience, mean that banks and credit unions will have to look at digital solutions to stay competitive and grow. Those that do not embrace this megatrend will inevitably be consumed by it.

The one economic force that may slow this transition will be the availability of the skilled workforce needed to power it. U.S. financial institutions will see an increasing premium on digital workers. Whether by workforce development and skills training, immigration reform or a combination of both, policymakers will have to grapple with solving this economic constraint. Financial institutions will have to be creative in how they attract, retain and develop their digital workforce.

About the author:

Blake Hastings is the chief economist at SWBC, as well as its senior vice president of corporate strategy. SWIVEL, an SWBC company, provides a payment platform for financial institutions nationally that enables consumers to make a safe one-time payment or set up recurring payments. Opinions in the article are the author’s alone and should not be construed as advice.